CALCULATION

OF REGISTRATION FEE

|

Title of Each Class of Securities To Be Registered

|

|

Proposed Maximum

Offering Price Per Share

|

Proposed Maximum

Aggregate Offering Price(1)

|

Amount of

Registration Fee

|

|

|

|

|

|

|

|

Common Stock by

Selling Shareholders

|

37,361,010

|

$0.014

|

$523,054.14

|

$67.89(2)

|

|

|

|

|

|

|

|

|

(1)

|

Estimated solely

for the purpose of computing the registration fee pursuant to Rule

457(o) under the Securities Act of 1933 ("the Securities Act")

based on the average of the 5-day average of the closing price of

the common stock on February 7, 2019 as reported on the

OTC Market QB.

|

|

|

(2)

|

$763.68 was paid

with original S-1 filing.

|

The registrant

hereby amends this registration statement on such date or dates as

may be necessary to delay its effective date until the registrant

shall file a further amendment which specifically states that this

registration statement shall thereafter become effective in

accordance with Section 8(a) of the Securities Act of 1933 or until

the registration statement shall become effective on such date as

the Commission, acting pursuant to said Section 8(a), may

determine.

EXPLANATORY

NOTE

This Post-Effective

Amendment No. 1 to the Registration Statement on Form S-1 (File No.

333-222094) (the “Registration Statement”) of TPT

Global, Inc. (“TPT”), as originally declared effective

by the Securities and Exchange Commission (the “SEC”)

on February 13, 2019, is being filed pursuant to the undertakings

in Item 17 of the Registration Statement to (i) include the

information contained in TPT’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2018, that was filed with the

SEC on April 11, 2019, (ii) include the information contained in

TPT’s Quarterly Report on Form 10-Q for the period ended

September 30, 2019, that was filed with the SEC on November 19,

2019 and (iii) update certain other information in the Registration

Statement.

The information

included in this filing amends this Registration Statement and the

prospectus contained therein. No additional securities are being

registered under this Post-Effective Amendment No. 1. All

applicable registration fees were paid at the time of the original

filing of the Registration Statement.

ii

(Subject

to Completion)

PROSPECTUS

TPT

GLOBAL TECH, INC.

37,361,010

shares of common stock of selling shareholders

We are registering

securities listed for sale on behalf of selling shareholders:

37,361,010 shares of common stock.

We will

not receive any

proceeds from sales of shares by selling shareholders.

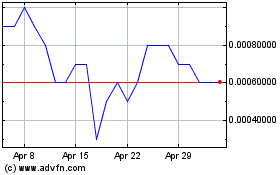

Our selling

shareholders plan to sell common shares at market prices for so

long as our Company is quoted on OTCQB and as the market may

dictate from time to time. There is a limited market for the common

stock, which has been trading on the OTCQB (“TPTW”) at

$0.014 in the past 5 days.

|

Title

|

Price

Per Share

|

|

Common

Stock

|

$0.014*

|

*Five-day average

market price

Our security

holders may sell their securities on the OTCQB at market prices or

at any price in privately negotiated transactions.

This offering involves a high degree of risk; see "RISK FACTORS" beginning on page

6 to read about factors you should consider before buying

shares of the common stock.

These securities have not been approved or disapproved by the

Securities and Exchange Commission (the “SEC”) or any

state or provincial securities commission, nor has the SEC or any

state or provincial securities commission passed upon the accuracy

or adequacy of this prospectus. Any representation to the contrary

is a criminal offense.

This offering will

be on a delayed and continuous basis only for sales of selling

shareholders shares. The selling shareholders are not paying any of

the offering expenses and we will not receive any of the proceeds

from the sale of the shares by the selling shareholders. (See

“Description of Securities –

Shares”).

The information in

this prospectus is not complete and may be changed. We may not sell

these securities until the date that the registration statement

relating to these securities, which has been filed with the

Securities and Exchange Commission, becomes effective. This

prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any state where the

offer or sale is not permitted.

The date of this

Prospectus is December 10, 2019.

iii

TABLE

OF CONTENTS

|

PART I

- INFORMATION REQUIRED IN PROSPECTUS

|

Page No.

|

|

ITEM

1.

|

Front of

Registration Statement and Outside Front Cover Page of

Prospectus

|

|

|

ITEM

2.

|

Prospectus Cover

Page

|

|

|

ITEM

3.

|

Prospectus Summary

Information, Risk Factors and Ratio of Earnings to Fixed

Charges

|

3

|

|

ITEM

4.

|

Use of

Proceeds

|

23

|

|

ITEM

5.

|

Determination of

Offering Price

|

24

|

|

ITEM

6.

|

Dilution

|

24

|

|

ITEM

7.

|

Selling Security

Holders

|

24

|

|

ITEM

8.

|

Plan of

Distribution

|

29

|

|

ITEM

9.

|

Description of

Securities

|

29

|

|

ITEM

10.

|

Interest of Named

Experts and Counsel

|

31

|

|

ITEM

11.

|

Information with

Respect to the Registrant

|

31

|

|

|

a. Description of

Business

|

31

|

|

|

b. Description of

Property

|

57

|

|

|

c. Legal

Proceedings

|

57

|

|

|

d. Market for

Common Equity and Related Stockholder Matters

|

58

|

|

|

e. Financial

Statements

|

59

|

|

|

f. Selected

Financial Data

|

61

|

|

|

g. Supplementary

Financial Information

|

61

|

|

|

h.

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

|

61

|

|

|

i. Changes In and

Disagreements With Accountants on Accounting and Financial

Disclosure

|

71

|

|

|

j. Quantitative and

Qualitative Disclosures About Market Risk

|

71

|

|

|

k. Directors and

Executive Officers

|

71

|

|

|

l. Executive and

Directors Compensation

|

74

|

|

|

m. Security

Ownership of Certain Beneficial Owners and Management

|

79

|

|

|

n. Certain

Relationships, Related Transactions, Promoters And Control

Persons

|

80

|

|

ITEM 11

A.

|

Material

Changes

|

82

|

|

ITEM

12.

|

Incorporation of

Certain Information by Reference

|

82

|

|

ITEM 12

A.

|

Disclosure of

Commission Position on Indemnification for Securities Act

Liabilities

|

82

|

|

PART II

– INFORMATION NOT REQUIRED IN PROSPECTUS

|

|

|

ITEM

13.

|

Other Expenses of

Issuance and Distribution

|

82

|

|

ITEM

14.

|

Indemnification of

Directors and Officers

|

82

|

|

ITEM

15.

|

Recent Sales of

Unregistered Securities

|

83

|

|

ITEM

16.

|

Exhibits and

Financial Statement Schedules

|

83

|

|

ITEM

17.

|

Undertakings

|

86

|

|

|

Signatures

|

87

|

ITEM

3. PROSPECTUS SUMMARY INFORMATION, RISK FACTORS AND RATIO OF

EARNINGS TO FIXED CHARGES

Our

Company

TPT Global Tech,

Inc. (“We”, “us”, “our”

“TPT”or “TPT Global”), is incorporated in

the State of Florida with operations located in San Diego,

California, providing complete, communication and data services and

products to small to mid-sized organizations

(“SMB”).

