Blank-Check IPOs in Europe Show Signs of Life

September 14 2020 - 5:59AM

Dow Jones News

By Ben Dummett

Europe has missed out on the wave of initial public offerings of

so-called blank-check companies, one of the drivers of

equity-markets activity in the U.S. this year. To help address this

dearth, the London Stock Exchange is reviewing ways to ignite its

market for such offerings, according to a person familiar with the

matter, amid early signs of renewed interest.

The LSE declined to comment.

Blank-check firms, often headed by well-known investors

including former Citigroup Inc. banker Michael Klein and New York

hedge-fund manager William Ackman, are publicly traded shell

companies that use money raised from an IPO to make an acquisition.

In the U.S., the vehicles, also known as special-purpose

acquisition companies, typically allow investors to vote on the

SPAC acquisition and redeem their money if they don't like the

deal. In some European jurisdictions, such as the U.K., this isn't

a requirement.

In London, investors are also prevented from trading a SPAC's

shares from the time a deal is announced to approval of the

prospectus. That means investors can be tied into a deal that they

don't support for an indefinite period.

Those differences are key reasons SPACs have historically proved

more popular in the U.S., some bankers and investors say, in part

because they give their investors greater influence over any deal.

However, the different rules governing blank-check offerings are

discouraging these types of IPOs in Europe more than they have in

years as the fallout from Covid-19 disrupts markets and businesses,

pushing companies to seek alternative sources of financing.

Europe this year has failed to attract any SPAC IPOs through

Sept. 10, compared with a previous low of two in 2015 and a high of

13 in 2017 for the comparable period, according to data provider

Dealogic. By contrast, the number of U.S. blank-check IPOs has more

than doubled to 94 for this year through Thursday from the

year-earlier period, and that amount is by far the highest level

over the last six years.

That divergence is also reflected in overall IPO activity. The

total value of European IPOs, comprising those involving

blank-check offerings and others, is down about 53% to $6.5

billion. Meanwhile, total U.S. IPO activity has jumped about 62% to

$78.1 billion, with SPAC IPOs representing about 47% of that total,

according to Dealogic.

Investors are plowing money into these vehicles in the U.S.,

betting in some cases on the management teams identifying deals at

discounted prices as firms struggle to manage their debt loads and

access alternative funding sources. The process can also offer the

target a quicker route to going public.

The $300 million IPO of Broadstone Acquisition Corp. underscores

both the drivers behind the proliferation of SPACs and the

advantages that U.S. markets offer as listing venues. Broadstone's

management team is based in London, and the company is targeting

"fundamentally sound but stressed businesses in the U.K. and

Europe" for an acquisition, according to its IPO filing. However,

it is a U.S. IPO that was priced Thursday and the company is listed

on the New York Stock Exchange.

"The investment base is deeper and wider in the States and that,

together with investor confidence in the model, makes the

fundraising on SPAC IPOs more achievable," said Paul Amiss, a

London-based corporate lawyer at Winston & Strawn LLP, who is

working on the Broadstone deal.

Still, in another indication that the market for European SPAC

IPOs is showing renewed signs of life, Martin Franklin, a

well-known blank-check sponsor, currently leads a group planning to

raise about $750 million in an IPO of such a vehicle known as

Harvester Holdings Ltd. and list it in London. Mr. Franklin's

previous blank-check companies include the LSE listing of J2

Acquisition Ltd., which raised $1.25 billion in an IPO in 2017.

About two years later, it acquired APi Group for $2.9 billion and

adopted the name of the specialty-services contractor. The stock is

now trading up about 44% since the deal closed in 2019.

Mr. Franklin favors the U.K. market for SPACs in part because

the rules prevent investors from redeeming their investment in the

vehicle. That provides an advantage competing for targets with

strong profits and cash flows by assuring the seller that the deal

can be financed without risk, he argued.

"When I commit to a transaction, I am on par with KKR,

Blackstone, a huge corporate -- anybody who has the power to invest

their capital with absolute authority," Mr. Franklin said.

Write to Ben Dummett at ben.dummett@wsj.com

(END) Dow Jones Newswires

September 14, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

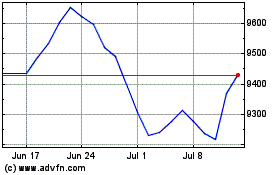

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

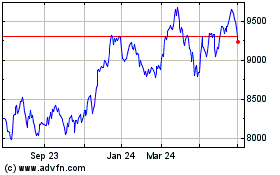

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024