Inspirit Energy Holdings PLC Short term debt facility, Issue of Equity and TVR (9834I)

December 08 2022 - 2:00AM

UK Regulatory

TIDMINSP

RNS Number : 9834I

Inspirit Energy Holdings PLC

08 December 2022

8 December 2022

Inspirit Energy Holdings Plc

("Inspirit" or "the Company")

Short term debt facility

Issue of Equity and TVR

Inspirit (LON: INSP), the waste heat recovery technology and

engineering solutions company, is pleased to announce that it has

entered into a short-term, un-secured debt facility of up to

US$250,000 (approximately GBP205,075) (the "Facility"). Under the

Facility Inspirit will be initially drawing down US$80,000

(approximately GBP65,624) (the "Initial Advance").

The Facility is with Riverfort Global Opportunities PCC Limited

("Riverfort" or the "Noteholder"), and the proceeds of the advance

are for general working capital.

Details of the Facility

The Facility has a 12-month term and allows Inspirit to draw

down funds ("Advances") which will be repayable within 6 months in

either cash or shares at the Noteholders' discretion in respect of

the Initial Advance and thereafter at the agreement of the Company

and Riverfort. If the debt is repaid in shares, they will be repaid

at 130% of the Reference Price being the average of the five (5)

daily VWAPs preceding the Drawdown Date in respect of the relevant

Advance (the "Fixed Premium Placing Price"). In the event that

Inspirit completes any share placing during the Term of the

relevant Advance and the share placing price is below the Fixed

Premium Placing Price, the Fixed Premium Placing Price will be

amended to be the relevant share placing price. Inspirit will issue

the Noteholder with warrants in respect of each Advance so as to

represent 50% of the value of the relevant Advance, divided by the

relevant Reference Price; the warrants will have an exercise price

of Fixed Premium Placing Price and a 48 month term.

Inspirit will be initially drawing down US$80,000 as the Initial

Advance and will therefore issue Riverfort with warrants to the

value of 50% of the Initial Advance at the reference price of

0.03376 pence being 97,191,943 warrants. These warrants will have a

term of 48 months and will be exercisable at 130% of the reference

price being 0.04388 pence.

The Facility will attract 1.5% interest per month based on the

value of the outstanding indebtedness payable in cash and an

implementation fee of 6% of any Advances if settled in cash or 8%

if issued in Shares. Accordingly, Inspirit will issue 15,550,710

Ordinary Shares of 0.001p each ("Shares") at a price of 0.03376

pence each for the implementation fee in respect of the Initial

Advance (the "Initial Shares"). The Facility contains a right of

first refusal clause allowing Riverfort to match the terms of any

alternative debt/ structured funding the Company may seek during

the term of the Facility.

The Facility contains standard warranties and indemnities from

the Company.

Issue of Equity and TVR

Application will be made for the 15,550,710 Ordinary Shares to

be admitted to trading on AIM ("Admission") and it is expected that

Admission will occur on or about 14 December 2022. The Ordinary

Shares will rank pari passu in all respects with the existing

Ordinary Shares of the Company.

Following admission of the Initial Shares, the Company's

enlarged issued share capital will comprise 4,287,190,896 Ordinary

Shares. The Company does not hold any shares in treasury. This

figure of 4,287,190,896 Ordinary Shares may be used by shareholders

in the Company as the denominator for the calculations by which

they will determine if they are required to notify their interest

in, or a change in their interest in, the share capital of the

Company under the FCA's Disclosure and Transparency Rules.

The Board comments:

"This is a good short-term facility providing near-term funding

while the engineering team work on the final phase of our Waste

Heat Recovery application on which the Board will provide further

updates in due course"

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE REGULATION (EU No. 596/2014) AS IT FORMS PART

OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT

2018.

More information on Inspirit Energy can be seen at:

www.inspirit-energy.com

For further information please contact:

Inspirit Energy Holdings plc

John Gunn, Chairman and CEO +44 (0) 207 048 9400

Beaumont Cornish Limited

www.beaumontcornish.com

(Nominated Advisor)

Roland Cornish / James Biddle +44 (0) 207 628 3396

Global Investment Strategy UK

Ltd

(Broker)

Samantha Esqulant +44 (0) 207 048 9045

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAEAXEALAFAA

(END) Dow Jones Newswires

December 08, 2022 02:00 ET (07:00 GMT)

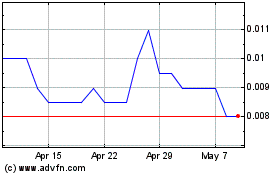

Inspirit Energy (LSE:INSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Inspirit Energy (LSE:INSP)

Historical Stock Chart

From Apr 2023 to Apr 2024