CORPORATE HISTORY

COMPANY OVERVIEW

We were originally

incorporated in 1988 in the state of Florida. TPT Global, Inc., a

Nevada corporation formed in June 2014, merged with Ally Pharma US,

Inc., a Florida corporation, (“Ally Pharma”, formerly

known as Gold Royalty Corporation) in a “reverse

merger” wherein Ally Pharma issued 110,000,000 shares of

Common Stock, or 80% ownership, to the owners of TPT Global, Inc.

and Ally Pharma changed its name to TPT Global Tech, Inc. In 2014,

we acquired all the assets of K Telecom and Wireless LLC (“K

Telecom”) and Global Telecom International, LLC

(“Global Telecom”). Effective January 31, 2015, we

completed our acquisition of 100% of the outstanding stock of

Copperhead Digital Holdings, Inc. (“Copperhead

Digital”) and Subsidiaries, TruCom, LLC

(“TruCom”), Nevada Utilities, Inc. (“Nevada

Utilities”) and CityNet Arizona, LLC (“CityNet”).

In October 2015, we acquired the assets of both Port2Port, Inc.

(“Port2Port”) and Digithrive, Inc.

(“Digithrive”). Effective September 30, 2016, we

acquired 100% ownership in San Diego Media, Inc.

(“SDM”). In December 2016, we acquired the Lion Phone

technology. In October and November 2017, we entered into

agreements to acquire Blue Collar, Inc. (“Blue

Collar”), and certain assets of Matrixsites, Inc.

(“Matrixsites”) which we have completed. On May 7, 2019

we completed the acquisition of a majority of the assets of

SpeedConnect, LLC, which assets were conveyed into our wholly owned

subsidiary TPT SpeedConnect, LLC (“TPT SC” or

“TPT SpeedConnect”) which was formed on April 16,

2019.

We are based in San Diego, California,

and operate as a Media Content Hub for Domestic and International

syndication Technology/Telecommunications company operating on our

own proprietary Global Digital Media TV and Telecommunications

infrastructure platform and also provides technology solutions to

businesses domestically and worldwide. We offer Software as a

Service (SaaS), Technology Platform as a Service (PAAS),

Cloud-based Unified Communication as a Service (UCaaS) and

carrier-grade performance and support for businesses over our

private IP MPLS fiber and wireless network in the United States.

Our cloud-based UCaaS services allow businesses of any size to

enjoy all the latest voice, data, media and collaboration features

in today's global technology markets. We also operate as a Master

Distributor for Nationwide Mobile Virtual Network Operators (MVNO)

and Independent Sales Organization (ISO) as a Master Distributor

for Pre-Paid Cellphone services, Mobile phones, Cellphone

Accessories and Global Roaming Cellphones.

We anticipate

needing an estimated $45,000,000 in capital to continue our

business operations and expansion. We do not have committed sources

for these additional funds and will need to be obtained through

debt or equity placements or a combination of those. As part of

this $45,000,000, we will need to pay a total of $3,350,000 in

Seller loans by February 2020 for prior acquisitions and

approximately $7,800,000 in debt repayments. The remainder is to be

used for equipment purchases and working capital. We are

in negotiations for certain sources to provide funding but at this

time do not have a committed source of these funds.

Our executive

offices are located at 501 West Broadway, Suite 800, San Diego, CA

92101 and the telephone number is (619) 400-4996. We maintain a

website at www.tptglobaltech.com, and such website is not

incorporated into or a part of this filing.

IMPLICATIONS

OF BEING AN EMERGING GROWTH COMPANY

As a company with

less than $1.0 billion of revenue during our last fiscal year, we

qualify as an emerging growth company as defined in the JOBS Act,

and we may remain an emerging growth company for up to five years

from the date of the first sale in this offering. However, if

certain events occur prior to the end of such five-year period,

including if we become a large accelerated filer, our annual gross

revenue exceeds $1.0 billion, or we issue more than $1.0 billion of

non-convertible debt in any three-year period, we will cease to be

an emerging growth company prior to the end of such five-year

period. For so long as we remain an emerging growth company, we are

permitted and intend to rely on exemptions from certain disclosure

and other requirements that are applicable to other public

companies that are not emerging growth companies. In particular, in

this prospectus, we have provided only two years of audited

financial statements and have not included all of the executive

compensation related information that would be required if we were

not an emerging growth company. Accordingly, the information

contained herein may be different than the information you receive

from other public companies in which you hold equity interests.

However, we have irrevocably elected not to avail ourselves of the

extended transition period for complying with new or revised

accounting standards, and, therefore, we will be subject to the

same new or revised accounting standards as other public companies

that are not emerging growth companies.

Summary

of Financial Information

The following

tables set forth, for the periods and as of the dates indicated,

our summary financial data. The statements of operations for the

nine months ended September 30, 2019, and the balance sheet data as

of September 30, 2019 are derived from our unaudited condensed

consolidated financial statements. The unaudited financial

statements include, in the opinion of management, all adjustments

consisting of only normal recurring adjustments, that management

considers necessary for the fair presentation of the financial

information set forth in those statements. You should read the

following information together with the more detailed information

contained in “Selected Financial Data,”

“Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and our financial

statements and related notes included elsewhere in this prospectus.

Our historical results are not indicative of the results to be

expected in the future and results of interim periods are not

necessarily indicative of results for the entire year. The

statements of operations for the years ended December 31, 2018 and

2017, and balance sheet data as of December 31, 2018, are derived

from our audited financial statements included elsewhere in this

prospectus. You should read the following information together with

the more detailed information contained in “Selected

Financial Data,” “Management’s Discussion and

Analysis of Financial Condition and Results of Operations”

and our financial statements and related notes included elsewhere

in this prospectus. Our historical results are not indicative of

the results to be expected in the future.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

Assets

|

$16,990,445

|

$10,821,717

|

$8,773,288

|

|

Current

Liabilities

|

$27,747,088

|

$16,144,015

|

$11,626,688

|

|

Long-term

Liabilities

|

$3,106,192

|

$604,200

|

$64,819

|

|

Stockholders’

Equity (Deficit)

|

$(13,892,835)

|

$(5,926,498)

|

$(2,918,219)

|

|

|

|

|

|

|

September

30,

2019

(Unaudited)

|

December 31,

2018

(Audited)

|

December 31,

2017

(Audited)

|

|

Revenues

|

$6,207,431

|

$937,069

|

$2,115,160

|

|

Net

Loss

|

$(8,538,360)

|

$(5,377,489)

|

$(3,807,401)

|

|

|

|

|

|

At September 30,

2019, the accumulated deficit was $27,341,287. At December 31,

2018, the accumulated deficit was $18,802,928. At December 31,

2017, the accumulated deficit was $13,425,439. We anticipate that

we will operate in a deficit position and continue to sustain net

losses for the foreseeable future.

