TIDMIII

RNS Number : 1878L

3i Group PLC

12 May 2022

12 May 2022

3i Group plc announces results for the year

to 31 March 2022

3i delivered an excellent result in FY2022

-- Total return of GBP4,014 million or 44% on opening

shareholders' funds (March 2021: GBP1,726 million, 22%) and NAV per

share of 1,321 pence (31 March 2021: 947 pence).

-- Our Private Equity business delivered a gross investment

return of GBP4,172 million or 47% (March 2021: GBP1,936 million,

30%). This excellent result was driven by strong earnings growth

and realisation profits with valuation multiple increases

contributing just 6% of Private Equity GIR in the year.

-- Action delivered annual revenue growth of 23% and EBITDA

growth of 36% in 2021 and has started 2022 well. Action's LTM

EBITDA to P3 2022, which ended on 3 April 2022, was EUR932 million

(31 March 2021: EUR602 million) showing the strength in recovery of

the group's trading since the severe Covid-19 restrictions in the

first three months of 2021.This strong performance underpinned

value growth of GBP2,655 million in the year, in addition to GBP284

million of dividends received.

-- In competitive markets the Private Equity team deployed

GBP529 million including six new investments and two

transformational bolt-on acquisitions. In addition our portfolio

companies completed a further 13 self-funded bolt-on

acquisitions.

-- Across the Group, we received over GBP1.2 billion of cash

primarily via portfolio company realisations, refinancings and

dividends in the year.

-- Our Infrastructure business generated a gross investment

return of GBP241 million, or 21% (March 2021: GBP178 million, 16%).

This return was driven by the increase in share price of 3i

Infrastructure plc ("3iN") and dividend income.

-- Scandlines generated a gross investment return of GBP112

million, or 26% (March 2021: GBP25 million, 6%). Freight volumes

have been consistently strong, finishing ahead of 2019 levels,

whilst leisure volumes showed some signs of recovery but remained

below 2019 levels due to varying degrees of travel restrictions

throughout 2021.

-- Total dividend of 46.5 pence per share for FY2022, with a

second FY2022 dividend of 27.25 pence per share to be paid in July

2022 subject to shareholder approval.

Simon Borrows, 3i's Chief Executive , commented:

"We have entered our new financial year acutely aware of the

political and macro-economic challenges the world is facing, but we

do this from a position of strength. Our teams are experienced and

well-embedded in their local markets across northern Europe and

North America. Our processes are carefully designed and disciplined

which allows us to react fast to sudden or sharp changes in markets

or the broader environment and our portfolio is well constructed

from a thematic, geographic and sector perspective and has

demonstrated clear resilience over the last few years. We asset

manage in the knowledge that we have assembled today's portfolio

with real price discipline and we have not over-bought recent

highly-priced vintages. In Action we have a formidable retail

company that will continue to grow and thrive in today's

challenging environment. We also have a number of healthcare and

consumer assets which have the potential to deliver significant

longer-term compounding returns for the Group. "

Financial highlights

Year to/as at Year to/as at

31 March 31 March

2022 2021

------------------------------------------------- -------------- --------------

Group

Total return GBP4,014m GBP1,726m

Operating expenses GBP(128)m GBP(112)m

Operating cash profit GBP340m GBP23m

================================================= ============== ==============

Realised proceeds GBP788m GBP218m

Gross investment return GBP4,525m GBP2,139m

- As a percentage of opening 3i portfolio value 43% 26%

Cash investment GBP543m GBP510m

3i portfolio value GBP14,305m GBP10,408m

Gross debt GBP975m GBP975m

Net debt GBP(746)m GBP(750)m

Gearing(1) 6% 8%

Liquidity GBP729m GBP725m

Net asset value GBP12,754m GBP9,164m

Diluted net asset value per ordinary share 1,321p 947p

Total dividend per share 46.5p 38.5p

1 Gearing is net debt as a percentage of net assets.

S

For further information, please contact:

Silvia Santoro

Group Investor Relations Director Tel: 020 7975 3258

Kathryn van der Kroft

Communications Director Tel: 020 7975 3021

For further information regarding the announcement of 3i's

annual results to 31 March 2022, including a live webcast of the

results presentation at 10.00am, please visit www.3i.com .

Notes to editors

3i is a leading international investment manager focused on

mid-market Private Equity and Infrastructure. Our core investment

markets are northern Europe and North America. For further

information, please visit: www.3i.com .

Notes to the announcement of the results

Note 1

All of the financial data in this announcement is taken from the

Investment basis financial statements. The statutory accounts are

prepared under IFRS for the year to 31 March 2022 and have not yet

been delivered to the Registrar of Companies. The statutory

accounts for the year to 31 March 2021 have been delivered to the

Registrar of Companies. The auditor's reports on the statutory

accounts for these years are unqualified and do not contain any

matters to which the auditor drew attention by way of emphasis or

any statements under section 498(2) or (3) of the Companies Act

2006. This announcement does not constitute statutory accounts.

Note 2

Copies of the Annual report and accounts 2022 will be posted to

shareholders on or soon after 25 May 2022.

Note 3

This announcement may contain statements about the future

including certain statements about the future outlook for 3i Group

plc and its subsidiaries ("3i"). These are not guarantees of future

performance and will not be updated. Although we believe our

expectations are based on reasonable assumptions, any statements

about the future outlook may be influenced by factors that could

cause actual outcomes and results to be materially different.

Note 4

Subject to shareholder approval, the proposed second dividend is

expected to be paid on 22 July 2022 to holders of ordinary shares

on the register on 17 June 2022. The ex-dividend date will be 16

June 2022.

Chairman's statement

"The Group has a clear, consistent strategy that continues to be

well executed, generating attractive and sustainable returns for

shareholders."

3i delivered an excellent result in FY2022, driven by organic

growth and the effective implementation of buy-and-build strategies

in our portfolio.

Overview

I am pleased to report that 3i delivered an excellent result in

the financial year to 31 March 2022 ("FY2022"), my first year end

as Chairman of the Group. The Group has a clear, consistent

strategy that continues to be well executed, generating attractive

and sustainable returns for shareholders.

Performance

The Group's total return for the year was GBP4,014 million

(2021: GBP1,726 million). Net asset value ("NAV") increased to

1,321 pence per share (31 March 2021: 947 pence) and our total

return on opening shareholders' funds was 44% (2021: 22%). This

year's result highlights the resilience that the Group and our

portfolios have demonstrated throughout the pandemic and our

ability to generate growth organically and through value accretive

acquisitions for our portfolio companies.

Market environment

The strength of the Group's FY2022 result has been achieved

against a challenging macro-economic and uncertain geopolitical

backdrop. The start of our financial year coincided with the

initial phase of the global deployment of Covid-19 vaccines.

Despite the emergence of new variants towards the end of 2021, the

effectiveness of the vaccination programme and wider public health

response resulted in reduced restrictions across many of the

regions in which our portfolio companies operate. The resulting

pick-up in economic activity gave rise to supply chain disruption

and inflationary pressures. These pressures have been exacerbated

since Russia's invasion of Ukraine with further increases in

commodity prices, including energy and fuel. The Group has no

direct exposure to Russia or Ukraine and across our portfolios the

exposure is limited.

Dividend

Our dividend policy is to maintain or grow the dividend year on

year, subject to balance sheet strength and the outlook for

investment and realisation levels. In the year, we had a good level

of investment activity across new, bolt-on and further investments,

and also generated a significant cash inflow of over GBP1.2 billion

from our portfolio companies. We also provided liquidity to two of

our portfolio companies to support their recovery from the pandemic

and have capacity to support other portfolio companies if

required.

