TIDMITM

RNS Number : 9307A

ITM Power PLC

27 January 2020

27 January 2020

ITM Power plc

("ITM Power", "the Group" or the "Company")

Half Year Results for the Period ended 31 October 2019

ITM Power (AIM: ITM), the energy storage and clean fuel company,

announces half year results for the six month period ended 31

October 2019. Comparable figures, where stated, refer to the

corresponding period in 2018 unless otherwise indicated.

Commercial:

-- Formation of a Joint Venture with Linde Engineering, ITM

Linde Electrolysis GmbH ("ILE") focusing on delivering green

hydrogen to large scale industrial projects

-- Transformative GBP58.8m fundraise to:

o facilitate move to Bessemer park

o fund the continuing development of 5MW electrolyser module

o initially fund the Joint Venture, ILE GmbH

o provide balance sheet strength and flexibility

Operational:

-- Lease for new 1GW factory signed, with Principal Contractor

appointed for fitout on a 30 week programme

-- US Business development MoU with Iwatani Corporation America

-- As of today, the total backlog stands at GBP42.4m (2018:

GBP33.6m) with GBP16.3m (2018: GBP23.2m) of projects under contract

and a further GBP26.1m (2018: GBP10.4m) in the final stages of

negotiation.

-- The qualified tender opportunity pipeline is now over GBP248m

(2018: GBP240m), representing 37 projects with an average size of

GBP6.7m.

Financial:

-- Total income of GBP3.8m (GBP5.0m), down 24%, comprising:

o Revenue of GBP2.4m (GBP1.2m), up 100%

o Grant income plus grants receivable for capital projects of

GBP1.4m (GBP3.8m), down 79%

-- Loss from operations GBP9.8m (GBP5.3m), increased by 85%

-- EBITDA Loss of GBP8.3m, (GBP4.5m), increased by 84%

-- Cash balance (excluding restricted balances) of GBP56.9m (GBP15.6m) at period end

-- Cash burn (excluding fundraise) of GBP6.2m (GBP4.8m), up 29%

-- Net working capital of GBP9.0m (GBP9.4m), down 4%

Corporate:

-- Sir Roger Bone steps up to Chairman following four years on the board

-- Martin Green joins the board as non-executive director

-- Juergen Nowicki appointed non-executive director, nominated by Linde

-- Appointment of Andreas Rupieper as MD of ITM Linde Electrolysis GmbH

-- Nicola Ham Edmonds appointed Company Secretary

-- Prof. Roger Putnam and Lord Roger Freeman retire from the board

Graham Cooley, CEO, commented: "The formation of the Joint

Venture with Linde and the strategic investment that accompanied it

is transformative for ITM Power. The deal allows ITM Power to

concentrate on its core competence of developing and manufacturing

electrolysis equipment. The Company is now able to offer a full

turnkey solution at industrial scale with the EPC competence of a

world leader in the hydrogen industry. The opportunity to bid up to

1GW per annum of electrolysis equipment from Bessemer Park gives

the Company a powerful cost reduction trajectory. I am confident

that ITM Power and our partner Linde have a world class

offering."

Roger Bone, added: "I am delighted to take over from Roger

Putnam as chairman of ITM Power and to oversee the integration of

the Company's activities with Linde Engineering into a successful

joint venture. I thank Roger for his contribution and commitment to

the Company during his tenure and look forward to further

developing our governance to drive ITM Power forward."

For further information please visit www.itm-power.com or

contact:

ITM Power plc (0)114 244 5111

Graham Cooley / Andy Allen

Investec Bank plc (Nominated Adviser

and Broker) (0)20 7597 5970

Jeremy Ellis / Chris Sim / Ben Griffiths

/ Tejas Padalkar

Tavistock (Financial PR and IR) (0)20 7920 3150

Simon Hudson / Edward Lee / Barney

Hayward

About ITM Power plc:

ITM Power plc manufactures integrated hydrogen energy solutions

for grid balancing, energy storage and the production of green

hydrogen for transport, renewable heat and chemicals. ITM Power plc

was admitted to the AIM market of the London Stock Exchange in

2004. In October 2019, the Company announced the completion of a

GBP58.8 million fundraise, including a subscription by Linde of

GBP38 million, together with the formation of a joint-venture with

Linde to focus on delivering green hydrogen to large scale

industrial projects worldwide. ITM Power signed a forecourt siting

agreement with Shell for hydrogen refuelling stations in September

2015, (which was extended in May 2019 to include buses, trucks,

trains and ships) and in January 2018 a deal to deploy a 10MW

electrolyser at Shell's Rhineland refinery. ITM Power announced the

lease of the world's largest electrolyser factory in Sheffield with

a capacity of 1GW (1,000MW) per annum in July 2019. Customers and

partners include Sumitomo, Ørsted, National Grid, Cadent, Northern

Gas Networks, Gasunie, RWE, Engie, BOC Linde, Toyota, Honda,

Hyundai and Anglo American among others.