CORPORATE

ORGANIZATION CHART

The

Offering

We are registering

37,361,010 shares for sale on behalf of selling

shareholders.

Our common stock,

only, will be transferable immediately upon the effectiveness of

the Registration Statement. (See “Description of

Securities”)

|

Common shares

outstanding before this offering November 25, 2019

|

145,236,483

|

|

Maximum common

shares being offered by our existing selling

shareholders

|

37,361,010

|

|

Maximum common

shares outstanding after this offering

|

145,236,483

|

|

|

|

We are authorized

to issue 1,000,000,000 shares of common stock with a par value of

$0.001 and 100,000,000 shares of preferred stock. Our current

shareholders, officers and directors collectively own 145,236,483

shares of restricted common stock as of November 25, 2019. Our

shares being registered were issued in the following amounts and at

the following prices:

|

Number

of Shares

|

Original

Consideration

|

Issue

Price Per Share

|

|

4,000,000

|

Founders

Services

|

$0.001

|

|

7,273,927

|

Asset

Acquisition

|

$0.10 to

$0.81

|

|

2,983,380

|

Conversion of

Payables and

Convertible

Promissory Notes

|

$0.20 to

$0.50

|

|

8,303,496

|

Private

Placement

|

$0.10 to

$0.50

|

|

8,126,649

|

Services

|

$0.10 to

$0.77

|

|

1,967,192

|

Prior Ally

Pharma

|

$0.001

|

|

4,706,366

|

Gifts to

Family

|

$0.001

|

Currently there is

a limited public trading market for our stock on OTCQB under the

symbol “TPTW.”

Forward Looking

Statements

This prospectus

contains various forward-looking statements that are based on our

beliefs as well as assumptions made by and information currently

available to us. When used in this prospectus, the words "believe",

"expect", "anticipate", "estimate" and similar expressions are

intended to identify forward-looking statements. These statements

may include statements regarding seeking business opportunities,

payment of operating expenses, and the like, and are subject to

certain risks, uncertainties and assumptions which could cause

actual results to differ materially from projections or estimates.

Factors which could cause actual results to differ materially are

discussed at length under the heading "Risk Factors". Should one or

more of the enumerated risks or uncertainties materialize, or

should underlying assumptions prove incorrect, actual results may

vary materially from those anticipated, estimated or projected.

Investors should not place undue reliance on forward-looking

statements, all of which speak only as of the date

made.

RISK

FACTORS RELATED TO OUR BUSINESS

Many of our competitors

are better established and have resources significantly greater

than we have, which may make it difficult to attract and retain

subscribers.

We will compete

with other providers of telephony service, many of which have

substantially greater financial, technical and marketing resources,

larger customer bases, longer operating histories, greater name

recognition and more established relationships in the industry. In

addition, a number of these competitors may combine or form

strategic partnerships. As a result, our competitors may be able to

offer, or bring to market earlier, products and services that are

superior to our own in terms of features, quality, pricing or other

factors. Our failure to compete successfully with any of these

companies would have a material adverse effect on our business and

the trading price of our common stock.

The market for

broadband and VoIP services is highly competitive, and we compete

with several other companies within a single market:

|

|

|

|

|

|

•

|

cable operators

offering high-speed Internet connectivity services and voice

communications;

|

|

|

•

|

incumbent and

competitive local exchange carriers providing DSL services over

their existing wide, metropolitan and local area

networks;

|

|

|

•

|

3G cellular, PCS

and other wireless providers offering wireless broadband services

and capabilities, including developments in existing cellular and

PCS technology that may increase network speeds or have other

advantages over our services;

|

|

|

•

|

internet service

providers offering dial-up Internet connectivity;

|

|

|

•

|

municipalities and

other entities operating free or subsidized WiFi

networks;

|

|

|

•

|

providers of VoIP

telephony services;

|

|

|

•

|

wireless Internet

service providers using licensed or unlicensed

spectrum;

|

|

|

•

|

satellite and fixed

wireless service providers offering or developing broadband

Internet connectivity and VoIP telephony;

|

|

|

•

|

electric utilities

and other providers offering or planning to offer broadband

Internet connectivity over power lines; and

|

|

|

•

|

resellers providing

wireless Internet service by “piggy-backing” on DSL or

WiFi networks operated by others.

|

Moreover, we expect

other existing and prospective competitors, particularly if our

services are successful; to adopt technologies or business plans

similar to ours or seek other means to develop a product

competitive with our services. Many of our competitors are

well-established and have larger and better developed networks and

systems, longer-standing relationships with customers and

suppliers, greater name recognition and greater financial,

technical and marketing resources than we have. These competitors

can often subsidize competing services with revenues from other

sources, such as advertising, and thus may offer their products and

services at lower prices than ours. These or other competitors may

also reduce the prices of their services significantly or may offer

broadband connectivity packaged with other products or services. We

may not be able to reduce our prices or otherwise alter our

services correspondingly, which would make it more difficult to

attract and retain subscribers.

Our Acquisitions could

result in operating difficulties, dilution and distractions from

our core business.

We have evaluated,

and expect to continue to evaluate, potential strategic

transactions, including larger acquisitions. The process of

acquiring and integrating a company, business or technology is

risky, may require a disproportionate amount of our management or

financial resources and may create unforeseen operating

difficulties or expenditures, including:

|

|

•

|

difficulties in

integrating acquired technologies and operations into our business

while maintaining uniform standards, controls, policies and

procedures;

|

|

|

•

|

increasing cost and

complexity of assuring the implementation and maintenance of

adequate internal control and disclosure controls and procedures,

and of obtaining the reports and attestations that are required of

a company filing reports under the Securities Exchange

Act;

|

|

|

•

|

difficulties in

consolidating and preparing our financial statements due to poor

accounting records, weak financial controls and, in some cases,

procedures at acquired entities based on accounting principles not

generally accepted in the United States, particularly those

entities in which we lack control; and

|

|

|

•

|

the inability to

predict or anticipate market developments and capital commitments

relating to the acquired company, business or

technology.

