Camellia PLC Trading Update (8556F)

July 20 2021 - 9:00AM

UK Regulatory

TIDMCAM

RNS Number : 8556F

Camellia PLC

20 July 2021

20 July 2021

Trading Update

Camellia Plc

Camellia Plc (CAM.L) is today issuing the following update on

trading.

Outlook

The underlying loss before tax(1) for the first half of the year

is expected to be approximately 15% lower than that of H1 2020.

This reflects improved profits from Agriculture (more details of

which are set out below) and the benefit of cost saving measures

which unfortunately have been offset in large part by the impact of

Covid on the markets served by our Engineering and Food Services

businesses and a softening of activity in the oil and gas

markets.

Whilst normality is starting to return in the UK, the speed and

intensity at which the pandemic has re-emerged in India, Bangladesh

and Africa creates uncertainty and demonstrates the need for

continued vigilance. We have a very strong financial position and

believe that over the long-term, demand for our agricultural

produce will continue to rise. As always, our financial results

remain largely dependent on Agriculture where the majority of

harvesting and sales take place in the second half of the year. It

is therefore too early to give a firm indication of the likely

results for 2021. However, the factors discussed below, in

particular the reduction in the expected avocado crop and the

continuing downward pressure on tea prices in Kenya, indicate the

potential for substantially lower overall results for the full year

than previously expected. Further announcements will be made as

appropriate in due course.

Trading

Agriculture We are pleased that, despite the pandemic, all of

our agricultural operations continue to operate broadly as

normal.

Tea

In Bangladesh, production in the first half of the year was 25%

higher than that of the same period last year and average pricing

has been significantly better (up 63%). The government has

announced a two week National lockdown although the tea industry

and tea auctions have been granted an exemption. We anticipate

lower prices in H2 2021 reflecting normal seasonality combined with

the possible softening of demand in the market as a result of the

National lockdown.

The Covid situation in India remains deeply concerning despite

the extensive efforts made to keep all our staff safe, including

restricting workforce deployment to 50% in West Bengal. Production

in the first half of the year was 16% up on the same period last

year. Prices in the Dooars have been strong (up 15%) but prices for

Orthodox teas in Assam, which constitute most of our production in

that region, are significantly lower than H1 2020. It is still very

early in the India tea sales cycle (around 70-75% of sales are made

in the second half of the year) which makes predicting prices for

the remainder of the year inherently uncertain even without the

impact of Covid.

In Kenya, benign weather continues to result in high volumes of

tea production nationally, although below the record levels of last

year. The market remains under pressure as a result and prices are

slightly below those of last year. Our estate production for the

first half is 11% below that of the same period of 2020 with

average prices down approximately 2%. We continue to see a risk of

further downward price pressure for the remainder of the year.

In Malawi, production is approximately 11% higher than the same

period last year but sales have been delayed by the uncertainty

created by the Malawi Revenue Authority's investigation into the

applicability of VAT to certain tea sales as reported in our 2020

annual report. This is expected to be a timing issue as between H1

and H2. Average tea prices are 2% ahead of H1 2020 but following

contractual discussions with our buyers and due to oversupply in

the Kenyan market, we now expect lower prices in the second half of

2021.

Avocado

The harvest for our Hass avocado crop is progressing well.

However, following a very strong 2020, it is now becoming clear

that our volumes will be significantly lower than previously

anticipated and we now expect our estate Hass crop to be

approximately 30% lower than last year which, all else being equal,

will reduce profits for the year by GBP3 million. European markets

are currently well supplied with avocados and while market

conditions indicate that our average prices may be marginally

higher than those of 2020, it is too soon to predict prices for the

remainder of the year with any certainty. It is however unlikely

that prices will improve sufficiently to offset the significantly

lower yield.

Macadamia

Our macadamia operations continue to harvest and process their

production with volumes expected to be approximately 20% higher

than last year despite the pest damage in Malawi that we previously

reported. Although the kernel market is active with both demand and

prices improving, we expect our average prices to be below those of

last year as a result of the impact on quality.

Our remaining agricultural businesses are trading well, with our

farming operation in Brazil seeing very high soya yields being sold

into a strong market.

Non-agriculture

Our non-agriculture businesses in the UK have had a difficult

first half with the continuing restrictions hitting retail and food

service. However, as expected we have seen that as the restrictions

continue to ease, trading in these businesses is slowly improving.

The oil and gas services market in Aberdeen has seen some softening

of demand for AJT Engineering with a consequent reduction in

margins, while the Site Services division, which is focussed on the

renewables sector, has seen a significant increase in activity over

2020. Aerospace also remains very quiet and as previously reported,

we anticipate no improvement in performance at Abbey Metal

Finishing for the remainder of the year.

BF&M recently reported shareholders' net income for the

three months ended 31 March 2021 of BD$6.5 million, a significant

improvement on the net loss reported for the comparative

three-month period of 2020 of BD$2.2 million. This reflects an

uplift in all lines of business but particularly in gross premiums

written in property and casualty in the Cayman Islands and The

Bahamas. An increase in interest rates adversely affected the

values of fixed-income securities but this was offset by strong

equity market performance. Short term claims and adjustments

experience increased 42% however this was more than offset by a 71%

reduction in Life and Health policy benefits. BF&M's Q2 results

are due to be released in late August.

Strategy

As announced in the AGM statement, the Board of Camellia is

undertaking a series of measures aimed at improving share price

performance. These measures include reducing our exposure to tea

auction prices, accelerating our agricultural diversification and

divesting of certain assets. Additional detail will be issued in

due course and as appropriate.

Notes

1 Underlying loss before tax is the unaudited loss before tax

before separately identified items (legal costs and impairments)

and excluding the trading profits of Horizon Farms to which was

sold the second half of 2020. Horizon Farms trading profit for H1

2020 was GBP3.6 million

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014.

Enquiries

Camellia Plc 01622 746655

Tom Franks, CEO

Susan Walker, CFO

Panmure Gordon 020 7886 2500

Nominated Adviser and Broker

Emma Earl

Erik Anderson

Maitland/AMO

PR

William Clutterbuck 07785 292617

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBBGDRDUDDGBG

(END) Dow Jones Newswires

July 20, 2021 09:00 ET (13:00 GMT)

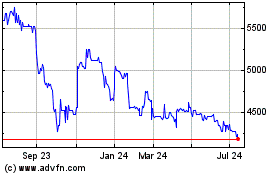

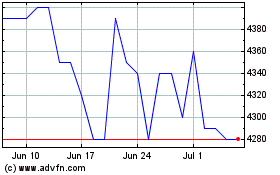

Camellia (LSE:CAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Camellia (LSE:CAM)

Historical Stock Chart

From Apr 2023 to Apr 2024