CEO's Review

The tender opportunity pipeline (TOP) continues to grow

highlighting the growth in interest of green hydrogen worldwide.

ITM Power has increasing commercial visibility of those projects

which are viable, and ready, and is becoming increasingly selective

about where it focuses its sales efforts, with an increasingly

rigorous bidding criteria for projects. ITM Power is working

closely with Linde to develop a joint bidding strategy appropriate

to the opportunities arising, and appropriate for ITM Linde

Electrolysis to bid. Going forward the TOP will begin to decrease

as larger industrial tenders are bid by ITM Power as

electrolyser-only sales, therefore excluding the EPC element (which

will fall to Linde via the joint venture). The pipeline will now

reflect the element of a solution that is specific to ITM Power,

therefore allowing the Company to focus on the element of a project

where its technology and expertise adds the greatest value.

Products Deployed in the Period

The opening, by HM King of the Netherlands, of the 1MW

electrolyser at Gasunie represented an important milestone for the

Group. The north Netherlands has a well-defined plan for the

deployment of electrolysis and it is now becoming an important

territory for the development of green hydrogen strategies.

The Company was also delighted to open its first bus refuelling

station in Pau, France, and has worked closely with Linde to

integrate the hydrogen production and bus refuelling equipment.

The network of ITM Power owned refuelling stations continues to

grow in the UK with the opening of our Gatwick station, on a Shell

forecourt. The total amount of hydrogen dispensed in the UK from

Jan-Dec 2019: 17,483 kg (GBP176,151) and 16,611 kg ($299,833) in

the USA over the same period.

Products in Build and Order Backlog

ITM Power continues to steadily process its order book. The

Group's current focus is the build of the Shell Refhyne project,

consisting of five 2MW standard modules that represent an important

reference plant for other quotes and deployments. In terms of the

project programme, the module build is expected to complete in

April 2020 with testing ongoing into the summer, which is in line

with the planned timescale for the project.

Financial Results

Total Income for the period was GBP3.8m (GBP5.0m), down 24%.

Revenue recognised for the period under review was GBP2.4m

(GBP1.2m), up 100%. This was supplemented by grant income of

GBP0.8m ( GBP2.5m) and GBP0.4m (GBP1.3m) of grants receivable for

capital projects, which impacts the balance sheet by subsidising

the build of assets that ITM Power owns and operates to generate

income. The Company expects the trajectory towards an improved mix

of revenue relative to grant income to continue as its works

through the current and future backlog.

The loss before tax for the half year was GBP9.8m (GBP5.2m).

This figure continues to be affected by certain legacy projects,

including that of the Shell Refhyne project, resulting primarily

from facing first-of-a-kind deployment challenges. These challenges

have been recognised by the board: the creation of the joint

venture with a global, world leading EPC partner will diminish the

Group's exposure to future deployment risk, and allow ITM to focus

further on developing its world-leading standard products.

Overhead costs were largely in line with expectations for the

year. However, in the past the Company has been able to offset some

overhead through grant income. This has diminished in the current

period (GBP0.8m vs GBP3.8m) as remaining EU grants have started to

reach a conclusion. Whilst there are new, UK, grant schemes

becoming available, the company's last major award of EU funds was

for the Refhyne project, awarded in 2016 (and contracted in 2017).

Whilst the company's future will increasingly be made up of revenue

through sales (and there has been a 100% year on year increase for

H1), the reduction in grant income has been steeper than

anticipated. The company shall continue to seek support via grant

funding when this aligns with the product and technology

development roadmaps.

Adjusting Post Balance Sheet Event

Since the period end the Company has received price indications

for installation and commissioning on the Refhyne project which are

likely to be higher than originally anticipated. The tender process

is continuing, with hopes that additional clarifications of works

will bring costs down from the outline estimates received to date.