|

Acquisitions of and joint ventures with companies organized outside

the United States often involve additional risks,

including:

|

|

|

|

|

|

•

|

difficulties, as a

result of distance, language or culture differences, in developing,

staffing and managing foreign operations;

|

|

|

•

|

lack of control

over our joint ventures and other business

relationships;

|

|

|

•

|

currency exchange

rate fluctuations;

|

|

|

•

|

longer payment

cycles;

|

|

|

•

|

credit risk and

higher levels of payment fraud;

|

|

|

•

|

foreign exchange

controls that might limit our control over, or prevent us from

repatriating, cash generated outside the United

States;

|

|

|

•

|

potentially adverse

tax consequences;

|

|

|

•

|

expropriation or

nationalization of assets;

|

|

|

•

|

differences in

regulatory requirements that may make it difficult to offer all of

our services;

|

|

|

•

|

unexpected changes

in regulatory requirements;

|

|

|

•

|

trade barriers and

import and export restrictions; and

|

|

|

•

|

political or social

unrest and economic instability.

|

The anticipated

benefit of any of our acquisitions or investments may never

materialize. Future investments, acquisitions or dispositions could

result in potentially dilutive issuances of our equity securities,

the incurrence of debt, contingent liabilities or amortization

expenses, or write-offs of goodwill, any of which could harm our

financial condition. Future investments and acquisitions may

require us to obtain additional equity or debt financing, which may

not be available on favorable terms, or at all.

Our substantial

indebtedness and our current default status and any restrictive

debt covenants could limit our financing options and liquidity

position and may limit our ability to grow our

business.

Our indebtedness

could have important consequences to the holders of our common

stock, such as:

|

|

|

|

|

|

•

|

we may not be able

to obtain additional financing to fund working capital, operating

losses, capital expenditures or acquisitions on terms acceptable to

us or at all;

|

|

|

•

|

we may be unable to

refinance our indebtedness on terms acceptable to us or at

all;

|

|

|

•

|

if substantial

indebtedness continues it could make us more vulnerable to economic

downturns and limit our ability to withstand competitive pressures;

and

|

|

|

•

|

cash flows from

operations are currently negative and may continue to be so, and

our remaining cash, if any, may be insufficient to operate our

business.

|

|

|

•

|

paying dividends to

our stockholders;

|

|

|

•

|

incurring, or cause

certain of our subsidiaries to incur, additional

indebtedness;

|

|

|

•

|

permitting liens on

or conduct sales of any assets pledged as collateral;

|

|

|

•

|

selling all or

substantially all of our assets or consolidate or merge with or

into other companies;

|

|

|

•

|

repaying existing

indebtedness; and

|

|

|

•

|

engaging in

transactions with affiliates.

|

As of September 30,

2019, the total debt or financing arrangements was $13,694,015, of

which $91,618 or less than 1% of total current liabilities is past

due. As of September 30, 2019, financing lease arrangements are in

the amount of $550,450, of which $101,815 is in default. Our

inability to renegotiate our indebtedness may cause lien holders to

obtain possession of a good portion of our assets which would

significantly alter our ability to generate revenues and obtain any

additional financing. There are some of our derivative

financial instruments which are being accounting for as in

default. These represent $4,708,524 or 15% of total

liabilities as of September 30, 2019.

We may experience

difficulties in constructing, upgrading and maintaining our

network, which could adversely affect customer satisfaction,

increase subscriber turnover and reduce our

revenues.

Our success depends

on developing and providing products and services that give

subscribers a high quality Internet connectivity and VoIP

experience. If the number of subscribers using our network and the

complexity of our products and services increase, we will require

more infrastructure and network resources to maintain the quality

of our services. Consequently, we expect to make substantial

investments to construct and improve our facilities and equipment

and to upgrade our technology and network infrastructure. If we do

not implement these developments successfully, or if we experience

inefficiencies, operational failures or unforeseen costs during

implementation, the quality of our products and services could

decline.

We may experience

quality deficiencies, cost overruns and delays on construction,

maintenance and upgrade projects, including the portions of those

projects not within our control or the control of our contractors.

The construction of our network requires the receipt of permits and

approvals from numerous governmental bodies, including

municipalities and zoning boards. Such bodies often limit the

expansion of transmission towers and other construction necessary

for our business. Failure to receive approvals in a timely fashion

can delay system rollouts and raise the cost of completing

construction projects. In addition, we typically are required to

obtain rights from land, building and tower owners to install our

antennas and other equipment to provide service to our subscribers.

We may not be able to obtain, on terms acceptable to us, or at all,

the rights necessary to construct our network and expand our

services.

We also face

challenges in managing and operating our network. These challenges

include operating, maintaining and upgrading network and customer

premises equipment to accommodate increased traffic or

technological advances, and managing the sales, advertising,

customer support, billing and collection functions of our business

while providing reliable network service at expected speeds and

VoIP telephony at expected levels of quality. Our failure in any of

these areas could adversely affect customer satisfaction, increase

subscriber turnover, increase our costs, decrease our revenues and

otherwise have a material adverse effect on our business,

prospects, financial condition and results of

operations.

If we do not obtain and

maintain rights to use licensed spectrum in one or more markets, we

may be unable to operate in these markets, which could adversely

affect our ability to execute our business

strategy.

Even though we have

established license agreements, growth requires that we plan to

provide our services obtaining additional licensed spectrum both in

the United States and internationally, we depend on our ability to

acquire and maintain sufficient rights to use licensed spectrum by

obtaining our own licenses or long-term spectrum leases, in each of

the markets in which we operate or intend to operate. Licensing is

the short-term solution to obtaining the necessary spectrum as

building out spectrum is a long and difficult process that can be

costly and require a disproportionate amount of our management

resources. We may not be able to acquire, lease or maintain the

spectrum necessary to execute our business strategy.

Using licensed

spectrum, whether owned or leased, poses additional risks to us,

including:

|

|

|

|

|

|

•

|

inability to

satisfy build-out or service deployment requirements upon which our

spectrum licenses or leases are, or may be,

conditioned;

|

|

|

•

|

increases in

spectrum acquisition costs;

|

|

|

•

|

adverse changes to

regulations governing our spectrum rights;

|

|

|

•

|

the risk that

spectrum we have acquired or leased will not be commercially usable

or free of harmful interference from licensed or unlicensed

operators in our or adjacent bands;

|

|

|

•

|

with respect to

spectrum we will lease in the United States, contractual disputes

with or the bankruptcy or other reorganization of the license

holders, which could adversely affect our control over the spectrum

subject to such license;

|

|

|

•

|

failure of the FCC

or other regulators to renew our spectrum licenses as they expire;

and

|

|

|

•

|

invalidation of our

authorization to use all or a significant portion of our spectrum,

resulting in, among other things, impairment charges related to

assets recorded for such spectrum.

|

If we fail to establish

and maintain an effective system of internal control, we may not be

able to report our financial results accurately or to prevent

fraud. Any inability to report and file our financial results

accurately and timely could harm our business and adversely impact

the trading price of our common stock.

