Shell 1Q Earnings Sink, Slashes Dividend

April 30 2020 - 3:02AM

Dow Jones News

By Jaime Llinares Taboada

Royal Dutch Shell PLC on Thursday said that it is cutting its

first-quarter dividend, as earnings for the period were dragged

down by the collapse in oil and gas demand and prices.

The British-Dutch oil giant said its profit for the three months

ended March. 31 on a net current cost of supplies basis--a figure

similar to the net income that U.S. oil companies report--fell to

$2.76 billion from $5.29 billion a year earlier. Net profit swung

to a $24 million loss from a $6.00 billion profit.

The company declared an interim dividend of $0.16 per share,

down from $0.47 a year earlier.

"Given the risk of a prolonged period of economic uncertainty,

weaker commodity prices, higher volatility and uncertain demand

outlook, the board believes that maintaining the current level of

shareholder distributions is not prudent", Chairman Chad Holliday

said.

Adjusted net CCS earnings, which excludes certain items and is

Shell's preferred metric, came in at $2.86 billion, down from $5.30

billion in January-March 2019 but above the $2.25 billion consensus

estimate compiled by Vara Research and based on 27 brokers'

forecasts.

Revenue decreased 28% to $60.0 billion. Cash flow from

operations was up 72% at $14.9 billion.

Shell's performance was significantly dragged by its upstream

business, with earnings including one-off items and impairments

swinging to a loss of $863 million.

Capital expenditure was $4.97 billion in the quarter, down from

$5.60 billion a year earlier. Shell said last month that it intends

to reduce 2020 capital expenditure below $20 billion, from the

original $25 billion plan.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

April 30, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

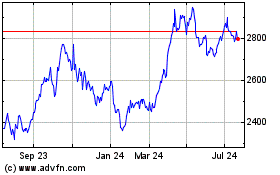

Shell (LSE:SHEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

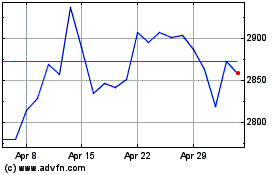

Shell (LSE:SHEL)

Historical Stock Chart

From Apr 2023 to Apr 2024