By Jenny Strasburg and Pietro Lombardi

Deutsche Bank AG's global overhaul has taken another big bite,

with the German lender reporting a second consecutive quarterly

loss and broad revenue declines as it exits businesses and absorbs

restructuring costs.

Shares in the bank were down 6.8% in Wednesday morning trading,

making it the weakest performer in the Stoxx Europe 600 index.

The bank Wednesday reported a EUR832 million ($924 million)

third-quarter net loss, including a EUR1 billion pretax loss in the

new division where it has stashed businesses and positions it is

selling or winding down, called the Capital Release Unit.

Overall net revenue fell 15% to EUR5.3 billion. All but one of

the bank's four core divisions, the corporate bank, suffered

revenue declines.

The results missed expectations, according to a consensus

forecast provided by FactSet. Analysts had expected a third-quarter

loss of about EUR772 million, while revenue had been forecast at

EUR5.53 billion, according to FactSet.

The results reflect the first quarter of post-overhaul reality.

Germany's biggest lender faces years of challenges cutting costs

while maintaining enough profit to pay for its restructuring,

without depleting too much of the capital buffer it needs to absorb

potential losses and satisfy regulators.

Deutsche Bank said its four core business divisions, including

its investment- and corporate-banking units and asset management,

were all profitable. Excluding the so-called bad-bank loss, the

core operations collectively had a pretax profit of EUR353 million

in the third quarter.

Chief Executive Christian Sewing said the bank's transformation

is on track, with a stable capital cushion, loan growth and

increase in assets being managed for clients. The bank said it is

also on track to meet its 2019 cost target.

The loan growth volume could concern investors cautious about

eroding soundness in the market. Deutsche Bank's finance chief,

James von Moltke, told reporters on a conference call that the

increase was consistent with the bank's strategy, and that it is

carefully gauging credit quality. He noted Deutsche Bank's

relatively stable provisions for loan losses, adding that those

provisions are likely to go up in future quarters, but calling that

an anticipated "normalization."

The bank said it is on track to meet its 2019 cost target,

though some analysts pointed out that third-quarter costs were

slightly higher than expected. The lender's head count has fallen

below 90,000 for the first time since it acquired German

retail-banking business Postbank, it said. In early July, Deutsche

Bank unveiled a big revamp including around 18,000 job cuts over

several years and a retreat from some of its global trading

ambitions.

In late July, it reported a big, but expected, second-quarter

net loss tied to restructuring costs. Drops in trading and

investment-banking revenue didn't help. That EUR3.15 billion

quarterly loss included a EUR3.4 billion restructuring charge.

Executives still expect Deutsche Bank to return to profitability

or at least break even next year, Mr. von Moltke said

Wednesday.

In the reorganized investment bank, overall revenue fell 5% in

the third quarter, with the fixed-income sales and trading revenue

decline offset by a 20% increase in revenue from origination and

advisory.

The fixed-income pain came largely from interest-rate trading

and emerging-markets debt, including losses in Argentina that Mr.

von Moltke declined to quantify. He called the fixed-income results

a "mixed picture" but said the bank is happy with areas like

currencies trading and predicts the overall business will

stabilize.

Corporate-bank revenue was up 6%, including an 8% increase in

transaction-banking revenue. Overall private-bank and

asset-management revenue were down 3% and 4%, respectively. DWS,

the asset-management arm, attracted net inflows.

Mr. Sewing has said the upfront restructuring pain will make

Deutsche Bank leaner and more focused on serving European companies

at home and abroad. The bank has largely exited from equities

trading and pulled back from other money-losing operations with the

aim of focusing on long-term strengths, such as managing companies'

cash and financing trade.

Mr. von Moltke told reporters that nothing in the results since

July has led the bank to consider closing more businesses or

lopping off more products than it already has planned or

announced.

But executives have also acknowledged that investors have heard

many restructuring promises before, only to be disappointed when

cuts failed to bring stability. The bank, which is almost 150 years

old, has had years of senior management turmoil and lost top

bankers. Investors aren't easily convinced that the latest plan

will succeed, either, analysts say.

Banks globally are suffering from low or negative interest

rates, with that prolonged weight on profits exacerbating Deutsche

Bank's already low-margin retail market in Germany.

Write to Jenny Strasburg at jenny.strasburg@wsj.com and Pietro

Lombardi at Pietro.Lombardi@dowjones.com

(END) Dow Jones Newswires

October 30, 2019 06:06 ET (10:06 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

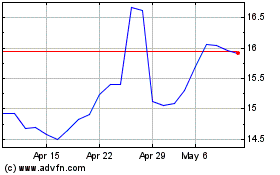

Deutsche Bank (TG:DBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Deutsche Bank (TG:DBK)

Historical Stock Chart

From Apr 2023 to Apr 2024