Effective internal

control is necessary for us to provide reliable financial reports

and prevent fraud. If we cannot provide reliable financial reports

or prevent fraud, we may not be able to manage our business as

effectively as we would if an effective control environment

existed, and our business, brand and reputation with investors may

be harmed.

In addition,

reporting a material weakness may negatively impact

investors’ perception of us. We have allocated, and will

continue to allocate, significant additional resources to remedy

any deficiencies in our internal control. There can be no

assurances that our remedial measures will be successful in curing

the any material weakness or that other significant deficiencies or

material weaknesses will not arise in the future.

Interruption or failure of

our information technology and communications systems could impair

our ability to provide our products and services, which could

damage our reputation and harm our operating

results.

We have experienced

service interruptions in some markets in the past and may

experience service interruptions or system failures in the future.

Any unscheduled service interruption adversely affects our ability

to operate our business and could result in an immediate loss of

revenues. If we experience frequent or persistent system or network

failures, our reputation and brand could be permanently harmed. We

may make significant capital expenditures to increase the

reliability of our systems, but these capital expenditures may not

achieve the results we expect.

Our products and

services depend on the continuing operation of our information

technology and communications systems. Any damage to or failure of

our systems could result in interruptions in our service.

Interruptions in our service could reduce our revenues and profits,

and our brand could be damaged if people believe our network is

unreliable. Our systems are vulnerable to damage or interruption

from earthquakes, terrorist attacks, floods, fires, power loss,

telecommunications failures, computer viruses, computer denial of

service attacks or other attempts to harm our systems, and similar

events. Some of our systems are not fully redundant, and our

disaster recovery planning may not be adequate. The occurrence of a

natural disaster or unanticipated problems at our network centers

could result in lengthy interruptions in our service and adversely

affect our operating results.

The industries in which we

operate are continually evolving, which makes it difficult to

evaluate our future prospects and increases the risk of your

investment. Our products and services may become obsolete, and we

may not be able to develop competitive products or services on a

timely basis or at all.

The markets in

which we and our customers compete are characterized by rapidly

changing technology, evolving industry standards and communications

protocols, and continuous improvements in products and services.

Our future success depends on our ability to enhance current

products and to develop and introduce in a timely manner new

products that keep pace with technological developments, industry

standards and communications protocols, compete effectively on the

basis of price, performance and quality, adequately address

end-user customer requirements and achieve market acceptance. There

can be no assurance that the deployment of wireless networks will

not be delayed or that our products will achieve widespread market

acceptance or be capable of providing service at competitive prices

in sufficient volumes. In the event that our products are not

timely and economically developed or do not gain widespread market

acceptance, our business, results of operations and financial

condition would be materially adversely affected. There can also be

no assurance that our products will not be rendered obsolete by the

introduction and acceptance of new communications

protocols.

The broadband

services industry is characterized by rapid technological change,

competitive pricing, frequent new service introductions and

evolving industry standards and regulatory requirements. We believe

that our success depends on our ability to anticipate and adapt to

these challenges and to offer competitive services on a timely

basis. We face a number of difficulties and uncertainties

associated with our reliance on technological development, such

as:

|

|

•

|

competition from

service providers using more traditional and commercially proven

means to deliver similar or alternative services;

|

|

|

•

|

competition from

new service providers using more efficient, less expensive

technologies, including products not yet invented or

developed;

|

|

|

•

|

uncertain consumer

acceptance;

|

|

|

•

|

realizing economies

of scale;

|

|

|

•

|

responding

successfully to advances in competing technologies in a timely and

cost-effective manner;

|

|

|

•

|

migration toward

standards-based technology, requiring substantial capital

expenditures; and

|

|

|

•

|

existing, proposed

or undeveloped technologies that may render our wireless broadband

and VoIP telephony services less profitable or

obsolete.

|

As the products and

services offered by us and our competitors develop, businesses and

consumers may not accept our services as a commercially viable

alternative to other means of delivering wireless broadband and

VoIP telephony services.

If we are unable to

successfully develop and market additional services and/or new

generations of our services offerings or market our services and

product offerings to a broad number of customers, we may not remain

competitive.

Our future success

and our ability to increase net revenue and earnings depend, in

part, on our ability to develop and market new additional services

and/or new generations of our current services offerings and market

our existing services offerings to a broad number of customers.

However, we may not be able to, among other things:

|

|

•

|

successfully

develop or market new services or product offerings or enhance

existing services offerings;

|

|

|

•

|

educate third-party

sales organizations adequately for them to promote and sell our

services offerings;

|

|

|

•

|

develop, market and

distribute existing and future services offerings in a

cost-effective manner; or

|

|

|

•

|

operate the

facilities needed to provide our services offerings.

|

If we fail to

develop new service offerings, or if we incur unexpected expenses

or delays in product development or integration, we may lose our

competitive position and incur substantial additional expenses or

may be required to curtail or terminate all or part of our present

planned business operations.

Our failure to do

any of the foregoing could have a material adverse effect on our

business, financial condition and results of operations. In

addition, if any of our current or future services offerings

contain undetected errors or design defects or do not work as

expected for our customers, our ability to market these services

offerings could be substantially impeded, resulting in lost sales,

potential reputation damage and delays in obtaining market

acceptance of these services offerings. We cannot assure you that

we will continue to successfully develop and market new or enhanced

applications for our services offerings. If we do not continue to

expand our services offerings portfolio on a timely basis or if

those products and applications do not receive market acceptance,

become regulatory restricted, or become obsolete, we will not grow

our business as currently expected.

We operate in a very

competitive environment.

There are three

types of competitors for our service offerings.

(1)

The

value-added resellers and other vendors of hardware and software

for on-site installation do not typically have an offering similar

to our cloud-based services. However, they are the primary historic

service suppliers to our targeted customers and will actively work

to defend their customer base.

(2)

There

are a number of providers offering services, but they typically

offer only one or two applications of their choosing instead of our

offering which bundles customer’s chosen

services.

(3)

There

are a few providers that offer more than two applications from the

cloud. However currently, these providers typically offer only

those applications they have chosen.

Our industry is

characterized by rapid change resulting from technological advances

and new services offerings. Certain competitors have substantially

greater capital resources, larger customer bases, larger sales

forces, greater marketing and management resources, larger research

and development staffs and larger facilities than our and have more

established reputations with our target customers, as well as

distribution channels that are entrenched and may be more effective

than ours. Competitors may develop and offer technologies and

products that are more effective, have better features, are easier

to use, are less expensive and/or are more readily accepted by the

marketplace than our offerings. Their products could make our

technology and service offerings obsolete or noncompetitive.

