TIDMITM

RNS Number : 6317O

ITM Power PLC

03 October 2019

The information contained in this announcement is inside

information for the purposes of article 7 of Regulation (EU)

596/2014.

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF

AMERICA (INCLUDING ITS TERRITORIES AND POSSESSIONS, ANY STATE OF

THE UNITED STATES AND THE DISTRICT OF COLUMBIA) (THE UNITED

STATES), AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA,

THE REPUBLIC OF IRELAND OR ANY OTHER JURISDICTION WHERE IT IS

UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE THIS ANNOUNCEMENT.

3 October 2019

ITM POWER PLC

Total fundraising of at least GBP52m

(i) a strategic investment of GBP38m by Linde

(ii) a proposed Firm Placing of GBP14m, and

(iii) an Open Offer of up to cGBP6.8m,

each at 40 pence per share

Entry into new 50/50 Joint Venture with Linde AG

ITM Power plc (AIM: ITM) (ITM Power or the Group) is pleased to

announce its intention to raise at least GBP52.0 million (before

expenses) through (i) a strategic investment of GBP38.0 million at

40 pence per share by Linde UK Holdings No. 2 Limited, a member of

the Linde AG group (Linde) (the Share Subscription); and (ii) a

conditional placing of GBP14.0 million at 40 pence per share (the

Firm Placed Shares) with certain existing and new institutional

investors (the Firm Placing).

The Group has also entered into a 50/50 joint venture with Linde

(the Joint Venture) which will focus on delivering green hydrogen

to large scale industrial projects, principally those with an

installed electrolyser capacity of 10 Megawatts ("MW") and

above.

In addition to the Firm Placing and the Share Subscription, the

Group intends to raise up to c.GBP6.8 million through an Open Offer

(the Open Offer) of 17,053,126 New Ordinary Shares at 40 pence per

share (the Open Offer Shares).

The net proceeds of the fundraising will be used principally to

enhance the manufacturing capabilities of the Group, particularly

for the development and production of large scale 5MW

electrolysers, to facilitate product standardisation and

manufacturing cost reduction, to fund its initial financial

contribution to the Joint Venture, and provide working capital and

balance sheet strength to support the delivery of the contract

backlog and opportunity pipeline.

The Group has also today published its results for the year

ended 30 April 2019 in a separate announcement.

Highlights of the conditional Share Subscription, the Firm

Placing, the Open Offer and Joint Venture

-- ITM Power intends to raise a minimum of GBP52.0 million

pursuant to the conditional Share Subscription, the Firm Placing

and the Open Offer at a price of 40 pence per New Ordinary Share

(the Issue Price).

-- Strategic investment of GBP38.0m by Linde, a world leader in

industrial gases and engineering, via a Share Subscription for

95,000,000 New Ordinary Shares at the Issue price. On completion,

Linde will hold approximately 20% of the Group's enlarged share

capital.

-- Formation of the Joint Venture alongside Linde's strategic

investment. The Joint Venture will focus on delivering green

hydrogen to large scale industrial projects (generally being

opportunities with installed electrolyser capacities of 10

Megawatts and above).

-- It is intended that Linde will appoint a Non-Executive

Director to the Board of ITM Power following completion of the

Share Subscription.

-- The Issue Price represents a discount of approximately 7.0

per cent to the closing mid-market price of an Existing Ordinary

Share on 2 October 2019, being the latest practicable date prior to

the publication of this announcement.

-- The Firm Placing is being conducted, subject to the

satisfaction of certain conditions, on ITM Power's behalf by

Investec Bank plc (Investec). The Firm Placing and the Open Offer

are not being underwritten by Investec.

-- The Share Subscription, the Firm Placing and the Open Offer

are inter-conditional. In particular, they are conditional on

(amongst other things): (i) the passing by the requisite majority

of Shareholders of resolutions to grant authorities to Directors to

allot further shares for cash on a non-pre-emptive basis; and (ii)

admission of the New Ordinary Shares to trading on AIM on or before

8.00 a.m. on 23 October 2019 (or such later time and/or date as may

be agreed between the Group and Investec) (Admission).

-- The net proceeds of the Share Subscription, the Firm Placing

and the Open Offer (expected to be a minimum of approximately

GBP50.8 million) will be utilised by the Group to facilitate the

Group's move to its new, larger Bessemer Park facility in Sheffield

with an annual production capacity of over 1000 MW per annum, fund

and resource development of a 5MW electrolyser module, enhance

product standardisation, meet initial funding requirements for the

Joint Venture and to provide working capital to support (among

other things) the delivery of the contract backlog and opportunity

pipeline and to strengthen the Group's balance sheet.

The Group announced its final results for the year to 30 April

2019 on 3 October 2019. A copy of the final results will be

available on the Group's website at www.itm-power.com.

The Group expects to publish a circular in connection with the

Firm Placing, the Open Offer and the Share Subscription in the

coming days. Shareholders should read the Circular and the Group's

full year results in full before making any application for Open

Offer Shares.

Graham Cooley, Chief Executive Officer of ITM Power plc,

said:

"The major strategic investment from Linde cements a five year

relationship between us and provides ITM Power with a world leading

partner that brings deep expertise in engineering, procurement and

construction and a global customer base. The joint venture will

enable us to focus on our core competency of the development and

sale of electrolysers, and with Linde as our partner to deliver

green hydrogen at scale, The successful fundraising provides the

financial resources to exploit this exciting opportunity to the

full.

