Adamas Finance Asia Limited Disposal of Interest in Global Pharm (4345V)

July 23 2018 - 4:44AM

UK Regulatory

TIDMADAM

RNS Number : 4345V

Adamas Finance Asia Limited

23 July 2018

ADAMAS FINANCE ASIA LIMITED

(the "Company" or "ADAM")

Disposal of Interest in Global Pharm

Adamas Finance Asia Limited, the London quoted pan-Asian

diversified investment vehicle, announces that, further to the

announcement on 15 June 2018, the Company has now received US$3.0

million from Fortune Insight Limited ("Fortune"), being the cash

component of the consideration payable by Fortune in respect of its

acquisition of ADAM's interest in Global Pharm Holdings Inc.

("Global Pharm") (the "Disposal").

The Disposal is in line with the Company's objective of a

managed disposal programme of its legacy portfolio where

commercially viable and reinvesting the proceeds in pan-Asian

income producing assets with capital gain potential.

A further announcement will be made upon Fortune completing its

subscription for shares in ADAM with a value of US$12.6 million as

agreed under the revised terms for the Disposal.

Enquiries:

Adamas Finance Asia Limited

John Croft +44 (0)1825 830587

Nominated Adviser

WH Ireland Limited

Tim Feather

James Sinclair-Ford +44 (0) 113 394 6600

Broker

Shard Capital Partners LLP

Philip Pooley +44 (0) 20 7186 9967

Public Relations Advisers

Buchanan

Charles Ryland

Henry Wilson +44 (0) 20 7466 5000

About Adamas Finance Asia ("ADAM")

ADAM is a London quoted investment company focusing on

delivering long-term income and capital growth to shareholders

through a diverse portfolio of pan-Asian investments. It aims to

provide uncorrelated returns through a combination of capital

growth and dividend income from a broad spectrum of national

geographies and asset classes.

The Company's investment manager, Harmony Capital, which has a

dedicated team with real Asian expertise, is focused on the

strategy of creating income and capital growth. Harmony Capital is

sourcing predominately private opportunities and has created a

strong pipeline of income generating assets include potential

investments in fintech, healthcare, property, mining,

pharmaceuticals and telecoms across Asia.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DISGIGDRGSDBGIX

(END) Dow Jones Newswires

July 23, 2018 04:44 ET (08:44 GMT)

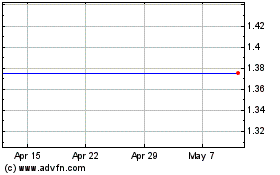

Jade Road Investments (LSE:JADE)

Historical Stock Chart

From Mar 2024 to Apr 2024

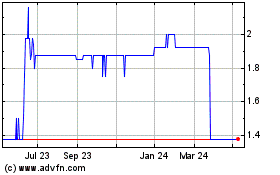

Jade Road Investments (LSE:JADE)

Historical Stock Chart

From Apr 2023 to Apr 2024