BlackRock in Talks With Tencent on China Tie-Up

October 02 2019 - 8:03AM

Dow Jones News

By Jing Yang in Hong Kong and Dawn Lim in New York

BlackRock Inc. has held talks over the past year with Chinese

internet giant Tencent Holdings Ltd., as the world's largest money

manager explores ways to strengthen its foothold in China,

according to people familiar with the matter.

The preliminary discussions with Tencent have been about how to

make BlackRock's tools and models for building investment

portfolios broadly available to the Chinese market, the people

said.

China is a market BlackRock has long coveted. The New York-based

company, which has more than $6.8 trillion in assets under

management globally, has had a presence in the world's

second-largest economy for more than a decade and its top

leadership has earmarked China as a priority.

BlackRock manages a few domestic funds for wealthy clients and

institutional investors on the mainland and has offshore investment

funds that hold Chinese stocks and bonds. In June, it said it had

been approved to offer investment advisory services to asset

managers, securities firms and other institutions in the country.

Like other foreign asset managers, BlackRock has so far been

restricted from selling its own mass-market mutual funds in China,

but is expected to apply to do so when Chinese authorities open up

the sector further in the coming year.

Tencent is among a number of companies that BlackRock is in

talks with as it evaluates potential partners in China, said one of

the people familiar with the discussions.

Shenzhen-based Tencent is one of China's largest internet and

technology companies and owns the popular Chinese social-media

network WeChat. It also runs one of the country's two largest

mobile-payment networks and has a burgeoning financial-services

business that sells mutual funds and investment products to about

150 million people in the country.

BlackRock's talks with Tencent are at an early stage and there

is no guarantee that a partnership will result. The discussions are

also taking place while trade talks between Beijing and Washington

are in flux.

There have been differing views among BlackRock staffers about

what a tie-up with Tencent could entail. The discussions have

focused on BlackRock's tools for constructing portfolios and

recommending investment combinations, and how they could

potentially be offered via a Tencent platform, said some of the

people.

There have also been talks about codeveloping a financial

software system modeled after Aladdin, a BlackRock technology

platform that the firm currently uses and sells to other asset

managers and financial institutions, according to one person

familiar with the matter. Aladdin is used by portfolio managers

globally to model risks and help them execute trades. In China,

leading trading and financial-software providers are all domestic

and the largest player is Hundsun Technologies Inc., which is

controlled by billionaire Jack Ma.

Some employees at BlackRock have been encouraging staffers in

Asia to deepen ties with Tencent, according to a person familiar

with the matter, particularly after BlackRock's rival Vanguard

Group formed a joint venture earlier this year with Ant Financial

Services Group, an affiliate of Alibaba Group Holding Ltd. that is

also controlled by Mr. Ma.

The company that Ant and Vanguard jointly incorporated, however,

hasn't disclosed what it plans to do and is still awaiting

regulatory approval to commence business.

Any potential tie-up could give Tencent, which competes fiercely

with Ant in mobile payments and sales of mutual funds, a way to

gain new ground in China's large and fast-growing financial

technology sector. In late September, a Tencent subsidiary and

China International Capital Corp., a state-backed investment bank,

said they had formed a technology joint venture to focus on the

bank's retail brokerage and wealth-management services, among other

things. The companies said the venture may extend services to other

financial institutions in the future.

BlackRock ultimately has ambitions to become a meaningful player

in China's $1.8 trillion domestic mutual-fund industry, which is

expected to expand significantly in the coming years. Earlier this

year, BlackRock appointed a new head of China, Tony Tang,

previously a securities regulator and the former chief executive of

one of the country's largest domestic investment managers. He has

been tasked with developing and executing BlackRock's business

strategy in the country.

At present, BlackRock's China business is relatively small

because of restrictions authorities have placed on the domestic

activities of foreign asset managers. An equity cap on foreign

asset managers' holdings in mutual-fund firms will be scrapped next

year and BlackRock, Fidelity International, and several other large

global money managers are expected to apply for licenses to manage

mutual funds.

Stella Yifan Xie contributed to this article.

Write to Dawn Lim at dawn.lim@wsj.com

(END) Dow Jones Newswires

October 02, 2019 07:48 ET (11:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

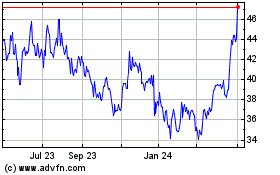

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

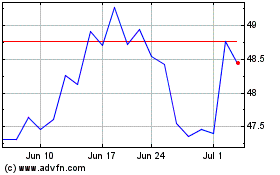

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024