"We are seeing increasing global demand for hydrogen as a

solution to renewable energy storage needs and the decarbonisation

of major industrial processes. The fundraising and our partnership

with Linde will help us to meet this demand on a growing scale,

deliver efficiencies throughout our supply chain and represents a

significant step on our pathway to medium-term profitability"

Enquiries:

+44 (0)114 244

ITM Power plc 5111

Graham Cooley, CEO

Investec Bank plc (Nominated Adviser, Financial

Adviser and Broker) +44 (0)20 75974000

Jeremy Ellis / Chris Sim / Ben Griffiths /

Tejas Padalkar

+44 (0)20 7920

Tavistock (Financial PR and IR) 3150

Simon Hudson / Nick Elwes / Barney Hayward

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Record Date for entitlement to participate 5.00 p.m. on 2 October

in the Open Offer 2019

Announcement of the Firm Placing, the

Share Subscription and the Open Offer 3 October 2019

Dispatch of the Circular, the Form of

Proxy and, to certain qualifying Non-CREST

Shareholders, the Application Form 4 October 2019

Expected ex-entitlement date for the 8.00 a.m. on 3 October

Open Offer 2019

Basic Entitlements and Excess CREST

Open Offer Entitlements credited to

CREST stock accounts of Qualifying CREST

Shareholders 7 October 2019

Recommended latest time and date for

requesting withdrawal of Basic Entitlements

and Excess CREST Open Offer Entitlements 4.30 p.m. on 15 October

from CREST 2019

Latest time for depositing Basic Entitlements

and Excess CREST Open Offer Entitlements 3.00 p.m. on 16 October

into CREST 2019

Latest time and date for splitting Application

Forms (to satisfy bona fide market claims 3.00 p.m. on 17 October

only) 2019

Latest time and date for receipt of 11.00 a.m. on 18 October

Forms of Proxy for the General Meeting 2019

Latest time and date for receipt of

completed Application Forms and payment

in full under the Open Offer or settlement 11.00 a.m. on 21 October

of relevant CREST instruction (as appropriate) 2019

11.00 a.m. on 22 October

General Meeting 2019

Result of Open Offer announced through

RNS 22 October 2019

Admission of the New Ordinary Shares 8.00 a.m. on 23 October

to trading on AIM 2019

New Ordinary Shares in uncertificated As soon as practicable

form expected to be credited to accounts after 8.00 a.m. on 23

in CREST (uncertificated holders only) October 2019

Expected date of dispatch of definitive

share certificates for the New Ordinary

Shares in certificated form (certificated

holders only) on 1 November 2019

Background to and reasons for the Firm Placing, Share

Subscription, the Open Offer and use of proceeds

The Group is seeing a considerable expansion in each of its

end-markets. This is being driven by the improving economics and

output of renewable power generation, alongside the growing

commercial and regulatory focus on decarbonisation of energy

intensive industrial processes. These trends are driving an

increasing demand for the provision of green hydrogen at scale and

the Group is in discussions over a number of proposals to deliver

projects of 100 Megawatts and above, particularly in the power to

gas and renewable chemistry markets.

Linde Minority Share Investment into ITM Power and Joint Venture

between ITM Power and Linde

The Group has entered into an agreement with Linde to establish

a 50/50 Joint Venture through the formation of a new vehicle. The

objective of the Joint Venture is to enable the acceleration of

large scale green hydrogen plant construction.

Linde is a leading industrial gases and engineering company with

2018 pro forma sales of USD 28 billion (EUR 24 billion). The

company employs approximately 80,000 people globally and serves

customers in more than 100 countries worldwide.

The Directors expect Linde's size and global reach to

significantly increase the ability of the Group to offer

cost-competitive electrolysis products and systems in key markets,

as well as to provide new opportunities through the Joint Venture's

access to Linde's global customer base, and project delivery

expertise. It is expected that these factors will materially

increase the Group's volume of electrolyser sales. This is a key

driver in the Group's ambition to continue the cost reduction and

increase competitiveness.

The Group and Linde have enjoyed for several years a successful

collaboration on hydrogen projects and the Joint Venture is

believed by the Directors to represent an important step in the

Group's development of the business and significantly enhancing the

Group's capability to offer and efficiently deliver electrolysers

for large-scale projects.

With the Joint Venture, the Group and Linde plan to primarily

serve the refinery market, among others, with electrolysis-based

hydrogen and green gases solutions, and jointly offer to customers

feasibility studies, project development and EPC services. The

Group will contribute with its electrolysis competences and

supplies, and Linde will contribute with its proprietary

technologies for gas separation and gas processing and its global

project realization competencies.

The Directors believe that by combining Linde's world-leading

experience with the Group's continued developments in delivery of

PEM electrolyser technology at increasing scale with the Joint

Venture, the Group will be uniquely placed to deliver large-scale

and complex gas production projects to industrial customers. In

particular the Joint Venture will enable the Group and Linde to

combine ITM Power's expertise in Polymer Electrolyte Membrane

("PEM") electrolysis with Linde's successful global project

realization experience in gases production and processing

facilities. The Joint Venture is expected to significantly increase

the ability of the Group to access complex large-scale projects and

solutions with its electrolysis technology, which require project

delivery and site integration.

