TIDMLOOK

RNS Number : 7093S

Lookers PLC

13 March 2019

LOOKERS plc

Annual Results for the year ended 31 December 2018

Resilient performance in a challenging market and increased

dividend

Lookers plc, ("Lookers", "the Company" or "the Group"), one of

the leading UK motor retail and aftersales service groups,

announces its annual results for the year ended 31 December

2018.

Key financials:

2018 2017 Change

Turnover GBP4,880m GBP4,696m 4%

---------- ---------- -------

Profit before tax GBP53.1m GBP58.4m (9%)

---------- ---------- -------

*Adjusted profit before tax GBP67.3m GBP68.4m (2%)

---------- ---------- -------

*Adjusted profit before tax excluding

property sales GBP59.6m GBP65.9m (9.5%)

---------- ---------- -------

*Adjusted earnings per share 14.68p 14.57p 0.8%

---------- ---------- -------

*Adjusted earnings per share excluding

property sales 12.72p 13.94p (8.7%)

---------- ---------- -------

Earnings per share 11.07p 12.06p (8%)

---------- ---------- -------

Final dividend per share 2.60p 2.48p 5%

---------- ---------- -------

Total dividend per share 4.08p 3.89p 5%

---------- ---------- -------

*Adjusted profit before tax is profit before amortisation of

intangible assets, debt issue costs, defined benefit scheme pension

costs, fair value of derivatives and share based payments. Adjusted

earnings per share is earnings per share before amortisation of

intangible assets, debt issue costs, defined benefit scheme pension

costs, fair value of derivatives and share based payments.

Operational highlights:

-- Total new car turnover down 3.3% and 3.0% on a like-for-like

basis, with gross profit per unit increasing

-- Total used car turnover up 14% and the same on a

like-for-like basis as we continue to grow our presence in this

market

-- Aftersales turnover up 6% on an absolute basis and 7% on a

like-for-like basis, with increased profitability

-- Cost inflation in property, salaries and IT

-- Continued investment to improve dealerships and develop our

multi-channel customer experience

-- Acquisition of Jennings Group in September, expanding our

partnership with Ford in the North East

Outlook:

-- Good start to 2019 with order book for the delivery of new

cars in March continuing to build in line with our expectations

-- Used car volumes continue to show growth and further opportunities in aftersales

Andy Bruce, Chief Executive of Lookers, said:

"We have produced a resilient set of results against a backdrop

of more challenging conditions in the motor sector, increasing

sales and maintaining profitability. In particular, growth in our

used car and aftersales divisions has helped to offset the impact

of a more muted new car market, demonstrating the resilience of our

business model.

"We remain focused on our strategy of having the right brands in

the right locations, underpinned by ensuring operational excellence

across our portfolio of dealerships. This focus, combined with the

quality of our people, is our formula for success and is helping us

to increase market share. At the same time, we continue to explore

opportunities to grow the Lookers estate and in September we

expanded our presence in the North East with the acquisition of the

Jennings Group.

"The order book for new cars in the important month of March is

in line with our expectations and we expect to make further

progress in used cars and aftersales. We remain mindful of a

prolonged period of political and economic uncertainty, but we

believe we are well positioned to strengthen our position to

deliver growth and enhance shareholder value over the medium to

long term."

There will be an analyst presentation today at 10.30am taking

place at Numis Securities, The London Stock Exchange Building, 10

Paternoster Square, London, EC4M 7LT. The presentation will also be

accessible via a live conference call for registered participants.

To register for the call please contact MHP Communications on +44

(0)20 3128 8742, or by email on lookers@MHPC.com.

Enquiries

Lookers Tel: 0161 291 0043

Andy Bruce, Chief Executive

Robin Gregson, Chief Financial Officer

MHP Communications Tel: 020 3128 8742 / 07551 170 451

Tim Rowntree Email: Lookers@mhpc.com

Simon Hockridge

Alistair de Kare-Silver

FINANCIAL INFORMATION

The following table sets out the financial information that is

referred to in this report and reconciles this to statutory

financial metrics.

2018 2017

Operating profit GBP73.6m GBP77.4m

---------- ----------

Amortisation of intangible assets GBP5.6m GBP5.6m

---------- ----------

Share based payments GBP1.7m GBP1.7m

---------- ----------

Defined benefit pension costs GBP4.7m -

---------- ----------

Adjusted operating profit GBP85.6m GBP84.7m

---------- ----------

Profit on sale of properties (GBP7.7m) (GBP2.5m)

---------- ----------

Adjusted operating profit excluding property GBP77.9m GBP82.2m

sales

---------- ----------

Profit before tax GBP53.1m GBP58.4m

---------- ----------

Amortisation of intangible assets GBP5.6m GBP5.6m

---------- ----------

Share based payments GBP1.7m GBP1.7m

---------- ----------

Net interest on pension scheme obligations GBP1.7m GBP4.2m

---------- ----------

Defined benefit pension costs GBP4.7m -

---------- ----------

Fair value on derivative instrument - (GBP1.9m)

---------- ----------

Debt issue costs GBP0.5m GBP0.4m

---------- ----------

Adjusted profit before tax GBP67.3m GBP68.4m

---------- ----------

Profit on sale of properties (GBP7.7m) (GBP2.5m)

---------- ----------

Adjusted profit before tax excluding GBP59.6m GBP65.9m

property sales

---------- ----------

Defined benefit pension costs include a one off charge of GBP3.4

million in 2018 following a High Court ruling against Lloyds Bank

in November 2018 to equalise guaranteed minimum pensions between

male and female participants, a decision that is likely to affect

most defined benefit pension schemes in the UK. The defined benefit

pension cost has been separated in 2018 between net interest on

pension scheme obligations of GBP1.7 million and other defined

benefit costs of GBP4.7 million. Should the prior year numbers be

recognised with the same split, this would have led to GBP2.4

million recognised in net interest on pension scheme obligations

and GBP1.8 million in other defined benefits costs, however due to

the immaterial nature, the balances have not been restated.

Alternative performance measures (APMs)

Lookers use several APMs, in addition to those reported under

IFRS, as management believe these measures enable users of the

financial statements to assess the underlying trading performance

of the business. The APMs used include adjusted operating profit,

adjusted profit before tax excluding property sale, adjusted

earnings per share and net debt to EBITDA. These measures reflect

the underlying trading performance of the business as they exclude

certain non-operational items and amortisation of acquired

intangible assets. The measures described above are also used in

the targeting process for executive and management annual bonuses

(adjusted profit before tax) and share schemes (adjusted profit

before tax and net debt to EBITDA).