In line with the Group's policy and in recognition of the

Group's financial performance, the Board recommends a second FY2022

dividend of 27.25 pence (2021: 21.0 pence), subject to shareholder

approval, which will take the total dividend to 46.5 pence (2021:

38.5 pence).

Board and people

I would like to take this opportunity to thank Simon Thompson,

my predecessor, for his stewardship of the Group over the last six

years, particularly through the early stages of Covid-19 and for

facilitating a smooth transition process.

As announced on 11 November 2021, Julia Wilson, Group Finance

Director, will retire from her role and the Board after the AGM in

June 2022 and will be succeeded by James Hatchley, who will also

retain his current Group Strategy responsibilities. We have also

promoted Jasi Halai, currently Group Financial Controller, to Chief

Operating Officer. I would like to thank Julia for her outstanding

contribution to the Group and the Board over her 16-year tenure and

welcome James and Jasi to the Board. I am also delighted to welcome

to the Board Peter McKellar, who succeeds me as Chairman of the

Valuation Committee and Lesley Knox, who has been appointed as our

Senior Independent Director.

Environmental, Social, and Governance ("ESG")

In 2021, ESG and in particular the impact of climate change, was

of significant prominence for governments and businesses. We have

recognised for some time its importance for our shareholders and

investors and wider society and I am encouraged by the Group's

progress during the year in implementing its sustainability agenda

under the oversight of our newly formed ESG Committee.

Outlook

We have started FY2023 with strong momentum across the Group and

our portfolio. The mitigation measures and growth strategies we

have implemented since the start of the pandemic mean that we are

well placed to adapt to the next phase of its evolution. The

current geopolitical instability and the wider implications for the

macro-economic environment remain a key focus for the Group and our

portfolio companies, and while we are not immune, our portfolio is

demonstrating its resilience and ability to generate growth.

The strength of our performance in FY2022 results from our

strategy of investing in assets backed by long-term structural

growth trends, supporting returns for our shareholders through the

cycle.

David Hutchison

Chairman

11 May 2022

Chief Executive's statement

"Since our restructuring in June 2012, we have focused on

investing our proprietary capital to deliver sustainable growth and

long-term compounding of value from our portfolio companies. This

strategy has been executed well by our international investment

teams and through the tight central control of the Group's

Investment Committee. Price discipline, active asset management and

careful cost control have been the hallmarks of the 3i approach

since 2012".

3i delivered an excellent result in FY2022, driven by a

resilient portfolio, carefully constructed and positioned in

sectors benefiting from long-term structural growth. Our Private

Equity and Infrastructure investment teams deployed capital

selectively and innovatively across several new, further and

bolt-on investments and we capitalised on favourable market

conditions to return significant cash to the Group. Against a

backdrop of geopolitical tensions and macro-economic uncertainty,

we enter the next financial year with a diversified portfolio that

has good momentum and is well positioned to generate attractive,

sustainable returns for our shareholders.

We continued to deliver against our long-term strategy and

objectives in FY2022, generating a total return on shareholders'

funds of GBP4,014 million, or 44% (2021: GBP1,726 million, or 22%),

ending the year with a NAV per share of 1,321 pence (31 March 2021:

947 pence). The Group and its portfolio have navigated the various

challenges of the last few years very effectively and the strength

of the 3i team and processes, together with the quality of the

current investment portfolio, have ensured sustained growth and

dividends for shareholders. Throughout the pandemic, rigorous

monitoring and active management of our portfolio enabled us to

respond quickly to developments in the wider environment and to

implement mitigating actions. This is important also in the context

of Russia's invasion of Ukraine. The Group has no direct exposure

to Russia or Ukraine, and the exposure across the portfolio is

limited but, where it exists, we are actively working on options to

deal with the situation in the short term.

A combination of pent-up demand and record levels of uninvested

capital continue to drive competition and aggressive pricing for

private market assets. We have maintained price discipline and

remained flexible, selective and innovative in deploying our

capital. During the year, we completed six new investments in

Private Equity and three in Infrastructure. Bolt-on acquisitions

enable our portfolio companies to increase their scale, customers,

capabilities and access new markets and have been fundamental to

our value creation strategy across both of our portfolios.

In FY2022 we completed a total of 15 bolt-on acquisitions,

including two transformational acquisitions for our Private Equity

portfolio companies and a number of further investments within our

Infrastructure portfolio. Our permanent capital is a distinct

advantage in allowing us flexibility in our investment holding

periods. We are under no pressure to accelerate exits before assets

have reached their full potential. We will, of course, capitalise

on favourable exit and refinancing market conditions when they

arise. Across the Group, we received over GBP1.2 billion of cash

primarily via portfolio company realisations, refinancings and

dividends in the year.

Private Equity performance

Our Private Equity portfolio consists of companies across

northern Europe and North America with international operations

across four sectors: Business & Technology Services; Consumer;

Healthcare; and Industrial Technology. In the year to 31 March

2022, it generated a Gross Investment Return ("GIR") of 47% (2021:

30%), predominately driven by performance, with 93% of our

portfolio companies by value growing their adjusted earnings in the

12 months to December 2021. We remained consistent on our long-term

view on multiples, with multiple increases contributing just 6% to

Private Equity GIR.

Action

Our largest Private Equity portfolio company, Action, is a

leading non-food discount retailer operating in ten countries

across Europe. Action delivered a very strong result for its

financial year ending 2 January 2022, generating sales growth of

23% and operating EBITDA of EUR828 million, 36% ahead of the

previous year. This performance was achieved notwithstanding

Covid-19 restrictions and store closures that affected Action in

six out of 12 months in 2021, as well as widespread global supply

chain disruptions and inflationary pressures.

2021 was a record year in terms of store openings for Action, as

the business added 267 stores. Action's simple and repeatable

format, selling good quality but inexpensive products across 14

different categories, remains highly successful in both its

established and newer markets. Action is seeing strong trading from

seven pilot stores in Italy, opened in 2021, and four pilot stores

in Spain, opened in early 2022. The group now has over 2,000 stores

across 10 countries and plenty of expansion potential in existing

and adjacent countries.

An effective end-to-end supply chain is critical to Action's

growth strategy and, in 2021, Action strengthened its distribution

infrastructure with the addition of two new distribution centres

("DCs"), in Bratislava, Slovakia and in Bieruń, Poland, and opened

a new hub in Wroclaw, Poland. Action's DC network has the capacity

to serve c.2,400 stores, providing important spare capacity to

support further growth, whilst the addition of hubs, used to

coordinate the inbound freight, ensures efficient supply to the

DCs. Enhancements in Action's IT infrastructure and the ability to

directly source products have enabled better quality sourcing, more

supply chain control and improved the availability of products in

stores. The flexibility of Action's product range and its

significant buying power have allowed the business to effectively

manage price inflation, whilst carefully maintaining price distance

to competitors and ensuring value for money for its customers.

Action has made significant progress in the implementation of

its ambitious sustainability agenda. The company has set a number

of important targets relating to the responsible sourcing of some

materials, the transparency of labour conditions in its supply

chain, and importantly aims to have circularity plans in place for

all its categories by the end of 2022. It has also pledged to

reduce the emissions from its own operations by 50% by 2030, from a

baseline year of 2020.

