TIDMITM

RNS Number : 6321O

ITM Power PLC

03 October 2019

3 October 2019

ITM Power plc

("ITM Power", "the Group" or the "Company")

Final Results

ITM Power (AIM: ITM), the energy storage and clean fuel company

is pleased to announce its final results for the year ended 30

April 2019. What follows is a preliminary announcement; the full

annual report and financial statements will be available

shortly.

HIGHLIGHTS

FINANCIAL:

-- Total Revenue & Grant Funding of GBP17.5m (2018:

GBP14.1m) up 25%, comprising:

o Sales revenue - GBP4.6m (2018: GBP3.3m) up 40%

o Grant income recognised on the income statement - GBP7.2m

(2018: GBP4.1m) up 75%

o Grant income recognised on the balance sheet - GBP5.7m (2018:

GBP6.7m), down 14%

-- Loss from operations GBP9.3m (2018: GBP6.5m) increased 44%,

EBITDA loss of GBP7.5m (2018: GBP4.8m) increased 56% as the Group

invests to significantly scale up facilities, resources and

production capacity

-- Available cash balance of GBP5.2m at year-end (2018:

GBP20.4m)

-- GBP52m minimum equity fundraising announced today, subject to

shareholder approval, including a:

- GBP38m cornerstone investment from new strategic partner Linde Engineering (part of Linde AG)

- GBP14m firm placing with certain existing and new institutional investors

- Open offer of up to approximately GBP6.8m

COMMERCIAL:

-- Formation of worldwide joint venture to market, tender and

sell green electrolytic hydrogen projects with Linde Engineering -

part of Linde AG, a world leading supplier of industrial, process

and specialty gases

-- Agreement to lease new premises in Sheffield for global

manufacturing headquarters with an electrolyser manufacturing

capacity of up to 1GW (1,000MW) per annum, the largest in the

world

-- Non-contracted tender opportunity pipeline increased to over

GBP379m (September 2017: GBP200m), illustrating the growth in the

global hydrogen economy

-- German presence expanded, first sales in Australia

CORPORATE:

-- Martin Green appointed as non-executive director, joining the

board on 16 September 2019

-- Lord Roger Freeman announces resignation as non-executive

director with effect from the publication of these financial

results

-- Appointment of Nicola Ham Edmonds, Head of Legal, as Company

Secretary on 16 September 2019

Clean Fuel

-- 15 wholly owned Hydrogen Refuelling Station (HRS) assets in

ITM Power's portfolio:

- eight fully open to the public, seven in various stages of construction

-- Awarded further GBP1.8m by OLEV to deliver another refuelling

station, part of a larger grant to put 57 new hydrogen cars on the

road in the next 12 months.