STRATEGIC REVIEW

I am pleased to report a resilient set of results for the

Company against a backdrop of challenging trading conditions for

the motor sector, particularly in the second half of the year. We

saw a 4% increase in turnover compared to the prior year with only

a slightly lower level of adjusted profit before tax* of GBP67.3

million (2017: GBP68.4 million). This includes the profit of GBP7.7

million (2017: GBP2.5 million) from the sale of a property, which

is separately included in other operating income. During the year

we had several changes to our dealership portfolio where a number

of businesses were closed and we therefore incurred certain closure

and reorganisation costs as a result of these changes.

Profit before tax was GBP53.1 million (2017: GBP58.4 million).

This result has been achieved during a period in which volumes in

the UK new car market fell by 6.8% to 2.37 million cars, the second

successive year of reduced volumes, albeit the market remains

relatively high compared to historical levels. The new car market

was affected by a continuation of the anti-diesel theme and a

shortage of supply of new vehicles in the last four months of the

year which had to be tested to the more stringent Worldwide

Harmonised Light Vehicle Testing Procedure ("WLTP") emission

regulations. We had anticipated that these supply issues would have

cleared during the last three months of the year but unfortunately,

they remained an issue for the rest of the year. The continuing

political uncertainty resulting from the Brexit situation and the

negative impact this has had on both consumer and business

confidence, has also adversely affected the demand for new

cars.

The new car market has now reduced by 320,000 cars since the

peak of 2.69m in 2016, a decrease of 12%. With our share of just

over 6.2% of the total new car market, this represents a reduction

of 12,800 new cars to Lookers, which is equivalent to a loss in

gross profit in excess of GBP20m. We therefore believe that to have

substantially maintained our profitability despite the loss of this

significant level of profit on new cars, demonstrates the

effectiveness of our strategy and resilience of our business

model.

The key elements of our performance were:

-- Turnover and volumes of new cars reduced and gross profit per unit was increased;

-- Further growth in used car turnover and gross profit;

-- Improvement in both aftersales turnover and margin; and

-- Further inflationary costs in salaries, property and IT.

Whilst the new car market remains challenging, we believe there

are opportunities to grow the business in 2019 and beyond,

particularly in used cars and where Lookers, as a leading company

in the industry, benefits from economies of scale, the skills of

our people and our ability to invest in improved technology.

OPERATING REVIEW

SUMMARY OF KEY FINANCIAL AND NON-FINANCIAL KPIs:

Financial 2018 2017

Turnover GBP4,880m GBP4,696m

---------- ----------

Gross profit GBP515.5m GBP504.1m

---------- ----------

Gross margin 10.6% 10.7%

---------- ----------

*Adjusted operating profit GBP85.5m GBP84.7m

---------- ----------

Profit on sale of property (GBP7.7m) (GBP2.5m)

---------- ----------

*Adjusted operating profit excluding GBP77.8m GBP82.2m

property sales

---------- ----------

*Adjusted profit before tax GBP67.3m GBP68.4m

---------- ----------

*Adjusted profit before tax excluding GBP59.6m GBP65.9m

property sales

---------- ----------

* Adjusted earnings per share 14.68p 14.57p

---------- ----------

*Adjusted earnings per share excluding

property sales 12.72p 13.94p

---------- ----------

Profit before tax GBP53.1m GBP58.4m

---------- ----------

Earnings per share 11.07p 12.06p

---------- ----------

Net debt GBP86.9m GBP97.8m

---------- ----------

Net debt to Adjusted EBITDA 0.88 0.95

---------- ----------

Non-financial

---------- ----------

UK new car market 2.37m 2.54m

---------- ----------

Group new car sales 97,641 104,331

---------- ----------

Share of UK new car retail 6.2% 6.0%

---------- ----------

Group used car sales 97,709 92,105

---------- ----------

Average number of employees 8,323 8,175

---------- ----------

*Adjusted operating profit is operating profit before

amortisation of intangible assets, defined benefit scheme pension

costs and share based payments. Adjusted profit before tax is

profit before amortisation of intangible assets, debt issue costs,

defined benefit scheme pension costs, fair value of derivatives and

share based payments. Adjusted earnings per share is earnings per

share before amortisation of intangible assets, debt issue costs,

defined benefit scheme pension costs, fair value of derivatives and

share based payments. Net debt is loans and overdrafts less cash

and cash equivalents. Adjusted EBITDA is adjusted operating profit

adding back depreciation

Where like-for-like figures are included in this report, they

are calculated on the basis that acquired businesses have been part

of the Group from 1 January 2017 and closed or sold businesses have

been excluded from the Group from 1 January 2017.

Acquisitions and portfolio management

Our motor retail business has been through a period of

significant transformation in recent years and further developments

continued in 2018 to ensure that our dealerships are aligned with

our strategy of having a meaningful representation of the major

automotive brands in the main centres of population in the UK. As

part of this process we closed two Vauxhall dealerships at

Warrington and Yardley, near Birmingham in March. These were both

underperforming businesses and were closed with the agreement of

Vauxhall as part of the rationalisation of their UK dealer network.

In July we acquired a Ford dealership which complements our larger

representation of Ford in Essex and in October we closed our

Hyundai and Nissan business in Motherwell. As referred to earlier

in this report we therefore incurred certain closure and

reorganisation costs as a result of these changes.

In September the Group acquired the Jennings Group for a gross

payment of GBP10.1m. Jennings is a long-established motor retail

group in the North East of England with Ford being the key brand

partner, particularly in the Teesside area. The acquisition

complements and strengthens Lookers' position in the region and we

are delighted to expand our key partnership with Ford. Given the

timing of the acquisition, it has been earnings neutral this year

but has now been successfully integrated and we expect a modest

contribution to earnings in 2019.

Analysis of turnover and gross profit

2018 GBPm 2017 GBPm % change

Turnover

----------- ---------- ---------

New cars 2,395 2,477 (3.3%)

----------- ---------- ---------

Used cars 1,939 1,702 14%

----------- ---------- ---------

Aftersales 433 409 6%

----------- ---------- ---------

Leasing and other 112 108 4%

----------- ---------- ---------

Total 4,880 4,696 4%

----------- ---------- ---------

Gross profit

New cars 161 165 (2%)

---- ---- -----

Used cars 135 133 2%

---- ---- -----

Aftersales 203 189 7%

---- ---- -----

Leasing and other 17 17 -

---- ---- -----

Total 516 504 2%

---- ---- -----

New cars

The sale of new cars represents 31% of gross profit for the

Group and the new car market reduced by 6.8% in the year to 2.37

million. The retail new car market reduced by 6.4% to 1.05 million

and the fleet new car market reduced by 7.2% to 1.32 million. There

were significant fluctuations in the market during the year

including a significant decrease in the first quarter, given the

strong comparatives from 2017 resulting from increased demand in

advance of the changes in Vehicle Excise Duty that became effective

in April 2017. This was followed by some modest growth within

certain months in the second quarter. The final four months of the

year suffered from a shortage in the supply of new cars following

the introduction of the more stringent WLTP emissions regulations

from 1 September. The resulting impact on the timings of when

vehicles could be tested meant that certain brands and models were

not available for sale. The impact of this in the final quarter was

greater than we had originally anticipated in September.

