Iron Ore Under Pressure Over Supply Concerns After Vale Mining Disaster

January 28 2019 - 11:38AM

Dow Jones News

By David Hodari

LONDON--Iron ore futures jumped on Monday following a fatal dam

failure at one of Vale SA's Brazilian mines.

Futures in the ferrous metal were last up 5.3% at $78.53 a ton,

after a Vale tailings dam burst on Friday at its Feijao mining

complex in Minas Gerais, Brazil, killing at least 60 people.

Hundreds of people were still unaccounted for.

The incident came less than four years after the failure of a

dam jointly owned by Vale and BHP Group Ltd., also in Minas Gerais,

killed 19 people and left hundreds homeless in one of the country's

worst environmental disasters.

While the dam that burst last week was relatively minor in terms

of output, investors are pricing in the potential for stricter

industry oversight going forward that would crimp supply, analysts

said.

"The market's always going to react, but the mine that's

involved is only about 7% of Vale's output and so not massively

material at this stage," said Vivenne Lloyd, senior analyst at

Macquarie. "The probability of more stringent inspections and

potential shutdown of other mines using similar methods has

elevated since the disaster."

Similar "wet" iron ore operations--which require the building of

tailings dams--comprise around half of all Vale operations,

according to Macquarie.

After falling 8.1% on Friday, New York-listed shares in the

Brazilian mining company plunged 19% in premarket trading to

$11.42. That would constitute the weakest closing price in more

than a year.

Increased scrutiny on Vale's operations could affect investor

confidence in the company's stock in the longer term too.

"Although Vale's modest levels of debt should protect the

company's solvency, we expect the aftermath of this incident will

weigh on the equity for the foreseeable future," RBC analysts in a

note.

The incident may both boost steel prices and support the share

prices of Vale's competitors in the coming weeks, other analysts

say.

"While this is clearly a headline negative for steelmakers,

they'll successfully pass on increased cost pressures to their

customers in the coming weeks," said Seth Rosenfeld, equity analyst

at Jefferies. The dam failure "gives them an easy excuse to push up

prices."

The prospect of higher prices ahead and economic stimulus in

China could boost demand for the metal in 2019's second

quarter.

Steel buyers around the world have been living hand to mouth and

are persistently reluctant to sit on supply amid relatively low

prices in recent months, Mr. Rosenfeld said. As a result, he said

many could move to replenish thin inventories before prices extend

their climb

Write to David Hodari at David.Hodari@dowjones.com

(END) Dow Jones Newswires

January 28, 2019 11:23 ET (16:23 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

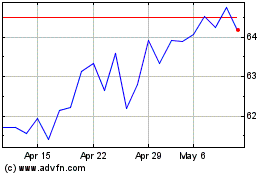

VALE ON (BOV:VALE3)

Historical Stock Chart

From Mar 2024 to Apr 2024

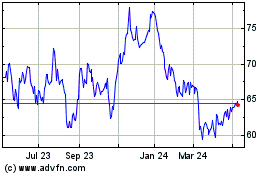

VALE ON (BOV:VALE3)

Historical Stock Chart

From Apr 2023 to Apr 2024