As filed with

the Securities and Exchange Commission on June 12, 2019

Registration No. 333-231522

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM S-1/A

Amendment

No. 1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ROCKY MOUNTAIN HIGH BRANDS,

INC.

(Exact name of registrant

as specified in its charter)

|

Nevada

|

|

2080

|

|

90-0895673

|

|

(State or other jurisdiction

|

|

(Primary Standard Industrial

|

|

(I.R.S. Employer

|

|

of incorporation or organization)

|

|

Classification Code Number)

|

|

Identification Number)

|

9101 LBJ Freeway, Suite 200

Dallas, TX 75243

(800)-260-9062

(Address, including zip code, and

telephone number, including area code, of registrant’s principal executive offices)

Michael Welch

Chief Executive Officer

Rocky Mountain High Brands,

Inc.

9101 LBJ Freeway, Suite

200

Dallas, TX 75243

(800)-260-9062

(Name, address, including zip code,

and telephone number, including area code, of agent for service)

Joe Laxague, Esq.

Laxague Law, Inc.

1 East Liberty, Suite 600

Reno, NV 89501

(775) 234-5221

Approximate date of commencement

of proposed sale to the public:

As soon as practicable after

this Registration Statement is declared effective.

If any of the securities

being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act

of 1933, check the following box: [X]

If this Form is filed to

register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

[ ]

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. [ ]

Indicate by check

mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

|

Non-accelerated filer (Do not check if a smaller reporting company) [ ]

|

Smaller reporting company [X]

|

|

Emerging Growth Company [X]

|

|

Pursuant to Rule 429(a) under

the Securities Act, the prospectus (“Prospectus”) included in this Registration Statement on Form S- (this “Registration

Statement”) is a combined prospectus and also relates to an aggregate of 66,118

shares

registered and remaining unsold (the “Previously Registered Shares”) under the registrant’s registration statements

on Form S-1 (No. 333-226091), as amended (the “Prior Registration Statement”), which became effective on October 15,

2018 pursuant to Section 8(a) of the Securities Act. Pursuant to Rule 429(b), this Registration Statement, upon effectiveness,

also constitutes a post-effective amendment to the Prior Registration Statement, which post-effective amendment shall hereafter

become effective concurrently with the effectiveness of this Registration Statement and in accordance with Section 8(c) of the

Securities Act.

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities

to be Registered

|

|

Amount to be Registered

(2)

|

|

Proposed Offering

Price Per Share

(1)

$

|

|

Proposed Maximum Aggregate Offering

Price

$

|

|

Amount of Registration Fee

$

|

|

Common stock, par value $0.001 per share, Issuable pursuant

to Securities Purchase Agreement

(3)

|

|

|

30,000,000

|

|

$

|

0.0765

|

|

$

|

2,295,000

|

$

|

278.16

|

|

Total

|

|

|

30,000,000

|

|

$

|

0.0765

|

|

$

|

2,295,000

|

$

|

278.16

|

|

|

(1)

|

Estimated pursuant to Rule 457(c) under the

Securities Act of 1933, as amended (the “Securities Act”), based on the average of the bid and asked price as of a

specified date within 5 business days prior to the date of the filing of this Registration Statement.

|

|

|

(2)

|

Pursuant to Rule 416(a) under the Securities

Act, the securities being registered hereunder include such indeterminate number of additional shares of common stock as may be

issued after the date hereof as a result of stock splits, stock dividends or similar transactions.

|

|

|

(3)

|

This amount is comprised of shares to be issued

to GHS Investments, LLC pursuant to the terms of a Securities Purchase Agreement.

|

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until

the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall

become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus

is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities

and Exchange Commission is effective. This prospectus is not an offer to sell and is not soliciting an offer to buy these securities

in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY

PROSPECTUS

|

SUBJECT

TO COMPLETION

|

DATED:

JUNE 12, 2019

|

Rocky Mountain High Brands, Inc.

30,000,000 Shares

of Common Stock

This prospectus relates

to the resale of up to 30,000,000 shares of our common stock to be offered by the selling stockholder, GHS Investments, LLC (“GHS”).

These 30,000,000 shares of common stock consist of up to 30,000,000 shares of common stock issuable to GHS under the terms of a

Securities Purchase Agreement dated June 27, 2018.

Our registration of the shares

of common stock covered by this prospectus does not mean that the selling stockholder will offer or sell any of such shares of

common stock. The selling stockholder may sell the shares of common stock covered by this prospectus in a number of different ways

and at varying prices. For additional information on the possible methods of sale that may be used by the selling stockholders,

you should refer to the section of this prospectus entitled “Plan of Distribution”. We will not receive any of the

proceeds from the sale of common stock by the selling stockholders.

GHS is an underwriter within

the meaning of the Securities Act of 1933, and any broker-dealers or agents that are involved in selling the shares may be deemed

to be “underwriters” within the meaning of the Securities Act of 1933 in connection with such sales. In such event,

any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed

to be underwriting commissions or discounts under the Securities Act of 1933. We will bear all costs, expenses and fees in connection

with the registration of the common stock. The selling stockholder will bear all commissions and discounts, if any, attributable

to its sales of our common stock.

Our common stock is quoted

on the OTCQB tier of the electronic over-the-counter marketplace operated by OTC Markets Group, Inc. On May 8, 2019, the last reported

sales price for our common stock was $0.073 per share.

Investment in our common

stock involves risk. See “Risk Factors” contained in this prospectus. You should carefully read this prospectus, together

with the documents we incorporate by reference, before you invest in our common stock.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the

adequacy or the accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus

is June 12, 2019.

TABLE OF CONTENTS

You should rely only

on the information contained in this prospectus or in any free writing prospectus that

we

may specifically authorize to be delivered or made available to you. We have not, and the underwriters have not, authorized

anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus

we

may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability

of, any other information that others may give you. This prospectus may only be used where it is legal to offer and sell shares

of our common stock. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time

of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations

and prospects may have changed since that date. We are not, and the selling stockholders are not, making an offer of these securities

in any jurisdiction where the offer is not permitted.

For investors outside

the United States: We have not and the selling stockholders have not done anything that would permit this offering or possession

or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States.

Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions

relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

PROSPECTUS SUMMARY

This summary highlights

information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making

your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our

financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” in each case included elsewhere in this prospectus.

Unless

the context otherwise requires, references to “we,” “our,” “us,” or the “Company”

in this prospectus mean Rocky Mountain High Brands, Inc. on a consolidated basis with its wholly-owned subsidiaries.

Rocky Mountain High Brands,

Inc.

