BP Swung to Replacement Cost Loss in 4Q Amid Weaker Environment

February 04 2020 - 2:55AM

Dow Jones News

By Adriano Marchese

BP PLC (BP.LN) said Tuesday that it swung to a replacement cost

loss in the fourth quarter, largely reflecting a weaker

environment, but beat a consensus of analysts' forecasts on an

underlying basis.

In the fourth quarter, the London-listed oil major said its

replacement cost loss--a figure similar to the net income that U.S.

oil companies report--was $4 million, compared with a replacement

cost profit of $2.72 billion in the same period last year.

After excluding one-off items, underlying replacement cost

profit for the three months was $2.57 billion, compared with $3.48

billion in the fourth quarter of 2018.

A consensus of 20 brokers supplied by BP had forecast underlying

replacement cost profit of $2.11 billion.

Revenue in the period was $71.12 billion, down from $75.68

billion.

The board declared a quarterly dividend of 10.5 cents a share,

an increase of 2.4% from a year earlier, the company said.

Reported oil-and-gas production averaged 3.8 million barrels of

oil equivalent per day in 2019, 2.7% higher than in 2018, it

said.

BP said it expanded its low-carbon business in 2019, increasing

ownership in its solar joint venture, Lightsource BP, to 50%, and

that it completed the formation of its new Brazilian biofuels and

biopower joint venture, BP Bunge Bioenergia.

Looking ahead to the first quarter of 2020, the company said it

expects lower levels of industry refining margins and wider North

American heavy crude oil discounts compared with the fourth quarter

of 2019.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

February 04, 2020 02:40 ET (07:40 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

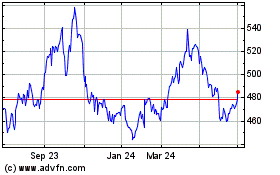

Bp (LSE:BP.)

Historical Stock Chart

From Mar 2024 to Apr 2024

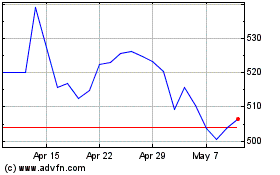

Bp (LSE:BP.)

Historical Stock Chart

From Apr 2023 to Apr 2024