Through the Joint Venture, the Group is expected to be in an

improved position to accelerate the process of converting

large-scale opportunities into sales, as well as to reduce project

lead times and improve execution through dedicated and experienced

resources across both electrolysis and project delivery / site

integration requirements. The increased manufacturing capacity of

the Group, together with Linde's engineering, procurement and

construction management resources through the Joint Venture, is

expected to further increase the volume of projects which can be

delivered in parallel, driving an associated cost reduction which

is expected to increase the Group's competitiveness.

Under the terms of the agreement, the Joint Venture will see an

innovation management council created with equal representation

from both ITM Power and Linde, with the target to determine

measures to enhance the value propositions and competitive edge.

The Joint Venture will be set up to include personnel from both

organisations to leverage the depth of expertise from both the

Group and Linde.

Move to Bessemer Park

The Group has an agreement for lease on a new 134,000 square

foot facility at Bessemer Park in Sheffield. The facility is

currently being developed in line with the Group's requirements and

is expected to have an annual production capacity sufficient for

the manufacture of over 1000 MW of electrolysers per annum, making

the facility the world's largest PEM electrolyser manufacturing

plant currently in development.

The facility is intended to be used for product assembly, stack

manufacturing and development and testing of the Group's proposed

5MW stack module and will address capacity constraints that the

Group currently experiences in its existing facilities, including

limited power sources. The Bessemer Park site will also have a

marketing area and office space for more than 100 employees.

Current expectations are that occupation of administrative offices

will commence in Spring 2020 and that manufacturing will commence

in the summer of 2020.

The Directors expect the move to Bessemer Park will facilitate a

number of advantages in addition to the increased manufacturing

capacity, including semi-automation of manufacturing processes and

a larger 5MW grid connection, to contribute to the Group's strategy

of delivering increased system sizes for larger projects.

Continued Product Development

The Directors' immediate objective in terms of product

development is to continue to focus on the scale up of proven

electrolysis equipment, targeting penetration of larger markets.

The Directors believe this approach to be a direct response to

market demand from sales enquiries, trade fairs and marketing

events and the large scale tender opportunities presenting in the

market at present. To achieve this, the Group is pursuing the

development of a 5MW 2-stack module which is scaleable for those

projects of up to and beyond 100MW capacity that are increasingly

being tendered. Product development, and in particular upscaling of

product offering, is further supported through the Group's

participation in large-scale feasibility studies, such as the 100MW

Centurion project and the Gigastack feasibility study with

Orsted.

The Group's provisional specifications for the 5MW module

indicate that it will be capable of generating 2.1 tonnes of

hydrogen per day, and the Group's current internal development

timetable anticipates that first hydrogen from a 5MW module will be

generated in the final quarter of 2020. The design of the 5MW

module is intended to improve design integration techniques in

order to reduce balance of plant costs on larger projects, and is

further indicative of the Group's drive for continuous product

improvement and cost reduction.

Cash Position and Requirements

As at 30 April 2019, the Group reported total financial assets

of cGBP19.8m, of which cGBP5.2m is cash, cGBP1.7m is cash on

guarantee and the remaining GBP12.9m is deployed working capital

(debtors less creditors).

To manage working capital demands and to mitigate the impact of

existing projects with cash receipts towards the end of the

contractual agreement, the Group is seeking a move towards quoting

for potential sales with upfront payment terms, thus reducing the

initial working capital outlay of such commercial projects. On

certain projects, working capital is also enhanced through working

with, and receiving support from, partners on the development of

technology.

Cash flow remains a key consideration for the Board, and the

presiding financial objective for the Group is the achievement of a

positive cash flow in the medium term.

Use of Proceeds

The Directors intend to use the proceeds of the Firm Placing,

the Open Offer and the Share Subscription to:

-- facilitate the Group's move to new larger facilities at

Bessemer Park in Sheffield, which will consolidate the Group's two

current sites and is expected to facilitate annual production

capacity of over 1000MW. This would include installation of an

enlarged grid connection with a capacity of 5MW, in order to be

able to test larger scale electrolysers, as well as development of

semi-automated manufacturing processes to enable cost

reduction;

-- fund and resource the Group's development of a 5MW

electrolyser module, which is seen by the Directors as a key

opportunity to increase the scale of projects which the Group is

capable of delivering on a competitive basis, along with further

product development focusing on the delivery of electrolyser

systems;

-- to meet requirements for the funding of the Joint Venture

referred to above, which is expected to be an initial GBP2million;

and

-- provide working capital to support (among other things) the

delivery of the contract backlog and opportunity pipeline, to

strengthen the Group's balance sheet, to assist in meeting tender

requirements and to improve contractual terms offered by customers

and suppliers, in particular with regard to obtaining improved

upfront payment terms from customers and suppliers;

Backlog and Pipeline

As at the beginning of September 2019, the Group had c.GBP17.1

million of existing projects under contract and a further c.GBP16.1

million in the later stages of negotiation (c.GBP33.2 million in

total). In addition, the Group has a qualified opportunity pipeline

of c.GBP379 million of commercial sales, which consists of over 50

separate projects, across all three end markets, Renewable

Chemistry, Power-to-Gas Storage and Clean Fuel.

