Current Report Filing (8-k)

January 15 2021 - 4:31PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

January 15, 2021

Date of Report (Date of earliest event reported)

Zion Oil & Gas, Inc.

(Exact name of registrant as specified in

its charter)

Delaware

(State or other jurisdiction of incorporation)

|

001-33228

|

|

20-0065053

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

12655 North Central Expressway, Suite

1000, Dallas, TX 75243

(Address of Principal Executive Offices)

(Zip Code)

Registrant’s telephone number, including

area code: 214-221-4610

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

|

|

|

|

|

Item 8.01 Other Events

On December 11, 2019, Zion Oil & Gas,

Inc. (the “Company”) filed with the Securities and Exchange Commission (the “SEC”) the prospectus supplement

dated as of December 11, 2019 and accompanying base prospectus dated November 27, 2019 (collectively, the “Prospectus”)

relating to the Company’s Dividend Reinvestment and Direct Stock Purchase Plan (the “Plan” or “DSPP”).

The Prospectus forms a part of the Company’s Registration Statement on Form S-1 (File No. 333-235299), as amended,

which was declared effective by the SEC on December 11, 2019 (the “Registration Statement”).

DSPP Program

Under the Plan, the Company,

pursuant to a Request for Waiver Program, executed Waiver Term Sheets under a unit option program consisting of a Unit (shares

of stock and warrants) of its securities with a participant. The participant’s Plan account will be credited with the number

of shares of the Company’s Common Stock and warrants that are acquired. Each warrant affords the participant the opportunity

to purchase one share of our Common Stock at a warrant exercise price of $1.00. The warrant shall have the Company notation of

“ZNWAM.” The warrants will not be registered for trading on the OTCQX or any other stock market or trading market.

The warrants will become exercisable on January 15, 2021 and continue to be exercisable through July 15, 2022 (18 months) at a

per share exercise price of $1.00.

Warrant Agent Agreement

Effective January 15, 2021, the Company executed

a Warrant Agent Agreement with AST as the Warrant Agent, Exhibit 4.7 below, for the warrant notated as ZNWAM. The Company is filing

the items included in Exhibits 4.6 and 4.7 to this Current Report on Form 8-K, each of which relates to the above Registration

Statement, for the purpose of incorporating such items as exhibits to the Registration Statement for the DSPP Program.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereto duly authorized.

|

|

Zion Oil and Gas, Inc.

|

|

|

|

|

|

Date: January 15, 2021

|

By:

|

/s/ Robert Dunn

|

|

|

|

Robert Dunn

|

|

|

|

Chief Executive Officer

|

2

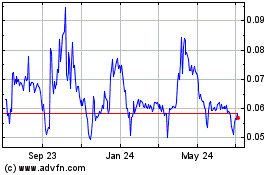

Zion Oil and Gas (QB) (USOTC:ZNOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

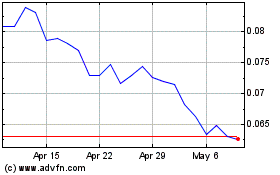

Zion Oil and Gas (QB) (USOTC:ZNOG)

Historical Stock Chart

From Apr 2023 to Apr 2024