A provision for loss which has been reflected in the statements

under cost of sales, at GBP1.9m, representing 16% of the total

contract value. The overrun reflects ITM's learning in being able

to accurately estimate the cost of installation of a major project

in an international refinery. Going forward, ITM Power will be

conducting these projects through ITM Linde Electrolysis GmbH and

the lead contracts will benefit from the estimating, quotation and

EPC delivery skills of Linde Engineering.

Cash and short-term deposits at the period end were GBP56.9m

(GBP5.2m at 30 April 2019 and GBP15.6m at 31 October 2018). This

reflects the receipt of proceeds from the equity raise completed in

October 2019. Debtor balances increased to GBP23.2m (GBP19.3m)

reflecting pro forma and stage payments made with suppliers. In the

second half of the year, cash burn shall increase as the work on

Bessemer Park progresses.

New Site: Bessemer Park

The new premises continue to progress, with the developers

handing over the landlord's completed build phase in November, just

after this period end. The Company is now focused on adapting the

site to meet its requirements. It is anticipated that the first

area of works will be the installation of an upgraded 5MW power

connection to facilitate the on-site testing of larger

electrolysers, which will support the Group's capability to deliver

large scale projects. The Clegg Group Ltd has been appointed to

complete the fit out. The development will also include an

extension to the existing offices and manufacturing and production

areas, as well as a test room for factory acceptance testing of

products. The programme of works at the factory is planned for

completion by Q3 2020, and is designed to enable the company to

reach a capacity of 1GW within three years.

Technology Progress

Technology progress in the year has focused on product

standardisation with the Company concentrating on its 2MW standard

offering, and its scalability to larger projects, as well as

developing the concept for the 5MW stack module for the next

generation of ITM Power electrolysis product.

Marketing

The Hannover Messe in April continues to be the company's

flagship event, and ITM Power will attend again in 2020. ITM Power

will also attend the Tokyo EXPO in February 2020 with Sumitomo. The

Company continues to issue a newsletter to people who sign up and

has launched a new website. A regularly updated list of all the

events the Company will be attending can be found at

http://www.itm-power.com/news-media/events

People

The Company now employs over 190 staff across the UK, USA,

France, Germany and Australia, and is well placed with the skills

mix to respond to the changing market for larger electrolyser

systems. The company has been focussed on production, project

delivery and after-sales support recruitment. Once again, the Board

would like to recognise the commitment of all staff as we continue

to be in a strong position, with strong industrial partners

globally, and the capability to increase volume and production in

the new site.

Outlook

Global energy markets are increasingly recognising the need for

the use of green hydrogen as an energy storage medium and as a

transport fuel, chemical fuel and for renewable heat. A number of

developed economies, including the Netherlands, Denmark, Germany,

Australia, Korea, Japan, China, and the UK have all developed

hydrogen roadmaps. In the UK, the Commission for Climate Change

(CC) Net Zero - Technical Report (published on 2 May 2019)

indicates that the UK will need between 6 and 17GW of electrolysis

to achieve its target of net zero by 2050. ITM Power, with its

joint venture ITM Linde Electrolysis GmbH is very well positioned

to capitalise on this opportunity. Following the successful

fundraising in October 2019, the Company also has the balance sheet

strength required to take on the challenge of large scale

industrial electrolysis.

Dr Graham Cooley

Chief Executive Officer

27 January 2019

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (UNAUDITED)

Results for the six months ended 31 October 2019

Six months Six months Year ended

ended 31 October ended 31 October 30 April

2019 (unaudited) 2018 (unaudited) 2019 (audited)

GBP'000 GBP'000 GBP'000

Revenue 2,438 1,187 4,589

Grant income against cost of

sales 689 5 427

Cost of sales (5,649) (1,832) (6,182)

----------------- ----------------- ---------------

Gross profit (2,522) (640) (1,166)

Operating costs

Distribution expenses

* Research and development (1,087) (1,117) (2,327)

* Prototype production and engineering (4,318) (3,197) (6,202)

* Sales and marketing (771) (833) (1,713)

----------------- ----------------- ---------------

(6,176) (5,147) (10,242)

Administration expenses (1,938) (2,007) (4,738)

Other operating income - grant

income 807 2,506 6,799

-----------------

Loss from operations (9,829) (5,288) (9,347)

Investment income 15 29

Interest expense (10)

-----------------

Loss before tax (9,839) (5,273) (9,318)