For each of the projects qualified within this figure, the Group

has been engaged to provide a written proposal within the past 12

months, the client is understood to remain actively interested in

pursuing the project, and the Directors believe the client has the

financial means and the ambition to implement the project in the

medium term. The majority of these projects, both under contract or

negotiation and in the qualified pipeline, provide for a portion of

the project cost to be paid by the client to the relevant member of

the Group up front, with the corresponding balance of the income

typically received towards the end of the contract. This results in

a working capital shortfall during the middle and later stages of

the contract term, when cash is used in the build phase as well as

final commissioning and user testing. The Board is also of the

opinion that to bid effectively for the increasing number of larger

scale projects it is important that the Group can demonstrate a

robust balance sheet and financial condition.

Details of the Firm Placing, the Open Offer and the Share

Subscription

Structure

The Directors have given careful consideration as to the

structure of the proposed fundraising and have concluded that the

Firm Placing, the Open Offer and the Share Subscription is the most

suitable option available to the Group and its Shareholders at this

time.

It is intended that 35,000,000 Firm Placed Shares will be issued

through the Firm Placing at 40 pence per New Ordinary Share to

raise gross proceeds of GBP14.0 million. Up to 17,053,126 New

Ordinary Shares will be issued through the Open Offer at 40 pence

per New Ordinary Share to raise gross proceeds of up to

approximately GBP6.8 million.

Principal terms of the Firm Placing

The Group is proposing to issue 35,000,000 Firm Placed Shares

pursuant to the Firm Placing. In accordance with the terms of the

Firm Placing and Open Offer Agreement, Investec has agreed to use

reasonable endeavours to procure placees for the Firm Placing

Shares at the Placing Price.

The Firm Placing is not being underwritten.

Dr. Graham Cooley, Robert Putnam, Sir Roger Bone and Martin

Green have undertaken to subscribe for, in aggregate, 265,000 Firm

Placed Shares in the Firm Placing at a price of 40 pence per New

Ordinary Share, as set out below.

The Firm Placed Shares are not subject to clawback and are not

part of the Open Offer.

Under the Firm Placing and Open Offer Agreement, the Group has

agreed to pay to Investec a fixed sum together with a commission

based on the aggregate value of certain of the Firm Placed Shares

placed at the Issue Price and the costs and expenses of the Firm

Placing together with any applicable VAT.

Principal terms of the Open Offer

The Board considers it important that Qualifying Shareholders

have the opportunity to participate in the fundraising, and the

Directors have concluded that the Open Offer is the most suitable

option available to the Group and its Shareholders.

The Open Offer provides an opportunity for all Qualifying

Shareholders to participate in the fundraising by both subscribing

for their respective Basic Entitlements and by subscribing for

Excess Shares under the Excess Application Facility, subject to

availability.

Pursuant to the Open Offer, Qualifying Shareholders will be

given the opportunity to subscribe for 1 Open Offer Share for every

19 Existing Ordinary Shares held on the Record Date.

The Open Offer will raise gross proceeds of up to approximately

GBP6.8 million.

The Issue Price represents a 7.0 per cent. discount to the

Closing Price of 43 pence per Ordinary Share on the Latest

Practicable Date.

Basic Entitlement

Qualifying Shareholders will be invited, on and subject to the

terms and conditions of the Open Offer, to apply for any number of

Open Offer Shares (subject to the limit on the number of Excess

Shares that can be applied for using the Excess Application

Facility) at the Issue Price. Qualifying Shareholders have a Basic

Entitlement of:

1 Open Offer Share for every 19 Existing Ordinary Shares

registered in the name of the relevant Qualifying Shareholder on

the Record Date.

Basic Entitlements under the Open Offer will be rounded down to

the nearest whole number and any fractional entitlements to Open

Offer Shares will be disregarded in calculating Basic Entitlements

and will be aggregated and made available to Qualifying

Shareholders under the Excess Application Facility.

The aggregate number of Open Offer Shares available for

subscription pursuant to the Open Offer will not exceed 17,053,126

New Ordinary Shares.

Principal terms of the conditional Share Subscription

Pursuant to a subscription agreement dated on or about the date

of this announcement, Linde UK Holdings No.2 Limited has agreed to

subscribe for 95,000,000 New Ordinary Shares at a price of 40 pence

per New Ordinary Share, raising GBP38.0m before expenses. The Share

Subscription is conditional on (amongst other things):

(a) the Firm Placing and Open Offer Agreement having not lapsed

or been terminated in accordance with its terms and the Open Offer

Shares and the Firm Placed Shares having been admitted to trading

on AIM in accordance with the AIM Rules;

(b) the Group successfully raising, pursuant to the Share

Subscription, the Firm Placing and the Open Offer, an amount which

equals not less than GBP52,000,000 and not more than

GBP59,000,000;

(c) the New Ordinary Shares issued pursuant to the Share

Subscription representing not less than 20% of the Enlarged Share

Capital of the Group; and

(d) admission of the Subscription Shares occurring no later than

8.00 am on the date on which Admission occurs.

