Information Statement - All Other (definitive) (def 14c)

July 09 2020 - 5:29PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C INFORMATION

(Rule

14c-101)

Information

Statement Pursuant to Section 14(c)

of

the Securities Exchange Act of 1934

(Amendment

No. )

|

Check

the appropriate box:

|

|

|

|

[ ]

|

Preliminary

information statement

|

|

[ ]

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

[X]

|

Definitive

information statement

|

SPARTA

COMMERCIAL SERVICES, INC.

(Name

of Registrant as Specified in Its Charter)

Payment

of filing fee (Check the appropriate box):

|

[X]

|

No fee required.

|

|

|

|

|

[ ]

|

Fee computed on table below per Exchange Act

Rules 14c-5(g) and 0-11.

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction

applies:

|

|

|

Common Stock, $.001 par value, per share

|

|

(2)

|

Aggregate number of securities to which transaction

applies: 627,092,904

|

|

|

|

|

(3)

|

Per unit price or other underlying value of

transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state

how it was determined):

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

|

[ ]

|

Fee paid previously with preliminary materials.

|

|

[ ]

|

Check box if any part of the fee is offset as

provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify

the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

|

|

(1)

|

Amount previously paid:

|

|

|

|

|

(2)

|

Form, schedule or registration statement no.:

|

|

|

|

|

(3)

|

Filing party:

|

|

|

|

|

(4)

|

Date filed:

|

|

|

|

SPARTA

COMMERICAL SERVICES, INC.

INFORMATION

STATEMENT

GENERAL

INFORMATION

General

Sparta

Commercial Services, Inc., a Nevada corporation (the “Company”) is providing this Information Statement (this “Information

Statement”), which is being mailed or furnished on or about July 9, 2020 to the holders of the Company’s common

stock, par value $.001 per share (the “Common Stock”) on such date, as notification that in accordance with the provisions

of Section 78-2055 of the Nevada Revised Statutes holders of a majority of the issued and outstanding shares of Common Stock of

the Company, by means of a written consent in lieu of a special meeting of the stockholders (the “Written Consent”,)

voted in favor of decreasing the number of issued and outstanding shares of Common Stock by effecting a 1 for 100 reverse split

of the Company’s common shares outstanding held by each holder of record of Common Stock at the effective date which shall

occur on the 21st calendar day after the Company files this Form 14(c)2 Information Statement with the Securities and

Exchange Commission (the “Effective Date”) .

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

This

Information Statement is being provided pursuant to the requirements of Rule 14c-2 promulgated under Section 14 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), to inform holders of the Company’s Common Stock entitled

to vote or give an authorization or consent in regard to the actions authorized by the Written Consent, of the actions to be taken

pursuant to the Written Consent.

Action

by Written Consent

Pursuant

to Section 78.320-2 of the Nevada Revised Statutes, any action that may be taken at a meeting of the stockholders may also be

taken without a meeting, without prior notice and without a vote, if a consent in writing, setting forth the action or actions

so taken, is signed by the holders of outstanding shares of capital stock holding a least a majority of the voting power needed

to approve the action.

Record

Date

The

Board of Directors fixed May 5, 2020 (the “Record Date”) as the record date for determining the stockholders entitled

receive notice of the foregoing action. Only stockholders of record of the Company at the close of business on the Record Date

are entitled to receive this Information Statement.

Date,

Time and Place Information

The

Written Consents, dated between May 9, 2020 and June 12, 2020, executed by the holders of a majority of the outstanding shares

of the Common Stock (the “Majority Stockholders”), have been delivered to the Company’s principal executive

offices at 555 Fifth Avenue, 14th Floor, New York, New York 10017.

Effectiveness

of the Written Consent

In

accordance with the regulations promulgated under the Exchange Act, the authorization of the reverse split may not become effective

until the Effective Date.

Voting

Securities

Common

Stock. On the Record Date, there were 627,092,904 shares of the Common Stock issued and outstanding. Each share of Common Stock

entitles its holder to one vote on the matters put to a vote of the Company’s stockholders.

The

Company’s stockholders entitled to vote were calculated, as of the Record Date, in order to determine the number of shares

of the Common Stock necessary to be voted to approve the reverse split. On the Record Date, the Majority Stockholders owned or

had the right to vote directly or indirectly 441,017,329, shares of the Common Stock, constituting approximately 70.33% of the

shares entitled to be voted in matters to be present to the Company’s stockholders for a vote. All of the Majority Stockholders,

including all of the directors and officers of the Company, cast all of the shares of Common Stock owned by them in favor of the

reverse split.