The Board of Action appointed Hajir Hajji to the role of CEO

effective from 1 January 2022 and she has presided over a good

start to the year. In the three months to the end of Action's

period 3 ("P3") which ended on 3 April 2022, all stores were open

for most of the period and the business generated like-for-like

("LFL") sales growth of 28% and opened 30 new stores. Action's last

12 months ("LTM") EBITDA to P3 2022 was EUR932 million (31 March

2021: EUR602 million) showing the strength in recovery of the

group's trading since the severe Covid-19 restrictions in the first

three months of 2021. Action has not been directly impacted by

Russia's invasion of Ukraine and has no stores in that region.

Throughout the pandemic, Action has remained highly cash

generative due to its strong performance, asset-light model and

structurally negative working capital. As a result, Action paid an

interim dividend to shareholders of EUR325 million in December

2021, and a second dividend of EUR344 million in March 2022. After

paying the dividends, Action had a cash balance of EUR394 million

as at 31 March 2022 and a net debt to run-rate earnings ratio of

2.5x.

Healthcare portfolio companies

Over the last five years, we have increased our exposure to

healthcare assets, recognising the significant trends in health and

wellbeing spend, ageing populations and the increased importance of

the sector following the pandemic. The healthcare assets that we

have acquired often operate in highly fragmented markets and the

significant bolt-on activity in each of our businesses is providing

a foundation for considerable growth. Since our initial platform

investment in 2019 and subsequent buy-and-build activity, SaniSure

is now amongst the largest independent pure-play bioprocessing

consumables businesses in the market and delivered very strong

organic growth in 2021. Q Holding's medical business ("QMD") has

seen significant recent commercial momentum with strong sales in

its core products with existing customers, as well as significant

new customer wins in 2021. We continued to enhance Cirtec Medical

with the self-funded acquisition of Cardea Catheter Innovations,

further strengthening Cirtec Medical's interventional segment

following the previous acquisitions of Vascotube and NovelCath.

Over our five-year hold in Havea, we have developed one of the

leading European players in consumer healthcare through the

simplification of its brand portfolio, omnichannel development and

by executing a value accretive buy-and-build strategy. In 2021, the

business delivered a good result despite Covid-19 restrictions

impacting retail footfall and completed the self-funded acquisition

of ixX Pharma.

Consumer portfolio companies (excluding Action)

Our consumer businesses performed well. BoConcept delivered

record order intake in 2021, with strong performance across most

markets, particularly in Japan, as the business continues to

outperform growth in the market and benefit from increased spending

on the home. Operational improvements implemented since our initial

investment and effective pricing strategies have largely offset the

increased supply chain and transportation costs. The business

expanded its international footprint with a further 35 new stores

in 2021, taking the total number of brand stores to 326 across 67

countries.

Hans Anders mitigated Covid-19 restrictions in the first and

last quarter of 2021 through its omnichannel strategy and increased

operational efficiencies. Following the easing of restrictions in

the second and third quarters of 2021, sales rebounded quickly.

Trading in the first quarter of 2022 was robust with all stores

open. High customer demand, driven by a structural shift to online

channels, generated strong performance in the first half of 2021

for Luqom, whilst market headwinds, specifically supply chain

delays and rising inbound container prices, resulted in pressure on

performance in the second half of 2021. The business completed an

important transaction with the bolt-on acquisition of

Lampemesteren, one of the online market leaders in Scandinavia with

a particularly strong position in the premium segment of the

market.

Over the last two years, Covid-19 has presented an unprecedented

challenge to the travel industry, and in 2021 both Audley Travel

and arrivia faced difficult trading conditions. To support their

recovery, we provided additional liquidity to both businesses.

Encouragingly, in the first quarter of 2022, both saw an

improvement in bookings.

Industrial Technology portfolio companies

Our long-term minority investments in AES and Tato continue to

perform well and yield cash dividends for the Group. Tato continued

to see sustained demand for its core biocides products and

maintained its supply levels throughout the pandemic. The Covid-19

driven boost to disinfectant sales normalised through the second

half of 2021 with end markets now driven by conventional consumer

and industrial drivers. AES outperformed our expectations in the

year, driven by increased sales volume and efficient cost

control.

WP successfully navigated resin and other material price

increases with effective pricing strategies in 2021. The business,

which has an operating subsidiary in Russia that contributed c.17%

of its adjusted 2021 earnings, is actively working with our team on

options to deal with the situation in the short term. Formel D's

performance in 2021 was severely impacted by plant shutdowns due to

the semi-conductor shortage affecting automotive production.

Private Equity investment

We invested GBP335 million in six new portfolio companies. Three

of these were in the consumer sector, including the GBP87 million

investment in Mepal, the GBP46 million investment in Dutch Bakery

and the GBP43 million investment in Yanga. These are distinctive

consumer companies with strong customer propositions and

international growth potential. As part of our thematic Business

& Technology Services investment strategy, we invested GBP53

million in MAIT, a leading IT services provider that benefits from

the digitalisation of SME customers in the manufacturing industries

in the DACH region, with a proven M&A platform to drive

consolidation in a highly fragmented market.

Our experience and network in the healthcare sector enables us

to identify investment opportunities away from the typical

processes that are currently commanding very high valuation

multiples. In May 2021, we adopted an innovative approach in

forming a new platform, ten23 health, to create a contract

development and manufacturing organisation ("CDMO"), which provides

an integrated offering for sterile drug product development and

manufacturing of biologics, challenging molecules and dosage forms.

Throughout the remainder of the financial year, we continued to

support the growth initiatives of this platform and completed the

transformational bolt-on acquisition of Swissfillon, a drug product

fill and finish CDMO. To date, we have invested GBP69 million in

the ten23 health platform. In November 2021, we also completed a

GBP37 million co-investment in insightsoftware, the company that

acquired Magnitude Software.

Building value through international roll-outs or bolt-on

acquisitions is fundamental to our investment and value creation

strategy. In the year, we completed several self-funded bolt-on

acquisitions across various stages of the investment lifecycle,

including three for MAIT and one for Dutch Bakery, within 12 months

of the completion of our original investment. We also completed

acquisitions for more established businesses such as Luqom, Cirtec

Medical, Havea, Evernex, Hans Anders, AES and Royal Sanders. We

also funded a transformational bolt-on acquisition for GartenHaus

with the acquisition of Outdoor Toys, a UK-based online retailer of

outdoor garden toys, investing GBP45 million of 3i proprietary

capital.

Further details on our Private Equity investment activity can be

found in the Private Equity section.

Private Equity realisations

Private assets continued to command favourable exit valuations,

with a particularly strong demand for technology assets. We

generated realisation proceeds of GBP684 million in the year.

Following our investment in Magnitude Software in May 2019, we

supported several new product launches, the transition from

on-premises to cloud software solutions and investments in sales

and marketing which increased Magnitude Software's organic growth

rate. With the business well positioned and a favourable market

backdrop, we completed its sale in November 2021, returning GBP346

million of proceeds to 3i, representing a 109% uplift on 31 March

2021 value. The sale achieved a sterling money multiple of 2.5x and

IRR of 44%, a very strong return after a holding period of only two

and a half years.

When market conditions and trading performance allow, we may

refinance our assets. Following refinancings in the year, Royal

Sanders and BoConcept returned proceeds to 3i of GBP84 million and

GBP73 million respectively.

We also capitalised on a recovery in public markets in November

2021 with the partial sale of our stake in Basic-Fit at EUR44.25

per share, generating proceeds of GBP146 million, meaning our money

multiple, including the value of our remaining stake at 31 March

2022, is 5.4x.