-- UK refuelling collaboration agreement with Shell extended to

2024 and to all hydrogen vehicle types

-- Hydrogen fuel contracts now 33 in total (2018: 20) with fuel

sales increased to 32 tonnes for the period (2018: 16 tonnes), up

100%

-- Two bus refuelling stations - Birmingham and Pau in France -

due to open this financial year

Power-to-Gas

-- Committee on Climate Change recommended a central role for

green hydrogen based power storage in its report to the UK

government

-- Official opening of BIG HIT (Building Innovative Green

Hydrogen Systems in an Isolated Territory) in Orkney provided a

reference blueprint for renewable hydrogen deployment for island

systems

-- Undertaking a feasibility study (Centurion) to deploy 100MW

Power-to-Gas (P2G) energy storage in Cheshire

-- Part of consortium awarded GBP14.9m over four years by Ofgem

to fund two decarbonised domestic heating trials in the north of

England (HyDeploy and HyDeploy 2) in the largest gas Network

Innovation Competition (NIC) project ever and the first to inject

green hydrogen into a UK gas grid

Industrial

-- EU 10MW refinery project with Shell in Germany is on schedule

and progressing well

-- Opportunity pipeline contains a growing number of industrial

projects as organisations seek to cut their carbon footprint -

focus is on refineries and steel making

-- Won BEIS competition to demonstrate delivery of bulk,

low-cost and zero carbon hydrogen through gigawatt scale PEM

electrolysis in partnership with Orsted

Graham Cooley, CEO, commented, "ITM Power continues to deliver

strong growth with revenues up 25% year on year. The Group has

benefited from the lessons learned in deploying units above 1MW for

the first time, including in harsh environments and difficult

operating conditions. This delivers significant competitive

advantage for future deployments as we scale up and standardise our

products. We've also been learning how to maximise value from our

growing portfolio of revenue generating assets in the shape of the

first real hydrogen refuelling network in the UK."

Roger Putnam, Chairman, added, "I am pleased to report our plans

for expansion of staff and production capacity are on track. The

next year will be a period in which we transition to our much

larger new factory. We welcome the Committee for Climate Change

report's aspirations to make the UK zero emissions by 2050 and its

recognition that PEM electrolysis will be an integral part of the

new energy mix. As always, I would like to thank our staff for

another year of hard work and enthusiastic dedication to our

business ambition to help decarbonise the world's energy

markets."

For further information please visit www.itm-power.com or

contact:

+44 (0)114 244

ITM Power plc 5111

Graham Cooley, CEO

+44 (0)20 7597

Investec Bank plc (Nominated Adviser and Broker) 5970

Jeremy Ellis / Chris Sim

+44 (0)20 7920

Tavistock (Financial PR and IR) 3150

Simon Hudson / Nick Elwes / Barney Hayward

About ITM Power plc

ITM Power plc designs and manufactures integrated hydrogen

energy systems for grid balancing, energy storage and the

production of green hydrogen for transport, renewable heat and

chemicals. ITM Power plc was admitted to the AIM market of the

London Stock Exchange in 2004. In September 2017, the Company

announced the completion of a GBP29.4m working capital fundraise.

The Company signed a forecourt siting agreement with Shell for

hydrogen refuelling stations in September 2015, which was extended

in May 2019 to include buses, trucks, trains and ships, and

subsequently a deal to deploy a 10MW electrolyser at Shell's

Rhineland refinery. The Company entered into a Strategic

Partnership Agreement with Sumitomo Corporation in July 2018 for

the development of multi-megawatt projects in Japan. Additional

customers and partners include Ørsted, National Grid, Cadent,

Northern Gas Networks, Gasunie, RWE, Engie, BOC Linde, Toyota,

Honda, Hyundai, Anglo American among others.

CORPORATE UPDATE

ITM Power - Building a Global Presence

ITM Power has worked hard to build relationships globally by

adding anchor points outside of the UK market. This effort will put

the Company in a good position to service markets internationally

both now and in the future.

Expansion of Presence in the German Market

In December, the Group moved its German subsidiary, ITM Power

GmbH, into new larger premises in Hungen, north of Frankfurt to

accommodate both business development staff and a growing after

sales and technical support team. Key to operations in Germany will

be a store of strategic spares for projects in Germany and

throughout Europe.

The technical sales and project management teams in Sheffield

have also recruited German personnel to optimise customer support

to the German speaking market and to streamline the tendering

process and design team liaison with Germany.

First Four Sales in Australia

January 2019 saw the sale of four 250kW electrolyser systems

totalling 1MW to three different customers across Australia. In

March 2019, the Group announced that one customer was Toyota

Australia who aim to couple their 0.25MW rapid-response PEM

electrolyser with renewable energy to generate hydrogen on-site at

Toyota's facilities in Altona, Melbourne for refuelling fuel cell

electric vehicles, including the Toyota Mirai.

The territory throws up new challenges for compliance and

operation in extreme thermal environments but these deployments

represent an important step in entering this significant new

territory and will serve as reference plants for ITM Power

technology in both the mobility and industrial hydrogen sectors in

Australia.

