By William Boston

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 16, 2020).

BERLIN -- Volkswagen AG, the world's biggest car maker, saw its

global sales shrink by almost half in April, but as coronavirus

lockdowns in the U.S. and Europe stunted demand the reopening of

China's economy offered signs of recovery.

The figures are the latest and most striking example of the

decoupling under way between the reviving Chinese market and

persistently weak demand in the West, a trend already on display in

figures from other European car makers in recent weeks.

China is ahead of the curve in responding to the pandemic. The

virus that causes Covid-19 first emerged there and Beijing was

first to reopen its economy, so its lead in resurgent auto sales

shouldn't surprise. But auto executives and analysts fear the

divergence could persist even after lockdowns are lifted across the

West, where markets are increasingly saturated and demand

pre-pandemic was already depressed.

Companies such as Volkswagen, which already made some 40% of its

sales in China before the pandemic, could find themselves even more

dependent on the Asian giant. In April, two thirds of the

Volkswagen's global vehicle sales came from China.

"We've seen two worlds in the month of April," said Jürgen

Stackmann, head of sales for the Volkswagen brand, calling China a

"bright spot."

Volkswagen said its new car sales world-wide fell to 473,500

vehicles in April from 866,400 vehicles a year ago. The biggest

declines were in South-America, mainly in Brazil, where sales fell

78%, and in Western Europe, that saw a fall of 77%. North America,

where the bulk of sales come from the U.S., had a 53% drop.

In China, already Volkswagen's largest single market, sales

totaled 305,600 vehicles, up 1% from a year ago, marking a

turnaround after three months of steep declines in the wake of the

Covid-19 outbreak.

Volkswagen's sales in China outperformed the broader Industry

last month. The China Association of Automobile Manufacturers has

previously reported that new vehicle sales rose 4.4% in April, the

first year-over-year gain in 21 months, largely driven by trucks

and commercial vehicles. Passenger car sales fell 2.6%.

Such figures expose a divergence in the industry's trajectory,

as car makers are emerging from lockdown and ramping up production

in factories around the world, China appears to be pulling out from

the worst of the slump while Europe and the U.S. are stuck in

reverse.

In a recent report, Moody's Investors Service cut its outlook

for the auto making industry, predicting a 20% decline in global

sales this year, with Europe and the U.S. facing the sharpest

falls. China was the only market for which Moody's stuck with its

forecast. April auto sales there "signals a healthy rebound in

demand," Moody's wrote.

BMW AG's CEO Oliver Zipse told shareholders on Thursday that BMW

sales in China rose 14% from year-earlier levels in April, after

falling 88% in February.

"We know from our Chinese customers that consumption there will

quickly bounce back, thanks to pent-up demand," Mr. Zipse said.

"Demand for cars in countries like Spain, Italy and the U.K. will

probably be very slow to recover. The same applies to the U.S."

In response, the industry has called on European governments to

incentivize car purchases worried that it could take years for core

European markets to recover because of weaknesses that existed

before the pandemic laid the industry low.

On top of the fallout from the lockdowns, European auto makers

are facing an aging society and structural hurdles to recovery.

Industry executives say saturated markets in Europe and the U.S.

are expected to grow more slowly than China with its lower levels

of car ownership.

For the industry as a whole, new car sales all but evaporated in

Europe last month. In the U.K., sales fell 97% to 4,321 vehicles,

the lowest level since 1946, the Society of Motor Manufacturers and

Traders, an industry lobby group, said. France and Spain, two of

the top five European car markets, reported drops of 90% and 97%

respectively. And Germany, the region's biggest auto market, saw

sales plummet 61%.

By mid-May, most of Europe's auto factories were back up and

running but well below normal capacity, with low demand proving a

bigger bottleneck than any hiccups in the supply chain.

Volkswagen said this week that its main plant in Wolfsburg,

which resumed operations at the end of April, would shut down again

for several days this month because of weak demand. Germany's

association of dealers says that up to one million unsold vehicles

were sitting on dealer lots.

European auto industry leaders met by videoconference this week

with Thierry Breton, the European Commission for the EU's single

market, to press their case for a coordinated response to boost

demand for new cars in the bloc's member states.

The European auto industry employs directly and indirectly

around 13.8 million people, accounting for 6% of all EU jobs and

11.4% of all manufacturing jobs.

European manufacturers lost around 2.4 million vehicles so far

this year due to production shutdowns, said Eric-Mark Huitema,

director general for the European Automobile Manufacturers'

Association.

"Given the near-total collapse in sales, it will be crucial to

provide a strong market stimulus to enable vehicle makers to fully

reopen production facilities and keep people in jobs," Mr. Huitema

said in a statement after the meeting with Mr. Breton.

German Economics Minister Peter Altmaier said Thursday that the

government and industry would agree on a package of measures for

the industry by early June. Auto executives are calling for a new

round of taxpayer-financed incentives -- modeled on those enacted

during the financial crisis -- to encourage consumers to trade in

old cars for new ones.

The proposal has sparked controversy because of auto industry

demands that the incentives support purchases of conventional

diesel and gasoline cars, not just the new, emissions-free electric

cars that form just a small share of their offerings.

Credit-ratings firms have downgraded the debt of some auto

makers and suppliers because of dwindling cash reserves.

Write to William Boston at william.boston@wsj.com

(END) Dow Jones Newswires

May 16, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

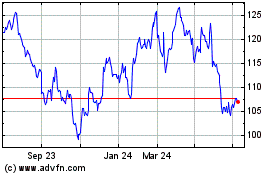

Volkswagen (TG:VOW3)

Historical Stock Chart

From Mar 2024 to Apr 2024

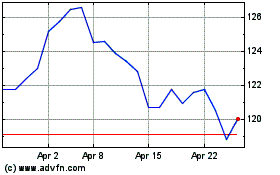

Volkswagen (TG:VOW3)

Historical Stock Chart

From Apr 2023 to Apr 2024