Despite this challenging backdrop, we delivered a positive

performance and our retail volumes were slightly ahead of the

market, with a reduction of 4.6%, or 4.7% on a like-for-like basis.

Fleet volumes, including commercial vehicles, reduced by 8.2%, or

5% on a like-for-like basis, although a reasonable proportion of

the decrease was a result of our decision to exit some high volume

but very low margin fleet business. Total new car turnover reduced

by 3.3% year-on-year and decreased by 3% on a like-for-like basis.

This represents a strong performance compared to the wider market,

as we continue to take share in a competitive environment. Total

gross profit from new cars decreased by less than the reduction in

volume or turnover at 2.3%, compared to the prior year and by 2.4%

on a like-for-like basis. This reflected an increase in profit per

unit during the year where we were able to successfully increase

margins where vehicles were in short supply.

The new car market continues to be at historically high levels

and we have an encouraging level of orders for the important month

of March, albeit these are at a lower level than last year. The

Society of Motor Manufacturers and Traders ("SMMT") current

estimate is that new car volumes will be 2.3% lower for 2019

compared to 2018, at 2.31 million. This is still a relatively

healthy outlook compared to historical levels of new car volumes

and provides opportunities for us to continue to increase market

share, particularly as the brands where we have significant

representation tend to outperform the wider market. Our

relationship with our manufacturer partners remains a critical part

of our success and we continue to work closely with them to achieve

a mutually beneficial commercial relationship, underpinning the

potential to develop further with them in the future.

Used cars

Used cars now contribute 26% of our gross profit and the market

continues to be buoyant with values remaining stable and

predictable. Turnover of used cars increased by 14%, and 14% on a

like-for-like basis, compared to 2017 and volumes increased by 6%.

Gross profit increased by 1.5%, or 1.5% on a like-for-like basis.

This is a pleasing performance given that our used car volumes have

increased significantly over recent years. We continue to focus on

stock management and sourcing good quality vehicles, both of which

help to improve profitability.

In conjunction with recognising the importance of new cars to

our business model, the used car market continues to represent a

significant additional opportunity for the Group and we plan to

accelerate our growth in this market with the target of increasing

our ratio of used cars to new retail to 2:1. Digital channels will

be a key tool to facilitate this growth and we continue to benefit

from the increasing number of leads generated by our website.

Further and extensive investment in technology continues to be

carried out and will lead to further increases in volumes and

profitability.

Aftersales

Our higher margin aftersales business, which represents 39% of

gross profit, has performed well in the period. Turnover (excluding

leasing) increased by 6% compared to 2017 and 7% on a like-for-like

basis and gross profit increased by 7% and 7% on a like-for-like

basis, with the margin being maintained. The increased

profitability has benefitted from the growth in the vehicle parc of

cars under three years old, a trend which has now begun to reduce

given the decreasing volume of new cars sold. However, we have

increased capacity when developing new dealership premises in

recent years which has provided an increase in the base

infrastructure to support these increased volumes.

The increased performance in aftersales is also due to the

initiatives we have made to develop our services, with an increased

emphasis on performance and improved customer retention through

enhanced technology and systems.

Developing a multichannel retail environment

We have continued to make a significant investment in our

multi-channel customer experience and our website plays a critical

and important role in the customer journey, influencing how our

customers research vehicles before they enter the showroom. Our

in-house digital marketing team now operate across all channels and

the latest version of a new, much improved and fully responsive

website, which continues to evolve and improve, has resulted in

further increases in our visitor and enquiry levels.

We are implementing further significant developments to our

website which will result in exciting improvements in functionality

and interaction with our customers. We are currently migrating to

the new and considerably improved website on a phased basis and

expect this to be fully operational across all dealerships during

this year. With over 70% of visits to our website being via mobile

or tablet we have ensured that functionality has concentrated on

this area. Our aim is to produce an industry-leading website, which

will improve the customer experience and ultimately increase sales

and profitability. We also believe that this investment in

technology will result in greater operational efficiencies which

will give us a significant competitive advantage and improved

profitability.

We have previously commented on our commitment to developing and

improving the customer journey through a significant programme of

capital investment in new and improved dealership premises. There

is still further investment to make in this transformation of our

property portfolio, but we believe this will start to reduce after

2021. The programme is taking us longer than originally anticipated

due to delays in finding appropriate properties and planning

issues. However, this has resulted in the benefit of capital

expenditure being incurred over a longer period and at lower levels

than originally anticipated. This programme will ensure that our

entire dealership estate represents best in class modern motor

retailing.

Customer experience

Our goal is to be recognised as providing the best customer

experience and engagement in the UK motor retail sector. We do this

through personal, relevant, meaningful and memorable expert advice

that helps our customers understand the product and make the right

choice. We conduct extensive customer research to monitor feedback

as we appreciate that customers have high expectations and

increasingly more access to detailed product information

themselves.

Our people

Our people are the key to helping us to deliver our strategy and

providing a first-class customer experience. We continue to invest

in our people with further improvements and new initiatives to our

training and development programme and a formal management

development programme. We believe Lookers offer the most attractive

employment prospects in our sector and we aim to be the best place

to work in our industry. This should result in us being able to

attract and retain the best people, including those from outside

the sector, to achieve enhanced levels of customer satisfaction and

help us continue to be a leading company in the UK motor retail

sector. It was therefore a great achievement for our progress in

this important area to be recognised again as the only motor

retailer to be awarded the exclusive Top Employers United Kingdom

certification, which we have now achieved for a third successive

year. We have also, for the first time, achieved the recognition

for outstanding staff engagement by achieving a prominent position

in the Sunday Times list of top companies to work for. This success

demonstrates our commitment to building a positive employee

experience and of our commitment to optimise, develop and work with

all our people to build a meaningfully and noticeably different

experience for them and our customers.

FINANCIAL REVIEW

GROUP RESULTS

Turnover increased by 3.9% to GBP4,880 million compared to the

previous year (2017: GBP4,696 million), with growth from used cars

and aftersales. Gross profit increased by 2.4% to GBP516 million

(2017: GBP504 million). The gross margin of 10.6% was a similar

level to last year, despite higher levels of used car turnover

which tends to dilute the margin.

Adjusted profit before tax of GBP67.3 million reduced by 1.6%

(2017: GBP68.4 million). As referred to above, this includes the

profit of GBP7.7 million (2017: GBP2.5 million) from the sale of a

property, which is separately included in other operating income.