At the start of April 2022, we agreed the sale of Q Holding's

QSR division, a leading developer and manufacturer of electrical

connector seals, to Datwyler for an enterprise value of US$625

million. We expect to receive proceeds of c.US$255 million in the

first half of FY2023. The valuation of Q Holding at 31 March 2022

of GBP398 million (31 March 2021: GBP187 million) includes the

expected sale proceeds from QSR and our remaining value of Q

Holding's QMD business, and means our money multiple for the

overall business is 2.5x, with plenty of runway for further value

generation in QMD.

Further details on our Private Equity realisation activity can

be found in the Private Equity section.

Infrastructure performance

Our Infrastructure portfolio generated a GIR of GBP241 million,

or 21% on the opening value (2021: GBP178 million, 16%). This

strong return was driven principally by the increase in share price

of the Group's 30% holding in 3iN, whose shares closed at 347 pence

at 31 March 2022 (31 March 2021: 296 pence). The Infrastructure

business generated strong cash income of GBP91 million (2021: GBP67

million) as a result of good underlying investment activity and

performance.

3iN's investment portfolio outperformed expectations in the year

to 31 March 2022. As a result, 3iN generated a total return on

opening NAV of 17.2% and delivered its dividend target of 10.45

pence, a 6.6% increase on last year.

As 3iN's Investment Manager, we have overseen a period of

significant investment activity, whilst maintaining our price

discipline in a highly competitive asset class. During the year,

the 3iN team completed the acquisitions of DNS:NET, an independent

telecommunications provider in Germany, for GBP190 million and of

SRL Traffic Systems, the market leading traffic management

equipment rental company in the UK, for GBP191 million. The team

also increased 3iN's stake from 50% to 100% in 3iN's existing

portfolio company ESVAGT and agreed to acquire Global Cloud Xchange

("GCX"), a leading global data communications service provider

which owns one of the world's largest private subsea fibre optic

networks. Whilst the investment hold horizon is typically longer in

the infrastructure asset class, we will sell an investment where

this generates attractive returns for shareholders. This year saw

the divestment by 3iN of Oystercatcher's four European terminals,

increasing Oystercatcher's unrealised money multiple to 3.1x.

The underlying 3iN portfolio has no operations in or direct

revenues from Russia or Ukraine and to date the indirect impacts on

portfolio companies has been limited.

In North America, we have now secured commitments from two

third-party blue-chip investors, who have co-invested in Regional

Rail and EC Waste and will make further investments alongside 3i in

its North America Infrastructure platform. As part of these

arrangements, 3i committed US$300 million into the platform and we

received GBP161 million of realised and syndication proceeds from

the co-investment transfers of EC Waste and Regional Rail. We

believe this platform provides the Group with an opportunity to

build on its experience in a market that has significant growth

potential.

Scandlines performance

Scandlines performed well in the year generating a GIR of 26%

(2021: 6%). Freight volumes were consistently strong, finishing

ahead of 2019 levels. Leisure volumes showed some signs of recovery

but remained below 2019 levels as travel restrictions remained in

place between Sweden, Denmark and Germany in the first part of the

peak trading season of 2021 and, following the emergence of another

Covid-19 variant, at the end of 2021. As a result of good cash

management throughout the pandemic, Scandlines was able to resume

its cash distributions in December 2021, and 3i recognised GBP13

million of dividends in the year.

Progress on our sustainability agenda

FY2022 was an important year in progressing our sustainability

agenda. In recognition of the importance of the management of

sustainability issues for the Group and our portfolio, we set up a

formal ESG Committee, with membership drawn from across the

business, to advise me, directly and through the Group Risk and

Investment Committees, on all ESG-related matters. Since its

creation this committee has focused in particular on developing

strategy, policy and governance for assessing and managing

climate-related risks and opportunities across the Group and its

portfolio, a topic of increasing urgency and prominence in society

and a focus area of governments and regulators and our

stakeholders.

As part of this, the ESG Committee has been working on preparing

the Group for reporting in alignment with the TCFD framework by the

2024 deadline set by the FCA for asset managers such as 3i, which

will require us to expand our current TCFD reporting to include

portfolio emissions metrics. To this end, in January 2022 we

started an engagement with EY's sustainability practice to

establish a roadmap to achieve alignment, refine our process for

ESG data collection and perform a first climate scenario analysis

to advance our understanding of climate-related risks and

opportunities in our portfolio companies.

We are now working on a number of initiatives that we have

already set in train. These include:

-- Investment assessment : we are refining our investment

screening process to include an earlier assessment of climate risks

and opportunities, with third-party input where required.

-- Data : we are now completing the process of collecting

greenhouse gas ("GHG") emissions data from our portfolio companies

and improving our processes and tools to ensure that this data can

be easily analysed. Our objective is to measure the carbon

footprint of our entire portfolio by the end of FY2023, to

facilitate TCFD reporting by 2024. This data will also allow us to

improve our engagement with portfolio companies on this topic and

set appropriate targets.

-- Scenario analysis : we are carrying out our first climate

scenario analysis for the entirety of our portfolio, to help us

assess the impacts on portfolio companies of different climate

warming scenarios. We will iterate these analyses periodically to

help us better understand and manage the impact of climate change

on our portfolio companies.

-- Skills and training : we are organising bespoke training

programmes on climate change physical and transition risks and

opportunities, with the objective of equipping everyone in 3i with

the knowledge required to assess and manage these

appropriately.

We will continue to manage climate change with the necessary

urgency. For further information on what we have done to date and

what we have planned in the immediate future, please refer to our

TCFD disclosures.

During the Covid-19 pandemic, we have continued to work closely

with our portfolio companies to ensure the safety and wellbeing of

their employees and to manage the range of operational issues they

have faced as a result of public health measures, and we have

provided financial support where required. The GBP5 million

Covid-19 charitable fund we set up in May 2020 to alleviate the

hardships suffered by many as a result of the pandemic has now been

fully deployed across the countries where we and our investment

teams operate.

3i portfolio companies' support for the humanitarian crisis in Ukraine

Action: donated EUR1 million to UNICEF. In addition, Action offered

the use of its Polish warehouses and logistics to provide supplies and

supported Polska Akcja Humanitarna. In the Czech Republic, Action's

staff worked closely with People in Need to provide support.

BoConcept: supported people affected by the conflict by matching their

employees' donations up to EUR100,000, with the aim of raising EUR200,000

to donate to the UN Refugee Agency (UNHCR).

Christ: donated EUR50,000, split between Aktion Deutschland Hilft e.V.'s

Ukraine Emergency Aid project and the regional organisation Gesellschaft

BochumDonetsk e.V. The latter organisation was chosen because Bochum

is where Christ's logistics department is located and the city is partnered

with Donetsk in Ukraine.

GartenHaus: matched employees' donations to the Csilla von Boeselager

Stiftung Otseuropahilfe e.V., which has been providing emergency aid

in Ukraine for 20 years and operates in Lviv, Beregovo and Zaporizhia.

Havea: donated 100,000 Biolane baby hygiene products, including wipes

and washing gel, for distribution to Ukrainian refugees. A second convoy

of 40 pallets was donated to organisations hosting refugee families

in France.

Scandlines: is offering free transport on its ferries to Ukrainian

passport holders.

ten23 health : supported the Swiss charity HEKS/ EPER (Swiss Church

Aid), which provides humanitarian aid to civilians in Ukraine and those

fleeing the country. The charity also supports Ukrainian refugees in

Switzerland.

3i Group's support for the humanitarian crisis in Ukraine

In March 2022, we donated GBP1 million split equally between UNICEF

and the Médecins Sans Frontières/ Doctors Without Borders

("MSF") Emergency Fund.