Pursuant to the Subscription Agreement:

(a) Linde will have the right, following completion of the Share

Subscription and for so long as it holds at least 10 per cent of

the issued ordinary share capital of the Group, to appoint a

non-executive director to the Board;

(b) following completion of the Share Subscription, the Group

will establish a technology management committee which will be

responsible for setting the direction of product innovation for the

Group, which committee will be chaired by the non-executive

director appointed by Linde; and

(c) Linde has agreed, other than in certain limited

circumstances, not to sell any of the Subscription Shares for a

period of 12 months following completion of the Share Subscription

or acquire shares which would increase Linde's shareholding to more

than 29.99% of the Group's issued ordinary share capital.

Conditionality

The Firm Placing, the Share Subscription and the Open Offer are

conditional, among other things, upon the following:

(a) the passing, without amendment, of the Resolutions at the General Meeting;

(b) Admission occurring by no later than 8.00 a.m. on 23 October

2019 (or such later time and/or date as may be agreed between the

Group and Investec, being no later than 8.00 a.m. on 1 November

2019); and

(c) the Firm Placing and Open Offer Agreement and the

Subscription Agreement becoming unconditional in all respects and

not having been terminated in accordance with their terms.

If the conditions set out above are not satisfied or waived

(where capable of waiver), the Firm Placing, the Share Subscription

and the Open Offer will lapse; and

(a) the Firm Placed Shares will not be issued and all monies

received from investors in respect of the Firm Placed Shares will

be returned to them (at the investors' risk and without interest)

as soon as possible thereafter; and

(b) any Basic Entitlements and Excess CREST Open Offer

Entitlements admitted to CREST will, after that time and date, be

disabled and application monies under the Open Offer will be

refunded to the applicants, by cheque (at the applicant's risk) in

the case of Qualifying Non-CREST Shareholders and by way of a CREST

payment in the case of Qualifying CREST Shareholders, without

interest, as soon as practicable thereafter.

Application for Admission

Application will be made to the London Stock Exchange for the

New Ordinary Shares to be admitted to trading on AIM. Admission is

expected to take place, and dealings on AIM are expected to

commence, at 8.00 a.m. on 23 October 2019 (or such later time

and/or date as may be agreed between the Group and Investec, being

no later than 8.00 a.m. on 1 November 2019). No temporary document

of title will be issued.

The New Ordinary Shares will, following Admission, rank pari

passu in all respects with the Existing Ordinary Shares and will

carry the right to receive all dividends and distributions

declared, made or paid on or in respect of the Ordinary Shares

after Admission.

Effect of the Firm Placing and the Open Offer

Upon completion of the Firm Placing, the Open Offer and the

Share Subscription, the New Ordinary Shares will represent

approximately 31.2 per cent. of the Enlarged Share Capital

(assuming the Open Offer is subscribed in full).

Total voting rights

Following Admission, the Group will have a total of 471,062,527

Ordinary Shares in issue (assuming the Open Offer is subscribed in

full). With effect from Admission, this figure may (assuming the

Open Offer is subscribed in full) be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in the Group, under the Disclosure Guidance and

Transparency Rules of the Financial Conduct Authority.

Intentions of the Directors in relation to the Firm Placing

The following participants intend to subscribe for an aggregate

of 265,000 Firm Placed Shares as set out below:

Participant Number of Firm Placed Shares

Sir Roger Bone 125,000

Martin Green 40,000

Graham Cooley 75,000

Andy Allen 25,000

Irrevocable voting commitments from certain Directors

Directors, who in aggregate hold 1,691,182 Existing Ordinary

Shares, representing approximately 0.52% per cent. of the Existing

Issued Share Capital, have irrevocably undertaken to vote (and

where such Existing Ordinary Shares are registered in the name of

any other persons have irrevocably undertaken to use reasonable

endeavours to procure that those persons will vote) in favour of

the Resolutions at the General Meeting.

General Meeting and Circular to Shareholders

A General Meeting of the Group is planned to be held at 11.00

a.m. on 22 October 2019, at the offices of Burges Salmon LLP, 6 New

Street Square, London, EC4A 3BF. The General Meeting is being held

for the purpose of considering and, if thought fit, passing the

Resolutions in order to approve the Firm Placing, the Open Offer

and the Share Subscription.

A summary and explanation of the Resolutions will be set out in

the Circular to be sent out shortly.

Important information

This announcement is for information purposes only and does not

purport to be full or complete. No reliance may be placed for any

purpose on the information contained in this announcement or its

accuracy or completeness.

This announcement does not itself constitute an offer or

invitation to underwrite, subscribe for or otherwise acquire or

dispose of any securities in the Group and does not constitute

investment advice.

Neither this announcement nor any copy of it may be taken or

transmitted, published, distributed, reproduced or otherwise made

available, in whole or in part, directly or indirectly, for any

purpose whatsoever, into the United States, Australia, Canada,

Japan, the Republic of South Africa, the Republic of Ireland or to

any persons in any of those jurisdictions or any other jurisdiction

where to do so would constitute a violation of the relevant

securities laws of such jurisdiction. Any failure to comply with

this restriction may constitute a violation of United States,

Australian, Canadian, Japanese, South African or Irish securities

laws. The distribution of this announcement in other jurisdictions

may be restricted by law and persons into whose possession this

announcement comes should inform themselves about, and observe any

such restrictions. Any failure to comply with these restrictions

may constitute a violation of the laws of the relevant

jurisdiction.

