Deutsche Bank Approved Property Sale to Russian Businessman Despite Internal Objections -- Update

October 31 2019 - 12:44PM

Dow Jones News

By Jenny Strasburg

Deutsche Bank AG officials approved the sale of a chunk of

Silicon Valley real estate to a Russian businessman despite

objections from its U.S. reputational risk committee, according to

documents and people familiar with the matter.

The lender's Germany-based global reputational risk committee

approved the $72 million deal in May 2018, overruling concerns

raised by executives including the one responsible for Deutsche

Bank's U.S. anti-money-laundering controls, the people said. He has

since left the bank.

The transaction, which was championed by its real-estate team,

occurred at a time when Deutsche was under scrutiny by members of

Congress over its Russian business relationships.

Deutsche Bank continues to hand over documents to Congress in a

probe of money-laundering controls and longtime links with Russian

companies and oligarchs. A U.S. Justice Department investigation

into aspects of those Russia relationships and the bank's handling

of internal red flags is ongoing, according to people close to the

bank and its interactions with investigators.

Spokesmen for Deutsche Bank and its asset-management arm, DWS,

said the business was acting as a fiduciary for fund investors.

They said the deal went through the bank's processes to prevent

money laundering and other financial crimes by clients. The deal

didn't involve financing from Deutsche Bank, they said.

"Consistent with our policies and procedures extensive due

diligence was conducted on this transaction and involved, among

others, the [anti-financial crime] unit of Deutsche Bank.

Additionally, the transaction was made subject to the reputational

risk assessment procedures in place at that time," a spokesman for

DWS said.

The bank identified no evidence the deal "would violate money

laundering or sanctions laws. As a result, the discussion of

whether to move forward with the transaction was focused on

reputational considerations, " a spokesman for Deutsche Bank

said.

"There are processes in place that govern reputational risk

considerations, and regional and global judgments about these

considerations can differ, as occurred in this instance," the

Deutsche Bank spokesman said.

Deutsche Bank is one of Wall Street's most troubled operators,

hamstrung by a legacy of aggressive lending practices and

regulatory lapses. The bank has paid large fines for failures to

police money coursing through its network, including transactions

that moved billions of dollars out of Russia. The bank is currently

going through a painful downsizing.

Deutsche Bank's asset management arm bought into the property on

behalf of clients in 2016. A private Bay Area firm called

Embarcadero Capital Partners also held a joint stake, according to

the companies.

The 6.6-acre property is located at 80 Willow Road in Menlo

Park, Calif., featuring a single-story office complex with

Spanish-colonial adobe and midcentury modernist design and

expansive gardens. It was built in the early 1950s as the

headquarters of Time Inc.'s Sunset Magazine, and used by the

publisher for offices, photography shoots and public tours for

decades.

The buyer was Vitaly Yusufov, Russian financier and son of

former energy minister Igor Yusufov, according to documents and

people familiar with the matter. He purchased the property through

a Delaware registered company, according to internal bank documents

and people involved in the sale. Neither Vitaly Yusufov nor his

father responded to repeated requests for comment.

Write to Jenny Strasburg at jenny.strasburg@wsj.com

(END) Dow Jones Newswires

October 31, 2019 12:29 ET (16:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

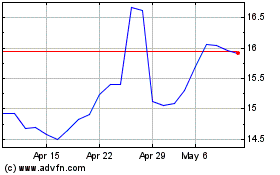

Deutsche Bank (TG:DBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Deutsche Bank (TG:DBK)

Historical Stock Chart

From Apr 2023 to Apr 2024