UNICEF is working with partners on the ground in Ukraine to reach vulnerable

children and families with essential services - including health, education,

protection, water and sanitation - as well as lifesaving supplies.

MSF provides medical assistance to people affected by conflict, epidemics,

disasters, or exclusion from healthcare.

MSF's Emergency Fund is an annual financial reserve that allows the

organisation to react quickly in emergencies, with an aim of being on

the ground within 48 hours.

Our people

It has been a challenging few years for our team and throughout

the pandemic we have focused on protecting the wellbeing of our

employees and contractors. In September 2021 we implemented a

hybrid working model which supports a strong collaborative culture

while providing employees with a degree of flexibility to manage

non-work commitments and improve their quality of life. I would

like to record a big thank you to the 3i team and the teams in our

portfolio companies for working through the last few years so

well.

We have seen some changes in key personnel this year. James

Hatchley will succeed Julia Wilson as Group Finance Director at the

end of June 2022 and Jasi Halai, currently Group Financial

Controller, will become Chief Operating Officer. They will join the

Board in May 2022.

We promoted Julien Marie, currently HR Director, to Chief Human

Resources Officer. He joined the Executive Committee in April 2022.

Phil White will step down as Managing Partner and Head of

Infrastructure and member of the Executive Committee at the end of

June 2022, remaining with the business on a part-time basis as Vice

Chair of Infrastructure and member of the Group's Investment

Committee. Scott Moseley and Bernardo Sottomayor will succeed him

as Managing Partners and Co-Heads of European Infrastructure, and

will join 3i Group's Executive and Investment Committees, effective

1 July 2022.

We have also seen a marked pick-up in hiring approaches from

competing investment firms targeting our investment and

professional services teams. This activity has resulted from asset

gathering firms in the private equity and infrastructure investment

sectors seeking to grow at a very rapid pace, often with a view to

becoming a listed company. We have had to respond to these

approaches by ensuring that careers and compensation at 3i remain

attractive and competitive for the talented individuals we have

working in the Group.

Operations and balance sheet

Cost discipline across the Group remains central to our

long-term strategy and, in FY2022, we continued to cover our costs

with income, generating an operating cash profit of GBP340 million

in the year, or GBP56 million excluding the GBP284 million of cash

dividends received from Action, which were recognised as

income.

We ended FY2022 with net debt of GBP746 million and 6% gearing,

after returning GBP389 million of cash dividends to shareholders in

the year. We close our financial year with liquidity, including our

undrawn RCF, of GBP729 million, meaning we can move fast when

suitable investment opportunities arise.

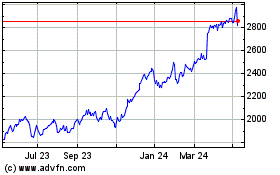

Our ten-year track record

Since our restructuring in June 2012, we have focused on

investing our proprietary capital to deliver sustainable growth and

long-term compounding of value from our portfolio companies. This

approach is underpinned by a robust investment strategy focused on

the identification of long-term growth trends across our sectors

and geographies. This strategy has been executed well by our

international investment teams and through the tight central

control of the Group's Investment Committee. Price discipline,

active asset management and careful cost control have been the

hallmarks of the 3i approach since 2012.

Both Julia Wilson and Phil White have been key members of the 3i

team and I am indebted to both for their significant contributions

since the restructuring in 2012. Both have reached the pinnacle of

their respective disciplines and I wish them well in the next phase

of their lives. While they will both be much missed, we have some

very capable internal promotees to step into their shoes.

2012 2022

========================== ======== ======================== =========

22% average total return

NAV per share 279p on equity 1,321p

Dividend growth 8.1p 19% CAGR 46.5p

Proprietary capital value GBP3.2bn 4.5x increase GBP14.3bn

Operating costs as a

% of AUM 1.7% 65% reduction 0.6%

-------------------------- -------- ------------------------ ---------

Outlook

We have entered our new financial year acutely aware of the

political and macro-economic challenges the world is facing, but we

do this from a position of strength.

-- Our teams are experienced and well-embedded in their local

markets across northern Europe and North America.

-- Our processes are carefully designed and disciplined which

allows us to react fast to sudden or sharp changes in markets or

the broader environment.

-- Our portfolio is well constructed from a thematic, geographic

and sector perspective and has demonstrated clear resilience over

the last few years. We asset manage in the knowledge that we have

assembled today's portfolio with real price discipline and we have

not over-bought recent highly-priced vintages.

In Action we have a formidable retail company that will continue

to grow and thrive in today's challenging environment. We also have

a number of healthcare and consumer assets which have the potential

to become significant longer-term compounders for the Group.

Simon Borrows

Chief Executive

11 May 2022

Private Equity

At a glance

Gross investment return

GBP4,172m

or 47%

(2021: GBP1,936m or 30%)

Cash investment

GBP457m

(2021: GBP508m)

Realised proceeds

GBP684m

(2021: GBP114m)

Portfolio growing earnings

93%(1)

(2021: 87%)

Portfolio value

GBP12,420m

(2021: GBP8,814m)

Portfolio dividend income

GBP331m

(2021: GBP53m)

We invest in mid-market businesses headquartered in northern

Europe and North America with potential for international growth.

Once invested, we work closely with our portfolio companies to

achieve their full potential, realising our investments to deliver

strong cash-to-cash returns for 3i shareholders and other

investors.

In the year to 31 March 2022, our Private Equity portfolio

delivered a GIR of GBP4,172 million or 47% on the opening portfolio

value (2021: GBP1,936 million or 30%) and the portfolio value

increased to GBP12,420 million (31 March 2021: GBP8,814 million).

This excellent result demonstrates the portfolio's resilience to

the pandemic and its ability so far to mitigate disruption to

global supply chains and inflationary pressures. 93% of our

portfolio by value grew adjusted earnings to the end of 2021, with

particularly robust performance from Action and our other assets

operating in the consumer and healthcare sectors. Our portfolio

companies grew organically and also completed 15 bolt-on

acquisitions, including two transformational acquisitions. We made

six new investments in FY2022 and ended the year as net divestors.

As we enter FY2023, whilst the direct impact of Russia's invasion

of Ukraine on our portfolio is limited, we continue to monitor its

impact on the broader political and economic environment.

The contribution of Action to the Private Equity performance is

detailed in Note 1 of the financial statements.

1 LTM adjusted earnings to 31 December 2021. Includes 28

portfolio companies.

Table 1: Gross investment return for the year to 31 March

2022 2021

Investment basis GBPm GBPm

----------------------------------------------------------- ----- -----

Realised profits over value on the disposal of investments 228 29

Unrealised profits on the revaluation of investments 3,545 2,161

Dividends 331 53

Interest income from investment portfolio 73 55

Fees receivable 6 9

Foreign exchange on investments (11) (371)

----------------------------------------------------------- ----- -----

Gross investment return 4,172 1,936

----------------------------------------------------------- ----- -----

Gross investment return as a % of opening portfolio value 47% 30%

----------------------------------------------------------- ----- -----

Investment activity

Acquisition multiples in 2021 across the US and Europe remained

high, reflecting fierce competition in private markets, with the

increase in pricing of healthcare and technology assets even more

pronounced. We remained selective and disciplined, deploying GBP335

million of our capital in six new portfolio companies with an

average initial investment size of GBP56 million. This is lower

than our typical average investment size but is part of a

deliberate strategy to avoid the more competitive processes we see

for larger investments. These new assets are all capable of

building scale through bolt-on acquisitions and further

internationalisation.

