Thyssenkrupp Chief Faces Dismissal as Turnaround Stalls -- WSJ

September 26 2019 - 3:02AM

Dow Jones News

By Ruth Bender and Ben Dummett

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 26, 2019).

BERLIN -- Thyssenkrupp AG's directors moved to oust the

company's chief executive 14 months after he took the job, marking

the latest effort to pull the industrial conglomerate out of years

of slowing sales, shrinking profit and indecision over

strategy.

Thyssenkrupp, a former crown jewel of German industry with

products ranging from high-grade steel to submarines and elevators,

said its supervisory board's personnel committee has recommended

that Guido Kerkhoff be replaced by Chairwoman Martina Merz until a

long-term successor could be named. Ms. Merz would be

Thyssenkrupp's first female CEO and one of only two women running a

major listed company in the country.

The directors decided to act after Mr. Kerkhoff failed to

convince them that he could reverse the prolonged erosion of

profit, people familiar with their thinking said.

A company spokeswoman declined to comment and said Mr. Kerkhoff

wasn't available to comment.

Thyssenkrupp's struggles, including executive turnover, point to

the challenge of trying to turn an unwieldy conglomerate into a

simpler, nimbler company and squeeze higher value from disparate

businesses.

Siemens AG, another German behemoth that has produced everything

from lightbulbs to mobile phones and gas turbines, has been

aggressively pruning underperforming businesses, simplifying its

corporate structure and trimming its head office. Thyssenkrupp, by

contrast, long resisted pressure to reshape itself and relented

only after becoming targeted by activist investors.

Mr. Kerkhoff, who was serving as finance chief, became interim

CEO in July 2018 as both his predecessor and the company's chairman

left under pressure from investors. However, Mr. Kerkhoff's first

major initiative -- a plan to split the company into two businesses

-- was abandoned after regulators blocked plans to form a European

steel joint venture with India's Tata Steel Ltd.

A deteriorating economic environment has added to Thyssenkrupp's

homegrown problems. The company, which issued four profit warnings

under Mr. Kerkhoff, has been hit by weaker demand from car makers,

higher raw material prices and uncertainty caused by international

trade conflicts.

Mr. Kerkhoff announced plans to shed nearly 4% of the staff and

nearly halve administrative costs in May, when the company issued

its third profit warning. However, some directors thought Mr.

Kerkhoff was moving too slowly, according to people close to the

board.

Some board members also disagreed with Mr. Kerkhoff's decision

to sell only a minority stake in the company's elevator business,

instead of a full divestment or an initial public offering, these

people said.

Trade union IG Metall said Mr. Kerkhoff's termination, which is

still being processed, is bound to unsettle employees already

troubled by the uncertainty over planned asset sales.

Thyssenkrupp said late Tuesday that the planned overhaul would

be "systematically continued."

The Krupp foundation, representing heirs to the company's

founders with a roughly 21% stake, and Cevian Capital, which holds

about 18%, said they fully support Ms. Merz. A trained mechanical

engineer, Ms. Merz spent 17 years at auto supplier Robert Bosch

GmbH and has overseen restructuring as a board member of Swedish

car maker Volvo AB.

"We expect that the new leadership will speed up the

transformation process that Thyssenkrupp so urgently needs, and

improve the quality of implementation," said Lars Förberg, founding

partner of Cevian Capital.

Shares in Thyssenkrupp, which were little changed Wednesday, are

down about 18% so far this year. As a result, the company was

dropped from Germany's blue-chip DAX index earlier this month.

Write to Ruth Bender at Ruth.Bender@wsj.com and Ben Dummett at

ben.dummett@wsj.com

(END) Dow Jones Newswires

September 26, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

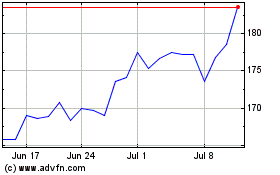

Siemens (TG:SIE)

Historical Stock Chart

From Mar 2024 to Apr 2024

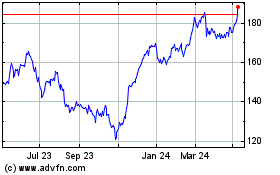

Siemens (TG:SIE)

Historical Stock Chart

From Apr 2023 to Apr 2024