Naspers to List Its $134bn Tencent Stake in Europe

March 25 2019 - 9:29AM

Dow Jones News

By WSJ City

Africa's most valuable company, Naspers, plans to separately

list its internet assets in Amsterdam, creating a European traded

tech giant that will house its $134bn stake in China's Tencent

Holdings.

The new entity will consist of all the conglomerate's internet

interests outside of South Africa, including its 31% stake in

Tencent, as well as holdings in Russian social-media operator

Mail.ru Group and US online marketplace Letgo.

KEY FACTS

--- Naspers said it would hold 75% of the Euronext

Amsterdam-listed business.

--- It will have a secondary listing on the Johannesburg Stock

Exchange.

--- It said the listing would happen no earlier than the second

half of this year.

--- The move will allow investors to directly access its

portfolio of international internet assets.

--- CEO Bob van Dijk declined to comment on the potential value

of the new entity.

Why This Matters

Naspers, with a market value around $100bn, currently trades at

a discount to the value of its stake in Tencent, despite having

additional profitable businesses. Naspers says that many

institutional investors in South Africa have been forced to sell

their shares in the company as it grew because of rules limiting

how much they can invest in a single stock.

A fuller story is available on WSJ.com

WSJ City: The news, the key facts and why it matters. Be deeply

informed in less than five minutes. You can find more concise

stories like this on the WSJ City app. Download now from the App

Store or Google Play, or sign up to newsletters here

http://www.wsj.com/newsletters?sub=356&mod=djemwsjcity

(END) Dow Jones Newswires

March 25, 2019 09:14 ET (13:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

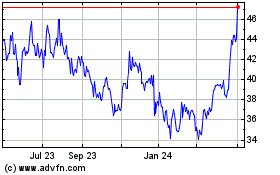

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

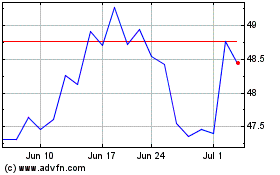

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024