BMW Earnings Bounce Back but Industry Woes Remain

November 06 2019 - 6:38AM

Dow Jones News

By William Boston

BERLIN -- BMW AG returned to profit in the third quarter, helped

by cost-cutting and a sales shift to higher-margin sport-utility

vehicles, but it warned that Germany's luxury car industry would

continue to be squeezed by growing costs and heightened

competition.

The manufacturer of BMW, Mini and Rolls-Royce automobiles

undertook a large cost-cutting program earlier this year after its

profit margin was eroded by slowing sales and the costs of shifting

toward electric cars and new self-driving technology.

On Wednesday BMW said its efforts to boost earnings were bearing

fruit and could see it achieve annual savings of EUR12 billion by

the end of 2022.

"We are performing at a high level in comparison with our

competitors and considering the difficult conditions our business

is facing," said Nicolas Peter, BMW's finance chief, in a

statement." Nonetheless, we aspire to achieve more than that."

BMW said the rise in profit was on the back of strong SUV sales.

Net profit in the third-quarter rose to EUR1.52 billion ($1.69

billion) from EUR1.36 billion a year earlier, and its closely

watched pretax profit margin in its core automotive business

rebounded to 6.6% of sales from 4.4% a year ago.

Revenue in the third-quarter rose nearly 8% to EUR26.7 billion

on the back of strong sales in China, where major car makers have

struggled due to the slowing economy. New car sales rose 3.6% on

the back of higher X3 and X4 SUV sales.

BMW's quarterly earnings were largely in line with analyst

forecasts, who noted that the company had already abandoned its

outlook for a strong rebound in profit in the second half of the

year, and now expect it to hit the low end of its 6% to 8% target

for automotive profit margins and lower its annual dividend.

"The third quarter shows that BMW is back to normal, but it is

not very inspiring," said Philippe Houchois, an automotive analyst

at brokerage Jeffries. "It's a well-run business, but it's a brand

that to some extent needs to be reinvented and we're not seeing

that yet."

Daimler AG and Audi AG, BMW's rivals in the high-end premium car

market, are also facing similar challenges. Daimler is expected

next week to unveil a cost-cutting plan to stem the erosion of its

profits, while Audi, the luxury unit of Volkswagen AG, is

struggling with severe overcapacity at its main plants in

Germany.

BMW is at the center of a European antitrust investigation

alleging that German auto makers colluded to limit competition in

emissions systems equipment, which forced the company to take a

EUR1.4 billion ($1.6 billion) charge against earnings earlier this

year to cover for potential fines and legal fees. BMW said it would

contest the European Union's allegations with all legal means at

its disposal.

Mr. Peter said the company would stick to its targets for the

full year, which had already been adjusted to lower

expectations.

In the first nine months of the year, BMW said net income fell

37% to EUR3.6 billion, and revenue rose 3.4% to EUR74.8 billion as

sales rose 1.7% to 1.87 million vehicles.

--Max Bernhard contributed to this article.

(END) Dow Jones Newswires

November 06, 2019 06:23 ET (11:23 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

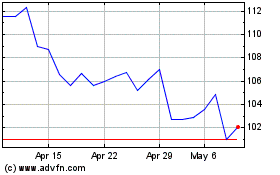

Bayerische Motoren Werke (TG:BMW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bayerische Motoren Werke (TG:BMW)

Historical Stock Chart

From Apr 2023 to Apr 2024