This announcement does not constitute, or form part of, any

offer or invitation to sell or issue, or any solicitation of any

offer to purchase or subscribe for any Ordinary Shares or other

securities in the Group.

This announcement is restricted and may not be released,

published or distributed in the United States, Australia, Canada,

Japan, the Republic of South Africa, the Republic of Ireland or in

any jurisdiction to whom or in which such offer or solicitation is

unlawful. The Firm Placing, the Open Offer and the Share

Subscription and the distribution of this announcement and other

information in connection with the Firm Placing, the Open Offer and

the Share Subscription in certain jurisdictions may be restricted

by law and persons into whose possession this announcement, any

document or other information referred to herein, comes should

inform themselves about and observe any such restriction. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction. Neither

this announcement nor any part of it nor the fact of its

distribution shall form the basis of or be relied on in connection

with or act as an inducement to enter into any contract or

commitment whatsoever.

In particular, the securities of the Group (including the Firm

Placed Shares, the Open Offer Shares and the Subscription Shares)

have not been and will not be registered under the US Securities

Act of 1933, as amended (the Securities Act), or under the

securities laws or with any securities regulatory authority of any

state or other jurisdiction of the United States, and accordingly

the Firm Placed Shares, the Open Offer Shares and the Subscription

Shares may not be offered, sold, pledged or transferred, directly

or indirectly, in, into or within the United States except pursuant

to an exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and the securities

laws of any relevant state or jurisdiction of the United States.

There is no intention to register any portion of the offering in

the United States or to conduct a public offering of securities in

the United States.

The Firm Placed Shares, the Open Offer Shares and the

Subscription Shares have not been approved or disapproved by the US

Securities and Exchange Commission, any state securities commission

or other regulatory authority in the United States, nor have any of

the foregoing authorities passed upon or endorsed the merits of the

Firm Placing, the Open Offer and the Share Subscription or the

accuracy or adequacy of this announcement. Any representation to

the contrary is a criminal offence in the United States.

Investec, which is authorised by the Prudential Regulation

Authority and regulated in the United Kingdom by the FCA and the

Prudential Regulation Authority, is acting as Nominated Adviser,

Financial Adviser and Broker to the Group in respect of the Firm

Placing. Investec is acting exclusively for the Group and for

no-one else in connection with the Firm Placing and the matters

referred to herein, and will not be treating any other person as

its client, in relation thereto and will not be responsible for

providing the regulatory protections afforded to its customers nor

for providing advice in connection with the Firm Placing or any

other matters referred to herein. Apart from the responsibilities

and liabilities (if any) imposed on Investec, as the case may be,

by the Financial Services and Markets Act 2000 (as amended) or any

regulatory regime established thereunder, Investec does not make

any representation express or implied in relation to, nor accepts

any responsibility whatsoever for, the contents of this

announcement, the Circular, or any other statement made or

purported to be made by it or on its behalf in connection with the

Group or the matters referred to herein. Investec (and its

affiliates) accordingly, to the fullest extent permissible by law,

disclaims any and all liability (save for statutory liability)

whether arising in tort, contract or otherwise which it might have

in respect of the contents of this this announcement or any other

statement made or purported to be made by it or on its behalf in

connection with the Group or the matters referred to herein. Any

other person in receipt of this announcement should seek their own

independent legal, investment and tax advice as they see fit.

All offers of the Firm Placed Shares, the Open Offer Shares and

the Subscription Shares in the EEA will be made pursuant to an

exemption under the Prospectus Regulation (2017/1129) from the

requirement to produce a prospectus.

Forward-looking statements

Certain information contained in this announcement constitute

forward looking information. This information relates to future

events or occurrences or the Group and/or the Group's future

performance. All information other than information of historical

fact is forward looking information. The use of any of the words

"anticipate", "plan", "continue", "estimate", "expect", "may",

"will", "project", "should", "believe", "predict" and "potential"

and similar expressions are intended to identify forward looking

information. This information involves known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such forward

looking information. No assurance can be given that this

information will prove to be correct and such forward looking

information included in this announcement should not be relied

upon. Forward-looking information speaks only as of the date of

this announcement.

The forward looking information included in this announcement is

expressly qualified by this cautionary statement and is made as of

the date of this announcement. The Group does not undertake any

obligation to publicly update or revise any forward looking

information except as required by applicable securities laws.

Information to distributors

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended (MiFID II); (b) Articles 9 and 10

of Commission Delegated Directive (EU) 2017/593 supplementing MiFID

II; and (c) local implementing measures (together, the MiFID II

Product Governance Requirements), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the MiFID II Product

Governance Requirements) may otherwise have with respect thereto,

the Firm Placed Shares, the Open Offer Shares and the Subscription

Shares have been subject to a product approval process, which has

determined that the Firm Placed Shares, the Open Offer Shares and

the Subscription Shares are: (i) compatible with an end target

market of retail investors and investors who meet the criteria of

professional clients and eligible counterparties, each as defined

in MiFID II, who do not need a guaranteed income or capital

protection who (either alone or in conjunction with an appropriate

nancial or other adviser) are capable of evaluating the merits and

risks of such an investment and who have appropriate resources to

be able to bear any losses that may result therefrom; and (ii)

eligible for distribution through all distribution channels as are

permitted by MiFID II (the Target Market Assessment).

