Assicurazioni Generali CEO Mario Greco to Step Down -- Upate

January 26 2016 - 3:24PM

Dow Jones News

By Giovanni Legorano and John Letzing

MILAN--Mario Greco is leaving the top job at Assicurazioni

Generali SpA to return to a troubled Zurich Insurance Group AG as

its new chief executive.

Mr. Greco, who is credited with a successful turnaround of the

Italian insurer, will face a number of challenges at Zurich

Insurance. Chief among them is revamping the general insurance unit

that he oversaw as the business's CEO for two years, before

departing for Generali in 2012.

In a statement, Zurich Insurance said Mr. Greco will become the

Swiss insurance giant's CEO effective in May. That follows the

departure last month of former CEO Martin Senn. Mr. Senn's tenure

included a failed bid to acquire U.K.-based RSA Insurance Group

PLC, and a deterioration of results for the general insurance

business--Zurich Insurance's largest unit.

Tom de Swaan, the Zurich Insurance chairman who has been filling

in as CEO on an interim basis, said in a statement that, "Mario

offers the rare combination of entrepreneurial spirit, deep

industry knowledge and proven CEO experience that anchored our

search for Zurich's next leader."

Mr. de Swaan noted that Mr. Greco brings with him "an intimate

understanding of our company."

Mr. Greco's board at Generali had pressed for him to stay,

according to a person familiar with the matter. During his time as

CEO he embarked on a strategy that involved shedding assets,

exiting from loss-making investments in Italian companies, and

refocusing Generali on insurance. He sold part of the company's

stake in Banca Generali, a reinsurance business in the U.S., and

Generali's Switzerland-based private bank, BSI SA.

The moves helped to improve Generali's capital position, which

had been a major concern for shareholders. Shares of Generali

gained 50% in value during his tenure, and the company paid higher

dividends.

Generali hasn't yet found Mr. Greco's replacement, according to

people familiar with the matter.

At Zurich Insurance, Mr. Greco will be confronted with a general

insurance business that posted an operating loss for the third

quarter, and is expected to again post an operating loss for the

fourth quarter.

For insurers generally, financial markets in recent years have

made it difficult to earn attractive investment returns. In

response, the industry has seen a spate of mergers of late, as

firms seek to gain heft and shed costs. But last year, Zurich

Insurance missed out on its own bid to make a significant

acquisition.

In July, the company unveiled plans to acquire RSA in a deal

potentially valued at more than $8 billion. But continued

difficulties at the general insurance business caused Zurich

Insurance to call off its attempt to buy RSA in September. Zurich

Insurance said at that time that it needed to focus instead on

revamping the general insurance unit.

When Mr. Senn stepped aside last month, he cited the failed RSA

bid as one of the reasons for his decision to leave.

Earlier this month, Zurich Insurance issued a profit warning for

its general insurance unit, for the fourth quarter. The company

cited an estimated $275 million in losses stemming from the recent

storms in the U.K. and Ireland.

Zurich Insurance is expected to report financial results on Feb.

11.

Write to Giovanni Legorano at giovanni.legorano@wsj.com and John

Letzing at john.letzing@wsj.com

(END) Dow Jones Newswires

January 26, 2016 15:09 ET (20:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

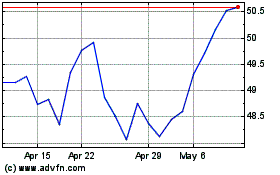

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Aug 2024 to Sep 2024

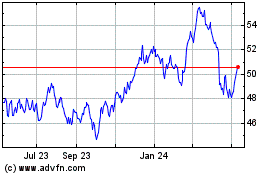

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Sep 2023 to Sep 2024