Current Report Filing (8-k)

March 26 2020 - 5:21PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 21, 2020

RESPIRERX

PHARMACEUTICALS INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

1-16467

|

|

33-0303583

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S

Employer

Identification No.)

|

|

126

Valley Road, Suite C

Glen

Rock, New Jersey

|

|

07452

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (201) 444-4947

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Forward-Looking

Statements.

This

Current Report on Form 8-K of RespireRx Pharmaceuticals Inc. (“RespireRx” or the “Company”)

contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934 and the Company intends that such forward-looking statements be subject to the safe harbor

created thereby. These might include statements regarding the Company’s future plans, targets, estimates, assumptions, financial

position, business strategy and other plans and objectives for future operations, and assumptions and predictions about research

and development efforts, including, but not limited to, preclinical and clinical research design, execution, timing, costs and

results, future product demand, supply, manufacturing, costs, marketing and pricing factors.

In

some cases, forward-looking statements may be identified by words including “anticipates,” “believes,”

“intends,” “estimates,” “expects,” “plans,” “contemplates,” “targets,”

“continues,” budgets,” “may,” and similar expressions and such statements may include, but are not

limited to, statements regarding (i) future research plans, expenditures and results, (ii) potential collaborative arrangements,

(iii) the potential utility of the Company’s proposed products, (iv) reorganization plans, and (v) the need for, and availability

of, additional financing.

The

forward-looking statements included herein are based on current expectations that involve a number of risks and uncertainties.

Although the Company believes that the assumptions underlying the forward-looking statements are reasonable, actual results may

differ materially from those set forth in the forward-looking statements. In light of the significant uncertainties inherent in

the forward-looking information included herein, the inclusion of such information should not be regarded as a representation

by the Company or any other person that the Company’s objectives or plans will be achieved.

Factors

that could cause or contribute to such differences include, but are not limited to, regulatory policies or changes thereto, available

cash, research and development results, competition from other similar businesses, interest of third parties in collaborations

with us, and market and general economic factors.

Item

1.01 Entry into a Material Definitive Agreement.

On

March 21, 2020, the Company entered into five separately negotiated Exchange Agreements (each an “Exchange Agreement”

and collectively, the “Exchange Agreements”) with certain existing holders (the “Noteholders”)

of Convertible Promissory Notes of the Company (the “Notes”). On March 22, 2020 (the “Closing Date”),

each Noteholder exchanged his, her or its Note or Notes for shares of common stock of the Company (“Common Stock”)

as contemplated by the respective Exchange Agreement. The Noteholders had purchased the Notes from the Company on one or more

of the following dates: December 31, 2014, December 6, 2018, December 7, 2018, February 27, 2019, March 6, 2019 and March 14,

2019. Under the Exchange Agreements, an aggregate of $255,786.37 principal amount and accrued interest with respect to

the Notes were exchanged and cancelled in return for an aggregate of 17,052,424 shares of Common Stock.

A

description and form of each Note that was exchanged under the Exchange Agreements can be found in the Company’s Current

Reports on Form 8-K filed on January 7, 2015, December 17, 2018, and March 5, 2019.

This

description of the Exchange Agreements does not purport to be complete and is qualified in its entirety by reference to the form

of Exchange Agreement, a copy of which is attached to this Current Report on Form 8-K as Exhibit 99.1. The information set forth

in Item 3.02 herein is incorporated into this Item 1.01 by reference.

2.04

Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

Under

the terms of certain other Convertible Promissory Notes of the Company issued in April, May, August, October and November of 2019

(the “Subsequent Notes”), as disclosed on the Company’s Current Reports on Form 8-K filed on April 30,

2019, May 23, 2019, August 27, 2019, October 28, 2019 and November 5, 2019, the Company is subject to covenants to maintain a

number of reserved shares of Common Stock with respect to these Subsequent Notes. The reserve requirement is generally a multiple

of the number of shares of Common Stock that would be issued if there were a conversion pursuant to the terms of the applicable

Subsequent Note. A breach by the Company of these covenants is an event of default under the terms of the April, August and

October Subsequent Notes that generally increases the applicable note’s principal amount and interest rate, and accelerates

its maturity date, making the debt immediately due and payable. For the May Subsequent Note, the provisions are similar, but

a notice of default is required before such increases and acceleration, which, as of the filing of this Current Report on Form

8-K, the Company had not received. For the November Subsequent Note, an event of default will only occur if the holder requests

replenishment of the reserves, and that request is not met within three days or a subsequent five day cure period. The holder

of the November Subsequent Note has not yet made such request. In addition, on March 26, 2020 the holders of the August and October Subsequent Notes agreed to waive the

event of default until April 30, 2020, by which time the Company expects to have completed the filing with respect to the increase

in authorized shares, as discussed under Item 8.01 below.

The

issuances of Common Stock described in Item 1.01 and Item 5.02 herein reduced the number of shares of Common Stock to a level

below what is required by the covenants in the Subsequent Notes, resulting in a breach and event of default, as described above,

of the Subsequent Notes. The Company is currently seeking waivers with respect to the reserve requirements and the default provisions

related thereto from the holders of the Subsequent Notes until the Amendment (as defined below) is effective. There can be no

assurance that such holders will agree to such waivers.