Whilst gross profit increased by GBP12.0 million, costs also

increased in the year by GBP20.4 million due to inflationary

pressures from payroll costs (cost of living, workplace pensions

and living wage) as well as higher property costs in relation to

rent, rates, depreciation and energy as well as an increase in IT

costs. Considering the challenging trading conditions, further cost

saving initiatives were carried out in the year to stabilise the

cost base although we will continue to experience the impact of

inflation on payroll costs.

Net interest costs increased by 13%, to GBP18.3 million (2017:

GBP16.3 million), due to higher levels of working capital and

increases in the bank base rate in November 2017 and August 2018.

Interest on group borrowings is based on floating interest rates

together with an historical interest rate hedge from 10 years ago.

This covered GBP20 million of debt at the relatively high rate of

interest of 4.99% and expired during the year.

Key financial highlights are summarised below:

-- *Adjusted profit before tax for the year, including the

profit on the sale of a property of GBP7.7 million, was maintained

at a similar level to the prior year at GBP67.3 million (2017:

GBP68.4 million);

-- Profit before tax was GBP53.1 million compared to a profit

before tax in the previous year of GBP58.4 million. This also

includes the cost of GBP3.4 million which relates to a back dated

pension adjustment for GMP equalisation and is explained in further

detail in the section on pensions;

-- Profit after tax was GBP43.5 million, a reduction of 9% (2017: GBP47.9 million); and

-- Earnings per share reduced to 11.07p compared to 12.06p in

the prior year and *Adjusted earnings per share was stable at

14.68p (2017:14.57p)

*Adjusted profit before tax is profit before amortisation of

intangible assets, debt issue costs, defined benefit scheme pension

costs, fair value of derivatives and share based payments. Adjusted

earnings per share is earnings per share before amortisation of

intangible assets, debt issue costs, defined benefit scheme pension

costs, fair value of derivatives and share based payments.

We have continued to consider that adjusted profit before tax is

before amortisation of intangible assets as this is consistent with

our previous financial reporting. However, we have reviewed this

and decided that in the future, it is more appropriate to report

adjusted profit before tax to include the amortisation of

intangible assets. This practice will be adopted in our interim

financial report for the six months ending 30 June 2019.

TAXATION

The tax charge for the year of GBP9.6 million (2017: GBP10.5

million) reflects a charge of 18% of profit before tax, which is

slightly lower than the standard rate of corporation tax for the

year of 19%. This is due to an over provision for corporation tax

in prior years as several tax issues relating to previous years

were agreed with HMRC.

CASH FLOW

Cash generated from operations for the year continued to be

strong at GBP79.4 million and represented a small reduction over

the prior year (2017: GBP79.7 million). Net working capital

increased by GBP10.1 million, an improvement of GBP7.7 million

(2017: increase of GBP17.8 million). Stock decreased by GBP1.4

million, debtors reduced by GBP48.9 million and creditors reduced

by GBP60.4 million, these movements representing the movement in

net working capital.

Capital expenditure was GBP25.7 million, a significant reduction

compared to last year (2017: GBP46.1 million), with proceeds from

the sale of properties and dealership businesses of GBP35.1 million

(2017: GBP8.0 million), resulting in a net capital receipt of

GBP9.4 million (2017: net expenditure of GBP38.1 million). The

majority of capital expenditure was on new or improved premises for

dealerships and reflects our ongoing commitment to improve our

retail environment, so they reflect modern and state of the art

facilities, as we have previously reported. The capital receipt of

GBP35.1 million reflects the sale of group properties that we had

previously developed which were sold as sale and leaseback

transactions and produced a profit of GBP7.7 million.

Cash flow in the year included loan repayments of GBP14.6

million compared to GBP12.5 million last year.

Net debt reduced by GBP10.9 million due to positive cash flow in

the year which resulted in net debt of GBP86.9 million at 31

December 2018 compared to GBP97.8 million at the start of the year.

Net debt is calculated as gross bank borrowings of GBP131.3 million

less cash balances of GBP44.4 million.

BANK FUNDING

Our bank facilities at the start of the year had a term until

March 2020 and consisted of a term loan of GBP75 million and a

revolving credit facility of GBP150 million. Whilst the facilities

had 15 months to run as at 31 December 2018, we considered it

prudent, given the uncertainty surrounding Brexit, to renew our

facilities at an earlier stage and a new facility was arranged in

December 2018. This consists of a revolving credit facility of

GBP250 million arranged with five banks, (Bank of Ireland,

Barclays, HSBC, Lloyds and NatWest), with a term to March 2022 and

an option to extend to March 2023. There is also the potential to

increase the facility up to an additional GBP50 million to fund

future acquisitions.

Interest is charged on the facility at a margin of between 1.3%

and 2.25% above LIBOR, depending on the ratio of net bank debt to

EBITDA. These facilities are subject to half yearly covenant tests

on interest cover and net bank debt to EBITDA. The covenant tests

are set at levels that should provide sufficient headroom and

flexibility for the Group until maturity of the facilities.

At 31 December 2018, total facilities were GBP250 million (2017:

GBP225 million) of which GBP86.9 million, net of cash balances, was

being utilised, leaving unutilised facilities of GBP145.1 million.

The bank facility, together with the Group's strong operational

cash flow, indicate that the Group has sufficient facilities

available to fund its operations and allow for future expansion. At

31 December 2018, net debt to EBITDA was 0.88 compared to 0.95 last

year. The Group's underlying profitability and strong cash flow

should result in further reductions in borrowing in the future and

help ensure that the level of borrowing remains under control and

is at a reasonable level in relation to net assets.

PROPERTY PORTFOLIO

The Group has a policy of investing in freehold and long

leasehold property as the preferred means of providing premises for

our car dealerships, where possible. As a result, we have a

significant and valuable portfolio of freehold and long leasehold

properties which is an important strength of our business. The net

book value at 31 December 2018 was GBP302.7 million compared to

GBP308.7 million last year. Short leasehold properties had a value

of GBP2.7 million (2017: GBP2.7 million).

From 1 January 2019 we will be retrospectively adopting the new

accounting standard, IFRS 16: Leases, which introduces a

comprehensive model for the identification of lease arrangements

and accounting treatments for both lessors and lessees. IFRS 16

will have a significant impact on the way our property leases are

included in the accounts, where we will include an asset and a

liability in the accounts in respect of each lease. The annual

operating lease rental will then be represented as depreciation and

interest in the income statement. Preliminary calculations indicate

that for the leases held at the year end the Group expects an

increase in gross assets of up to GBP100 million and an increase in

gross liabilities of up to GBP120 million. EBITDA is expected to

increase by up to GBP20 million and operating profit is expected to

increase by up to GBP7.5 million. However, these changes are not

expected to significantly impact on profit before tax.