BESSEMER PARK - Global Manufacturing HQ, Sheffield

In July 2019, the Company announced that it has signed an

agreement to lease new premises in Sheffield for its global

manufacturing headquarters. The manufacturing facility will have an

electrolyser manufacturing capacity of up to 1GW (1,000MW) per

annum, the largest in the world.

PLP Bessemer Park is a strategic location next to junction 34 of

the M1 and in close proximity to the Company's existing facilities.

ITM Power expects to occupy the building from Spring 2020 and

complete its own technical and industrial fit out and transition

the majority of its operations into PLP Bessemer Park by Summer

2020.

The requirement to expand production capacity has been led by

the continued growth in the Company's order pipeline. The new

headquarters will see ITM Power locate into a single building and

gain access to a five-fold increase in production space. Key to the

selection of the building was the proximity of the grid connection

to provide the substantial power supply required for ITM Power's

needs, using existing infrastructure near to the location.

BUSINESS ENVIRONMENT AND ANNUAL REVIEW OF THE BUSINESS

Power-to-Gas

Emissions reduction targets set out in the COP21 Paris Agreement

on climate change, as well as reports such as that of the Committee

for Climate Change from May 2019 have contributed to an increasing

proportion of power from renewables in electricity generation. The

ability to match this unscheduled intermittent supply with demand

becomes increasingly problematic. In fact, at the point when

deployment meets or exceeds 20% capacity, as already experienced in

many countries, grid balancing issues become more acute, often

leading to the curtailment of wind.

Power-to-Gas can meet the demand for long-term, large-scale

energy storage, converting surplus renewable energy into hydrogen

gas by rapid response electrolysis and subsequently injecting it

into the gas distribution network. These grid balancing services

can be an important source of revenue for operators and ITM Power's

rapid response Proton Exchange Membrane (PEM) technology allows

units to be turned on and off in under one second making them

eligible for the UK National Grid's Enhanced Frequency Response

Payments.

ITM Power enjoys a unique position having supplied the world's

first PEM Power-to-Gas electrolyser in 2014, and continues to

engage in a number of industry-leading strategic projects, which

include HyDeploy, Big Hit, and Centurion.

Clean Fuels

The transport sector is one of the largest users of fuel in the

world, and currently it is dependent on fossil fuels, which are

highly polluting and are becoming ever more scarce and

expensive.

Hydrogen is light and can be stored under pressure, making it

suitable for many vehicle types as it does not add further weight,

or use further energy when on board. Hydrogen can be made from just

water and renewable energy using an electrolyser, splitting the

water into hydrogen and oxygen, when used, the hydrogen returns to

water vapour.

A hydrogen station produces hydrogen on site via ITM Power's

rapid response electrolyser system, and can refuel a fuel cell

electric vehicle in minutes. Inner city air quality is a driving

force for Fuel Cell Electric Bus (FCEB) deployment, as air

pollution is a major contributor to poor health in the UK.

Extension of hydrogen refuelling for use in trains and boats is

also gaining traction.

On 11 September 2018 at the 'Zero Emission Vehicle Summit' in

Birmingham, Prime Minister Theresa May outlined the UK Government's

"Road to Zero Strategy" which includes funding of GBP1.5 billion

for ultra-low-emission vehicles by 2020. At the event, the Prime

Minister also announced more than GBP100 million of funding for

innovators in ultra-low-emission vehicles and hydrogen technology.

The Road to Zero Strategy is the most comprehensive plan globally -

mapping out in detail how the UK will reach its target for all new

cars and vans to be, effectively, zero emission by 2040 - and for

every car and van to be zero emission by 2050.

ITM Power has won contracts to supply on-site hydrogen

generation equipment for refuelling in the UK, France and the US.

It is currently rolling out a network of 14 hydrogen refuelling

stations in the UK of which seven are now fully open for public

access. In the year, the Group dispensed 32 tonnes of hydrogen from

its refuelling stations (2018: 16 tonnes).