Security

Ownership of Certain Beneficial Holders and Management

The

table below sets forth information regarding the beneficial ownership of our common stock as of May 5, 2020 by:

each

person known by us to be the beneficial owner of more than 5% of our common stock;

each

of our directors;

each

of our executive officers; and

our

executive officers and directors as a group.

Beneficial

ownership is determined in accordance with the rules of the SEC and includes voting and investment power. Under SEC rules, a person

is deemed to be the beneficial owner of securities which may be acquired by such person upon the exercise of options and warrants

or the conversion of convertible securities within 60 days from the date on which beneficial ownership is to be determined. Each

beneficial owner’s percentage ownership is determined by dividing the number of shares beneficially owned by that person

by the base number of outstanding shares, increased to reflect the beneficially-owned shares underlying options, warrants or other

convertible securities included in that person’s holdings, but not those underlying shares held by any other person.

Unless

indicated otherwise, the address for each person named is c/o Sparta Commercial Services, Inc., 555 Fifth Ave, 14th Floor, New

York, New York 10017.

|

|

|

Number of

|

|

|

Percentage

|

|

|

|

|

Shares

|

|

|

Of Class

|

|

|

|

|

Beneficially

|

|

|

Beneficially

|

|

|

Name

|

|

Owned

|

|

|

Owned

|

|

|

Anthony L. Havens (1)

|

|

|

259,118

|

|

|

|

*

|

|

|

Kristian Srb

|

|

|

398,944

|

|

|

|

*

|

|

|

Jeffrey Bean

|

|

|

103,614

|

|

|

|

*

|

|

|

Sandra L. Ahman

|

|

|

2,467,865

|

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

All current directors and named officers as a group (4 in all) (1)

|

|

|

3,229,541

|

|

|

|

*

|

|

|

(1)

|

Excludes

approximately 50,000 shares of common stock owned by Mr. Havens’ son held in an irrevocable trust account. Mr. Havens

is not the trustee for his son’s trust account, and does not have the sole or shared power to vote or direct the vote

of such shares. Mr. Havens disclaims beneficial ownership of such shares held in his son’s trust account.

|

|

|

|

|

|

Includes

4,003,500 vested options, and 2,669,000 options subject to vesting on May 12, 2012, exercisable at $0.025 per share

until May 12, 2015.

|

*

Represents less than 1%

ACTION

DECREASE

THE NUMBER OF ISSUED AND OUTSTANDING SHARES OF COMMON STOCK THE COMPANY

The

Company’s Board of Directors unanimously recommended, and the Majority Stockholders have approved, a reverse split of 1

for 100 shares of the outstanding shares of Common Stock held by stockholders of record on the Effective Date. If, as a result

of the reverse split, a stockholder is left with a fractional share, such fractional share shall be rounded to the nearest whole

share.

Reasons

for the Reverse Split.

The

effect of the reverse split will be a decrease in the number of issued and outstanding shares of the Company’s Common Stock

which will generally cause a corresponding increase in the per share trading price of the common stock. However, because some

investors may view the reverse stock split negatively, there can be no assurance that the market price of the Common Stock will

reflect proportionately the reverse stock split, that any particular price may be achieved, or that any price gain will be sustained

in the future. Company’s management and Board of Directors believe that a higher per share trading price will broaden the

Company’s potential shareholders by making it possible for additional potential shareholders to purchase the stock who are

presently prohibited from doing so by their brokerage firms, which by policy typically will not allow trading in shares trading

below a certain price per share or may charge additional fees for trading the lower priced stock.

By

Order of the Board of Directors

|

By:

|

/s/ Anthony L. Havens

|

|

|

|

|

|

|

By:

|

Anthony

L. Havens

|

|

|

Title:

|

Chief

Executive Officer

|

|

|

Dated:

July 9, 2020

|

|

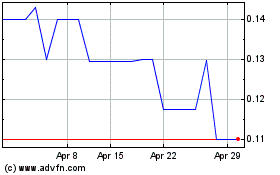

Sparta Commercial Services (PK) (USOTC:SRCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

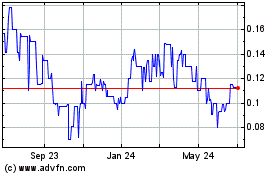

Sparta Commercial Services (PK) (USOTC:SRCO)

Historical Stock Chart

From Apr 2023 to Apr 2024