Tax 25 79 (133)

----------------- ----------------- ---------------

Loss for the period (9,814) (5,194) (9,451)

OTHER TOTAL COMPREHENSIVE INCOME:

Foreign currency translation

differences on foreign operations 30 65 40

================= ================= ===============

Total comprehensive loss for

the period (9,874) (5,129) (9,411)

================= ================= ===============

Loss per share

Basic and diluted (3.0p) (1.8p) (2.9p)

================= ================= ===============

Weighted average number of shares 331,124,871 287,311,287 324,009,397

================= ================= ===============

The loss per ordinary share and diluted loss per share are equal

because share options are only included in the calculation of

diluted earnings per share if their issue would decrease the net

profit per share or increase the net loss per share.

All results presented above are derived from continuing

operations.

The loss for the period is equal to the total comprehensive

expense for the period.

Prior periods have not been restated in this transition to IFRS

16 Lease Accounting. Therefore comparison with the current period

may be affected for Distribution and Administration expenses and

Investment income. This is explained further in the accompanying

notes, which form part of these financial statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (UNAUDITED)

Results for the six months ended 31 October 2019

Called Share Foreign

up share premium Merger Exchange Retained Total

capital account reserve reserve loss Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 May 2019 16,200 86,631 (1,973) 111 (74,760) 26,209

Loss for the period - - - - (9,814) (9,814)

Other comprehensive income

for the period - - - 30 - 30

--------- --------- --------- --------- ---------- ---------

Total Comprehensive income

for the period - - - 30 (9,814) (9,784)

Issue of share capital 7,353 50,443 - - - 57,796

Credit to equity for

equity settled share

based payments - - - - 182 182

At 31 October 2019 (unaudited) 23,553 137,074 (1,973) 141 (84,392) 74,403

========= ========= ========= ========= ========== =========

At 1 May 2018 16,200 86,631 (1,973) 71 (65,338) 35,591

Adjustment for IFRS15 (161) (161)

--------- --------- --------- --------- ---------- ---------

Adjusted balance at 1

May 2018 16,200 86,631 (1,973) 71 (65,499) 35,430

Loss for the period - - - - (5,194) (5,194)

Other comprehensive income

for the period - - - 65 - 65

--------- --------- --------- --------- ---------- ---------

Total Comprehensive income

for the period - - - 65 (5,194) (5,129)

At 31 October 2018 (unaudited) 16,200 86,631 (1,973) 136 (70,693) 30,301

========= ========= ========= ========= ========== =========

The accompanying notes form part of these financial

statements.

CONSOLIDATED BALANCE SHEET (UNAUDITED)

31 October 2019

As at 31 October As at 31 October As at 30

2019 2018 April 2019

(audited)

(unaudited) (unaudited) GBP'000

GBP'000 GBP'000

NON CURRENT ASSETS

Software & Development Costs 1,056 486 669

Property, plant and equipment 8,302 4,217 5,742

---------------- ---------------- -----------

9,358 4,703 6,411

CURRENT ASSETS

Inventories 3,519 1,652 1,906

Trade and other receivables 23,239 19,260 31,903

Cash and cash equivalents 56,878 15,603 5,173

---------------- ---------------- -----------

TOTAL CURRENT ASSETS 83,636 36,515 38,982

CURRENT LIABILITIES

Trade and other payables (14,362) (9,905) (17,579)

Lease liability (310) - -

Provisions (3,435) (1,011) (1,605)

---------------- ---------------- -----------

TOTAL CURRENT LIABILITIES (18,107) (10,916) (19,184)

NET CURRENT ASSETS 65,529 25,599 19,798

Long-term lease liability (484) - -

NET ASSETS 74,403 30,302 26,209

================

EQUITY

Called up share capital 23,553 16,200 16,200

Share premium account 137,074 86,631 86,631

Merger reserve (1,973) (1,973) (1,973)

Foreign Exchange Reserve 141 136 111

Retained loss (84,392) (70,692) (74,760)

---------------- ---------------- -----------

TOTAL EQUITY 74,403 30,302 26,209

================ ================ ===========

The accompanying notes form part of these financial

statements.

