Current Report Filing (8-k)

November 29 2018 - 4:02PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

November 26, 2018

Date of Report (Date of earliest event reported)

|

SolarWindow Technologies, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

Nevada

(State or other jurisdiction of incorporation)

333-127953

(Commission File Number)

59-3509694

(I.R.S. Employer Identification No.)

9375 East Shea Blvd.

Suite 107-B

Scottsdale, AZ 85260

(Address of principal executive offices)

(800) 213-0689

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 1.01. Entry Into a Material Definitive Agreement.

On November 26, 2018, SolarWindow Technologies, Inc. (the “

Company

”) entered into Subscription Agreements (each, a “

Subscription Agreement

”) with three investors (collectively, the “

Investors

”), including Kalen Capital Corporation, a private corporation owning in excess of 10% of the Company's issued and outstanding common stock, for the purchase and sale of 16,666,667 units of the Company's equity securities (the “

Units

”) at a price of $1.50 per Unit, pursuant to a private placement offering conducted by the Company (the “

Offering

”) for (i) aggregate cash proceeds of $19,800,000 and (ii) conversion of $3,600,000 principal amount of outstanding loan indebtedness and $1,600,000 or accrued and unpaid interest thereon. The Company intends to pay the accrued and unpaid interest on such loan indebtedness in the aggregate amount of $52,181.80 as soon as practicable following the Closing Date.

The Unit price represents an approximately 20% discount to the 20-day lookback of the closing price of the Company's common stock as quoted on the OTC Markets Pink Sheets for the 20 trading days prior to the Closing Date. Each Unit consists of: (i) one (1) share of common stock; and (ii) one (1) Series T Stock Purchase Warrant to purchase one (1) share of common stock at a price of $1.70 per share for a period of seven (7) years commencing on the six month anniversary of the date the Warrants are first issued. (the “

Series T Warrants

”).

The Series T Warrants do not have a cashless exercise provision. The Investors do not have any registration rights with respect to the shares comprising a part of the Units or issuable upon exercise of the Series T Warrants.

The Company intends to use the proceeds from the Offering to continue the development and commercialization efforts of its novel SolarWindow

TM

technology and for general corporate purposes.

In connection with the Offering, the Company entered into agreements (collectively, the “

Amendatory Agreements

”) with KCC pursuant to which KCC agreed to convert the $3,600,000 principal indebtedness and up to $1,600,000 of accrued unpaid interest thereon, into Units on the terms and conditions set forth in the Subscription Agreement.

The summary of the terms of the Offering included in this Current Report on Form 8-K (this “

Report

”) does not purport to be complete and is qualified in its entirety by reference to the Form of Series T Warrant and the Form of Subscription Agreement, and the Amendatory Agreements attached as

Exhibits 4.1

and

10.1

,

10.2

and

10.3

respectively (collectively, the “

Transaction Documents

”) and are incorporated by reference herein; capitalized but undefined terms used in this Report have the meaning ascribed to such term as set forth in the Transaction Documents.

The forms of the Transaction Documents and the Amendatory Agreements have been included to provide investors and security holders with information regarding their terms. They are not intended to provide any other factual information about the Company. The Transaction Documents contain certain representations, warranties and indemnifications resulting from any breach of such representations or warranties. Investors and security holders should not rely on the representations and warranties as characterizations of the actual state of facts because they were made only as of the respective dates of the Transaction Documents. In addition, information concerning the subject matter of the representations and warranties may change after the respective dates of the Transaction Documents, and such subsequent information may not be fully reflected in the Company's public disclosures.

The securities were issued to the Investors pursuant to exemptions from the registration requirements afforded by, among others, Regulation D and Regulation S as certain of the Investors were not U.S. Persons, as such term is defined in Rule 902 of Regulation S.

Item 3.02. Unregistered Sales of Equity Securities.

The information provided in response to

Item 1.01

of this Report is incorporated by reference into this

Item 3.02

.

Item 7.01. Regulation FD Disclosure

On November 28, 2018, SolarWindow Technologies, Inc. (the “

Company

”), developer of transparent coatings that turn ordinary glass into electricity-generating windows, issued a press release announcing the closing of a $25 million equity financing. A copy of the press release is attached as

Exhibit 99.1

hereto.

Except for the historical information presented in this document, the matters discussed in this Form 8-K, or otherwise incorporated by reference into this document, contain “forward-looking statements” (as such term is defined in the Private Securities Litigation Reform Act of 1995). These statements are identified by the use of forward-looking terminology such as “believes,” “plans,” “intend,” ”scheduled,” “potential,” “continue,” “estimates,” “hopes,” “goal,” “objective,” “expects,” “may,” “will,” “should” or “anticipates” or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy that involve risks and uncertainties. The safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, apply to forward-looking statements made by the Registrant. The reader is cautioned that no statements contained in this Form 8-K should be construed as a guarantee or assurance of future performance or results. These forward-looking statements involve risks and uncertainties, including those identified within this Form 8-K. The actual results that the Registrant achieves may differ materially from any forward-looking statements due to such risks and uncertainties. These forward-looking statements are based on current expectations, and the Registrant assumes no obligation to update this information. Readers are urged to carefully review and consider the various disclosures made by the Registrant in this Form 8-K and in the Registrant’s other reports filed with the Securities and Exchange Commission that attempt to advise interested parties of the risks and factors that may affect the Registrant's business.

Note: Information in this report furnished pursuant to Item 7 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in this current report shall not be incorporated by reference into any registration statement pursuant to the Securities Act of 1933, as amended. The furnishing of the information in this current report is not intended to, and does not, constitute a representation that such furnishing is required by Regulation FD or that the information this current report contains is material investor information that is not otherwise publicly available.

Item 9.01. Financial Statements and Exhibits

|

Exhibit No.

|

|

Description

|

|

4.1

|

|

Form of Series T Stock Purchase Warrant

|

|

|

|

|

|

10.1

|

|

Form of Subscription Agreement

|

|

|

|

|

|

10.2

|

|

Amendment dated November 26, 2018 to the March 4, 2015 Bridge Loan Agreement, as amended, by and between SolarWindow Technologies, Inc. and Kalen Capital Holdings, LLC a wholly owned subsidiary of Kalen Capital Corporation.

|

|

|

|

|

|

10.3

|

|

Amendment dated November 26, 2018 to the November 10, 2014 Bridge Loan Agreement, as amended, by and between SolarWindow Technologies, Inc. and Kalen Capital Corporation.

|

|

|

|

|

|

99.1

|

|

Press Release dated November 28, 2018

|

[SIGNATURE PAGE FOLLOWS]

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on November 28, 2018.

|

|

SolarWindow Technologies, Inc.

|

|

|

|

|

|

|

|

By:

|

/s/ John Conklin

|

|

|

|

Name:

|

John Conklin

|

|

|

|

Title:

|

President and Chief Executive Officer

|

|

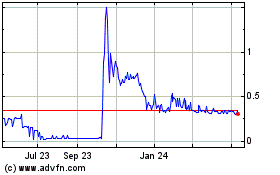

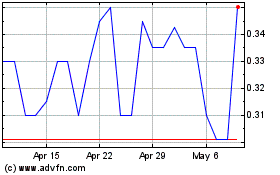

Solarwindow Technologies (PK) (USOTC:WNDW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Solarwindow Technologies (PK) (USOTC:WNDW)

Historical Stock Chart

From Apr 2023 to Apr 2024