Between May and October 2021 we invested initial capital in

ten23 health to fund its start-up spend, before completing the

transformational acquisition of Swissfillon in October 2021,

bringing our total invested capital to GBP69 million in the year.

We invested GBP53 million in MAIT, an IT services provider catering

to larger SME clients across the DACH region, operating in a market

segment with structural growth potential and momentum from

digitalisation. In October 2021, we invested GBP46 million in Dutch

Bakery to drive the company's international growth strategy in the

fragmented European private label market for bake-off products,

whilst supporting the business in its continued investment in its

home markets. In December 2021, we completed the GBP87 million

investment in Mepal to continue the international expansion of this

successful consumer brand known for its high-quality products for

storing, take-away and serving food and drink whilst building on

its current core markets, most notably the Netherlands, Belgium and

Germany, and strong online performance.

In January 2022, we invested GBP43 million in Yanga, a sports

drink provider operating in the attractive value-for-money fitness

space, to support its international growth and expansion into North

America. In November 2021, we also completed a GBP37 million

co-investment in insightsoftware, the company that acquired

Magnitude Software.

We continued to execute our buy-and-build strategy more

generally with 15 acquisitions completed by our portfolio

companies. These create material value by adding scale, as well as

broadening the product range and geographical reach while

generating synergy opportunities for our portfolio companies. Two

of these transactions were transformational in size: ten23 health's

acquisition of Swissfillon, and the acquisition of Outdoor Toys by

GartenHaus. The remaining 13 bolt-on acquisitions listed below were

self-funded.

We invested GBP81 million in Luqom to buy out minority holdings

and provide further investment for the next stage of its growth as

well as for M&A. We provided additional funding of GBP25

million and GBP30 million to Audley Travel and arrivia respectively

to support their recoveries from the pandemic. We also completed a

GBP12 million further investment in Christ as part of the

successful extension of its debt package.

As a result of a refinancing, and within 12 months of our

investment in Sani-Tech West, SaniSure returned GBP59 million of

3i's proprietary capital. Similarly, WilsonHCG returned GBP13

million of investment.

In total, in the year to 31 March 2022, our Private Equity team

invested GBP529 million across new, bolt-on and further

investments, or a net GBP457 million after the return of funding of

GBP72 million.

Portfolio company Name of acquisition Business description of Date

bolt-on investments

-------------------------- ----------------- --------------------------- -------------------------- --------------

Private Equity portfolio Luqom + Lampemesteren Online retailer of premium April 2021

bolt-ons - funded by the lighting products in the

portfolio company balance Nordic region

sheets

-------------------------- ----------------- --------------------------- -------------------------- --------------

Cirtec Medical + Cardea Catheter Contract manufacturer July 2021

Innovations specialising in the design

and development of

catheter systems

-------------------------- ----------------- --------------------------- -------------------------- --------------

Havea + ixX Pharma Independent player in the September 2021

Belgian premium food

supplement segment

----------------- --------------------------- -------------------------- --------------

Dutch Bakery + Goodlife Foods Deurne Leading production October 2021

facility specialised in

the production of sausage

rolls

----------------- --------------------------- -------------------------- --------------

Evernex + Emcon-IT US player in the October 2021

third-party hardware

maintenance industry

----------------- --------------------------- -------------------------- --------------

AES + JAtech Services Canada-based asset November 2021

condition monitoring

specialist

----------------- --------------------------- -------------------------- --------------

Hans Anders + Eyes! NV and Eyes Society Belgian franchisee for December 2021

BV Eyes+More

----------------- --------------------------- -------------------------- --------------

SaniSure + GL Engineering Manufacturer of single-use December 2021

filling needles for use in

the fill & finish stage of

production

----------------- --------------------------- -------------------------- --------------

MAIT + Infolutions Swiss-managed services January 2022

provider with a focus on

infrastructure monitoring

----------------- --------------------------- -------------------------- --------------

MAIT + Scirotec German provider of PTC PLM January 2022

solutions

----------------- --------------------------- -------------------------- --------------

Royal Sanders + Otto Cosmetic German manufacturer of February 2022

private label and contract

manufacturing products for

the personal

care industry

----------------- --------------------------- -------------------------- --------------

WilsonHCG + Claro Analytics Talent analytics provider February 2022

that analyses candidate

data to help enterprises

with workforce

planning

----------------- --------------------------- -------------------------- --------------

MAIT + Cytrus Swiss-based product March 2022

lifecycle management

provider

-------------------------- ----------------- --------------------------- -------------------------- --------------

Proprietary

Capital

investment

Portfolio company Business description Date GBPm

--------------- ------------------ --------------------------------------------------- --------------- -----------

Dutch lifestyle consumer brand known for designing

and manufacturing food and drink storage

New investment Mepal and serving solutions December 2021 87

--------------- ------------------ --------------------------------------------------- --------------- -----------

ten23 health1 Pharmaceutical product CDMO Various 69

------------------ --------------------------------------------------- ------------------------------- -----------

IT services provider of PLM & ERP software

applications and IT infrastructure solutions for

MAIT larger SME clients in the DACH region September 2021 53

------------------ --------------------------------------------------- ------------------------------- -----------

Industrial bakery group specialised in home

Dutch Bakery bake-off bread and snack products October 2021 46

------------------ --------------------------------------------------- ------------------------------- -----------

Yanga Sports drink provider for gym operators January 2022 43

------------------ --------------------------------------------------- ------------------------------- -----------

Provider of financial reporting and enterprise

performance management software for the

insightsoftware office of the CFO November 2021 37

------------------ --------------------------------------------------- ------------------------------- -----------

Total new investment 335

---------------------------------------------------------------------------------------- -----------

1 Includes the transformational bolt-on acquisition of

Swissfillon.

Proprietary

Capital

Name of investment

Business Date GBPm

description of

Portfolio company acquisition bolt-on investments

-------------------------------------- ------------------ ------------------- -------------- ------------

Further investment UK-based online

to finance retailer of

portfolio bolt-on outdoor garden

acquisitions GartenHaus + Outdoor Toys toys October 2021 45

------------------- ------------------ ------------------- ------------------- -------------- -----------

Total further investment to finance portfolio bolt-on acquisitions 45

---------------------------------------------------------------------------- -----------

Proprietary

Capital

investment

Portfolio company Business description Date GBPm

---------------------- ------------------ ---------------------------------------------- ------------- -----------

Further investment

to support portfolio

companies Audley Travel Provider of experiential tailor-made travel October 2021 25

------------------ ---------------------------------------------- ------------- -----------

Global travel and loyalty company that

connects leading brands, travel suppliers and

arrivia end consumers March 2022 30

------------------ ---------------------------------------------- ------------------------------------ -----------

Total further investment to support portfolio companies 55

--------------------------------------------------------------------------------- -----------

Proprietary

Capital

investment

Portfolio company Type Business description Date GBPm

----------------- ------------------ -------- ------------------------------------- -------------- ------------

Other investment Luqom Further Online lighting specialist retailer Various 81

----------------- ------------------ -------- ------------------------------------- --------------- -----------

German retailer of jewellery and

Christ Further watches November 2021 12

------------------ -------- ------------------------------------- --------------- -----------

Other Further Various Various 1

------------------ -------- ------------------------------------- --------------- -----------

Total other investment 94

------------------------------------------------------------------------------------ -----------

Total FY2022 Private Equity gross investment 529

--------------------------------------------- ---

Proprietary

Capital

investment

Portfolio company Type Business description Date GBPm

------------------ ------------------ ------------ ------------------------------------ ---------- ------------

Global provider of recruitment

Return process outsourcing and other

Return of funding WilsonHCG of funding talent solutions Various (13)

------------------ ------------------ ------------ ------------------------------------ ----------- -----------

Manufacturer, distributor and

integrator of single-use

Return bioprocessing systems and

SaniSure of funding components July 2021 (59)

------------------ ------------ ------------------------------------ ----------- -----------

Total return of funding (72)

----------------------------------------------------------------------------------- -----------

Total FY2022 Private Equity net investment 457

------------------------------------------- ---

Realisation activity

In the year we completed the sale of Magnitude Software,

returning GBP346 million of realised proceeds to 3i, achieving a

sterling money multiple of 2.5x and an IRR of 44% after only a two

and a half year hold. We also capitalised on a recovery in equity

markets in November 2021, with the partial sale of our shares in

Basic-Fit for EUR44.25 per share, generating proceeds of GBP146

million. We retain a 5.7% holding in the business.

