By Anna Isaac

U.K. government agencies are examining whether a trading outage

blamed on a software hiccup at the London Stock Exchange in August

may actually have been caused by a cyberattack aimed at disrupting

markets, according to people familiar with the matter.

A British intelligence agency has contacted the LSE in the past

two months requesting additional information about the Aug. 16

outage, according to people familiar with the matter. The U.K.'s

Treasury is also involved in the probe.

An LSE spokesperson denied that the incident was cybersecurity

related, attributing it to a "technical software configuration

issue following an upgrade of functionality." She added that the

LSE "has thoroughly investigated the root cause of the issue to

mitigate against any future incidents."

The incident, which delayed the market open by more than an hour

and a half and was the worst outage in eight years, immediately

triggered government cyber alert systems, according to the people

familiar with the matter.

The U.K.'s Government Communications Headquarters, known as

GCHQ, which monitors critical national infrastructure, including

major financial trading platforms, is examining if the software

code may have played a role in the outage. Officials are looking at

time stamps affiliated with the code's production, which could

offer clues to its origin.

The status of the examination and whether any action will be

taken by regulators or the LSE is unclear.

At the time, the London Stock Exchange Group, which operates the

LSE, said a technical software issue had temporarily prevented

trading in a range of securities, including stocks listed on the

FTSE 100 and FTSE 250. It didn't specify the cause of the

issue.

If the outage was caused by an attack, the aim may have been to

cause market disruption and undermine confidence in critical

national infrastructure in the U.K., according to the people

familiar with the government's examination.

When the LSE notified regulators shortly after the outage in

August, there was no indication of a possible cyberattack from the

correspondence, according to a government official and a person

familiar with the LSE's operations.

The LSE is a key contributor to London's financial pre-eminence

in Europe, home to blue-chip stocks like Unilever PLC and BP PLC.

It is also the global leader in clearing trillions of dollars worth

of derivatives contracts. It has been subject to takeover battles

for years and is strengthening its ability to sell data through a

$14.5 billion acquisition of financial information business

Refinitiv.

A spokesman for the Financial Conduct Authority, which regulates

U.K. financial markets, declined to comment on the incident, but

said "all regulated firms must have appropriate systems and

controls in place to manage operational and technology-related

risks and we expect them to report material incidents of this

nature to us."

At the time of the outage, the LSE was updating internal

systems, which may have made the exchange vulnerable to attack,

according to the people familiar with the government

examination.

Like many companies, LSE contracts out software development to

third parties. Some of those in turn parcel out work to individual

developers. LSE technology managers have identified the security of

this development supply chain as an area of concern, according to a

person familiar with the LSE's operations.

A deal to combine LSE Group with rival Deutsche Börse AG was

blocked by regulators in 2017. The tie-up was in part aimed at

accessing Deutsche Börse's superior technology and pooling

resources to defray the cost of upgrades, according to a person

familiar with its technical operations.

In its latest annual report, the LSE said the risk associated

with cyberattacks on its institution had risen and identified

dangers posed by sophisticated malware and malicious actions from

contractors or vendors.

The LSE has suffered three outages since it implemented a new

trading system called Millennium Exchange in 2011. These occurred

in 2011, 2018, and 2019.

LSE Group announced Dec. 16 that its top technology executive,

Chris Corrado, will leave at the end of March. The company said he

is leaving to pursue other opportunities. Mr. Corrado declined to

comment.

LSE isn't alone in having suffered recent outages.

In September, Hong Kong Exchanges and Clearing said a bug in

third party software had led it to suspend activity on its

derivatives trading platform.

On Aug. 12, a key NYSE data feed suffered a technical glitch

that delayed end-of-day values for the Dow Jones Industrial Average

and the S&P 500.

In 2013, the Chicago Metals Exchange Group said it had suffered

a cyberattack, which didn't affect its operations.

Some observers say exchanges historically felt protected from

conventional cyberattacks, because they developed closed networks,

which were relatively isolated from the broader internet and did

much of their software development in house.

"Adoption of emerging technology and a growing reliance on

outsourcing means the era of truly closed networks is over," Monica

Summerville, director of fintech research for research and

consulting company TABB Group, said.

Write to Anna Isaac at anna.isaac@wsj.com

(END) Dow Jones Newswires

January 05, 2020 09:14 ET (14:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

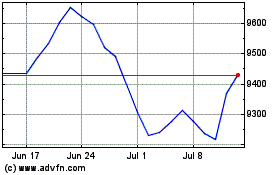

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

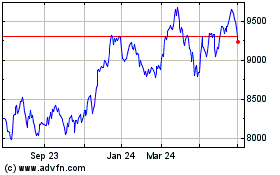

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024