Competitors may also be able to achieve more efficient operations

and distribution than ours may be able to and may offer lower

prices than we could offer profitably. We may decide to alter or

discontinue aspects of our business and may adopt different

strategies due to business or competitive factors or factors

currently unforeseen, such as the introduction by competitors of

new products or services technologies that would make part or all

of our service offerings obsolete or uncompetitive.

In addition, the

industry could experience some consolidation. There is also a risk

that larger companies will enter our markets.

If we fail to maintain

effective relationships with our major vendors, our services

offerings and profitability could suffer.

We use third party

providers for services. In addition, we purchase hardware, software

and services from external suppliers. Accordingly, we must maintain

effective relationships with our vendor base to source our needs,

maintain continuity of supply, and achieve reasonable costs. If we

fail to maintain effective relationships with our vendor base, this

may adversely affect our ability to deliver the best products and

services to our customers and our profitability could

suffer.

Any failure of the

physical or electronic security that resulted in unauthorized

parties gaining access to customer data could adversely affect our

business, financial condition and results of

operations.

We use commercial

data networks to service customers cloud based services and the

associated customer data. Any data is subject to the risk of

physical or electronic intrusion by unauthorized parties. We have a

multi-homed firewalls and Intrusion Detection / Prevention systems

to protect against electronic intrusion and two physical security

levels in our networks. Our policy is to close all external ports

as a default. Robust anti-virus software runs on all client

servers. Systems have automated monitoring and alerting for unusual

activity. We also have a Security Officer who monitors these

systems. We have better security systems and expertise than our

clients can afford separately but any failure of these systems

could adversely affect our business growth and financial

condition.

Demand for our service

offerings may decrease if new government regulations substantially

increase costs, limit delivery or change the use of Internet access

and other products on which our service offerings

depend.

We are dependent on

Internet access to deliver our service offerings. If new

regulations are imposed that limit the use of the Internet or

impose significant taxes on services delivered via the Internet it

could change our cost structure and/or affect our business model.

The significant changes in regulatory costs or new limitations on

Internet use could impact our ability to operate as we anticipate,

could damage our reputation with our customers, disrupt our

business or result in, among other things, decreased net revenue

and increased overhead costs. As a result, any such failure could

harm our business, financial condition and results of

operations.

Our securities, as

offered hereby, are highly speculative and should be purchased only

by persons who can afford to lose their entire investment in us.

Each prospective investor should carefully consider the following

risk factors, as well as all other information set forth elsewhere

in this prospectus, before purchasing any of the shares of our

common stock.

Increasing regulation of

our Internet-based products and services could adversely affect our

ability to provide new products and services.

On

February 26, 2015, the FCC adopted a new "network neutrality"

or Open Internet order (the "2015 Order") that:

(1) reclassified broadband Internet access service as a Title

II common carrier service, (2) applied certain existing Title

II provisions and associated regulations; (3) forbore from

applying a range of other existing Title II provisions and

associated regulations, but to varying degrees indicated that this

forbearance may be only temporary and (4) issued new rules

expanding disclosure requirements and prohibiting blocking,

throttling, paid prioritization and unreasonable interference with

the ability of end users and edge providers to reach each other.

The 2015 Order also subjected broadband providers' Internet traffic

exchange rates and practices to potential FCC oversight and created

a mechanism for third parties to file complaints regarding these

matters. The 2015 Order could limit our ability to efficiently

manage our cable systems and respond to operational and competitive

challenges. In December 2017, the FCC adopted an order (the "2017

Order") that in large part reverses the 2015 Order. The 2017 Order

has not yet gone into effect, however, and the 2015 Order will

remain binding until the 2017 Order takes effect. The 2017 Order is

expected to be subject to legal challenge that may delay its effect

or overturn it. Additionally, Congress and some states are

considering legislation that may codify "network neutrality"

rules.

Offering

telephone services may subject us to additional regulatory burdens,

causing us to incur additional costs.

We offer telephone

services over our broadband network and continue to develop and

deploy interconnected VoIP services. The FCC has ruled that

competitive telephone companies that support VoIP services, such as

those that we offer to our customers, are entitled to interconnect

with incumbent providers of traditional telecommunications

services, which ensures that our VoIP services can operate in the

market. However, the scope of these interconnection rights are

being reviewed in a current FCC proceeding, which may affect our

ability to compete in the provision of telephony services or result

in additional costs. It remains unclear precisely to what extent

federal and state regulators will subject VoIP services to

traditional telephone service regulation. Expanding our offering of

these services may require us to obtain certain authorizations,

including federal and state licenses. We may not be able to obtain

such authorizations in a timely manner, or conditions could be

imposed upon such licenses or authorizations that may not be

favorable to us. The FCC has already extended certain traditional

telecommunications requirements, such as E911 capabilities,

Universal Service Fund contribution, Communications Assistance for

Law Enforcement Act ("CALEA"), measures to protect Customer

Proprietary Network Information, customer privacy, disability

access, number porting, battery back-up, network outage reporting,

rural call completion reporting and other regulatory requirements

to many VoIP providers such as us. If additional telecommunications

regulations are applied to our VoIP service, it could cause us to

incur additional costs and may otherwise materially adversely

impact our operations. In 2011, the FCC released an order

significantly changing the rules governing intercarrier

compensation for the origination and termination of telephone

traffic between interconnected carriers. These rules have resulted

in a substantial decrease in interstate compensation payments over

a multi-year period. The FCC is currently considering additional

reforms that could further reduce interstate compensation payments.

Further, although the FCC recently declined to impose additional

regulatory burdens on certain point to point transport ("special

access") services provided by cable companies, that FCC decision

has been appealed by multiple parties. If those appeals are

successfully, there could be additional regulatory burdens and

additional costs placed on these services.

We may engage in

acquisitions and other strategic transactions and the integration

of such acquisitions and other strategic transactions could

materially adversely affect our business, financial condition and

results of operations.

Our business has

grown significantly as a result of acquisitions, including the

Acquisitions, which entail numerous risks including:

•

distraction of our

management team in identifying potential acquisition targets,

conducting due diligence and negotiating acquisition

agreements;

•

difficulties in

integrating the operations, personnel, products, technologies and

systems of acquired businesses;

•

difficulties in

enhancing our customer support resources to adequately service our

existing customers and the customers of acquired

businesses;

•

the potential loss

of key employees or customers of the acquired

businesses;

•

unanticipated

liabilities or contingencies of acquired

businesses;

•

unbudgeted costs

which we may incur in connection with pursuing potential

acquisitions which are not consummated;

•

failure to achieve

projected cost savings or cash flow from acquired businesses, which

are based on projections that are inherently

uncertain;

•

fluctuations in our

operating results caused by incurring considerable expenses to

acquire and integrate businesses before receiving the anticipated

revenues expected to result from the acquisitions;

and

•

difficulties in

obtaining regulatory approvals required to consummate

acquisitions.