We continue to refinance our most cash generative assets where

appropriate for the business and when the market allows. We

completed refinancing for Royal Sanders and BoConcept, returning

GBP80 million (as well as GBP4 million recorded as income) and

GBP73 million of realised proceeds respectively. BoConcept also

returned a further GBP17 million earlier in the year following the

partial repayment of a shareholder loan. Finally, we received GBP22

million of proceeds from our legacy portfolio.

In aggregate, we generated total Private Equity proceeds of

GBP684 million (2021: GBP114 million) and realised profits of

GBP228 million (2021: GBP29 million).

At the start of April 2022, we agreed the sale of Q Holding's

QSR division, a developer and manufacturer of electrical connector

seals, to Datwyler for an enterprise value of US$625 million. We

expect to receive proceeds of c.US$255 million in H1 FY2023.

Table 2: Private Equity realisations in the year to 31 March

2022

31 March Profit Uplift on

Calendar 2021 3i realised in the opening Residual

year value1 proceeds year value2 value Money

Investment Country invested GBPm GBPm GBPm % GBPm multiple3 IRR

------------------------ ------------ --------- -------- ----------- ------ --------- -------- --------- ---

Full realisations

Magnitude Software US 2019 165 346 180 >100% - 2.5x 44%

Other n/a n/a 1 2 1 100% - n/a n/a

------------------------ ------------ --------- -------- ----------- ------ --------- -------- --------- ---

Total realisations 166 348 181 - 2.5x 44%

------------------------------------------------- -------- ----------- ------ --------- -------- --------- ---

Refinancings1,3

BoConcept Denmark 2016 73 73 - - 184 2.4x 16%

Royal Sanders Netherlands 2018 80 80 - - 297 3.1x 36%

------------------------ ------------ --------- -------- ----------- ------ --------- -------- --------- ---

Total refinancings 153 153 - - 481 n/a n/a

------------------------------------------------- -------- ----------- ------ --------- -------- --------- ---

Partial realisations1,3

Basic-Fit Netherlands 2013 110 146 37 33% 129 5.4x 40%

BoConcept Denmark 2016 17 17 - - 184 2.4x 16%

Other n/a n/a 10 10 - - n/a n/a n/a

Deferred consideration

Eltel Nordic 2007 - 10 10 n/a - n/a n/a

------------------------ ------------ --------- -------- ----------- ------ --------- -------- --------- ---

Total Private Equity realisations 456 684 228 - n/a n/a n/a

-------------------------------------- --------- -------- ----------- ------ --------- -------- --------- ---

1 For partial realisations, 31 March 2021 value represents value of stake

sold.

2 Profit in the year over opening value.

3 Cash proceeds over cash invested. For partial realisations and refinancings,

valuations of any remaining investment are included in the multiple.

Money multiples are quoted on a GBP basis.

Portfolio valuation approach

To varying degrees, our portfolio companies had to respond to

supply chain disruption, commodity price increases, other

inflationary pressures and Covid-19 travel restrictions in FY2022.

Against this backdrop the majority of our portfolio companies

demonstrated great resilience and adaptability and continued to

meet their investment plans. Therefore, our longer-term investment

view on those portfolio companies has not changed and our valuation

approach has remained consistent. For a small number of assets that

remained challenged due to Covid-19, we sought to gather a broader

range of inputs, considered different methodologies and applied

further judgement. We valued earnings directly attributable to

Russian operations at nil as at 31 March 2022.

Our Private Equity portfolio generated an unrealised profit of

GBP3,545 million (2021: GBP2,161 million).

Action valuation and performance

In the 12 months to the end of Action's P3 2022 (which ended on

3 April 2022), Action delivered very strong earnings growth and

cash generation and continued its international store roll-out.

This was reflected in the GBP2,655 million (March 2021: GBP1,202

million) unrealised profits shown in Table 3. As the largest

Private Equity investment by value, it represented 58% of the

Private Equity portfolio (31 March 2021: 52%). Further information

on Action's performance in the period is provided in the Chief

Executive's statement.

At 31 March 2022, Action was valued using its LTM run-rate

earnings to the end of P3 2022 of EUR1,012 million. The LTM

run-rate earnings included our normal adjustment to reflect stores

opened in the year. At 31 March 2022, Action was valued on a

multiple of 18.5x net of the liquidity discount (31 March 2021:

18.5x). This resulted in a valuation of our 52.7% stake in Action

of GBP7,165 million (31 March 2021: GBP4,566 million).

Performance (excluding Action)

Excluding Action, the performance of investments valued on an

earnings basis resulted in unrealised profits of GBP483 million

(March 2021: GBP536 million), driven by strong earnings growth and

cash generation across the portfolio, with particularly robust

performance from our companies operating in the healthcare and

consumer sectors.

Following our initial platform investment in 2019, SaniSure

delivered strong earnings growth in 2021 as the business

capitalised on the double-digit growth of the bioprocessing

single-use market, with a robust order book supporting innovative

therapeutic modalities. The business is well positioned for

sustained growth into 2022 and beyond as it strives for operational

excellence and supply chain enhancement. The QMD business of Q

Holding benefited from an increase in elective surgical procedures

in 2021 and secured significant new product wins that will drive

strong organic growth in 2022. Further information on the valuation

of its QSR business is detailed under sum of the parts heading

later in this section. Cirtec Medical delivered new wins across its

end markets and capabilities, positioning the business for

sustained growth as procedure volumes recover and customers

re-stock their inventories. The bolt-on acquisition of Cardea

Catheter Innovations in the year further expanded its end market

exposure. Despite Covid-19 impacting retail footfall, the strength

of Havea's brands drove good organic growth in 2021, whilst the

business continued its omnichannel development and international

expansion with the bolt-on acquisition of ixX Pharma.

BoConcept generated strong earnings growth and cash flow in

2021, driven by existing store sales growth across almost all

markets and 35 new store openings. Through effective pricing

strategies, utilising its strong relationship with existing

suppliers and by diversifying its supplier base, the business has

largely mitigated the increased raw material and transportation

costs and supply chain constraints seen in its industry. Hans

Anders largely mitigated reduced footfall in the first and last

quarter of 2021 through its online appointment booking tool and

higher conversion rates. When Covid-19 restrictions eased in the

second and third quarter of 2021, sales quickly rebounded. As a

value-for-money optical retailer, Hans Anders' price positioning is

below that of its major competitors and its tight cost control has

enabled it to manage inflationary pressures. Following a very

strong performance in 2020, Luqom 's strong trading momentum

continued into the first half of 2021 as consumer demand for

lighting products online remained robust against a backdrop of

ongoing Covid-19 related restrictions. The second half of 2021 saw

headwinds on performance predominately driven by supply chain

disruptions and rising inbound container prices. Luqom completed

its second bolt-on acquisition since our initial investment, with

the purchase of Lampemesteren, an important acquisition from a

market share and international expansion perspective, particularly

in the premium segment.