DIVIDS

In our interim report, we indicated that due to the encouraging

results and strong financial position of the Group, the interim

dividend would be increased by 5% to 1.48p per ordinary share and

this was paid on 24 November 2018. We are now proposing a 5%

increase in the final dividend to 2.60p per share (2017: 2.48p),

giving a total dividend for the year ended 31 December 2018 of

4.08p per share (2017: 3.89p), representing an annual increase of

5%.

The dividend has now increased by over 127% compared to the

dividend payable for the year ended 31 December 2010, when the

Company re-commenced dividend payments, and continues our

progressive policy of increasing the dividend provided there is

satisfactory growth in profitability.

The increase in the total dividend this year recognises that the

dividend cover has risen significantly in recent years. The Board

maintains its view that the level of cover should reduce over the

medium term to a level of between 3.5 and 4.0 times. However, the

Board will continue to review the dividend policy in light of the

Company's trading performance whilst retaining sufficient cash flow

to fund future expansion in terms of both organic growth and

acquisitions.

The final dividend of 2.60p per share is subject to shareholder

approval at the Annual General Meeting and will be payable on 5

June 2019. The ex-dividend date will be 25 April 2019 and the

record date will be 26 April 2019. This will represent a cash

outflow of GBP10.1 million, which gives a total dividend for the

year of GBP15.9 million (2017: GBP15.4 million). Dividends paid in

cash during the year were GBP15.6 million, an increase of 4%

compared to the previous year.

PENSION SCHEMES

The Group has three defined benefit pension schemes, The Lookers

Pension Plan, The Dutton Forshaw Pension Plan and The Benfield

Motor Group Pension Plan. All three schemes are closed to entry for

new members and closed to future accrual. The asset values of the

three pension schemes decreased by GBP19.7 million during the year

due to the adverse movements in global investments during the year

and the valuation of the liabilities of the schemes reduced by

GBP14.6 million. The pension schemes also suffered a one-off charge

of GBP3.4 million following a High Court ruling against Lloyds Bank

in November 2018 to equalise guaranteed minimum pensions between

male and female participants, a decision that is likely to affect

most defined benefit pension schemes in the UK.

As a result, the net deficit included in the balance sheet

increased by GBP5.1 million in the year. However, it is important

to appreciate that the assessment of valuation of the pension

schemes is based on several key assumptions prescribed by

accounting standards. As a result, the calculation which estimates

the potential liabilities of the schemes can increase or decrease

the liabilities due to factors that have no relation or relevance

to the trading results of the Group.

The impact of these factors is that the combined value of the

deficits of the three schemes increased in the year and the total

deficit after deferred tax is now GBP57.1 million (2017: GBP52.9

million). Relatively small changes in the bases of valuation can

have a significant effect on the calculated deficit hence the

movement in the calculated deficit can be subject to high levels of

volatility. The Board continues to look at its options to reduce

both the annual cost of operating both schemes and what actions can

be taken to reduce the deficit on the schemes, thereby reducing

exposure to movements in these liabilities and reducing the deficit

over the medium and longer term.

SHARE BUY BACK PROGRAMME

In March 2018 we announced a share buyback programme of up to

GBP10 million of the Company's ordinary shares, given the sensible

returns it would provide based on the share price at that time.

This was based on the Board's consideration of the Group's capital

structure and capital allocation priorities in relation to the

previously stated target range of net debt to EBITDA of between 0.5

and 1.5. By 31 December 2018, the Company had purchased GBP9.3

million of the company's ordinary shares and this completed the

share buyback programme, representing 2.3% of the Company's share

capital at the start of the share buyback programme. The Board has

considered whether to operate a similar programme this year and has

decided that, given the uncertainty surrounding Brexit, it would be

prudent to retain flexibility and review the situation as we

progress through the year. A share buy back programme will not

therefore be implemented at the moment but will be kept under

review depending on trading conditions and economic

circumstances.

SUMMARY AND OUTLOOK

Our strategy of having the right brands in the right locations

combined with excellent operational execution leaves us well placed

to continue to make good progress against our goals. The Group has

produced a resilient performance in difficult market conditions

with underlying growth across the majority of the business, which

demonstrates the resilience of the Lookers business model.

Our new car business has performed well in a challenging market

and whilst volumes are expected to continue to reduce, the market

is forecast to remain at near historic high levels and we are well

positioned to continue to take market share. We have also

significantly increased our used car volumes and profit, growing

our share of this market and our high margin aftersales business

also continues to provide opportunities to increase both turnover

and profit.

We continue to make significant investments to upgrade our

facilities and enhance our multichannel customer experience. This,

together with the broad base of our franchise representation and

our strong relationship with our manufacturer partners, strengthens

our position as a leading UK automotive retail and aftersales

service group. This will enable us to achieve future growth over

the medium to long term.

The current political environment, Brexit and weaker exchange

rates create a degree of uncertainty in the UK economy, which is

unhelpful. We also remain conscious of consumer confidence levels

and the Pound-Euro exchange rate, both of which could have an

impact on our business. We therefore look forward with a degree of

caution and continue to plan prudently for the business, mindful of

these external factors.

However, we have a strong balance sheet which continues to be

strengthened by operational cash flow with both net debt and net

debt to EBITDA being at relatively low levels. We have recently

renewed our bank facilities to provide higher levels of facility

for an extended term as well as ensuring substantial headroom in

these facilities. This provides secure funding capacity and

financial security to grow the business through further strategic

acquisitions at a time when there continue to be significant

consolidation opportunities within the sector. Our record of

successfully integrating acquisitions and turning around

performance is a significant differentiator for Lookers.

The Group has made a good start to the current financial year

and our order book for the delivery of new cars in the important

month of March continues to build in line with our expectations.

Our used car volumes continue to show growth and further

opportunities in aftersales.

I would like to finish my review by thanking all my colleagues

at Lookers for their hard work, commitment and dedication to the

Company and without whom we would not have been able to yet again

deliver another resilient set of results.