Overview

Rocky

Mountain High Brands, Inc. is a Nevada corporation. RMHB currently operates through its parent company, three wholly-owned subsidiaries

and one minority-owned subsidiary, which the Company controls. All subsidiaries are consolidated for financial reporting purposes:

|

|

•

|

Rocky Mountain High Brands, Inc., an active Nevada corporation

(Parent)

|

|

|

•

|

Wellness For Life Colorado, Inc. (“WFLC”) (f/k/a Rocky

Mountain Hemp Company and Wellness For Life, Inc.), an active Colorado corporation (Subsidiary)

|

|

|

•

|

Eagle Spirit Land & Water Company (“Eagle Spirit”),

an active Oklahoma corporation (Subsidiary)

|

|

|

•

|

Rocky Mountain High Water Company, LLC (“WaterCo”),

an active Delaware limited liability

company

(Subsidiary-consolidated beginning November

12, 2016)

|

|

|

•

|

FitWhey Brands Inc. (“FitWhey”), an active Nevada corporation

(Subsidiary)

|

|

|

•

|

Rocky Mountain High Clothing Company, Inc., an inactive Texas Corporation

(Subsidiary)

|

|

|

•

|

Smarterita, LLC, an inactive Texas limited liability company (Subsidiary)

|

RMHB is a lifestyle brand

management company that markets primarily CBD and hemp-infused products to health-conscious consumers. Our products span various

categories including beverage, food, fitness, and skin care. RMHB also markets a naturally high alkaline spring water and a water-based

protein drink with caffeine and B vitamins. All products comply with federal regulations on hemp products and contain 0.0% tetrahydrocannabinol

(THC), the psychoactive constituent of cannabis.

In March 2018, the Company

launched the HEMPd brand with gummies, water soluble drops, capsules, tinctures, lotions, and salves. The Company introduced four

flavors of CBD-infused waters in 12 oz. cans in November 2018.

In July 2018, the Company

acquired the assets of BFIT Brands, LLC and formed a new subsidiary, FitWhey Brands LLC. FitWhey markets a line-up of five water-based

protein drinks that include caffeine and B vitamins.

During 2017 and 2018,

the Company continued to market its lineup of naturally flavored hemp-infused functional beverages, as well as hemp-infused 2oz.

Mango Energy Shots and Mixed Berry Energy Shots through the first half of 2018. The Company plans to introduce updated offerings

of hemp seed extract-infused functional beverages in the second quarter of 2019 under the name of Rocky Mountain.

Corporate History

Rocky Mountain High Brands

Inc. October 23, 2014 to present – Articles of Amendment filed with the State of Nevada f/k/a Totally Hemp Crazy Inc.

July

17, 2014 to October 23, 2014 – Articles of Amendment filed with the State of Nevada

f/k/a Republic of Texas

Brands Incorporated November 2011 to July 17, 2014 – Articles of Amendment filed with the State of Nevada

f/k/a Legends Food Corporation

May 2011 to November 2011 – Articles of Amendment filed with the State of Nevada

f/k/a Precious Metals Exchange Corp. –

Articles of Amendment filed with the State of Nevada on December 23, 2008

f/k/a Stealth Industries,

Inc. – Articles of Amendment filed with the State of Minnesota on October 25, 1999 (name change). Articles of Incorporation

filed with the State of Nevada on October 30, 2000 (Change of Domicile; Merger with Stealth Industries, Inc. (Minnesota)

f/k/a Assisted Living Corporation

– Articles of Amendment filed with the State of Minnesota on November 3, 1993 (name change) f/k/a Electric Reel Corporation

of America, Inc. -- Articles of Incorporation filed with the State of Minnesota on August 15, 1968

Acquisitions

Rocky Mountain High Water Company

LLC

In July 2016, the Company

entered into a business alliance with Poafpybitty Family, LLC to launch Eagle Spirit Spring Water, a line of purified, high-alkaline

spring water sourced from Native American tribal land in Oklahoma.

The agreement calls for

the Company to pay a royalty on each gallon of water collected at the spring. Production of filtered spring water filled bottles

commenced in August 2016 and sales began in October 2016.

In consideration for the 20-year

water and surface rights, and a related 10-year renewal option, the Company paid Poafpybitty Family, LLC cash payments of $22,500

and issued a warrant for 500,000 shares of the Company’s common stock exercisable at $.03 per share over a three-year period

beginning July 27, 2016.

The agreement grants the Company

an exclusive right to develop land adjacent to the spring for commercial purposes as agreed to by both parties. Additionally, the

Company has agreed to grow hemp for experimental or commercial purposes on the land within three years.

On November 12, 2016, the

agreement with the Poafpybitty Family was amended to give the Company a controlling voting interest of 75% of WaterCo, while

the Poafpybitty Family received a majority 51% of the equity interest. The amended agreement is being accounted for as a

step-acquisition, with the resulting goodwill of $59,163 included in other assets. During the six months ended December 31,

2017, the Company obtained an outside valuation of the rights to use the land and obtain the water described in the

agreement. As a result of that analysis and the continued operating losses by the Company’s spring water business, the

Company determined that its investment, including the related goodwill, was fully impaired. The Company recorded an

impairment expense of $59,163 as of November 12, 2017. As a result of the step-acquisition, beginning on November 12, 2016

the operations of WaterCo are consolidated in the financial statements of RMHB.

FitWhey Brands Inc. (acquisition

of the assets of BFIT Brands, LLC)

In July 2018, the Company

purchased the assets of BFIT Brands, LLC, an Arizona-based company. The acquired assets include the cash, accounts receivable,

inventory, FitWhey software, trademark, and formulas of BFIT’s FitWhey branded water-based protein drinks containing caffeine

and a vitamin-B pack. The Company paid $230,438 including common stock issued to the owners of BFIT of $75,000, forgiveness of

a note receivable of $80,000 plus accrued interest of $438, and $75,000 to be paid to the owners of BFIT over time based on 5%

of net sales of FitWhey products. The acquisition includes $98,297 of assets including cash, accounts receivable, inventory, and

prepaid production costs and $132,141 of intangible assets, including the FitWhey software, trademark, formulas, and goodwill.

The Company is obtaining an outside valuation of these assets.

