Roche Nears Deal to Buy Spark -- WSJ

February 25 2019 - 3:02AM

Dow Jones News

By Dana Cimilluca, Dana Mattioli and Jonathan D. Rockoff

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 25, 2019).

Roche Holding AG has agreed to buy Philadelphia biotechnology

company Spark Therapeutics Inc., as the Swiss drugmaker seeks to

expand its presence treating hemophilia.

The companies said Monday that Roche would acquire Spark for

$114.50 a share and that the deal is expected to close in the

second quarter.

The deal corresponds to a total equity value of about $4.8

billion on a fully diluted basis, inclusive of approximately $500

million of projected net cash expected at the transaction's

closing, Spark said.

The per-share price represents a premium of 122% to Spark's

closing price Friday, Spark said. The company had a market value of

just under $2 billion as of Friday's close.

The Wall Street Journal reported on the planned deal

Saturday.

The companies said Spark would continue to operate as an

independent company within the Roche group.

Under the terms of the deal, Roche will file a tender offer to

acquire all outstanding shares of Spark common stock, and Spark

will file a recommendation statement containing the unanimous

recommendation of the Spark board that its shareholders tender

their shares to Roche, the companies said.

Therapies that replace a defective gene with a healthy one are

an emerging class of treatment pioneered by companies including

Spark. It was founded in 2013 out of gene-therapy research at

Children's Hospital of Philadelphia.

Doctors and patients have been looking forward for years to gene

therapies treating intractable inherited diseases, but development

of the therapies has proved more challenging than initially

thought, including the death in 1999 of a young man who received an

experimental gene therapy.

Yet development of the therapies appeared to turn a corner in

recent years, and big companies like Pfizer Inc. and Novartis AG

have been making moves to offer such treatments.

Pfizer has joined with Spark on development of a hemophilia B

treatment. Last year, Novartis paid $8.7 billion for gene-therapy

developer AveXis.

In 2017, Spark's Luxturna, which treats a condition that can

cause blindness, was the first gene therapy for an inherited

disease to receive Food and Drug Administration approval.

Spark also is developing gene therapies to treat the inherited

blood disorder hemophilia.

The company generated just $64.7 million in revenue last year

and a net loss of $78.8 million. Even though that represents

dramatic improvement from the prior year on both counts, it

underscores how much Roche is having to pay up to secure the

acquisition.

Hemophilia is a new and emerging category for Roche. In 2017,

the U.S. Food and Drug Administration approved the company's

hemophilia A treatment, Hemlibra, which analysts expect will have

billions of dollars in yearly sales.

In January, the company described Hemlibra as one of its biggest

growth drivers, with sales surpassing 100 million Swiss francs

($100 million) in the fourth quarter alone.

If Spark's hemophilia gene therapies pan out, Roche would be

able to expand its offerings in the area, helping it compete with

market rivals like Takeda Pharmaceutical Co. Ltd. and Sanofi

SA.

Among the challenges confronting companies like Roche seeking to

sell the new gene therapies is gaining reimbursement. Spark has

said it plans to sell Luxturna in the U.S. at a cost of $850,000 a

patient, but it wants to offer partial refunds if patients don't

meet recovery targets.

Roche is among a number of big drug companies hungry for

biotechs that can help restock their pipelines and portfolios.

There have been a raft of such deals already this year, including

Bristol-Myers Squibb Co.'s roughly $74 billion planned purchase of

Celgene Corp. and Eli Lilly & Co.'s agreement to pay $8 billion

for cancer specialist Loxo Oncology Inc.

--Anthony Shevlin contributed to this article.

Write to Dana Cimilluca at dana.cimilluca@wsj.com, Dana Mattioli

at dana.mattioli@wsj.com and Jonathan D. Rockoff at

Jonathan.Rockoff@wsj.com

(END) Dow Jones Newswires

February 25, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

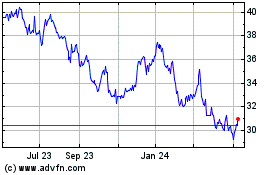

Roche (QX) (USOTC:RHHBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

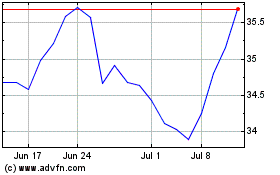

Roche (QX) (USOTC:RHHBY)

Historical Stock Chart

From Apr 2023 to Apr 2024