Palladium Prices Hit Record Despite Chinese Auto Disruption

February 18 2020 - 12:04PM

Dow Jones News

By Joe Wallace

Palladium prices soared Tuesday despite shutdowns and delays at

car plants in China, the world's biggest consumer of the precious

metal, highlighting an extended spell of volatility in the

commodity's market.

The price of the metal -- which is in high demand from auto

makers seeking to meet tighter emissions standards -- jumped 5.4%

in the New York futures market, hitting a record of $2,442.20 a

troy ounce. The continued rise took traders and analysts by

surprise as it extended the advance in 2020 to 27.8%.

China's automotive market has been disrupted this year by the

outbreak of the new coronavirus as factories were forced to halt

operations to help curtail the contagion. Germany's Volkswagen AG

has postponed resuming production at some of its Chinese plants

until next week as the quarantine of nearly 60 million people

constrains the transportation of both parts and workers.

Palladium's price, meanwhile, has rallied as its supply has been

strained by years of stalled production by miners.

"It's the most dysfunctional market I've ever seen in my life,"

said Michael Widmer, an analyst at Bank of America. If palladium

keeps growing more expensive, it will force car manufacturers to

electrify their vehicle fleets faster than previously planned, he

added.

Upheaval in China, the world's second-largest economy, following

the coronavirus outbreak has weighed on the price of many raw

materials, including oil and industrial metals. Brent-crude futures

fell 2.3% on Tuesday, while copper slipped 1% on the London Metal

Exchange.

Demand for palladium surged in recent years as officials in the

European Union and China imposed stricter restrictions on emissions

from cars, amid worries about the impact of certain pollutants on

public health. When applied to catalytic converters that are fitted

to gasoline-driven cars, the metal is highly effective at

converting toxic gases such as carbon monoxide into substances that

are less toxic to inhale.

Almost all gasoline cars manufactured in China this year will

meet updated emissions standards, up from two-thirds in 2019,

according to a recent report by the U.K.'s Johnson Matthey. The

British chemicals maker said this will raise the average amount of

palladium that car makers use in each catalyst, and could push the

global demand for the metal in the auto industry above 10 million

ounces.

Supply hasn't kept up pace with consumption because palladium is

typically produced as a byproduct of platinum, and miners are wary

of flooding the weaker platinum market with excess material.

Prices have spiked as a result, providing a windfall for the

handful of South African and Russian miners that dominate

production of palladium and its sister metals. The rally is hurting

auto makers already grappling with a downturn in the global car

market and the cost of designing and producing new fleets of

electric vehicles.

Global demand for palladium will exceed production by 1.9

million ounces in 2020, Anglo American Platinum Ltd. forecast in

its annual report on Monday. The company said the rising price of

palladium contributed to a 33% rise in net sales revenue in

2019.

However, outgoing Chief Executive Chris Griffith said there were

signs that demand was now starting to weaken in response to high

prices. He predicted that auto makers may start to use more

platinum -- almost $1,500 an ounce cheaper -- instead of palladium

in their catalytic converters.

(END) Dow Jones Newswires

February 18, 2020 11:49 ET (16:49 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

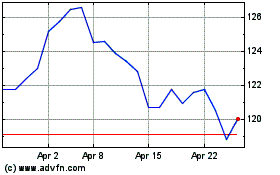

Volkswagen (TG:VOW3)

Historical Stock Chart

From Mar 2024 to Apr 2024

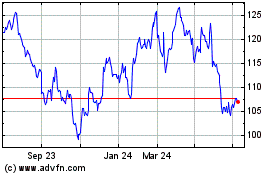

Volkswagen (TG:VOW3)

Historical Stock Chart

From Apr 2023 to Apr 2024