Deutsche Bank Beats Expectations but Coronavirus Clouds Outlook--2nd Update

April 29 2020 - 6:58AM

Dow Jones News

By Patricia Kowsmann

It looked like Deutsche Bank AG was finally going to have a good

year. Then the coronavirus came, forcing it to set aside money for

loan losses, disrupting targets and clouding the bank's

outlook.

The uncertainty is an unwelcome development for the German

lender, which for years has struggled to make money and clean up a

massive portfolio of complex and risky bets that it is set aside to

wind down or sell. An overhaul of its business-focused around

cost-cutting and making its investment-banking unit leaner was

starting to bear fruit.

"This changed environment will impact Deutsche Bank's results of

operations, capital ratios and the capital plan that underlies our

targets," the bank said as it officially announced its

first-quarter results Wednesday.

Deutsche Bank said that its revenue for the full year is

expected to fall slightly in 2020 compared with last year, as its

main businesses of lending and serving clients will remain flat,

while asset disposals in its capital release unit -- a type of bad

bank -- may face headwinds given the market turmoil. Provisions for

credit losses, meanwhile, are expected to increase significantly

from low levels.

All that combined means the bank doesn't know whether it will be

able to finally record a pretax break-even result for the year,

following a EUR2.6 billion ($2.8 billion) pretax loss last

year.

"First-quarter [performance] was well ahead of our plan," James

von Moltke, Deutsche Bank's financial chief said in a conference

call. "It's too early to say what the rest of the year will look

like."

Deutsche Bank said it has set aside EUR506 million to cover

credit losses in the first quarter ended March 31, including EUR260

million directly related to the virus. More will come, although Mr.

von Moltke said he is comfortable with the quality of the bank's

loan book.

Despite all that, first-quarter results were actually strong and

better than expected, mostly thanks to an 18% jump in

investment-banking revenue. Its fixed-income trading business did

particularly well, as customers shifted their assets around to

better weather the virus storm, resulting in big fees and

commissions.

Overall profit for the three months ended March 31 still fell

67% to EUR66 million, from EUR201 million a year ago. But the

figure beat analysts' expectations, thanks to a

higher-than-expected revenue of EUR6.35 billion. Revenue at its

corporate bank unit, which caters to clients like midsize German

companies, fell 1% from a year ago. It rose 2% at its private and

retail banking.

Shares of the bank have risen over 19% since late Sunday, when

the bank reported parts of the results. They are still down close

to 6% since the beginning of the year.

Mark Fedorcik, head of the investment bank, said the unit was

doing well before the virus spread in Europe in March, with revenue

growth and market-share gains. Once the virus hit Europe and the

U.S., he said corporate clients focused on getting liquidity

through credit lines, issuance of debt in the markets and in some

cases loan waivers. Institutional investors, meanwhile,

repositioned their investment portfolios based on their risk

appetite.

"We are seeing some fixed-income markets normalize and stabilize

as we move to the end of April," Ram Nayak, head of fixed income,

said.

For the rest of the year, the bank said it expects

investment-banking revenue to decline from the stronger

first-quarter levels, leaving it overall slightly higher in 2020

compared with last year. Corporate banking and private banking

revenue are expected to stay flat. But bigger loan-loss provisions

will hurt their bottom line.

The bank remained on track with its cost-cutting drive, a key

part of a plan it launched last year meant to make it a leaner and

profitable lender focused on European companies and retail-banking

customers. Deutsche Bank reported costs fell 5% in the first

quarter.

Controlling costs is key for Deutsche Bank and other European

lenders given low and negative interest rates across the region

making it difficult to make money. Germany's banking system is also

the least profitable in the eurozone due to its overcrowded market

of more than 1,500 banks.

There too, the coronavirus is an unwelcome development. While

the bank said it remains committed to its targets, it paused

layoffs last month until some stability returns. Chief Executive

Christian Sewing has promised to cut 18,000 of its approximately

92,000 jobs by 2022.

Write to Patricia Kowsmann at patricia.kowsmann@wsj.com

(END) Dow Jones Newswires

April 29, 2020 06:43 ET (10:43 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

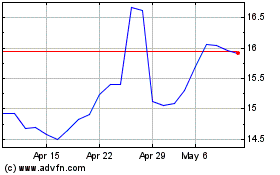

Deutsche Bank (TG:DBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Deutsche Bank (TG:DBK)

Historical Stock Chart

From Apr 2023 to Apr 2024