Andy Bruce

Chief Executive

13 March 2019

Consolidated Income Statement

Total Total

2018 2017

GBPm GBPm

Note

Revenue 1 4,879.5 4,696.3

Cost of sales (4,364.0) (4,192.2)

-------------------------------------------- ----- ---------- ----------

Gross profit 515.5 504.1

-------------------------------------------- ----- ---------- ----------

Distribution costs (294.6) (292.5)

Administration expenses (153.3) (135.0)

Share based payments (1.7) (1.7)

Other operating income 7.7 2.5

Operating profit 73.6 77.4

-------------------------------------------- ----- ---------- ----------

Net interest 2 (18.3) (16.3)

Net interest on pension scheme obligation (1.7) (4.2)

Fair value on derivative instrument - 1.9

Debt issue costs (0.5) (0.4)

-------------------------------------------- ----- ---------- ----------

Profit before taxation 53.1 58.4

-------------------------------------------- ----- ---------- ----------

Tax charge (9.6) (10.5)

Profit for the year 43.5 47.9

-------------------------------------------- ----- ---------- ----------

Actuarial (losses)/gains on pension

scheme obligations (7.2) 10.6

Deferred tax on pension scheme obligations 1.2 (1.9)

Total other comprehensive income

for the year (6.0) 8.7

Total comprehensive income for the

year 37.5 56.6

Attributable to:

Shareholders of the company 37.5 56.6

Earnings per share

Basic earnings per share 3 11.07p 12.06p

-------------------------------------------- ----- ---------- ----------

Diluted earnings per share 3 10.59p 11.70p

-------------------------------------------- ----- ---------- ----------

Consolidated Statement of Financial Position

Restated

2018 2017

Note GBPm GBPm

------------------------------- ----- -------- ---------

Non-current assets

Goodwill 5 116.2 108.9

Intangible assets 114.6 112.3

Property, plant and equipment 350.9 342.0

581.7 563.2

------------------------------- ----- -------- ---------

Current assets

Inventories 1,027.7 984.1

Trade and other receivables 179.5 242.1

Rental fleet vehicles 54.2 60.9

Cash and cash equivalents 44.4 45.3

Assets held for sale 8.0 -

1,313.8 1,332.4

------------------------------- ----- -------- ---------

Total assets 1,895.5 1,895.6

-------------------------------- ----- -------- ---------

Current liabilities

Bank loans and overdrafts 2.6 19.6

Trade and other payables 1,236.6 1,228.1

1,239.2 1,247.7

------------------------------- ----- -------- ---------

Net current assets 74.6 84.7

Non-current liabilities

Bank loans 128.7 123.5

Trade and other payables 19.4 36.8

Pension scheme obligations 68.9 63.8

Deferred tax liabilities 40.0 38.8

-------------------------------- ----- -------- ---------

257.0 262.9

------------------------------- ----- -------- ---------

Total liabilities 1,496.2 1,510.6

-------------------------------- ----- -------- ---------

Net assets 399.3 385.0

-------------------------------- ----- -------- ---------

Shareholders' equity

Ordinary share capital 19.4 19.9

Share premium 78.4 78.4

Capital redemption reserve 15.1 14.6

Retained earnings 286.4 272.1

-------------------------------- ----- -------- ---------

Total equity 399.3 385.0

-------------------------------- ----- -------- ---------

Consolidated Cash Flow Statement

Restated

Note 2018 2017

GBPm GBPm

Cash flows from operating activities

Profit for the year 43.5 47.9

Tax charge 9.6 10.5

Depreciation of property, plant and equipment 20.6 20.7

Fair value on derivative instruments - (2.4)

(Profit)/loss on disposal of plant and

equipment (8.2) 0.4

Amortisation of intangible assets 5.6 5.6

Share based compensation 1.7 1.7

Interest income (0.3) (0.3)

Interest payable 18.6 16.6

Debt issue costs 0.5 0.4

Difference between pension charge and cash

contributions (2.1) (3.6)

Changes in inventories 1.4 (144.7)

Changes in receivables 48.9 (16.1)

Changes in payables (60.4) 143.0

Cash generated from operations 79.4 79.7

----------------------------------------------- ------- -------- ---------

Purchase of rental fleet vehicles (89.4) (87.1)

Proceeds from sale of rental fleet vehicles 90.3 87.0

Interest paid 2 (18.6) (16.6)

Interest received 2 0.3 0.3

Tax paid (7.1) (25.5)

----------------------------------------------- ------- -------- ---------

Net cash inflow from operating activities 54.9 37.8

----------------------------------------------- ------- -------- ---------

Cash flows from investing activities

Purchase of property, plant and equipment (25.7) (46.1)

Purchase of intangibles (7.9) (8.1)

Purchase of subsidiaries net of cash received (13.7) (1.3)

Proceeds from sale of property, plant and

equipment 35.1 8.0

Net cash outflow from investing activities (12.2) (47.5)

----------------------------------------------- ------- -------- ---------

Cash flows from financing activities

Proceeds from issue of ordinary shares - 0.8

Redemption of ordinary shares (9.3) -

Repayment of loans (14.6) (12.5)

Drawdown on RCF 135.3 282.8

Repayment of RCF (134.1) (239.7)

Dividends paid 4 (15.6) (15.0)

----------------------------------------------- ------- -------- ---------

Net cash outflow from financing activities (38.3) 16.4

----------------------------------------------- ------- -------- ---------

Increase in cash and cash equivalents 4.4 6.7

Cash and cash equivalents at 1 January 38.9 32.2

Cash and cash equivalents at 31 December 43.3 38.9

----------------------------------------------- ------- -------- ---------

Included within cash and cash equivalents is GBP44.4m (2017:

GBP45.3m) recognised as cash and GBP1.1m (2017: GBP6.4m) of

overdrafts recognised in short term liabilities on the balance

sheet.

Consolidated Statement of Changes in Equity

Capital

Share Share redemption Retained Total

capital premium reserve earnings equity

GBPm GBPm GBPm GBPm GBPm

---------------------------- ---------- ---------- ------------ ----------- ---------

As at 1 January 2017 19.8 77.7 14.6 229.6 341.7

Profit for the year - - - 47.9 47.9

Other comprehensive income

for the year - - - 8.7 8.7

Total comprehensive income

for the year 56.6 56.6

New shares issued 0.1 0.7 - - 0.8

Share based compensation - - - 1.7 1.7

Tax recognised in equity - - - (0.8) (0.8)

Dividends paid - - - (15.0) (15.0)

As at 31 December 2017 19.9 78.4 14.6 272.1 385.0

---------------------------- ---------- ---------- ------------ ----------- ---------

As at 1 January 2018 19.9 78.4 14.6 272.1 385.0

Profit for the year - - - 43.5 43.5

Other comprehensive income

for the year - - - (6.0) (6.0)

Total comprehensive income

for the year 37.5 37.5

New shares issued 0.0 0.0 - - 0.0

Share based compensation - - - 1.7 1.7

Share buy-back (0.5) - 0.5 (9.3) (9.3)

Dividends paid - - - (15.6) (15.6)

As at 31 December 2018 19.4 78.4 15.1 286.4 399.3

---------------------------- ---------- ---------- ------------ ----------- ---------

Retained earnings include GBP16.5m (2017: GBP16.8m) of

non-distributable reserves relating to properties which had been

revalued under UK GAAP, but treated as deemed cost under IFRS.