On March 26, 2020, the holder of the April

Subsequent Note converted the remaining outstanding principal under the note into shares, pursuant to the terms of the note. That

note is now repaid in full and no ongoing default exists thereunder. Similarly, several of the holders of Subsequent Notes have

been converting repeatedly over the past several days. These ongoing conversions make it difficult to calculate precisely the

amounts currently outstanding under the Subsequent Notes, but the amounts outstanding as of the date hereof are approximately

$375,000 in the aggregate.

As

is disclosed in Item 8.01 below, the board of directors of Company approved, and the holders of a majority of the outstanding

shares of the Company’s Common Stock executed written consents approving an Amendment (as defined below) to the Company’s

Certificate of Incorporation. When filed with the Secretary of State of Delaware, the Amendment will increase the number of authorized

shares of Common Stock, with the intention of reestablishing the Company’s compliance with the share reserve covenants contained

in the Subsequent Notes. The Company has taken this action primarily to increase the number of authorized shares available and

to bring it back into compliance with the covenants in the Subsequent Notes regarding the required number of reserved shares of

Common Stock. The outstanding principal of certain of the Subsequent Notes has been reduced as the holders of these notes have

converted a portion of the outstanding principal in exchange for Common Shares, pursuant to the term of the applicable Subsequent

Note. With respect to those Subsequent Notes for which conversions have occurred, interest continues to accrue based upon the

reduced principal amount of the relevant Subsequent Note. As noted above, the Company is in discussions with the holders of the

Subsequent Notes with respect to this recent action, seeking waivers regarding the technical breach of the reserve provisions

until such time as the increase in authorized shares is effective, which the Company currently expects will be in late April 2020,

and the number of reserved shares is again in compliance with the applicable covenants.

The

description of the Subsequent Notes does not purport to be complete and is qualified in its entirety by reference to the descriptions

and forms thereof in the Company’s Current Reports on Form 8-K filed on April 30, 2019, May 23, 2019, August 27, 2019, October

28, 2019 and November 5, 2019.

Item

3.02 Unregistered Sales of Equity Securities.

The

information set forth in Item 1.01 and Item 5.02 herein is incorporated into this Item 3.02 by reference.

The

Noteholders made representations to the Company in the Exchange Agreements that they met the accredited investor definition of

Rule 501 of Regulation D of the Securities Act of 1933, as amended (the “Securities Act”), and the Company

relied on such representations.

The

transactions described in Item 1.01 and Item 5.02 herein were between the Company and its existing security holders and were made

in reliance on the exemption from registration afforded by Section 3(a)(9), or alternatively Section 4(a)(2), of the Securities

Act. These transactions were not conducted in connection with a public offering and the participants in these transactions did

not rely on, and the Company did not make, any public solicitation or advertisement in connection with these transactions.

This

Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall such securities

be offered or sold in the United States absent registration or an applicable exemption from the registration requirements.

5.02

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

On

March 21, 2020, Jeff E. Margolis and Dr. Arnold Lippa, each a director and officer of the Company, agreed to forgive a portion

of the accrued but unpaid compensation to which each was entitled pursuant to his employment agreement with the Company, equal

to $153,000 each. On March 22, 2020, the Company issued to each of Mr. Margolis and Dr. Lippa 4,500,000 shares of Common Stock

in exchange for this forgiveness, which equates to a per share value of $0.034 per share, the closing share price of Common Stock

on Friday, March 20, 2020, the last business day prior to the transaction.

Item

8.01 Other Events.

On

March 21, 2019, the board of directors of the Company approved a Certificate of Amendment to the Company’s Certificate of

Incorporation (the “Amendment”) that would increase the number of authorized shares of Common Stock from 65,000,000

to 1,000,000,000. On March 22, 2019, a majority of the holders of Common Stock approved the Amendment by written consent, which

constituted a majority of the Company’s outstanding stock entitled to vote on the increase as well as a majority of Common

Stock voting as a separate class, as is required for such approval under the General Corporation Law of the State of Delaware.

Further information on the Amendment, including a form of the Amendment, and its approval can be found in the Preliminary Information

Statement on Schedule 14C filed by the Company on March 24, 2020. This information may be supplemented or revised in the Definitive

Information Statement, which the Company currently expects to file in early April 2020 in accordance with the applicable rules

regarding such filings promulgated by the Securities and Exchange Commission.

The

Company will file the Amendment with the Secretary of State of the State of Delaware, and the Amendment will become effective,

no earlier than 20 days after the Definitive Information Statement is first mailed to stockholders, as required by Rule 14c-2

of the Securities Exchange Act of 1934, as amended. The Company currently expects to make this filing in late April 2020.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

*

filed herewith

Pursuant

to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

Date:

March 26, 2020

|

RESPIRERX

PHARMACEUTICALS INC.

(Registrant)

|

|

|

|

|

|

By:

|

/s/

Jeff E. Margolis

|

|

|

|

Jeff

E. Margolis

SVP,

CFO, Secretary and Treasurer

|

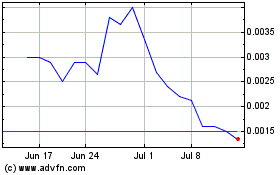

RespireRx Pharmaceuticals (PK) (USOTC:RSPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

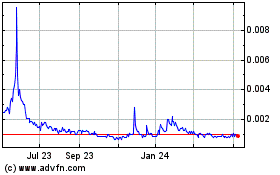

RespireRx Pharmaceuticals (PK) (USOTC:RSPI)

Historical Stock Chart

From Apr 2023 to Apr 2024