Our Transactions with GHS

Secured Promissory

Notes

We have eight Secured Promissory

Notes issued and outstanding to GHS in the amounts set forth below. The Notes bear interest at an annual rate of ten percent (10%),

and are secured by all of our assets. A summary of the Notes as currently issued, the amounts due as of May 3, 2019 and due dates

of the Notes are as follows:

|

Note

|

Principal

Amount Owing

|

Accrued

Interest Owing

|

Due

Date

|

|

First

Note (issued Jul 24, 2018)

|

$157,500.00

|

$13,894.52

|

December

1, 2019

|

|

Second

Note (issued August 9, 2018)

|

$157,500.00

|

$13,204.11

|

January

1, 2020

|

|

Third

Note (issued August 30, 2018)

|

$105,000.00

|

$8,198.63

|

February

1, 2020

|

|

Fourth

Note (issued September 14, 2018)

|

$131,250.00

|

$9,708.90

|

March

1, 2020

|

|

Fifth

Note (issued September 28, 2018)

|

$55,000.00

|

$3,797.26

|

March

1, 2020

|

|

Sixth

Note (issued October 12, 2018)

|

$52,500.00

|

$3,480.82

|

April

1, 2020

|

|

Seventh

Note (issued May 3, 2019)

|

$105,000.00

|

$1,121.92

|

February

3, 2020

|

|

Eighth

Note (issued May 16, 2019)

|

$157,500.00

|

$1,121.92

|

February

16, 2020

|

|

Ninth

Note (issued June 7, 2019)

|

$105,000.00

|

$115.07

|

February

16, 2020

|

|

Totals

|

$1,026,250.00

|

$54,643.15

|

March

7, 2020

|

Events of default under the

Notes include: (i) failure to pay installments when due, (ii) failure to timely deliver shares of common stock in the event that

we

have elected such conversion and sent notice of such to GHS, (iii) breach of representations

or warranties made in the Notes, (iv) receivership, bankruptcy, or liquidation, (v) our failure to comply with the reporting requirements

of the Exchange Act, and (vi) failure to maintain OTC quotation of our common stock.

In the event of our default,

the GHS Note will bear interest at an annual rate of 20% and the balances due under the Notes will be accelerated. Further, a

default penalty of 50% will apply to the outstanding balances and GHS may, as a secured creditor, enforce its lien on our assets

and liquidate them under Article 9 of the Uniform Commercial Code. The Notes are not currently in default. The Notes are convertible

at prices ranging from $0.03 to $0.05 per share. GHS’s ability to convert the Notes is limited such that: (i) no conversion

may be effected to the extent that, following such conversion, GHS would own more that 9.99% of our issued and outstanding common

stock; and (ii) for so long as we are not in default under any of the Notes, GHS may not convert, in any calendar month, any portion

of a Note in excess of $50,000. In addition, for so long as we are not in default under any of the Notes, GHS may not, on any

individual trading day, re-sell an amount of shares of common stock received upon conversion of all Notes that is in excess of

fifteen percent (15%) of the total trading volume for such trading day.

Securities Purchase Agreement

With GHS

On June 27, 2018, we entered into

a Securities Purchase Agreement with GHS which provides for GHS’s purchase of up to $15,000,000 worth of our common stock

(the “SPA”). We have previously registered for resale 16,000,000 shares of common stock to be purchased by GHS under

the SPA. To date, we have put a total of 16,000,000 shares to GHS under the SPA for total proceeds to us of approximately $2,194,349.

We are now registering for resale

by GHS up to 30,000,000 additional shares of common stock to be purchased by GHS under the SPA. Under the SPA, GHS has agreed to

purchase up to $15,000,000 worth of our common stock over a period of twenty-four (24) months. Sales of common stock to GHS under

SPA shall be initiated from time to time by our issuance of individual Put Notices to GHS. The price of shares put to GHS under

each Put Notice shall be eighty-two (82%) percent of the “Market Price,” which is the lowest traded price of our common

stock during the ten (10) consecutive trading days preceding the date of the Put Notice. However, in the event that (i) the lowest

volume-weighted average price (“VWAP”) of our common stock for any given trading day during the ten (10) trading days

following a Put Notice (the “Trading Period”) is less than 82% of the Market Price used to determine the Purchase Price

in connection with the Put and (ii) as of the end of such Trading Period, GHS still holds shares issued pursuant to such Put Notice

(the “Trading Period Shares”), then we will be required to issue such additional shares of common stock, on the trading

day immediately following the Trading Period, as may be necessary to adjust the Purchase Price for that portion of the Put represented

by the Trading Period Shares to equal the lowest VWAP during the Trading Period.

The amount and timing of each Put

Notice will be subject to certain limitations: (i) a new Put Notice may not be issued until the prior put has closed, (ii) there

must be a

minimum

of eight (8) trading days between each Put Notice, (iii) no Put

Notice will be effective to the extent that, following the closing of the put, GHS and its affiliates would own more than 9.99%

of our common stock; (iv) the

maximum

dollar amount of each put will not exceed

two

times (2x) the average of the daily trading dollar volume for our common stock during the ten (10) trading days preceding

the put date; and (v) no put will be made in an amount greater than five hundred thousand dollars ($500,000).

Our ability to use the SPA facility

is conditioned upon, among other things, the effectiveness of a registration statement registering the resale by GHS of the shares

of common stock issuable under the SPA. Our obligations in this regard are governed by a Registration Rights Agreement with GHS

dated June 27, 2018 (the “RRA”). The RRA requires us to file a Registration Statement for GHS’s resale of the

Registrable Securities with thirty (30) days, and to use our best efforts to secure effectiveness of the Registration Statement

with ninety (90) days after filing. Once the Registration Statement is effective, we are required to maintain its effectiveness,

by appropriate amendments and/or prospectus supplements, until the earlier to occur of the following: (A) GHS has sold all the

Registrable Securities; or (B) GHS has no right to acquire any additional shares of common stock under the SPA.

A total of 30,000,000 shares

issuable under the SPA are being offered under this Prospectus. At a price of $0.04264 (82% of our market price as of June 11,

2019), a sale of all of these shares to GHS would represent total proceeds to us of $1,279,200. Our actual sale prices to GHS,

however, will be determined by reference to the trading price of our common stock in the market, with GHS receiving a discount

from the market trading price as indicated above. Because market prices of our common stock are subject to constant fluctuations,

the actual amount to be received by us upon sale of the 30,000,000 shares being offered could vary substantially from the listed

offering amount for shares issuable under the SPA. If our stock price were to decrease, the total proceeds available to us upon

sale of the shares being offered under this Prospectus could correspondingly decrease substantially. Please see “Future

Liquidity Requirements” on page 20 for an illustration of the total proceeds which would be received under a range of assumed

trading prices.

Our principal executive offices

are located at 9101 LBJ Freeway, Suite 200, Dallas, TX 75243. Our telephone number is (800) 260-9062. The Company’s website

address is

http://www.rockymountainhighbrands.com

. Information contained on the Company’s website is not incorporated

into this prospectus. Annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments

to those reports are available free of charge through the Securities and Exchange Commission (“SEC”) website at

http://www.sec.gov

as soon as reasonably practicable after those reports are electronically filed with or furnished to the SEC. These reports are

also available on the Company’s website.