Notes to the Consolidated Financial Statements

Basis of preparation

The unaudited financial information for the year end 31 December

2018 has been based on the Company's financial statements which are

prepared in accordance with International Financial Reporting

Standards (IFRS) as adopted for use in the EU. Whilst the financial

information contained in this preliminary announcement has been

prepared in accordance with the recognition and measurement

criteria of IFRS, this announcement does not itself contain

sufficient information to comply with those standards. The Company

expects to publish full financial statements that comply with IFRS

in March 2019. The financial information presented herein has been

prepared in accordance with the accounting policies expected to be

used in preparing the Lookers Annual Report 2018, which are the

same as those used in preparing the Lookers Annual Report 2017,

with the exception of the implementation of IFRS 9 'Financial

Instruments' and IFRS 15 'Revenue with Contracts with Customers'

from 1 January 2018.The adoption of both of these new standards has

not had a material effect on the reported results for either

current or prior period.

Going concern

In determining the basis of preparation for the Annual Report

and the Group's viability statement, the directors have considered

the Group's business activities, together with the factors likely

to affect its future development, performance and position. This

includes an overview of the Group's financial position, cash flows,

liquidity position and borrowing facilities for the three year

period to 31 December 2021 as well as compliance with existing

banking covenants. These forecasts and projections have been

subject to sensitivity movements which involve modifying one or

more of the main assumptions underpinning the base forecast. Based

on the results of this exercise and the assessment of risks and

associated controls, the directors have an expectation that the

Group will be able to continue in operation, comply with facility

covenants and meet its liabilities as they fall due. The Directors

therefore

continue to adopt the going concern basis in preparing the

financial statements.

Prior period restatement

Following the refinancing that occurred during late 2018 the

Directors have reviewed the terms and conditions prevalent within

the previous revolving credit facility arrangement. As a result of

this review the Directors have considered it more appropriate to

reclassify the previous revolving credit facility balances that was

disclosed within overdrafts in cash and cash equivalents to be

shown as long-term financial liabilities.

This presentation is then consistent with the disclosure of the

new long-term revolving credit facility. The effect of this

restatement in the statement of financial position on the years

ending 31 December 2017 and 31 December 2016 are as follows:

2017 2016

GBPm GBPm

As previously reported:

Cash and cash equivalents at 1 January 45.3 39.8

Bank overdrafts (52.9) (11.0)

Cash and cash equivalents reported in the

cash flow statement (7.6) 28.8

-------------------------------------------- ------- -------

Current liabilities

Bank loans and overdrafts 66.1 25.1

Non-current liabilities

Long term borrowings 77.0 88.8

Total liabilities 143.1 113.9

-------------------------------------------- ------- -------

Net current assets/(liabilities) 38.2 41.0

-------------------------------------------- ------- -------

As restated:

Cash and cash equivalents at 1 January 45.3 39.8

Bank overdrafts (6.4) (7.6)

Cash and cash equivalents reported in the

cash flow statement 38.9 32.2

-------------------------------------------- ------- -------

Current liabilities

Bank loans and overdrafts 19.6 21.7

Non-current liabilities

Long term borrowings 123.5 92.2

Total liabilities 143.1 113.9

-------------------------------------------- ------- -------

Net current assets 84.7 44.4

-------------------------------------------- ------- -------

The effect of this on the consolidated cash flow statement is as

follows:

2017

GBPm

As previously reported:

Net cash outflow from financing activities -26.7

--------------------------------------------------- ------

(Decrease) / increase in cash and cash

equivalents -36.4

--------------------------------------------------- ------

As restated:

Net cash inflow/(outflow) from financing

activities 16.4

--------------------------------------------------- ------

Increase /(decrease) in cash and cash equivalents 6.7

--------------------------------------------------- ------

There is no effect on the reported profits for either financial

year as a result of this presentational adjustment.

1. Segmental reporting

At 31 December 2018 and 31 December 2017, being the group is

organised into one business segment, motor distribution. All

revenue and profits originate in the United Kingdom and the

Republic of Ireland.

Motor

Year ended distribution Unallocated Group

ended 31 December 2018 GBPm GBPm GBPm

------------------------------------- -------------- ------------ --------

New Cars 2,394.8 - 2,394.8

Used Cars 1,939.4 - 1,939.4

Aftersales 545.3 - 545.3

-------------------------------------- -------------- ------------ --------

Revenue 4,879.5 - 4,879.5

-------------------------------------- -------------- ------------ --------

Segmental operating profit / (loss) 87.2 (13.6) 73.6

Net interest (15.5) (2.8) (18.3)

Net interest on pension scheme

obligations - (1.7) (1.7)

Debt issue costs - (0.5) (0.5)

Profit / (loss) before taxation 71.7 (18.6) 53.1

Tax charge (9.6)

Profit for the year 43.5

-------------------------------------- -------------- ------------ --------

Total assets 1,895.5 - 1,895.5

-------------------------------------- -------------- ------------ --------

Total liabilities 1,364.9 131.3 1,496.2

-------------------------------------- -------------- ------------ --------

Motor

Year ended Distribution Unallocated Group

ended 31 December 2017 GBPm GBPm GBPm

------------------------------------- -------------- ------------ --------

New Cars 2,476.8 - 2,476.8

Used Cars 1,702.7 - 1,702.7

Aftersales 516.8 - 516.8

-------------------------------------- -------------- ------------ --------

Revenue 4,696.3 - 4,696.3

-------------------------------------- -------------- ------------ --------

Segmental operating profit / (loss) 84.7 (7.3) 77.4

Net interest (13.4) (2.9) (16.3)

Net interest on pension scheme

obligations - (4.2) (4.2)

Fair value on derivative instrument - 1.9 1.9

Debt issue costs - (0.4) (0.4)

-------------------------------------- -------------- ------------ --------

Profit / (loss) before taxation 71.3 (12.9) 58.4

Tax charge (10.5)

-------------------------------------- -------------- ------------ --------

Profit for the year 47.9

-------------------------------------- -------------- ------------ --------

Total assets 1,895.6 - 1,895.6

-------------------------------------- -------------- ------------ --------

Total liabilities 1,367.5 143.1 1,510.6

-------------------------------------- -------------- ------------ --------

Notes to the Consolidated Financial Statements

2. Finance costs - net

2018 2017

GBPm GBPm

-------------------------------------------------------- ------- -------

Interest expense

Interest payable on bank borrowings (5.6) (4.9)

Interest on consignment vehicle liabilities & stocking

loans (13.0) (11.7)

-------------------------------------------------------- ------- -------

Interest and similar charges payable (18.6) (16.6)

-------------------------------------------------------- ------- -------

Interest income

Bank interest 0.3 0.3

Total interest receivable 0.3 0.3

-------------------------------------------------------- ------- -------

Finance costs - net (18.3) (16.3)

-------------------------------------------------------- ------- -------

Notes to the Consolidated Financial Statements

3. Earnings per share

The calculation of earnings per ordinary share is based on the

profit on ordinary activities after taxation attributable to

shareholders amounting to GBP43.5m (2017: GBP47.9m) and a weighted

average number of ordinary shares in issue during the year of

393,422,446 (2017: 397,305,738).