We also participate

in competitive bidding processes, some of which may involve

significant cable systems. If we are the winning bidder in any such

process involving significant cable systems or we otherwise engage

in acquisitions or other strategic transactions in the future, we

may incur additional debt, contingent liabilities and amortization

expenses, which could materially adversely affect our business,

financial condition and results of operations. We could also issue

substantial additional equity which could dilute existing

stockholders.

If our

acquisitions, including the Acquisitions and the integration of the

Optimum and Suddenlink businesses, do not result in the anticipated

operating efficiencies, are not effectively integrated, or result

in costs which exceed our expectations, our business, financial

condition and results of operations could be materially adversely

affected.

Significant unanticipated

increases in the use of bandwidth-intensive Internet-based services

could increase our costs.

The rising

popularity of bandwidth-intensive Internet-based services poses

risks for our broadband services. Examples of such services include

peer-to-peer file sharing services, gaming services and the

delivery of video via streaming technology and by download. If

heavy usage of bandwidth-intensive broadband services grows beyond

our current expectations, we may need to incur more expenses than

currently anticipated to expand the bandwidth capacity of our

systems or our customers could have a suboptimal experience when

using our broadband service. In order to continue to provide

quality service at attractive prices, we need the continued

flexibility to develop and refine business models that respond to

changing consumer uses and demands and to manage bandwidth usage

efficiently. Our ability to undertake such actions could be

restricted by regulatory and legislative efforts to impose

so-called "net neutrality" requirements on broadband communication

providers like us that provide broadband services. For more

information, see "Regulation—Broadband."

We operate

in a highly competitive business environment which could materially

adversely affect our business, financial condition, results of

operations and liquidity.

We operate in a

highly competitive, consumer-driven industry and we compete against

a variety of broadband, pay television and telephony providers and

delivery systems, including broadband communications companies,

wireless data and telephony providers, satellite-delivered video

signals, Internet-delivered video content and broadcast television

signals available to residential and business customers in our

service areas. Some of our competitors include AT&T and its

DirecTV subsidiary, CenturyLink, DISH Network, Frontier and

Verizon. In addition, our pay television services compete with all

other sources of leisure, news, information and entertainment,

including movies, sporting or other live events, radio broadcasts,

home-video services, console games, print media and the

Internet.

In some instances,

our competitors have fewer regulatory burdens, easier access to

financing, greater resources, greater operating capabilities and

efficiencies of scale, stronger brand-name recognition,

longstanding relationships with regulatory authorities and

customers, more subscribers, more flexibility to offer promotional

packages at prices lower than ours and greater access to

programming or other services. This competition creates pressure on

our pricing and has adversely affected, and may continue to affect,

our ability to add and retain customers, which in turn adversely

affects our business, financial condition and results of

operations. The effects of competition may also adversely affect

our liquidity and ability to service our debt. For example, we face

intense competition from Verizon and AT&T, which have network

infrastructure throughout our service areas. We estimate that

competitors are currently able to sell a fiber-based triple play,

including broadband, pay television and telephony services, and may

expand these and other service offerings to our potential

customers.

Our competitive

risks are heightened by the rapid technological change inherent in

our business, evolving consumer preferences and the need to

acquire, develop and adopt new technology to differentiate our

products and services from those of our competitors, and to meet

consumer demand. We may need to anticipate far in advance which

technology we should use for the development of new products and

services or the enhancement of existing products and services. The

failure to accurately anticipate such changes may adversely affect

our ability to attract and retain customers, which in turn could

adversely affect our business, financial condition and results of

operations. Consolidation and cooperation in our industry may allow

our competitors to acquire service capabilities or offer products

that are not available to us or offer similar products and services

at prices lower than ours. For example, Comcast and Charter

Communications have agreed to jointly explore operational

efficiencies to speed their respective entries into the wireless

market, including in the areas of creating common operating

platforms and emerging wireless technology platforms. In addition,

changes in the regulatory and legislative environments may result

in changes to the competitive landscape.

In addition,

certain of our competitors own directly or are affiliated with

companies that own programming content or have exclusive

arrangements with content providers that may enable them to obtain

lower programming costs or offer exclusive programming that may be

attractive to prospective subscribers. For example, DirecTV has

exclusive arrangements with the National Football League that give

it access to programming we cannot offer. AT&T also has an

agreement to acquire Time Warner, which owns a number of cable

networks, including TBS, CNN and HBO, as well as Warner Bros.

Entertainment, which produces television, film and home-video

content. AT&T's and DirecTV's potential access to Time Warner

programming could allow AT&T and DirecTV to offer competitive

and promotional packages that could negatively affect our ability

to maintain or increase our existing customers and revenues. DBS

operators such as DISH Network and DirecTV also have marketing

arrangements with certain phone companies in which the DBS

provider's pay television services are sold together with the phone

company's broadband and mobile and traditional phone

services.

Most broadband

communications companies, which already have wired networks, an

existing customer base and other operational functions in place

(such as billing and service personnel), offer DSL services. We

believe DSL service competes with our broadband service and is

often offered at prices lower than our Internet services. However,

DSL is often offered at speeds lower than the speeds we offer. In

addition, DSL providers may currently be in a better position to

offer Internet services to businesses since their networks tend to

be more complete in commercial areas. They may also increasingly

have the ability to combine video services with telephone and

Internet services offered to their customers, particularly as

broadband communications companies enter into co-marketing

agreements with other service providers. In addition, current and

future fixed and wireless Internet services, such as 3G, 4G and 5G

fixed and wireless broadband services and Wi-Fi networks, and

devices such as wireless data cards, tablets and smartphones, and

mobile wireless routers that connect to such devices, may compete

with our broadband services.

Our telephony

services compete directly with established broadband communications

companies and other carriers, including wireless providers, as

increasing numbers of homes are replacing their traditional

telephone service with wireless telephone service. We also compete

against VoIP providers like Vonage, Skype, GoogleTalk, Facetime,

WhatsApp and magicJack that do not own networks but can provide

service to any person with a broadband connection, in some cases

free of charge. In addition, we compete against ILECs, other CLECs

and long-distance voice-service companies for large commercial and

enterprise customers. While we compete with the ILECs, we also

enter into interconnection agreements with ILECs so that our

customers can make and receive calls to and from customers served

by the ILECs and other telecommunications providers. Federal and

state law and regulations require ILECs to enter into such

agreements and provide facilities and services necessary for

connection, at prices subject to regulation. The specific price,

terms and conditions of each agreement, however, depend on the

outcome of negotiations between us and each ILEC. Interconnection

agreements are also subject to approval by the state regulatory

commissions, which may arbitrate negotiation impasses. These

agreements, like all interconnection agreements, are for limited

terms and upon expiration are subject to renegotiation, potential

arbitration and approval under the laws in effect at that

time.