Summary of the

Offering

|

Common stock offered by the selling shareholder

|

|

30,000,000 shares

of common stock, consisting of up to 30,000,000 shares of common stock issuable to GHS under the terms of a Securities Purchase

Agreement dated June 27, 2018.

|

|

|

|

|

|

Common stock to be outstanding after this offering

|

|

135,061,000

shares,

assuming all shares issuable to GHS under the Securities Purchase Agreement are issued by us

.

|

|

|

|

|

|

Use of proceeds

|

|

We will not receive any proceeds from the sale of the common stock offered by the selling stockholders.

|

|

|

|

|

|

Risk factors

|

|

See “Risk Factors” beginning on page

9

of this prospectus and the other information included in this prospectus for a discussion

of factors you should carefully consider before investing in our securities.

|

|

|

|

|

|

OTCQB trading symbol

|

|

RMHB

|

Unless we indicate otherwise,

all information in this prospectus is based on 105,598,650 shares of common stock issued and outstanding as of May 8, 2019, and

excludes shares issuable upon conversion of convertible notes and shares issuable upon the conversion of outstanding warrants

and options.

RISK FACTORS

Investing in our common

stock involves a high degree of risk. Prospective investors should carefully consider the risks described below and other information

contained in this prospectus, including our financial statements and related notes before purchasing shares of our common stock.

There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. If any of these risks actually

occurs, our business, financial condition or results of operations may be materially adversely affected. In that case, the trading

price of our common stock could decline and investors in our common stock could lose all or part of their investment.

We have a limited operating

history and operate in a new industry, and we may not succeed.

The hemp oil and beverage businesses

are highly competitive and risky, and competition from companies much bigger than us could adversely affect our operating results.

We compete with many national,

regional and local businesses. We could experience increased competition from existing or new companies in the hemp oil and beverage

channels, which could create increasing pressures to grow ours. If we are unable to maintain our competitive position, we could

experience downward pressure on prices, lower demand for our products, reduced margins, the inability to take advantage of new

business opportunities and the loss of channel share, which would have an adverse effect on our operating results. Other factors

that could affect our business are:

|

|

•

|

National, regional or local economic conditions

|

|

|

•

|

Disposable purchasing power

|

|

|

•

|

Demographic trends; and

|

|

|

•

|

The price of special ingredients that go into our products.

|

We may fail to successfully

implement our growth strategy, which includes direct-to-consumer as well as brick and mortar channels.

Our success as a national brand

requires that we successfully compete online through our proprietary websites, Amazon, and eBay and place our products in national

and local retailers through our distribution network. Failure to achieve sales in any of these areas will have an adverse effect

on our growth.

The hemp oil and beverage

industries are affected by consumer preferences and perceptions. Changes in these preferences and perceptions may lessen the demand

for our products, which would reduce sales and harm our business.

The hemp oil and beverage businesses

are affected by changes in consumer tastes, national, regional and local economic conditions, and demographic trends. If consumer

demand for our brand categories should decrease, our business would suffer.

Increases in the cost of ingredients

and raw materials could materially affect our operating results.

Our principal products contain

hemp oil. Increases in the cost of hemp oil as well as other ingredients such as natural sweeteners, or other raw materials such

as aluminum, which we use for our beverage cans, could have a material adverse effect on our operating results. Significant price

increases, market conditions, weather, acts of God and other disasters could materially affect our operating results.

Increases in ingredients,

raw materials, labor, and other costs could adversely affect our profitability and operating results.

An increase in our operating

costs could adversely affect our profitability. Factors such as inflation, poor hemp harvests, increased labor costs, and increased

energy costs may adversely affect our operating profits. Many of the factors affecting costs are beyond our control and we may

not be able to pass these increased costs along to our customers.

We do not have long-term contracts

with our suppliers, and as a result they could seek to significantly increase prices or fail to deliver.

We typically do not rely on

long-term arrangements with our suppliers. Although

we

have not experienced significant

problems with our suppliers, our suppliers may implement significant price increases or may not meet our requirements in a timely

fashion, if at all. The occurrence of any of the foregoing could have a material adverse effect on our operating results.

Any prolonged disruption in

the operations of any of our co-packing and fulfillment facilities could harm our business.

We generally operate through

co-packing agreements. All of our hemp oil-based gummies, capsules, tinctures, water soluble drops, lotions, and salves are produced

by co-packers in Colorado and direct-to-consumer orders are filled in Dallas. Our newly-formulated beverage products are co-packed

at third-party production facilities in the Dallas area. As a result, any prolonged disruption in the operations of any of these

facilities, whether due to technical or labor difficulties, destruction or damage to the facility, real estate issues or other

reasons, could result in increased costs and reduced revenues and our profitability and prospects could be harmed.

Loss

of key personnel or our inability to attract and retain new qualified personnel could hurt our business and inhibit our ability

to operate and grow successfully.

Our ability to successfully

grow our brands hinges on our ability to attract and retain professionals with talent, integrity, enthusiasm and loyalty. If we

are unable to attract or retain key personnel, our profitability and growth potential could be harmed.

We may not be able to

adequately protect our intellectual property, which could harm the value of our brands and branded products and adversely affect

our business.

We depend in large part on our

brands and branded products and believe that they are very important to our business, as well as on our proprietary hemp infused

processes. We rely on a combination of trademarks, copyrights, service marks, trade secrets and similar intellectual property rights

to protect our brand and branded products. The success of our business depends on our continued ability to use our existing trademarks

and service marks in order to increase brand awareness and further develop our branded products in both domestic and international

markets. We have registered certain trademarks and have other trademark registrations pending in the United States. We may not

be able to adequately protect our trademarks and our use of these trademarks may result in liability for trademark infringement,

trademark dilution or unfair competition. We may from time to time be required to institute litigation to enforce our trademarks

or other intellectual property rights, or to protect our trade secrets. Such litigation could result in substantial costs and diversion

of resources and could negatively affect our sales, profitability and prospects regardless of whether

we

are able to successfully enforce our rights.

We are subject to extensive

government regulation, and our failure to comply with existing or increased regulations could adversely affect our business and

operating results. We are subject to numerous federal, state, local and foreign laws and regulations, including those relating

to:

|

|

•

|

The production of beverages and other products

|

|

|

•

|

The preparation and sale of

food and

beverage products

|

|

|

•

|

Environmental protection

|

|

|

•

|

FDA and state agricultural requirements

|

|

|

•

|

The use of hemp, which is subject to federal regulations

|

|

|

•

|

Interstate commerce and taxation laws

|

|

|

•

|

Working and safety conditions,

minimum

wage and other labor requirements

|

Our annual and quarterly financial

results are subject to significant fluctuations depending on various factors, many of which are beyond our control, which could

adversely affect our ability to satisfy our debt obligations as they become due.