Notwithstanding the Target Market Assessment, distributors should

note that: the price of the Firm Placed Shares, the Open Offer

Shares and the Subscription Shares may decline and investors could

lose all or part of their investment; the Firm Placed Shares, the

Open Offer Shares and the Subscription Shares offer no guaranteed

income and no capital protection; and an investment in

the Firm Placed Shares, the Open Offer Shares and the

Subscription Shares is compatible only with investors who do not

need a guaranteed income or capital protection, who (either alone

or in conjunction with an appropriate financial or other adviser)

are capable of evaluating the merits and risks of such an

investment and who have appropriate resources to be able to bear

any losses that may result therefrom. The Target Market Assessment

is without prejudice to the requirements of any contractual, legal

or regulatory selling restrictions in relation to the Firm Placing,

the Open Offer and Share Subscription. Furthermore, it is noted

that, notwithstanding the Target Market Assessment Investec has

only procured investors who meet the criteria of professional

clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the Firm Placed Shares,

the Open Offer Shares and the Subscription Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Firm Placed Shares, the Open

Offer Shares and the Subscription Shares and determining

appropriate distribution channels.

DEFINITIONS

The following definitions apply throughout this announcement

unless the context otherwise requires:

Act the Companies Act 2006 (as amended);

Admission admission of the New Ordinary Shares to

trading on AIM and such admission becoming

effective in accordance with the AIM Rules;

AIM the AIM market operated by the London Stock

Exchange;

AIM Rules the AIM Rules for Companies and/or the AIM

Rules for Nominated Advisers (as the context

may require);

AIM Rules for Companies the rules of AIM as set out in the publication

entitled 'AIM Rules for Companies' published

by the London Stock Exchange from time to

time;

AIM Rules for Nominated the rules of AIM as set out in the publication

entitled 'AIM Rules for

Advisers Nominated Advisers' published by the London

Stock Exchange from time to time;

Application Form the application form to be used by Qualifying

Non-CREST Shareholders in connection with

the Open Offer and which will accompany

the Circular;

Basic Entitlement the Open Offer Shares which a Qualifying

Shareholder is entitled to subscribe for

under the Open Offer calculated on the basis

of 1 Open Offer Share for every 19 Existing

Ordinary Shares held by that Qualifying

Shareholder as at the Record Date;

Board or Directors the board of directors of the Company for

the time being;

certificated form the description of a share or other security

or which is not in uncertificated form

Circular the Circular to be published by the Group

following the date of this announcement

in connection with the Firm Placing, the

Open Offer and the Share Subscription, which

will contain (amongst other things) the

Notice of General Meeting

Closing Price the closing middle market quotation of an

Ordinary Share as derived from the AIM Appendix

to the Daily Official List of the London

Stock Exchange;

Group or ITM Power plc, a company incorporated in

England and Wales with

ITM Power plc registered number 05059407 and having its

registered office at 22 Atlas Way, Sheffield,

S4 7QQ;

CREST the relevant system (as defined in the CREST

Regulations) in respect of which Euroclear

is the Operator (as defined in the CREST

Regulations);

CREST Regulations the Uncertificated Securities Regulations

2001 (as amended);

Enlarged Share Capital the issued share capital of the Group immediately

following Admission, assuming (save for

the purposes of calculating the 29.9 per

cent. Aggregate Limit) the maximum number

of Open Offer Shares are allotted;

Euroclear Euroclear UK & Ireland Limited;

Excess Applications applications pursuant to the Excess Application

Facility;

Excess Application the mechanism whereby a Qualifying Shareholder,

Facility who has taken up his Basic Entitlement in

full, can apply for Excess Shares up to

an amount equal to the total number of Open

Offer Shares available under the Open Offer

less an amount equal to a Qualifying Shareholder's

Basic Entitlement, subject always to the

29.9 per cent. Aggregate Limit, in accordance

with the provisions to be set out in the

Circular;

Excess CREST Open in respect of each Qualifying CREST Shareholder

Offer Entitlements who has taken up his Basic Entitlement in

full, the entitlement to apply for Open

Offer Shares in addition to his Basic Entitlement

credited to his stock account in CREST,

pursuant to the Excess Application Facility,

which may be subject to scaling back in

accordance with the provisions to be set

out in the Circular;

Excess Shares Open Offer Shares which are not taken up

by Qualifying Shareholders pursuant to their

Basic Entitlement and which are offered

to Qualifying Shareholders under the Excess

Application Facility;

Excluded Overseas other than as agreed by the Group and Investec

Shareholders or as permitted by applicable law, Shareholders

who are located or have registered addresses

in a Restricted Jurisdiction;

Existing Issued the issued share capital of the Group as

Share Capital at the Latest Practicable Date;

Existing Ordinary the 324,009,400 Ordinary Shares in issue

Shares as at the Record Date;

FCA the UK Financial Conduct Authority;

Firm Placees the persons who have agreed to subscribe

for the Firm Placed Shares;

Firm Placed Shares the 35,000,000 New Ordinary Shares to be

issued by the Group under the Firm Placing;

Firm Placing the placing of the Firm Placed Shares with

the Firm Placees pursuant to the Firm Placing

and Open Offer Agreement;