The diluted earnings per share are based on the weighted average

number of shares, after taking account of the dilutive impact of

shares under option of 17,964,569 (2017: 12,030,902).

2018 2017

Earnings Earnings

Per share Per share

p p

------------------------------- ----------- -----------

Basic EPS 11.07 12.06

Effect of dilutive securities (0.48) (0.36)

Diluted EPS 10.59 11.70

------------------------------- ----------- -----------

Adjusted EPS 2018 GBPm 2018 EPSp 2017 GBPm 2017 EPSp

Earnings attributable to ordinary shareholders 43.5 11.07 47.9 12.06

Amortisation of intangible assets 5.6 1.42 5.6 1.40

Net interest and costs on pension scheme obligations 6.4 1.63 4.2 1.06

Share based payments 1.7 0.43 1.7 0.43

Debt issue costs 0.5 0.13 0.4 0.1

Fair value of derivative instrument - - (1.9) (0.48)

------------------------------------------------------ ---------- ---------- ---------- ----------

Adjusted EPS 57.7 14.68 57.9 14.57

------------------------------------------------------ ---------- ---------- ---------- ----------

Profit on sale of property (7.7) (1.96) (2.5) (0.63)

------------------------------------------------------ ---------- ---------- ---------- ----------

Adjusted EPS including property 65.4 12.72 55.4 13.94

------------------------------------------------------ ---------- ---------- ---------- ----------

4. Dividends

2018 2017

GBPm GBPm

------------------------------------------------- ------ ------

Interim dividend for the year ended 31 December

2018 1.48p (2017: 1.41p) 5.8 5.6

Final dividend for the year ended 31 December

2017 2.48p (2016:2.36p) 9.8 9.4

------------------------------------------------- ------ ------

The Directors propose a final dividend of 2.60p per share in

respect of the financial year ending 31 December 2018 (2017:

2.48p). The proposed final dividend is subject to approval by the

shareholders at the Annual General Meeting and has not been

included as a liability in these financial statements. The final

dividend will be payable on 5 June 2019 and the ex-dividend date

will be 25 April 2019 with the record date being 26 April 2019.

5 Goodwill

2018 2017

GBPm GBPm

=============================== ===== =====

Cost

=============================== ===== =====

As at 1 January 119.3 118.0

=============================== ===== =====

Additions 7.3 1.3

=============================== ===== =====

As at 31 December 126.6 119.3

=============================== ===== =====

Aggregate impairment

=============================== ===== =====

As at 1 January 10.4 10.4

=============================== ===== =====

Impairment - -

=============================== ===== =====

As at 31 December 10.4 10.4

=============================== ===== =====

Carrying amount at 31 December 116.2 108.9

=============================== ===== =====

During the year the Group has changed its approach for the

determination of cash generating units (CGU's). Previously this was

done on a subsidiary by subsidiary basis however the Directors have

elected to change this in the current year to better reflect the

markets served by the CGU's and the appropriate level at which CGUs

are monitored for impairment.

The following table summarises goodwill and intangibles with an

indefinite useful economic life allocated by CGU.

2018 2018 2017 2017

Goodwill Intangibles Goodwill Intangibles

GBP'm GBP'm GBP'm GBP'm

JLR 13.8 - 13.8 -

Audi 22.1 28.9 22.1 28.9

Charles Hurst 9.4 - 9.4 -

Renault Nissan 2.6 2.9 2.6 2.9

Mercedes 15.2 28.1 15.2 28.1

Volkswagen 7.5 15.9 7.5 15.9

Ford 26.7 2.9 19.4 2.9

BMW 9.6 22.3 9.6 22.3

Vauxhall 0.2 - 0.2 -

Fleet / Leasing 9.1 - 9.1 -

----------------- ------------- ---------- -------------

116.2 101.1 108.9 101.1

----------------- ------------- ---------- -------------

Each CGU's recoverable amounts have been derived from value in

use calculations using the most recent projections for each CGU.

The group prepares cash flow forecasts derived from the most recent

Board approved budgets for 2019 and uses growth assumptions to

extrapolate the cash flows into perpetuity based on estimated

growth rates.

There are a number of key assumptions within these forecasts and

these have been based on management's past experience, knowledge of

the market and given the significant uncertainty surrounding

Brexit, an assumption has been made that the UK will leave the UK

through an orderly exit. Set out below are the key assumptions that

have been used in determining the impairment model.

Assumption 2018 2017

Two to five year revenue

growth 1.4% 1.6%

----- -----

Two to five year operating

expenses growth 1.1% 1.0%

----- -----

Post five year growth rates 0.0% 0.0%

----- -----

Discount rate 8.7% 9.7%

----- -----

The pre-tax adjusted discount rate used has been calculated and

benchmarked against externally available data.

As a result of the impairment review, for all CGUs the value in

use estimation exceeds the associated carrying value. However,

acknowledging continued uncertainty in the UK economy, including

the outcome of Brexit negotiations, we have prepared a sensitivity

analysis, principally being a reduction in forecast revenue of 6%.

This shows that, with the exception of the BMW, Volkswagen and Ford

CGUs, no impairment arises in response to reasonable possible

change scenarios. For the three CGUs that do show material

impairment, the impairment that would arise is as follows:

CGU Impairment

(GBPm)

BMW 17.4

-----------

Volkswagen 7.3

-----------

Ford 5.5

-----------

Based on the review performed, the directors believe that the

value of the CGUs remains strong and will continue to monitor

performance during 2019. At 31 December 2018 we consider that the

carrying values in use of all CGUs included in the financial

statements are appropriate.

6. Principal risks and uncertainties

There are a number of potential risks and uncertainties which

could have a material impact on the group's performance, business

activities, financial condition, results of operations or the

company's share price could cause actual results to differ

materially from expected and historical results. The Board

maintains a policy of continuous identification and review of risks

and uncertainty and the principal risks identified are the adverse

impact of the global economy, manufacturers' financial stability,

adverse movements in exchange rates, , liquidity and financing

issues for the company, legislative changes in relation to vehicle

taxation and transport policy, failure of group information

systems, investment in people and the relative strength and

influence of the vehicle manufacturers on the UK market. The Board

has recently reviewed the risk factors and confirm that they should

remain valid for the rest of this year. These risks now include a

risk for the adverse impact of Brexit.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR UOUVRKBAOARR

(END) Dow Jones Newswires

March 13, 2019 03:02 ET (07:02 GMT)

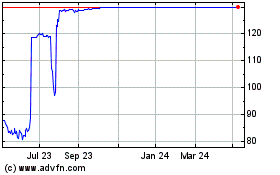

Lookers (LSE:LOOK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lookers (LSE:LOOK)

Historical Stock Chart

From Apr 2023 to Apr 2024