Our sales and operating results

can vary significantly from quarter to quarter and year to year depending on various factors, many of which are beyond our control.

These factors include:

|

|

•

|

Variations in the timing and volume of our sales

|

|

|

•

|

The timing of expenditures in anticipation of future sales

|

|

|

•

|

Sales promotions by us and our competitors

|

|

|

•

|

Changes in competitive and economic conditions generally

|

Consequently, our results of

operations may decline quickly and significantly in response to changes in order patterns or rapid decreases in demand for our

products. We anticipate that fluctuations in operating results will continue in the future. The Company's operating results may

vary. We may incur net losses. The Company expects to experience variability in its revenues and net income. While we intend to

implement our business plan to the fullest extent we can, we may experience net losses.

Factors expected to contribute

to this variability include, among other things:

|

|

•

|

The regulatory environment concerning hemp and food and beverage production

|

|

|

•

|

Climate, seasonality and environmental factors

|

|

|

•

|

Consumer demand for the Company’s products

|

|

|

•

|

Competition in products

|

You should further consider,

among other factors, our prospects for success in light of the risks and uncertainties encountered by companies that, like us,

are in their early stages. For example, unanticipated expenses, problems, and technical difficulties may occur and they may result

in material delays in the operation of our business, in particular with respect to our new products. We may not successfully address

these risks and uncertainties or successfully implement our operating strategies. If we fail to do so, it could materially harm

our business to the point of having to cease operations and could impair the value of our common stock to the point investors may

lose their entire investment.

These factors, among others,

raise substantial doubt about the ability of the Company to continue as a going concern.

We will require additional

capital to finance our operations in the future, but that capital may not be available when it is needed and could be dilutive

to existing stockholders.

We will require additional capital

for future operations. We estimate those requirements to approximate $1,500,000. We plan to finance operations and capital requirements

with funds generated from the following sources:

|

|

•

|

Capital raised through equity and debt offerings

|

|

|

•

|

Available cash and cash investments

|

|

|

•

|

Cash provided by operating activities

|

Current conditions in the capital

markets are such that traditional sources of capital may not be available to us when needed or may be available only on unfavorable

terms. Our ability to raise additional capital, if needed, will depend on conditions in the capital markets, economic conditions

and a number of other factors, many of which are outside our control, and on our financial performance. Accordingly,

we

cannot assure you that

we

will be able to successfully raise additional capital

at all or on terms that are acceptable to us. If

we

cannot raise additional capital

when needed, it may have a material adverse effect on our liquidity, financial condition, results of operations and prospects.

Further, if

we

raise capital by issuing stock, the holdings of our existing stockholders

will be diluted.

If we raise capital by issuing

debt securities, such debt securities would rank senior to our common stock upon our bankruptcy or liquidation. In addition, we

may raise capital by issuing equity securities that may be senior to our common stock for the purposes of dividend and liquidating

distributions, which may adversely affect the market price of our common stock. Finally, upon bankruptcy or liquidation, holders

of our debt securities and shares of preferred stock and lenders with respect to other borrowings will receive a distribution of

our available assets prior to the holders of our common stock. Additional equity offerings may dilute the holdings of our existing

stockholders or reduce the market price of our common stock, or both.

Our stock price has been extremely

volatile and our common stock is not listed on a national stock exchange; as a result, stockholders may not be able to resell their

shares at or above the price paid for them.

The market price of our common

stock has been extremely volatile and could be subject to significant fluctuations due to changes in sentiment in the market regarding

our operations or business prospects, among other factors. Further, our common stock is not listed on a national stock exchange;

we intend to list the common stock on a national stock exchange once we meet the entry criteria. An active public market for our

common stock currently exists on the OTC Markets (www.otcmarkets.com) but may not be sustained. Therefore, stockholders may not

be able to sell their shares at or above the price they paid for them.

Among the factors that could

affect our stock price are:

|

|

•

|

Industry trends and the business success of our vendors

|

|

|

•

|

Actual or anticipated fluctuations in our quarterly financial and operating results and operating results that vary from the expectations of our management or of securities analysts and investors

|

|

|

•

|

Our failure to meet the expectations of the investment community and changes in investment community recommendations or estimates of our future operating results

|

|

|

•

|

Announcements of strategic developments, acquisitions, dispositions, financings, product developments and other materials events by us or our competitors

|

|

|

•

|

Regulatory and legislative developments

|

|

|

•

|

General market conditions

|

|

|

•

|

Other domestic and international macroeconomic factors unrelated to our performance

|

|

|

•

|

Additions or departures of key personnel

|

Sales by our stockholders

of a substantial number of shares of our common stock in the public market could adversely affect the market price of our common

stock.

A substantial portion of our

total outstanding shares of common stock may be sold into the market at any time. Some of these shares are owned by executive officers

and directors, and

we

believe that such holders have no current intention to sell

a significant number of shares of our stock. If all of the major stockholders were to decide to sell large amounts of stock over

a short period of time such sales could cause the market price of our common stock to drop significantly, even if our business

is doing well.

Our financial statements

may not be comparable to those of other companies.

Pursuant to Section 107(b) of

the JOBS Act,

we

have elected to use the extended transition period for complying

with new or revised accounting standards under Section 102(b)(2) of The JOBS Act. This election allows us to delay the adoption

of new or revised accounting standards that have different effective dates for public and private companies until those standards

apply to private companies. As a result, our financial statements may not be comparable to companies that comply with public company

effective dates, and our stockholders and potential investors may have difficulty in analyzing our operating results if comparing

us to such companies.

The success of our new and

existing products and services is uncertain

.

We have committed, and expect

to continue to commit, significant resources and capital to develop and market existing product enhancements and new products.

These products are relatively untested, and

we

cannot assure you that

we

will achieve market acceptance for these products, or other new products that

we

may

offer in the future. Moreover, these and other new products may be subject to significant competition with offerings by new and

existing competitors. In addition, new products and enhancements may pose a variety of technical challenges and require us to attract

additional qualified employees. The failure to successfully develop and market these new products or enhancements could seriously

harm our business, financial condition and results of operations.

Our business is dependent

upon continued market acceptance by consumers

.

We are substantially dependent

on continued market acceptance of our products by consumers. Although

we

believe that

our products in the United States are gaining better consumer acceptance,

we

cannot

predict the future growth rate and size of this market.