Car Refuelling

In September 2018, the Group opened its seventh public access

hydrogen refuelling station (HRS) located at Johnson Matthey,

Swindon on the M4 corridor. The opening was supported by Toyota,

Hyundai and Honda. The station uses electricity via a renewable

energy contract and water to generate hydrogen on-site with no need

for deliveries. It is now open for public and private fleets

operating fuel cell electric vehicles

As the refuelling network continues to grow alongside growth in

deployment of vehicles, ITM Power has designed a mobile app which

lets users of our stations know where their nearest hydrogen

refuelling station is located, provides directions and other

details on how to refuel all from the convenience of their mobile

phone. A video has also been published which shows customers how to

refuel a Fuel Cell Electric Vehicle (FCEV). The video outlines the

full refuelling process, which is standardised from one station to

the next and takes you step by step, how to refuel at both 350bar

and 700bar hydrogen.

During the year, ITM Power became a partner in a EUR26 million

pan-European initiative, the ZEFER (Zero Emission Fleet vehicles

for European Roll-out) project. It will deploy 180 hydrogen fuel

cell electric vehicles as taxis, private-hire vehicles and police

cars in Paris, Brussels and London.

For ITM Power, the existence of this scheme will help to ensure

high utilisation of its early networks of hydrogen refuelling

stations. This improves the economics of operating the stations and

hence helps accelerate the commercialisation of hydrogen as a

zero-emission fuel.

Larger vehicle refuelling

ITM Power will deploy bus refuellers in Birmingham and Pau next

year. This will prove that ITM Power systems are now at a scale

where a fleet of buses can be supported by one electrolyser on a

return to base principle and other large schemes are likely to

follow, for applications such as heavy logistics, trains and

ships.

Industrial

Refineries currently use hydrogen to improve the quality of

fractional distillation products and most of this hydrogen is

produced from steam-reforming but in order to comply with stringent

legislation and avoid fines, refineries need a cost effective green

hydrogen solution that reduces carbon emissions while allowing them

to maintain output.

In addition, natural gas reformers have long start-up times.

With their rapid start up times, ITM Power's PEM electrolysers

could provide an immediate backup solution to prevent production

downtime and preserve security of hydrogen supply.

Finally, in steel making, iron ore requires chemical reduction

before being used to produce steel; this is currently achieved

through the use of carbon, in the form of coal or coke. When

oxidised, this leads to emissions of about 2.2 tonnes of CO(2) for

each tonne of liquid steel produced. The substitution of hydrogen

for carbon has the potential to significantly reduce CO(2)

emissions, because hydrogen is an excellent reducing agent and

produces only water as a by-product.

The Company's flagship EU 10MW refinery project with Shell is

progressing well. The Group has established a dedicated project

office and ring-fenced staff to work exclusively on this

ground-breaking project. The initial design work has been completed

for the planning permit application submission in Q4 2018.

The Project Manager, Dr John Newton (formerly CIO at RWE

npower), is working closely with Shell and their chemical process

engineering sub-contractor in preparation for the detailed design

phase, to ensure the plant will conform with the stringent safety

and compliance requirements of a major refinery.

The project team are attending regular joint technical review

meetings at the refinery and will be hosting Shell and their

sub-contractor partners, for similar meetings in the dedicated

project office in Sheffield. The Refhyne consortium has recently

produced an information video, available at:

https://www.youtube.com/watch?v=tpPS62RTKd0

Financial Performance

ITM Power continues to be first and foremost a manufacturer,

with the majority of revenue coming from construction contracts to

build full hydrogen systems. Revenues in the year were mainly

generated across four build projects, providing electrolysers in

each of our three target markets. This year's revenue figures have

been affected by a transitional adjustment to the new IFRS 15

"Revenue from contracts with Customers" (resulting in an increase

of GBP0.638m). See Notes 2 and 3.

Meanwhile, consultancy income reduced from GBP0.14m in 2018 to

GBP0.07m. This is likely to be cyclical as consultancy services are

often procured with a view to sourcing units in competitive

tenders.