Tato delivered strong performance in 2021 with continued demand

for its core biocide products. Given Tato's biocides speciality

focus, scale and strong global diversification of both production

and customers, the business is managing input price inflation with

effective pricing strategies. AES generated strong earnings growth

from increased sales volumes combined with efficient cost control.

The business also strengthened its geographical footprint in North

America following the acquisition of JAtech Services in November

2021. Both Tato and AES were cash generative in the year and

distributed dividends to 3i of GBP18 million in total. Dynatect

generated earnings that materially outperformed pre-pandemic levels

driven by market recovery and strong performance on pricing, which

offset inflationary pressures from materials. MPM performed well in

both its core markets and in its international expansion, with

particularly strong performance in the US. WilsonHCG continues to

benefit from strong labour markets globally as we emerge from the

pandemic.

Over the last 24 months, the pandemic has presented an

unprecedented challenge to the travel industry. arrivia, our

travel-based loyalty services specialist, has been fairly resilient

throughout the pandemic and in 2021 the business saw a noticeable

recovery in bookings for hotels, resorts, air travel and car

rentals, interrupted periodically by various new Covid-19 variants

and restrictions. Leisure cruising, arrivia's primary market,

remained challenged with 2021 bookings returning to just over a

third of 2019 levels. Audley Travel 's performance throughout 2021

closely mirrored Covid-19 incidence rates and Government policy

across its US and UK markets. As restrictions have eased, we have

seen an encouraging recovery in bookings. To support both

businesses through this recovery, we invested a further GBP25

million in Audley Travel and GBP30 million in arrivia in the

year.

WP recorded a solid performance in 2021, despite inflationary

pressures on various input materials and energy costs and subdued

demand in certain personal care products as a result of Covid-19.

It mitigated resin price increases through effective pricing

strategies. The business, which has an operating subsidiary in

Russia that contributed c.17% of its adjusted 2021 earnings, is

actively working with our team on options to deal with the

situation in the short term. Those earnings attributable to Russia

have been excluded from the valuation of WP at 31 March 2022. Our

valuation of Formel D at 31 March 2022 reflects the challenges the

business continues to face as a result of semiconductor shortages

and automotive market impacts from the Ukraine crisis. Formel D has

a small exposure to Russia mostly via testing facilities which are

currently being discontinued.

Table 3: Unrealised profits on the revaluation of Private Equity

investments(1) in the year to 31 March

2022 2021

GBPm GBPm

----------------------------------------- ----- -----

Earnings based valuations

Action performance 2,655 1,067

Action multiple - 135

Performance (excluding Action) 483 536

Multiple movements (excluding Action) 241 408

Other bases

Sum of the parts 132 -

Discounted cash flow 7 (101)

Other movements on unquoted investments 2 3

Quoted portfolio 25 113

---------------------------------------- ----- -----

Total 3,545 2,161

----------------------------------------- ----- -----

1 Further information on our valuation methodology, including

definitions and rationale, is included in the Portfolio valuation -

an explanation section in our Annual report and accounts 2022.

Overall, 93% of the portfolio by value grew LTM adjusted

earnings in the year (2021: 87%). Table 4 shows the earnings growth

of our top 20 assets.

Table 4: Portfolio earnings growth of the top 20 private

equity(1) investment

3i value

at 31 March 2022

Number of companies GBPm

======= ==================== =================

<0% 4 777

0-9% 4 1,453

10-19% 3 1,254

20-29% 1 269

>=30% 8 8,224

======= ==================== =================

1 Includes top 20 Private Equity companies by value. This represents 96% of the Private Equity

portfolio by value (31 March 2021: 98%).

Last 12 months' adjusted earnings to 31 December 2021 and Action based on LTM run-rate earnings

to the end of P3 2022.

Leverage

Leverage across the portfolio decreased to 3.3x earnings (31

March 2021: 3.9x) or increased to 4.6x excluding Action (31 March

2021: 4.3x).

Table 5 shows the ratio of net debt to adjusted earnings by

portfolio value.

Table 5: Ratio of net debt to adjusted earnings(1)

3i value

at 31 March 2022

Number of companies GBPm

===== ==================== =================

<1x - -

1-2x 1 448

2-3x 4 7,595

3-4x 6 1,094

4-5x 7 1,121

5-6x 3 994

>6x 3 236

===== ==================== =================

1 This represents 92% of the Private Equity portfolio by value (31 March

2021: 88%). Quoted holdings, deferred consideration and companies

with net cash are excluded from the calculation. Net debt and adjusted

earnings at 31 December 2021 and Action based on LTM run-rate earnings

to the end of P3 2022.

Multiple movements

The increase in value due to multiple movements was GBP241

million (2021: GBP543 million). When selecting multiples to value

our portfolio companies, we consider a number of factors including

recent performance and outlook, comparable recent transactions and

exit plans, and monitor external equity markets.

Global equity markets saw a strong recovery through 2021 driven

by favourable monetary policy, fiscal stimulus and the global

deployment of Covid-19 vaccines. The emergence of Covid-19 variants

at the end of 2021 and Russia's invasion of Ukraine resulted in

increased volatility in global equities in the first three months

of 2022. Such unpredictable movements reinforce our strategy of

taking a long-term view on the multiples used to value our

portfolio companies.

We increased the valuation multiples for some of our portfolio

companies that have grown organically or through recent

acquisitions and operate in sectors that have benefited from

positive market trends.

There was no change to the multiple used to value Action at 31

March 2022. Based on the valuation at 31 March 2022, a 1.0x

movement in Action's post-discount multiple would increase or

decrease the valuation of 3i's investment by GBP451 million.

DCF

Audley Travel is our largest Private Equity asset valued on a

DCF basis and its valuation reflects our expectation on recovery in

the UK and US travel markets. At 31 March 2022, Audley Travel was

valued at GBP117 million (31 March 2021: GBP85 million).

Quoted portfolio

Basic-Fit is the only quoted investment in our Private Equity

portfolio. Covid-19 restrictions continued to affect Basic-Fit's

performance in 2021 due to temporary club closures and government

restrictions. However, the business saw its membership level

recover to its pre-pandemic levels and expanded its club base by

110 clubs.

At 31 March 2022 our residual 5.7% shareholding was valued at

GBP129 million (31 March 2021: 12.8% shareholding valued at GBP214

million).

Sum of the parts

At 31 March 2022, Q Holding was valued on a sum of the parts

basis. The sum of the parts included the valuation of the QSR

division, valued on an imminent sale basis after the agreed sale

and the value of its QMD business, valued on an earnings basis.

Assets under management

The value of the Private Equity portfolio, including third-party

capital, increased to GBP16.7 billion (31 March 2021: GBP11.6

billion), primarily due to unrealised value movements in the

year.

Table 6: Private Equity assets by geography as at 31 March

2022

3i carrying

value

2022

3i office location Number of companies GBPm

------------------- ------------------- -----------

Netherlands 8 8,296

France 2 595

Germany 7 939

UK 8 960

US 9 1,608

Other 3 22

------------------- ------------------- -----------

Total 37 12,420