Firm Placing and Agreement the conditional agreement dated

Open Offer Agreement on or about the date of this announcement

between the Group and Investec Bank plc

relating to the Firm Placing

General Meeting the general meeting of the Group to be convened

or GM in connection with the Firm Placing, the

Open Offer and the Share Subscription, details

of which will be set out in the Circular

to be published by the Group

Group or ITM Power the Group and/or its subsidiary undertakings

at the date of this announcement (as defined

in sections 1159 and 1160 of the Act);

Group

Investec or Investec Investec Bank plc, a company incorporated

Bank plc in England and Wales with registered number

00489604 and having its registered office

at 2 Gresham Street, London EC2V 7QP;

Issue Price 40 pence per New Ordinary Share;

Latest Practicable means 5.00 p.m. on 2 October 2019, being

Date the latest practicable date prior to publication

of this announcement;

London Stock Exchange London Stock Exchange plc;

New Ordinary Shares up to 147,053,126 New Ordinary Shares of

5 pence each to be issued by the Group pursuant

to the Firm Placing, the Open Offer and

the Share Subscription;

Notice of General the notice of General Meeting, to be set

Meeting out in the Circular;

Open Offer the conditional invitation by the Group

to Qualifying Shareholders to apply to subscribe

for Open Offer Shares at the Issue Price

on the terms and subject to the conditions

to be set out in the Circular and in the

case of the Qualifying Non-CREST Shareholders

only, the Application Form;

Open Offer Entitlements an entitlement to subscribe for Open Offer

Shares, allocated to a Qualifying Shareholder

under the Open Offer (and, for the avoidance

of doubt, references to Open Offer Entitlements

include Basic Entitlements and Excess CREST

Open Offer Entitlements);

Open Offer Shares up to 17,053,126 New Ordinary Shares to

be offered to Qualifying Shareholders under

the Open Offer;

Ordinary Shares ordinary shares of 5 pence each in the capital

of the Group;

Prospectus Regulation the Prospectus Regulation Rules Instrument

Rules published by the FCA (FCA 2019/80), implementing

the EU Prospectus Regulation 2017/1129;

Qualifying CREST Qualifying Shareholders whose Existing Ordinary

Shareholders Shares on the register of members of the

Group on the Record Date are in uncertificated

form;

Qualifying Non-CREST Qualifying Shareholders whose Existing Ordinary

Shareholders Shares on the register of members of the

Group on the Record Date are held in certificated

form;

Qualifying Shareholders holders of Existing Ordinary Shares on the

register of members of the Group at the

Record Date with the exception (subject

to certain exceptions) of Excluded Overseas

Shareholders;

Record Date 5.00 p.m. on 2 October 2019;

Resolutions the resolutions to be proposed at the General

Meeting which will be set out in full in

the Notice of General Meeting;

Restricted Jurisdictions each of Australia, Canada, Japan, the Republic

of South Africa and the United States;

Shareholders holders of Existing Ordinary Shares;

Share Subscription means the conditional subscription for Ordinary

Shares by Linde UK Holdings No.2 Limited

on the terms and conditions contained in

the Subscription Agreement;

Subscription Agreement means the subscription agreement entered

into between the Group and Linde UK Holdings

No.2 Limited on or about the date of this

announcement, pursuant to which Linde UK

Holdings No.2 Limited has agreed to subscribe

for 95,000,000 Ordinary Shares on the terms

and conditions set out therein;

Subscription Shares means the 95,000,000 Ordinary Shares to

be subscribed for by Linde UK Holdings No.2

Limited pursuant to the Share Subscription;

uncertificated recorded on a register of securities maintained

by Euroclear in accordance with the CREST

Regulations as being in uncertificated form

in CREST and title to which, by virtue of

the CREST Regulations, may be transferred

by means of CREST;

UK or United Kingdom the United Kingdom of England, Scotland,

Wales and Northern Ireland;

US or United States the United States of America, its territories

and possessions, any state of the United

States of America and the District of Columbia;

US Securities Act the US Securities Act of 1933 (as amended);

USE unmatched stock event;

GBP or sterling pounds sterling, the legal currency of the

United Kingdom; and

29.9 per cent. Aggregate the restriction on the number of Open Offer

Limit Shares that each Qualifying Shareholder

may receive under the Open Offer on the

basis that no Qualifying Shareholder shall

be entitled to receive in excess of such

number of Open Offer Shares as would bring

its aggregate interest in the Group to more

than 29.9 per cent. of the Enlarged Share

Capital.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCCKNDDPBDKAKK

(END) Dow Jones Newswires

October 03, 2019 02:00 ET (06:00 GMT)

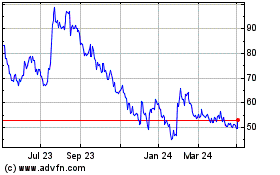

Itm Power (LSE:ITM)

Historical Stock Chart

From Mar 2024 to Apr 2024

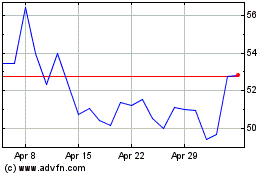

Itm Power (LSE:ITM)

Historical Stock Chart

From Apr 2023 to Apr 2024