If we are able to expand our

operations, we may be unable to successfully manage our future growth.

Since we initiated product sales

in 2015, we have added additional subsidiaries and product lines. These additions have placed substantial strain on our management,

operational, financial, and other resources. If we are able to continue expanding our operations in the United States and in other

countries where we believe our products will be successful, as planned, we may experience periods of rapid growth, which will require

additional resources. Any such growth could place increased strain on our management, operational, financial and other resources,

and we will need to train, motivate, and manage employees, as well as attract management, sales, finance and accounting, international,

technical, and other professionals. In addition, we will need to expand the scope of our infrastructure and our physical resources.

Any failure to expand these areas and implement appropriate procedures and controls in an efficient manner and at a pace consistent

with our business objectives could have a material adverse effect on our business and results of operations.

Any future litigation could

have a material adverse impact on our results of operations, and financial condition and liquidity. The company holds Directors

& Officers insurance with a liability limit of $2,000,000, which may not be sufficient to cover a claim.

Despite our significant efforts

in quality control and preservation, we will face risks of litigation from customers, employees and others in the ordinary course

of business, which may divert our financial and management resources. Any adverse litigation or publicity may negatively impact

our financial condition and results of operations.

Claims of illness or injury

relating to food and beverage quality or handling are common in our industry. While

we

believe

our co-packer and fulfillment partners processes and high standards of quality control will minimize these instances, there is

always a risk of occurrence, and so despite our best efforts to regulate quality control, litigation may occur. In that event,

our financial condition, operating results and cash flows could be harmed.

From time to time we may be

subject to litigation, including potential stockholder derivative actions. Risks associated with legal liability are difficult

to assess and quantify, and their existence and magnitude can remain unknown for significant periods of time. The Company holds

Directors and Officers insurance with a liability limit of $2,000,000, which may not be sufficient to cover a potential claim.

While neither Nevada law nor our articles of incorporation or bylaws require us to indemnify or advance expenses to our officers

and directors involved in such a legal action, we expect that we would do so to the extent permitted by Nevada law.

Our prior operating results

may not be indicative of our future results.

You should not consider prior

operating results with respect to revenues, net income, or any other measure to be indicative of our future operating results.

The timing and amount of future revenues will depend almost entirely on our ability to sell our products to new customers. Our

future operating results will depend upon many other factors, including:

|

|

•

|

The level of product and price competition,

|

|

|

•

|

Our success in expanding our business network and managing our growth,

|

|

|

•

|

Our ability to develop and market product enhancements and new products,

|

|

|

•

|

The timing of product enhancements, activities of and acquisitions by competitors,

|

|

|

•

|

The ability to hire additional qualified employees, and

|

|

|

•

|

The timing of such hiring and our ability to control costs.

|

We have only two outside Board

Directors, which could create conflicts of interests and pose risks from a corporate governance perspective.

Our Board of Directors consists

primarily of current executive officers, which means that

we

have only two outside

or independent directors. The lack of independent directors may prevent the Board from being independent from management in its

judgments and decisions and its ability to pursue the Board responsibilities without undue influence. For example, an independent

Board can serve as a check on management, which can limit management taking unnecessary risks. Furthermore, the lack of a sufficient

number of independent directors creates the potential for conflicts between management and the diligent independent decision-making

process of the Board. In this regard, our lack of an independent compensation committee presents the risk that our executive officers

on the Board may have influence over his/their personal compensation and benefits levels that may not be commensurate with our

financial performance. Furthermore, our lack of outside directors deprives our company of the benefits of various viewpoints and

experience when confronting the challenges

we

face. With only two independent directors

on the Board of Directors, it will be difficult for the Board to fulfill its traditional role as overseeing management.

Our preferred stock may have

rights senior to those of our common stock which could adversely affect holders of common stock.

Our articles of incorporation

give our Board of Directors the authority to issue additional series of preferred stock without a vote or action by our stockholders.

The Board also has the authority to determine the terms of preferred stock, including price, preferences, and voting rights. The

rights granted to holders of preferred stock in the future may adversely affect the rights of holders of our common stock. Any

such authorized class of preferred stock may have a liquidation preference – a pre-set distribution in the event of a liquidation

– that would reduce the amount available for distribution to holders of common stock or superior dividend rights that would

reduce the amount of dividends that could be distributed to common stockholders. In addition, an authorized class of preferred

stock may have voting rights that are superior to the voting rights of the holders of our common stock.

We are an emerging growth

company and, as a result of the reduced disclosure and governance requirements applicable to emerging growth companies, our common

stock may be less attractive to investors.

We are an emerging growth company,

as defined in the JOBS Act, and

we

are eligible to take advantage of certain exemptions

from various reporting requirements applicable to other public companies, but not to emerging growth companies, including, but

not limited to, a requirement to present only

two

years of audited financial statements,

an exemption from the auditor attestation requirement of Section 404 of the Sarbanes-Oxley Act, reduced disclosure about executive

compensation arrangements pursuant to the rules applicable to smaller reporting companies and no requirement to seek non-binding

advisory votes on executive compensation or golden parachute arrangements, although some of these exemptions are available to us

as a smaller reporting company (i.e. a company with less than $75 million of its voting equity held by non-affiliates). We have

elected to adopt these reduced disclosure requirements. We cannot predict if investors will find our common stock less attractive

as a result of our taking advantage of these exemptions. If some investors find our common stock less attractive as a result of

our choices, there may be a less active trading market for our common stock and our stock price may be more volatile.

We do not expect to pay any

cash dividends in the foreseeable future.

We intend to retain our future

earnings, if any, in order to reinvest in the development and growth of our business and, therefore, do not intend to pay dividends

on our common stock for the foreseeable future. Any future determination to pay dividends will be at the discretion of our board

of directors and will depend on our financial condition, results of operations, capital requirements, and such other factors as

our board of directors deems relevant. Accordingly, investors may need to sell their shares of our common stock to realize a return

on their investment, and they may not be able to sell such shares at or above the price paid for them.

We can sell additional shares

of common stock without consulting stockholders and without offering shares to existing stockholders, which would result in dilution

of existing stockholders’ interests in RMHB and could depress our stock price.