CONSOLIDATED CASH FLOW STATEMENT (UNAUDITED)

Results for the six months ended 31 October 2018

Six months Six months Year ended

ended 31 October ended 31 October 30 April

2019 (unaudited) 2018 (unaudited) 2019 (audited)

GBP'000 GBP'000 GBP'000

Loss from operations (9,830) (5,288) (9,347)

Adjustments:

IFRS 15 adjustment - (128) (145)

Depreciation of property, plant

and equipment 1,089 887 1,773

Loss on disposal 92 - -

Impairment reversal - - (24)

Amortisation 126 53 122

Share based payment 182 - 184

Operating cash flows before movements

in working capital (8,341) (4,476) (7,437)

Decrease/ (Increase) in inventories (1,614) (998) (1,251)

Decrease/ (Increase) in receivables 8,637 (755) (13,571)

(Decrease)/ Increase in payables (3,215) 1,974 9,651

Increase in provisions 2,624 163 757

----------------- ----------------- ---------------

Cash from/ (used in) operations (1,909) (4,092) (11,852)

Income taxes received 52 76 77

----------------- ----------------- ---------------

Net cash used in operating activities (1,857) (4,016) (11,774)

----------------- ----------------- ---------------

Investing activities

Purchases of property, plant and

equipment (3,950) (640) (3,052)

Proceeds from sale of plant & equipment 224 - -

Payments for intangible assets (513) (183) (436)

----------------- ----------------- ---------------

Net cash (used in) investing activities (4,239) (823) (3,488)

----------------- ----------------- ---------------

Financing activities

Proceeds from issue of shares 58,822 - -

Costs associated with fund raise (1,026) - -

Net interest (10) 15 29

----------------- ----------------- ---------------

Net cash from financing activities 57,786 15 29

----------------- ----------------- ---------------

Increase/ (decrease) in cash and

cash equivalents 51,690 (4,824) (15,233)

Cash and cash equivalents at the

beginning of the period 5,173 20,403 20,403

Effect of foreign exchange rate

changes 15 24 3

-----------------

Cash and cash equivalents at the

end of the period 56,878 15,603 5,173

================= ================= ===============

Cash Burn

Cash burn is a measure used by key management personnel to

monitor the performance of the business.

Six months

Six months ended 31 Year ended

ended 31 October October 2018 30 April

2019 (unaudited) (unaudited) 2018 (audited)

GBP'000 GBP'000 GBP'000

Increase/ (Decrease) in Cash and

Cash equivalents per the cash flow

statement 51,690 (4,824) (15,233)

Effect of foreign exchange rates 15 24 3

Less share issue proceeds (net) (57,796) - -

Cash Burn (52,621) (4,800) (15,230)

----------------- ------------- ---------------

The accompanying notes form part of these financial

statements.

The condensed Interim Financial Statements were approved by the

board of Directors on:

27 January 2019

Notes to condensed Interim Financial Statements

1. Basis of preparation of interim figures

The interim financial statements have been prepared using

accounting policies consistent with International Financial

Reporting Standards (IFRSs) as adopted for use in the EU. While the

financial information included in this interim announcement has

been compiled in accordance with the recognition and measurement

principles of IFRSs, this announcement does not itself contain

sufficient information to comply with IFRSs. This interim financial

information does not constitute statutory financial statements

within the meaning of section 435 of the Companies Act 2006. The

financial information for the six months periods ended 31 October

2018 and 2019 have not been subject to an interim review. The

information relating to the year ended 30 April 2019 has been

extracted from the Group's published financial statements for that

year, which contain an unqualified audit report that does not draw

attention to any matters of emphasis, and did not contain

statements under section 498(2) and 498(3) of the Companies Act

2006 and which have been filed with the Registrar of Companies.

The Group's condensed interim financial statements have been

prepared in accordance with the principles of IAS 34 Interim

Financial Reporting as adopted by the European Union. The principal

accounting policies adopted by the group are as applied in the

Group's latest annual audited financial statements.

The financial statements have been prepared on the historical

cost basis. The principal accounting policies adopted by the Group

are as applied in the Group's latest audited financial statements,

except that in the period the company adopted IFRS 16 for the first

time. The details of this adoption is set out in note 3 of this

announcement.

Going concern

The Directors have prepared a cash flow forecast (the

"Forecast") for the period to 31 January 2021 (the "Forecast

Period"). The Forecast includes a number of assumptions, including

the level of projected sales and grant income, the timing of which

is inherently uncertain.

The Directors have a reasonable expectation that the Company and

Group can continue to meet their liabilities as they fall due, for

a period of not less than twelve months from the date of approval

of this condensed set of financial statements.

