Current Report Filing (8-k)

January 16 2020 - 4:23PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of

1934

Date of Report (Date of earliest event reported):

January 15, 2020

SUGARMADE, INC.

(Exact name of registrant as specified in its

charter)

|

Delaware

|

|

000-23446

|

|

94-3008888

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

750 Royal Oaks Dr., Suite 108

Monrovia, CA

|

|

91016

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (888) 982-1628

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule

14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule

13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the

Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

SGMD

|

OTCQB

|

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [

]

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

On October

30, 2019, SGMD closed the previously announced acquisition of BZRTH, Inc., a Nevada corporation (“BZRTH”) pursuant

to a Stock Exchange Agreement. BZRTH is headquartered in Irwindale, California and is a marketer and manufacturer of hydroponic

growth supplies and related products to distributors and retailers. The total consideration to be paid by the Company to acquire

BZRTH was 650,000,000 shares of SGMD’s common stock, 3,500,000 shares of Series B convertible preferred stock, $870,000 in

cash, and 5% promissory notes in the sum of $7,130,000.00 due on or before October 31, 2021 to the BZRTH shareholders. $870,000

of cash had been paid along with 449,373,817 common shares and 750,000 Series B Convertible Preferred shares.

On January

15, 2020, the Company entered into a Rescission and Mutual Release Agreement (“Agreement”) with each of the parties

agreeing to return all consideration exchanged pursuant to the Stock Exchange Agreement. The Agreement provided for mutual releases

and indemnities.

The shareholders

of BZRTH have agreed to surrender for cancellation, 449,373,817 common shares and 750,000 Series B Convertible Preferred shares.

On an as converted to common basis the returns to Sugarmade’s treasury equal 449,373,817 relating to the common shares to

be surrendered and 750,000,000 million common shares equivalents due to each Series B Convertible Preferred share converting to

common shares on a 1 for 1,000 basis. Thus, on a common share equivalent basis, the surrender equals 1,199,373,817 common shares,

if all Preferred Series B were converted. As part of the Agreement, the Company will retain or will receive 102,248 shares in BZRTH.

The foregoing description

of the Mutual Rescission and Settlement Agreements does not purport to be complete and is qualified in its entirety by reference

to the full text of the Rescission Agreements, copies of which are filed as exhibits to this Current Report on Form 8-K and incorporated

by reference herein.

Item 1.02 Termination of a Material Definitive

Agreement.

The

information called for by this item is contained in Item 1.01, which is incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition

of Assets.

The

information called for by this item is contained in Item 1.01, which is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SUGARMADE, INC.

|

|

|

|

|

|

|

|

Date: January 16, 2020

|

By:

|

/s/ Jimmy Chan

|

|

|

|

|

Name: Jimmy Chan

|

|

|

|

|

Title: Chief Executive Officer

|

|

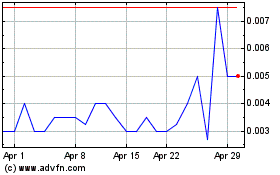

Sugarmade (PK) (USOTC:SGMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

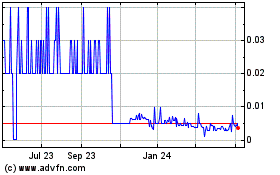

Sugarmade (PK) (USOTC:SGMD)

Historical Stock Chart

From Apr 2023 to Apr 2024