Our Articles of Incorporation,

as amended, authorize 200,000,000 shares of common stock, of which 105,598,650 are outstanding as of May 8, 2019; 20,000,000 of

preferred stock, of which 1,000,000 shares of series A preferred stock are designated and no shares are issued and outstanding;

7,000,000 shares of series B preferred stock are designated and no shares are issued and outstanding; 2,000,000 shares of series

C preferred stock are designated and no shares are issued and outstanding; 2,000,000 of series D preferred stock are designated

and no shares are issued and outstanding; and 789,474 shares of Series E preferred stock are designated and no shares are issued

and outstanding. Our Board of Directors is authorized to issue additional shares of our common stock and preferred stock. Although

our Board of Directors intends to utilize its reasonable business judgment to fulfill its fiduciary obligations to our then existing

stockholders in connection with any future issuance of our capital stock, the future issuance of additional shares of our common

stock or preferred stock convertible into common stock would cause immediate, and potentially substantial, dilution to our existing

stockholders, which could also have a material effect on the market value of the shares.

Further, our shares do not have

preemptive rights, which mean we can sell shares of our common stock to other persons without offering purchasers in this offering

the right to purchase their proportionate share of such offered shares. Therefore, any additional sales of stock by us could dilute

an existing stockholder’s ownership interest in our company.

You will experience future

dilution as a result of future equity offerings

We may in the future offer additional

shares of our common stock or other securities convertible into or exchangeable for our common stock. Although no assurances can

be given that we will consummate a financing, in the event we do, or in the event we sell shares of common stock or other securities

convertible into shares of our common stock in the future, additional and substantial dilution will occur. In addition, investors

purchasing shares or other securities in the future could have rights superior to investors in this offering.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

AND INDUSTRY DATA

This prospectus contains forward-looking

statements. Such forward-looking statements include those that express plans, anticipation, intent, contingency, goals, targets

or future development and/or otherwise are not statements of historical fact. These forward-looking statements are based on our

current expectations and projections about future events and they are subject to risks and uncertainties known and unknown that

could cause actual results and developments to differ materially from those expressed or implied in such statements.

In some cases, you can

identify forward-looking statements by terminology, such as “expects”, “anticipates”, “intends”,

“estimates”, “plans”, “potential”, “possible”, “probable”, “believes”,

“seeks”, “may”, “will”, “should”, “could” or the negative of such terms

or other similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties that could cause actual

results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference

to the factors discussed throughout this prospectus.

You should read this prospectus and the documents

that

we

reference herein and therein and have filed as exhibits to the registration

statement, of which this prospectus is part, completely and with the understanding that our actual future results may be materially

different from what

we

expect. You should assume that the information appearing in

this prospectus is accurate as of the date on the front cover of this prospectus only. Because the risk factors referred to above

could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us

or on our behalf, you should not place undue reliance on any forward-looking statements. These risks and uncertainties, along

with others, are described above under the heading “Risk Factors” beginning on page 9 of this prospectus. Further,

any forward-looking statement speaks only as of the date on which it is made, and

we

undertake

no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement

is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for

us to predict which factors will arise. In addition,

we

cannot assess the impact

of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements. We qualify all of the information presented in this prospectus,

and particularly our forward-looking statements, by these cautionary statements.

SELLING STOCKHOLDER

Unless the context otherwise

requires, as used in this prospectus, “selling stockholder” refers to GHS Investments, LLC.

We have prepared this prospectus

to allow the selling stockholder to sell or otherwise dispose of, from time to time, up to 30,000,000 shares of our common stock.

The 30,000,000 shares of common stock to be offered hereby are issuable to the selling stockholder in connection with the Securities

Purchase Agreement with the Selling Stockholder.

No estimate can be given as

to the amount or percentage of common stock that will be held by the selling stockholder after any sales made pursuant to this

prospectus because the selling stockholder is not required to sell any of the common stock being registered under this prospectus.

The following table assumes that the selling stockholder will sell all of the common stock listed in this prospectus.

Unless otherwise indicated

in the footnotes below, the selling stockholder has not had any material relationship with us or any of our affiliates within the

past three years other than as a security holder.

Unless otherwise indicated

in the footnotes below, we believe that: (1) the selling stockholder is not a broker-dealer or affiliate of any broker-dealer,

(2) the selling stockholder does not have direct or indirect agreements or understandings with any person to distribute the common

stock, and (3) the selling stockholder has sole voting and investment power with respect to all common stock beneficially owned.

GHS will be deemed to be an

underwriter within the meaning of the Securities Act. Any profits realized by the selling stockholder may be deemed to be underwriting

commissions.

The following table sets forth information

with respect to the beneficial ownership of our common stock held, as of May 3, 2018 by the selling stockholder and the number

of shares of common stock being registered hereby and information with respect to shares to be beneficially owned by the selling

stockholder after completion of the offering of the shares for resale. The percentages in the following table reflect the shares

beneficially owned by the selling stockholder as a percentage of the total number of shares of common stock outstanding as of

May 3, 2019. As of such date, 105,596,904 shares of common stock were outstanding.

|

Name of Selling Shareholder

|

Shares Owned Prior to this Offering

(1)

|

Total Number of Shares to be Offered for Selling Shareholder Account

|

Total Shares to be Owned Upon Completion of this Offering

|

Percent Owned Upon Completion of this Offering

|

|

GHS Investments, LLC

(2)

|

66,118

|

30,066,118

|

0

|

0

|

|

|

(1)

|

The actual number of shares of common stock offered in this prospectus, and included in the registration

statement of which this prospectus is a part, includes such additional number of shares of common stock as may be issued or issuable

under the Securities Purchase Agreement.

|

|

|

(2)

|

Mark Grober exercises voting and dispositive power with respect to the shares

of our common stock that are beneficially owned by GHS Investments LLC.

|

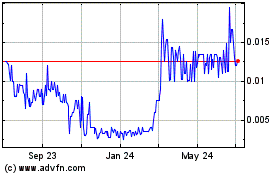

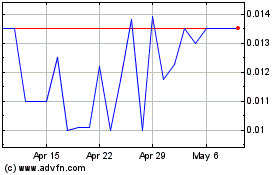

PRICE RANGE OF COMMON STOCK AND RELATED MATTERS

Our common stock is

quoted on the OTCQB tier of the OTC Markets Group quotation system (

www.otcmarkets.com

) under the trading ticker “RMHB.”

The following tables set forth the range of high and low prices for our common stock for the two years ended December 31, 2018,

as reported on the OTC Market Group’s quotation system. These quotations reflect inter-dealer prices, without retail markup,

markdown, or commission and may not necessarily represent actual transactions.

|

Quarter Ended:

|

|

High Sale Price

|

|

Low Sale Price

|

|

March 31, 2017

|

$

|

3.28

|

$

|

0.78

|

|

June 30, 2017

|

$

|

2.22

|

$

|

1.30

|

|

September 30, 2017

|

$

|

1.45

|

$

|

0.34

|

|

December 31, 2017

|

$

|

0.68

|

$

|

0.11

|

|

March 31, 2018

|

$

|

0.61

|

$

|

0.24

|

|

June 30, 2018

|

$

|

0.34

|

$

|

0.20

|

|

September 30, 2018

|

$

|

0.27

|

$

|

0.15

|

|

December 31, 2018

|

$

|

0.33

|

$

|

0.15

|

|

March 31, 2019

|

$

|

0.275

|

$

|

0.082

|

On June 11, 2019, the last sales

price per share of our common stock was $0.052.