Accordingly, the financial statements have been prepared on a

going concern basis.

2. Revenue, other operating income and investment income

The following accounted for more than 10% of total revenue:

H1 2019 H1 2018

Customer A GBP666,015 <10%

Customer B GBP815,187 <10%

Customer C GBP377,792 <10%

Customer D <10% GBP788,838

An analysis of the Group's revenue is a follows:

H1 2019 H2 2018

GBP'000 GBP'000

Continuing operations

Revenue from construction contracts 1,687 950

Consulting services 392 16

Maintenance services 30 34

Fuel sales 237 158

Other 93 29

--------- ---------

Revenue in the Consolidated Income Statement 2,438 1,187

Grant income 1,496 2,505

Investment income 10 15

--------- ---------

3,944 3,707

========= =========

Revenues from major products and services

The Group's revenues from its major products and services were

as follows:

2019 2018

GBP'000 GBP'000

Continuing operations

Power-to gas 233 959

Refuelling 908 193

Chemical Industry 822 4

Other 475 31

-------- --------

Consolidated revenue (excluding investment revenue) 2,438 1,187

======== ========

GEOGRAPHIC ANALYSIS OF REVENUE

A geographic analysis of the Group's revenue is set out

below:

2019 2018

GBP'000 GBP'000

United Kingdom 583 314

Germany 832 (10)

Rest of Europe 868 800

North America 155 82

---------

2,438 1,187

========= =========

3. Leases (Transition to IFRS 16)

The new accounting standard is effective for years commencing on

or after 1 January 2019. Under the new standard, the distinction

between operating and finance leases is removed and most leases

will be brought onto the statement of financial position, as both a

right-of-use asset and a corresponding lease liability.

We have used the modified retrospective transitional approach

meaning that the lease liability and equivalent right of use asset

are brought on to the balance sheet at the discounted amount

applicable at the transition date. Prior year financial information

will not be restated, resulting in no impact on retained earnings

on transition.

The right to control the use of an asset over a period of time

applies when the lessee has the right to obtain substantially all

the economic benefits from the use of the asset and the right to

direct the use of the asset. If the lessor has the substantive

right to substitute the asset during this period, then it would not

meet this condition. Two potential exemptions can also be applied

-for leases of less than 12 months duration or of low value. For

these reasons, we have not included temporary equipment hire for

projects nor the rent-a-room office and storage facilities.

A key judgement associated with the adoption of this standard is

the identification of the discount rate to be used to calculate the

present value of the future lease payments on which the reported

lease liability and right-of-use asset are based. With no clearly

defined interest rates for our existing leases and no incremental

borrowing rate known for the group, we have selected discount rates

of 2.5% (properties) and 5% (non-property) based on similar

companies and leases.

The impact on the current period financial statements is

described below:

Liability Half-year Interest recognised Depreciation

at 1/5/19 operating in current recognised

costs under period in current

old standard period

GBP000s GBP000s GBP000s GBP000s

Property leases 898 158 8 150

Van leases 59 18 2 16

----------- -------------- -------------------- -------------

957 176 10 166

=========== ============== ==================== =============

4. Business Combinations

ITM Power have entered into a Joint Venture (JV) with Linde

Engineering. The creation of ITM Linde Electrolysis GmbH in January

2020 will require ITM Power, as 50% owner, to make a GBP2m

investment initially with the view that the JV will provide a

conduit for larger scale projects.

Under the JV, ITM Power will supply its technical know-how and

products in manufacturing and commissioning hydrogen electrolysers,

while Linde will supply their experience of coordinating and

executing EPC projects.

The JV will operate under joint ownership of 50% ITM Power and

50% Linde shareholdings, with no one party having control.

Accounting for the JV will take the form of an investment on the

balance sheet of ITM Power PLC.

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR EAXFKADXEEFA

(END) Dow Jones Newswires

January 27, 2020 02:00 ET (07:00 GMT)

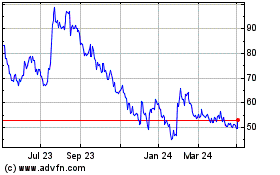

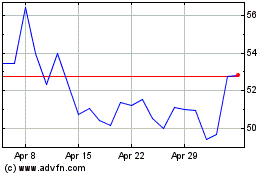

Itm Power (LSE:ITM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Itm Power (LSE:ITM)

Historical Stock Chart

From Apr 2023 to Apr 2024