Fuel sales continue to increase from GBP0.16m in 2018 to

GBP0.37m as our refuelling stations begin to attract greater

volumes of customers and sales.

Total collaborative project funding recognised in the year was

GBP12.97m of which GBP7.23m is recognised on the income statement

(2018: GBP10.82m, of which GBP4.14m was recognised on the income

statement). Project funding has supported ITM Power in developing a

suite of hydrogen generation equipment that it will own and operate

as part of the collaborative projects, with data and knowhow to be

incorporated into new generations of electrolysers.

The pre-tax loss for the year under review increased to GBP9.32m

(2018: GBP6.48m). This can be attributed to similar factors as last

year; firstly, the impact of producing first-of-a-kind large scale

plant then installing it in new and varied situations; secondly,

increased costs of recruitment in the year as the Group continued

to grow in preparation for delivery of ITM Power's future order

book. The Company also recognised an impairment relating to a

historic prepayment having reached a commercial agreement with the

supplier. These costs will not be expected to recur once the move

to the new factory is completed as additional space and upgraded

power will allow for more rigorous factory testing of our larger

scale products prior to site delivery.

Net cash burn increased to GBP15.23m (2018: GBP9.55m before

fundraise). Cash burn is a non-statutory measure the directors use

to monitor the Group, and is calculated by deducting from the cash

flow the effects of any equity fund raise. The cash burn increase

is a result of up front expenditures required on our build projects

(including grant funded projects) in order to secure timely

deliveries of long lead-time components. This figure was

particularly high at the year-end given our focus on larger systems

and the timing of their design completion, procurement and

commencement of build.

Financial position

In the year, the Group capitalised development costs of GBP0.38m

(2018: GBP0.07m). This was for product developments that will

continue to keep the Group at the forefront of PEM electrolysis as

well as the design of standard products and internal procedures

that will facilitate our offering to the markets. The directors see

continued product development as key to building commercial

traction.

There was also an increase in fixed assets to GBP5.7m from

GBP4.5m in the prior year, which relates to assets under

construction and shows the continued commitment of ITM Power to

being a refuelling system owner and operator as the industry grows

in the UK in order to gain market share and improve opportunities

for FCEV adoption. The total book value of refuelling assets was

GBP4.1m (2018:GBP2.5m).

At year end, ITM Power had current assets totalling GBP39.0m

(2018: GBP39.6m). Funds in the bank amounted to GBP6.9m (2018:

GBP22.0m), of which amounts on guarantee totalled GBP1.7m (2018:

GBP1.6m). The Group has previously been required to place amounts

on guarantee as cash cover, which limits working capital available

to the Group mid-contract. ITM Power continues to structure quotes

to include upfront payment with orders to limit the adverse impact

of increased activity on working capital.

Total receivables excluding restricted cash amounts have

increased from GBP16.9m (2018) to GBP30.2m. This movement is

dominated by pro forma and early stage payments made to suppliers

for stock items required in the next wave of units through

production. As systems in production become larger and more

sophisticated, the need to find new suppliers who can meet our

requirements for parts means that we are faced with higher volumes

of staged or up-front payments until a trading history can be

developed to assist our credit rating. Prepayments and accrued

income was GBP22.5m in 2019 (2018: GBP11.2m), up 102%.

Trade debtors at the end of years 2018 and 2019 predominantly

relate to grant income debtors.

Creditors have increased from GBP7.9m (2018) to GBP17.6m. This

movement is primarily a result of an increase in accruals and

deferred income from GBP6.4m to GBP13.9m, which reflects both money

received up front for construction contracts and grant income

receivable against payment of pro forma invoices. This latter

income is generated as grant claims are made against defrayed

costs, including any stage payments to suppliers. The income would

normally sit against the costs of the build to which it relates.

However, until the parts arrive and become incorporated in that

build, the grant income sits unmatched on the balance sheet.

At year end, the Group had trade creditors of GBP3.4m against a

prior year balance of GBP1.4m. This number has predominantly

increased due to the size and stage of progress on contracts.

