Tesla Tops Volkswagen to Become Second Most Valuable Auto Maker

January 22 2020 - 12:06PM

Dow Jones News

By Tim Higgins

Elon Musk has navigated Tesla Inc. into new territory, as the

electric-car maker's market value topped $100 billion Wednesday

morning and overtook Volkswagen AG as the world's No. 2 most

valuable auto maker.

Tesla shares traded 6.25% higher early on Wednesday, lifting its

market cap to $104.8 billion. Crossing the $100 billion threshold

could start unlocking a more than $50 billion pay package for Mr.

Musk. Volkswagen shares fell 1.48% in late German trading, putting

its market cap around 90 billion euros ($99.7 billion).

Tesla shareholders almost two years ago approved an incentive

package for Mr. Musk considered one of the most lucrative for any

chief executive. The first tranche of options under that

arrangement nominally would net $346 million if immediately sold at

today's price.

It doesn't vest immediately. Tesla's value needs to remain above

$100 billion for some time and the company has to achieve $20

billion in annual sales or $1.5 billion in earnings before

interest, taxes, depreciation and amortization, after adjusting for

stock compensation before Mr. Musk is entitled to the payout. Tesla

reached both of those two earnings metrics in 2018.

Tesla, when it reports 2019 earnings in the coming days, is

expected to post $2.6 billion in earnings by that measure and

$24.19 billion in sales, according to analysts surveyed by

FactSet.

For Mr. Musk to receive the first tranche, Tesla must sustain

the market value on average for a trailing six-month period as well

as on average for 30 calendar days. There are 11 other tranches of

potential payments.

Tesla shares have risen sharply in recent months after the

company surprised investors with strong third-quarter results last

year. The rally has continued after the Silicon Valley auto maker

in recent weeks said it had begun deliveries from its factory in

China and met 2019 delivery guidance.

Tesla's stock is up more than 200% since last year's closing low

of $178.97 in June, when investors worried about the company's

ability to achieve 2019 targets.

Since then, the shares have hit several milestones. They have

raced past $420, a symbolic threshold at which Mr. Musk, in 2018,

said he wanted to take the electric-vehicle maker private. Tesla

this month became the most valuable U.S. auto maker of all time

when it topped the historic high Ford Motor Co. hit in 1999.

The stock's rally means Tesla is second only to Toyota Motor

Corp. in valuation, even though it builds far fewer cars than its

main U.S., European and Japanese rivals.

Volkswagen said it delivered almost 11 million vehicles last

year, including cars made by other brands its owns such as Audi and

Porsche. Tesla delivered 367,500 cars last year.

VW Chairman Herbert Diess has been frustrated by the company's

low valuation. In a presentation this month, Mr. Diess laid out

VW's accomplishments, including meeting financial targets.

"However, our company valuation is not where it should be!," one of

his slides said.

As part of its efforts to fight back, Volkswagen plans several

new electric-vehicle launches. Its ID.3 compact electric car will

go on sale in the summer, the car maker has said.

Write to Tim Higgins at Tim.Higgins@WSJ.com

(END) Dow Jones Newswires

January 22, 2020 11:51 ET (16:51 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

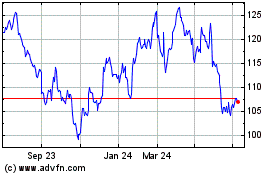

Volkswagen (TG:VOW3)

Historical Stock Chart

From Mar 2024 to Apr 2024

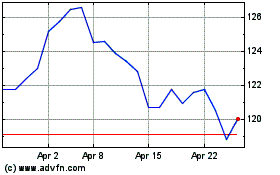

Volkswagen (TG:VOW3)

Historical Stock Chart

From Apr 2023 to Apr 2024