Penny Stock

The SEC has adopted rules

that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities

with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on

the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided

by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a

standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in

the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's

duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other

requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask

prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number

for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in

penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC

shall require by rule or regulation.

The broker-dealer also must

provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock;

(b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and

ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly

account statement showing the market value of each penny stock held in the customer's account.

In addition, the penny

stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must

make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's

written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks,

and a signed and dated copy of a written suitability statement.

These disclosure requirements

may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling

our securities.

Holders of Our Common Stock

As of May 8, 2019 there were approximately

271 holders of record of our common stock.

Securities Authorized for Issuance

under Equity Compensation Plans

On March 17, 2017, our

Board of Directors approved the Rocky Mountain High Brands, Inc. 2017 Incentive Plan (the “2017 Incentive Plan”). The

purpose of the Incentive Plan is to provide a means for the Company to continue to attract, motivate and retain management, key

employees, consultants and other independent contractors, and to provide these individuals with greater incentive for their service

to the Company by linking their interests in the Company’s success with those of the Company and its shareholders. The Plan

provided that up to a

maximum

of 1,750,000 shares of the Company’s common stock

(subject to adjustment) are available for issuance under the Plan. The Board of Directors awards these shares at its sole discretion.

Also on March 31, 2017,

certain of our officers and directors returned a total of 1,252,087 shares of common stock to treasury for cancellation. On that

same date, we granted to each of these officers and directors an equivalent number of restricted shares of common stock under our

2017 Incentive Plan. The restricted shares so granted may not be transferred, sold, or encumbered until six (6) months from the

date of issue.

On July 14, 2017 the Board of

Directors increased the authorized shares in the 2017 Incentive Plan to 3,250,000.

On December 19, 2017 the Board of

Directors increased the authorized shares in the 2017 Incentive Plan to 5,000,000 and issued 1,655,000 options to members of the

Board, management and employees.

During the year ended December 31,

2017 the Board granted 1,550,000 options to two new members of the Board of Directors (Mr. Jerry David and Mr. Kevin Harrington),

84,500 options to consultants, and 1,755,000 options to other members of the Board of Directors, officers and employees. Messrs.

David and Harrington resigned from the Board of Directors in July 2017 and joined the newly formed Advisory Board to the Board

of Directors at that time.

During the year ended December 31,

2018 the Board granted 665,623 options to members of the Advisory Board and 12,716 options to consultants.

On January 31, 2019, 2,185,775 options

were forfeited by former members of the Board of Directors. On February 28, 2019, 42,565 options were forfeited by former consultants.

DIVIDEND POLICY

There are no restrictions in our articles of incorporation

or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends

where after giving effect to the distribution of the dividend:

|

|

1.

|

We would not be able to pay

our debts as they become due in the usual course of business, or;

|

|

|

|

|

|

|

2.

|

Our total assets would be less than the sum of our total liabilities plus the amount that

would be needed to satisfy the rights of shareholders

who

have preferential rights

superior to those receiving the distribution.

|

We have not declared any dividends and we do not plan

to declare any dividends in the foreseeable future.

DILUTION

The sale of our common stock

to GHS in accordance with the Securities Purchase Agreement may have a dilutive impact on our shareholders. As a result, our net

income per share could decrease in future periods and the market price of our common stock could decline. In addition, the lower

our stock price is at the time we exercise our put option, the more shares of our common stock we will have to issue to GHS. If

our stock price decreases, then our existing shareholders would experience greater dilution for any given dollar amount raised

through the offering.

The perceived risk

of dilution may cause our stockholders to sell their shares, which would contribute to a decline in the price of our common stock.

Moreover, the perceived risk of dilution and the resulting downward pressure on our stock price could encourage investors to engage

in short sales of our common stock. By increasing the number of shares offered for sale, material amounts of short selling could

further contribute to progressive price declines in our common stock.

Dilution represents

the difference between the offering price (market price) and the net tangible book value per share immediately after completion

of this Offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets (product

development costs) from total assets. Dilution arises mainly as a result of our arbitrary determination of the Offering price of

the shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of shares of

our common stock held by our existing shareholders.

As of December 31, 2018, the net tangible

book value of our shares of common stock was ($1,060,374), or approximately ($0.0112) per share based upon 94,580,869 shares then

outstanding. Upon completion of this Offering, if 100% of the shares are sold (30,000,000 shares) at a discounted market price

of $0.04264 (82% of $0.052 market price) per share, the net tangible book value of the 124,580,870 shares to be outstanding will

be approximately $218,826 or approximately $0.0018 per share

. Based

on these figures, current shareholders will not experience a dilution in terms of net tangible book value per share as a result

of this offering.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

The

following discussion and analysis of financial condition and results of operations should be read together with our financial statements

and accompanying notes appearing elsewhere in this Prospectus. This Management’s Discussion and Analysis contains forward-looking

statements that involve risks and uncertainties. Please see “Forward-Looking Statements” set forth in the beginning

of this Prospectus, and see “Risk Factors” beginning on page 9 for a discussion of certain risk factors applicable

to our business, financial condition, and results of operations. Operating results are not necessarily indicative of results that

may occur in future periods.

Overview

The Company generates revenue

from finished product sales to distributors (resellers), retailers and consumers. The wholesale market for the Company’s

products includes all retailers in the convenience and grocery store channels as well as a number of specialty retail niche markets

including health food, “smoke shop,” and novelty stores. Additionally, the Company has an online retail presence on

Amazon.com and via our Company websites.

Results of Operations

Three Months Ended March 31, 2019

Compared to Three Months Ended March 31, 2018

Financial Summary

The Company’s sales for the three

months ended March 31, 2019 were $76,429 compared to net sales of $50,909 for the three months ended March 31, 2018.

The Company’s net loss for the three

months ended March 31, 2019 was $1,263,260 compared to a net loss of $2,332,064 for the three months ended March 31, 2018.

Sales

For the three months ended March 31, 2019

sales were $76,429 compared to net sales of $50,909 for the three months ended March 31, 2018, an increase of $25,520 or 50%.

The sales increase was driven by the incremental sales of our HEMPd product line-up, which was launched in late March 2018 and