We also face

competition for our advertising sales from traditional and

non-traditional media outlets, including television and radio

stations, traditional print media and the Internet.

We face significant risks

as a result of rapid changes in technology, consumer expectations

and behavior.

The broadband

communications industry has undergone significant technological

development over time and these changes continue to affect our

business, financial condition and results of operations. Such

changes have had, and will continue to have, a profound impact on

consumer expectations and behavior. Our video business faces

technological change risks as a result of the continuing

development of new and changing methods for delivery of programming

content such as Internet-based delivery of movies, shows and other

content which can be viewed on televisions, wireless devices and

other developing mobile devices. Consumers' video consumption

patterns are also evolving, for example, with more content being

downloaded for time-shifted consumption. A proliferation of

delivery systems for video content can adversely affect our ability

to attract and retain subscribers and the demand for our services

and it can also decrease advertising demand on our delivery

systems. Our broadband business faces technological challenges from

rapidly evolving wireless Internet solutions. Our telephony service

offerings face technological developments in the proliferation of

telephony delivery systems including those based on Internet and

wireless delivery. If we do not develop or acquire and successfully

implement new technologies, we will limit our ability to compete

effectively for subscribers, content and advertising. In addition,

we may be required to make material capital and other investments

to anticipate and to keep up with technological change. These

challenges could adversely affect our business, financial condition

and results of operations.

Our revenues and growth

may be constrained due to demand exceeding capacity of our systems

or our inability to develop solutions.

We anticipate

generating revenues in the future from broadband connectivity,

other Internet services, and broadband and in the cloud services.

Demand and market acceptance for these recently introduced services

and products delivered over the Internet is uncertain. Critical

issues concerning the use of the Internet, such as ease of access,

security, reliability, cost and quality of service, exist and may

affect the growth of Internet use or the attractiveness of

conducting commerce online. In addition, the Internet and online

services may not be accepted as viable for a number of reasons,

including potentially inadequate development of the necessary

network infrastructure or delayed development of enabling

technologies and performance improvements. To the extent that the

Internet and online services continue to experience significant

growth, there can be no assurance that the infrastructure of the

Internet and online services will prove adequate to support

increased user demands. In addition, the Internet or online

services could lose their viability due to delays in the

development or adoption of new standards and protocols required to

handle increased levels of Internet or online service activity.

Changes in, or insufficient availability of, telecommunications

services to support the Internet or online services also could

result in slower response times and adversely affect usage of the

Internet and online services generally and us in particular. If use

of the Internet and online services does not continue to grow or

grows more slowly than expected, if the infrastructure for the

Internet and online services does not effectively support growth

that may occur, or if the Internet and online services do not

become a viable commercial marketplace, our business could be

adversely affected.

Certain aspects of

our VoIP telephony services differ from traditional telephone

service. The factors that may have this effect

include:

|

|

|

|

|

|

•

|

our subscribers may

experience lower call quality than they experience with traditional

wireline telephone companies, including static, echoes and

transmission delays;

|

|

|

•

|

our subscribers may

experience higher dropped-call rates than they experience with

traditional wireline telephone companies; and

|

|

|

•

|

a power loss or

Internet access interruption causes our service to be

interrupted.

|

Additionally, our

VoIP emergency calling service is significantly more limited than

the emergency calling services offered by traditional telephone

companies. Our VoIP emergency calling service can only transmit to

a dispatcher at a public safety answering point, or PSAP, the

location information that the subscriber has registered with us,

which may at times be different from the actual location at the

time of the call. As a result, our emergency calling systems may

not assure that the appropriate PSAP is reached and may cause

significant delays, or even failures, in callers’ receipt of

emergency assistance. Our failure to develop or operate an adequate

emergency calling service could subject us to substantial

liabilities and may result in delays in subscriber adoption of our

VoIP telephony services or all of our services, abandonment of our

services by subscribers, and litigation costs, damage awards and

negative publicity, any of which could harm our business,

prospects, financial condition or results of

operations.

If our subscribers

do not accept the differences between our VoIP telephony services

and traditional telephone service, they may not adopt or keep our

VoIP telephony services or our other services, or may choose to

retain or return to service provided by traditional telephone

companies. Because VoIP telephony services represent an important

aspect of our business strategy, failure to achieve

subscribers’ acceptance of our VoIP telephony services may

adversely affect our prospects, results of operations and the

trading price of our shares.

We rely on

contract manufacturers and a limited number of third-party

suppliers to produce our network equipment and to maintain our

network sites. If these companies fail to perform, we may have a

shortage of components and may be required to suspend our network

deployment and our product and service

introduction.

We depend on

contract manufacturers, to produce and deliver acceptable, high

quality products on a timely basis. We also depend on a limited

number of third parties to maintain our network facilities. If our

contract manufacturer or other providers do not satisfy our

requirements, or if we lose our contract manufacturers or any other

significant provider, we may have an insufficient network services

for delivery to subscribers, we may be forced to suspend portions

of our wireless broadband network, enrollment of new subscribers,

and product sales and our business, prospects, financial condition

and operating results may be harmed.

We rely on highly

skilled executives and other personnel. If we cannot retain and

motivate key personnel, we may be unable to implement our business

strategy.

We will be highly

dependent on the scientific, technical, and managerial skills of

certain key employees, including technical, research and

development, sales, marketing, financial and executive personnel,

and on our ability to identify, hire and retain additional

personnel. To accommodate our current size and manage our

anticipated growth, we must expand our employee base. Competition

for key personnel, particularly persons having technical expertise,

is intense, and there can be no assurance that we will be able to

retain existing personnel or to identify or hire additional

personnel. The need for such personnel is particularly important

given the strains on our existing infrastructure and the need to

anticipate the demands of future growth. In particular, we are

highly dependent on the continued services of our senior management

team, which currently is composed of a small number of individuals.

We do not maintain key-man life insurance on the life of any

employee. The inability of us to attract, hire or retain the

necessary technical, sales, marketing, financial and executive

personnel, or the loss of the services of any member of our senior

management team, could have a material adverse effect on

us.

Our future success

depends largely on the expertise and reputation of our founder,

Chairman and Chief Executive Officer Stephen J. Thomas, Richard

Eberhardt, and the other members of our senior management team. In

addition, we intend to hire additional highly skilled individuals

to staff our operations. Loss of any of our key personnel or the

inability to recruit and retain qualified individuals could

adversely affect our ability to implement our business strategy and

operate our business.