CONSOLIDATED INCOME STATEMENT AND OTHER COMPREHENSIVE INCOME -

UNAUDITED

for the year ended 30 April 2019

2019 2018

GBP'000 GBP'000

Revenue 4,589 3,283

Direct costs (6,182) (3,438)

Grant income against direct

costs 427 -

Gross loss (1,166) (155)

Operating costs

Distribution expenses

* Research and Development (2,327) (1,792)

* Prototype production and engineering (6,202) (4,144)

* Sales and marketing (1,713) (1,455)

------- -------- ------- --------

(10,242) (7,391)

Administration expenses (4,738) (3,086)

Other operating income -

grant income 6,799 4,138

Loss from operations before

tax (9,347) (6,494)

Investment income 29 18

Loss before tax (9,318) (6,476)

Tax (133) 360

Loss for the year (9,451) (6,116)

-------- --------

OTHER TOTAL COMPREHENSIVE INCOME:

Items that may be reclassified subsequently to profit or loss

Foreign currency translation

differences on foreign operations 40 267

-------- --------

Net other total comprehensive

income 40 267

-------- --------

Total comprehensive loss

for the year (9,411) (5,849)

======== ========

Loss per share

Basic and diluted (2.9p) (2.1p)

======== ========

All results presented above are derived from continuing

operations and are attributable to owners of the Company.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY - UNAUDITED

Called Share Foreign

up share premium Merger exchange Retained Total

capital account reserve reserve loss equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 30 April 2017 12,531 61,930 (1,973) (196) (59,222) 13,070

Transactions with Owners

Issue of shares 3,669 24,701 - - - 28,370

--------- -------- --------- --------- --------- ---------

Total Transactions with

Owners 3,669 24,701 - - - 28,370

Loss for the year - - - - (6,116) (6,116)

Other comprehensive

income - - - 267 - 267

--------- -------- --------- --------- --------- ---------

Total comprehensive

income - - - 267 (6,116) (5,849)

At 30 April 2018 16,200 86,631 (1,973) 71 (65,338) 35,591

--------- -------- --------- --------- --------- ---------

Adjustment for IFRS15 - - - - (155) (155)

Adjusted balance at

1 May 2018 16,200 86,631 (1,973) 71 (65,493) 35,436

--------- -------- --------- --------- --------- ---------

Loss for the year - - - - (9,451) (9,451)

Other comprehensive

income - - - 40 - 40

--------- -------- --------- --------- --------- ---------

Total comprehensive

income - - - 40 (9,451) (9,411)

Credit to equity for

share based payment - - - - 184 184

At 30 April 2019 16,200 86,631 (1,973) 111 (74,760) 26,209

========= ======== ========= ========= ========= =========

CONSOLIDATED BALANCE SHEET - UNAUDITED

2019 2018

GBP'000 GBP'000

NON CURRENT ASSETS

Intangible Assets 669 355

Property, plant and equipment 5,742 4,454

-------- --------

6,411 4,809

-------- --------

CURRENT ASSETS

Inventories 1,906 655

Trade and other receivables 31,903 18,500

Cash and cash equivalents 5,173 20,403

--------

TOTAL CURRENT ASSETS 38,982 39,558

-------- --------

CURRENT LIABILITIES

Trade and other payables (17,579) (7,928)

Provisions (1,605) (848)

--------

TOTAL CURRENT LIABILITIES (19,184) (8,776)

-------- --------

NET CURRENT ASSETS 19,798 30,782

-------- --------

NET ASSETS 26,209 35,591

======== ========

EQUITY

Called up share capital 16,200 16,200

Share premium account 86,631 86,631

Merger reserve (1,973) (1,973)

Foreign exchange reserve 111 71

Retained loss (74,760) (65,338)

-------- --------

TOTAL EQUITY 26,209 35,591

======== ========

CONSOLIDATED CASH FLOW STATEMENT -UNAUDITED

2019 2018

GBP'000 GBP'000

Net cash used in operating activities (11,774) (8,005)

