Volkswagen Warns Auto Industry Downturn Is Worsening

October 30 2019 - 5:46AM

Dow Jones News

By William Boston

BERLIN -- Volkswagen AG warned Wednesday that the downturn in

the global car market was worsening, but maintained its outlook for

profit and revenue as the world's biggest auto maker by sales

continued to sell more higher-priced sport-utility vehicles.

Volkswagen's gloomy outlook comes amid a spate of profit

revisions and downbeat assessments of the industry by leading

manufacturers such as General Motors Co., Ford Motor Co. and

Renault SA, who cited trade conflicts, Brexit and economic slowdown

in China, the U.S. and Europe. Auto sales world-wide are expected

to decline 4% this year, after a 0.5% decline in 2018.

Meanwhile, pressure is mounting on manufacturers to achieve

scale, cut costs and generate more cash to finance investment in

electric vehicles and new self-driving technology.

Underscoring this, Fiat Chrysler Automobiles NV and PSA Group,

maker of Peugeot and Citroën cars, confirmed Wednesday they were in

talks to merge to create a trans-Atlantic heavyweight better able

to absorb the rising costs of industry transformation.

Volkswagen, which boasts a host of automotive brands from

passenger cars and luxury sports cars to vans and long-haul

tractor-trailer trucks, is reaping the rewards of a major overhaul

of its business that began in the wake of its 2015 diesel-emissions

cheating scandal.

"The best days of the party are over, but I wouldn't want to

drown in worries about recession," Volkswagen Chief Finance Officer

Frank Witter said.

Despite falling deliveries of new vehicles, Volkswagen's net

income in the three months to the end of September rose 42% to

EUR3.8 billion ($4.2 billion), as revenue rose 11% to EUR61.4

billion.

It attributed the rise in sales and earnings to cost cuts and an

increase in the share of higher-price SUVs in its product mix.

Overall, new car sales were down 1.7% in the first nine months of

the year because of falling sales in Europe and China.

Mr. Witter said the company was improving its finances, pointing

to EUR8.6 billion in cash flow in the first nine months, up from

EUR3.5 billion the year before, as the ratio of capital expenditure

to revenue remained steady at around 5%.

Volkswagen shares opened about 2% higher on the earnings, before

losing steam and trading around 0.6% higher in Frankfurt.

As industry consolidation accelerates, a battle between

financially powerful manufacturers with global scale could decide

the winners and losers in the race to dominate the sector.

Big players such as Volkswagen, Toyota Motor Corp. and GM have

long been seen as favorites, with the scale and financial firepower

to shoulder the costs of change. But a merger of Peugeot and Fiat

Chrysler would create a $50 billion giant with solid footing in the

U.S. and Europe and the potential to grow in China.

Smaller players, such as the German luxury brands Daimler AG and

BMW AG, are struggling to maintain profits. Daimler reported higher

overall earnings last week, but its flagship Mercedes-Benz luxury

car division is struggling, with a 1% decline in sales to 1.74

million vehicles in the first nine months of this year and a sharp

drop in its return on sales.

Renault, which is grappling with upheaval in its alliance with

Japan's second-largest auto maker, Nissan Motor Co., recently

booted its chief executive and reported last week that

third-quarter revenue fell 1.6% to EUR11.3 billion and that vehicle

unit sales were down more than 4%.

GM and Ford are also struggling. The former lowered its profit

outlook this week, saying the 40-day United Auto Workers strike

nearly wiped out its free cash flow for the year and cost it nearly

$3 billion in lost earnings.

Ford, in the midst of a global reorganization, slashed its

profit outlook for 2019 in the face of tougher competition in the

U.S.

Write to William Boston at william.boston@wsj.com

(END) Dow Jones Newswires

October 30, 2019 05:31 ET (09:31 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

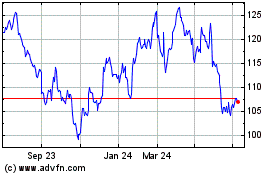

Volkswagen (TG:VOW3)

Historical Stock Chart

From Mar 2024 to Apr 2024

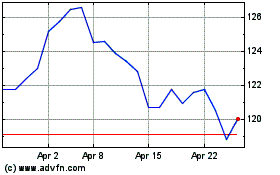

Volkswagen (TG:VOW3)

Historical Stock Chart

From Apr 2023 to Apr 2024