China Pauses U.K. Listings Project

January 02 2020 - 9:43AM

Dow Jones News

By Xie Yu

Beijing has halted a high-profile project letting Chinese

companies list in London, people familiar with the matter said, in

a move that could signal chillier financial relations with

Britain.

The Shanghai-London Connect project has been put on hold,

according to a Shanghai Stock Exchange official and a senior banker

in Hong Kong. Neither gave a reason for the hiatus, which was

reported earlier by Reuters.

The Connect program, which was years in the making, launched in

June with a roughly $1.5 billion offering of London-listed global

depositary receipts by China's Huatai Securities Co. It is separate

from a larger trading scheme linking Hong Kong to Shanghai and

Shenzhen.

The Shanghai-London tie-up was meant to show how China continues

to embrace globalization, while simultaneously deepening London's

ties with China and boosting its credentials as a financial center

ahead of Brexit.

In September, when London Stock Exchange Group PLC was fending

off an unwanted approach from rival Hong Kong Exchanges &

Clearing Ltd., LSE Chief Executive David Schwimmer touted

Shanghai's prospects as a financial hub and his group's direct

links there, according to media reports.

However, relations between the two countries have been tested by

unrest in Hong Kong. In November, London condemned China's

treatment of a former official at Britain's Hong Kong consulate as

torture, in a case tied to the protests.

It couldn't be learned how formal the hold-up was, or how long

it was likely to last. A person familiar with the matter said the

LSE hadn't received any notification that the system was closed or

blocked, and the U.K. exchange viewed the Connect as still

operational.

Likewise, another senior banker, who advises SDIC Power Holdings

Co., said that while the Chinese power company believed now wasn't

the right time to launch a deal, work continued on a potential

listing. SDIC called off a sale of securities through the Connect

program in December, blaming market conditions. This banker

expressed skepticism that U.K.-China relations would derail a deal

in the long run.

The Connect system lets Chinese companies issue tradable

securities in London, backed by shares in Shanghai. The plan

envisages U.K. companies eventually being allowed to list similar

instruments in China. However, only Chinese companies can raise new

money, and the program will be structured to limit capital

flight.

Despite fanfare in Chinese state media, analysts and investors

have played down the program's appeal, since larger foreign

institutions can already buy or sell mainland-listed Chinese stocks

via Hong Kong, while Chinese investors are unfamiliar with many

British companies.

Chinese foreign ministry spokesman Geng Shuang told a regular

briefing on Thursday he wasn't aware of the specifics, adding that

he hoped Britain would "provide a fair, just and open,

nondiscriminatory environment for Chinese businesses to

invest."

--Joanne Chiu in Hong Kong and Anna Isaac in London contributed

to this article.

Write to Xie Yu at Yu.Xie@wsj.com

(END) Dow Jones Newswires

January 02, 2020 09:28 ET (14:28 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

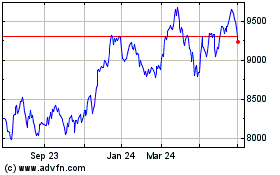

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

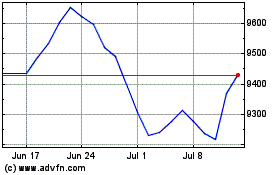

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024