-------- --------

Investing activities

Purchases of property, plant and

equipment (4,125) (8,622)

Capital Grants received against

purchases of property plant and

equipment 1,073 7,130

Proceeds on disposal of Property,

Plant & Equipment - 1

Payments for intangible assets (436) (76)

--------

Net cash used in investing activities (3,488) (1,567)

-------- --------

Financing activities

Issue of ordinary share capital - 29,358

Costs associated with fund raise - (988)

Interest received 30 18

Interest paid (1) -

--------

Net cash from financing activities 29 28,388

--------

(Decrease)/ increase in cash and

cash equivalents (15,233) 18,816

Cash and cash equivalents at the

beginning of year 20,403 1,558

Effect of foreign exchange rate

changes 3 29

-------- --------

Cash and cash equivalents at the

end of year 5,173 20,403

======== ========

NOTES

1. GENERAL INFORMATION

ITM Power plc is a Public company incorporated in England and

Wales under the Companies Act 2006. The registered office is at 22

Atlas Way, Sheffield, South Yorkshire S4 7QQ.

These financial statements are presented in pounds sterling

which is also the functional currency because that is the currency

of the primary economic environment in which the Group

operates.

The unaudited summary accounts set out above do not constitute

statutory accounts as defined by Section 434 of the UK Companies

Act 2006..

2. adoption of new and revised standards

Amendments to IFRSs that are mandatorily effective for the

current year

In the current year, the Group has applied the following

amendments to IFRSs issued by the International Accounting

Standards Board (IASB) that are mandatorily effective for an

accounting period that begins on or after 1 January 2018.

IFRS 15 Revenue from Contracts with Customers

Revenue Recognition under new financial standard IFRS 15

'Revenue from Contracts with Customers'

In May 2014, the International Accounting Standards Board (IASB)

jointly with US Financial Accounting Standards Board (FASB)

published IFRS 15 'Revenue from Contracts with Customers' to

replace IAS 11 'Construction Contracts' for annual reporting

periods commencing on or after January 2018. IFRS 15 provides a

single, principles based 5-step model to be applied to all sales

contracts. It is based on the transfer of control of goods and

services to customers and replaces the separate models for goods,

services and construction contracts previously included in IAS 11

Construction Contracts and IAS 18 Revenue. The Group has adopted

the new standard using the modified retrospective method, with the

cumulative effect of initial application recognised as an

adjustment to the opening balance of retained earnings at 1 May

2018.

As ITM Power Plc's projects are complex, long-term construction

contracts, Management consider that the new standard is likely to

have a material impact on the presentation of its revenues in

future periods but the timing of such an impact is uncertain and

can only be judged in the nearer term once contracts are known. A

detailed description of how our contracts are treated under the new

rules can be found in Note 3 to the financial statements.

A comparison of this year's revenues under old and new rules can

be seen below. To clarify, the income in 2019 under both standards

would have been similar but the financial statements as prepared

include income of GBP638,000 in both the 2018 and 2019 years.

2019 2019

Under old Under new

IAS 11 & IFRS 15

18

GBP'000

GBP'000

Revenue from construction contracts 3,750 3,746

Consulting services 74 67

Maintenance services 49 66

Fuel Sales 373 373

Other 337 337

---------- ----------

Revenue in the Consolidated Income Statement 4,583 4,589

The potential impact has been limited in the current year due to

the Group being in a phase of developing technology and markets,

where many of our contracts continue to be "first-of-a-kind"

bespoke projects. However, as more repeat business or similar

projects are undertaken, revenue recognition is likely to become

further aligned with recognition upon transfer.

The Group see a particular sensitivity around the timings of a

transfer of ownership to a customer, in that the amount of revenue

recognised may differ significantly between two financial periods

depending on how many performance obligations are fulfilled before

the end of each financial period. This will require extra

disclosure year on year to enable appropriate comparison between

financial years.

3. SIGNIFICANT ACCOUNTING POLICIES

Basis of accounting

The annual accounts have been prepared in accordance with

International Financial Reporting Standards (IFRSs), as adopted by

the European Union.

The financial statements have been prepared under the assumption

that the Group operates on a going concern basis and on the

historical cost basis. Historical cost is generally based on the

fair value of the consideration given in exchange for goods and

services.

Going concern

The directors have prepared a cash flow forecast for the period

ending 31 October 2020. This forecast indicates that the Group and

parent company would not expect to remain cash positive without the

requirement for further fund raising based on delivering the

existing pipeline, for a period of at least 12 months from the date

of approval of these financial statements.

The Group and parent company has commenced a fundraise and has

to date received subscription agreements of GBP52m which indicates

that this will be successful. The Group and parent company cannot

issue the shares and formally raise the funds until the fund raise

is approved at the forthcoming EGM on 22 October 2019. The

directors are very confident that approval will be received. The

funds raised are expected to be sufficient to enable the Group and

parent company to continue to trade in line with its forecasts.

Until the fund raise is complete, this represents a material

uncertainty.

The existence of a material uncertainty may cast significant

doubt about the Group and parent company's ability to continue as a

going concern. Notwithstanding this material uncertainty, the

directors have a reasonable expectation that the Group and parent

company are a going concern. The financial statements do not

include the adjustments that would result if the Group and parent

company was unable to continue as a going concern.

The accounts have therefore been prepared on a going concern

basis.

Revenue recognition

Product sales

ITM Power Plc undertakes product sales that involve the

manufacture, installation and commissioning of an electrolyser

system over a period of several months. Such systems are usually

quoted to a customer as a single value but may be split into agreed

payment milestones in order to facilitate cash flow. Any ancillary

requests will be treated as separate performance obligations if

costs can be separately identified and the revenue value is also

quoted separately, but the main objective, to provide a working

system for use in a specific application, is viewed as a single

performance obligation.

Under IFRS15, a performance obligation is satisfied over time if

one of the following criteria is met:

a) the customer simultaneously receives and consumes the

benefits provided by the seller's performance as the seller

performs;

b) the seller's performance creates or enhances an asset that

the customer controls as the asset is created or enhanced; or

c) the seller's performance does not create an asset with an

alternative use to the seller and the seller has an enforceable

right to payment for performance completed to date.

4. LOSS PER SHARE

The calculation of the basic and diluted earnings per share is

based on the following data:

2019 2018

GBP'000 GBP'000

Loss for the purposes of basic and diluted

loss per share being net loss attributable

to owners of the Company (9,451) (6,116)

Number of shares

Weighted average number of ordinary shares

for the purposes of basic and diluted earnings

per share 324,009,397 287,311,287

Loss per share 2.9p 2.1p

=============== ===============

The loss per ordinary share and diluted loss per share are equal

because share options are only included in the calculation of

diluted earnings per share if their issue would decrease the net

profit per share.

5. CALLED UP SHARE CAPITAL AND RESERVES

2019 2018

GBP'000 GBP'000

Called up, allotted and fully paid:

324,009,397 (2018: 324,009,397) ordinary shares

of 5p each 16,200 16,200

======== ========

Authorised Share capital:

324,009,397 (2018: 324,009,397) ordinary shares

of 5p each 16,200 16,200

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR GUBDGCDGBGCX

(END) Dow Jones Newswires

October 03, 2019 02:01 ET (06:01 GMT)

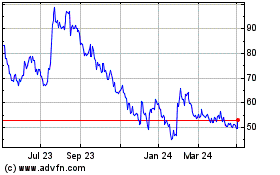

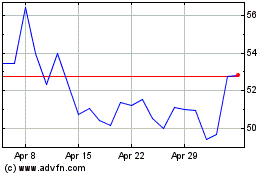

Itm Power (LSE:ITM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Itm Power (LSE:ITM)

Historical Stock Chart

From Apr 2023 to Apr 2024