Current Report Filing (8-k)

April 16 2021 - 3:51PM

Edgar (US Regulatory)

AUNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): April 15, 2021

REGEN

BIOPHARMA, INC.

(Exact

name of small business issuer as specified in its charter)

|

Nevada

|

45-5192997

|

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

Commission

File No. 333-191725

711

S. Carson Street, Suite 4, Carson City, Nevada, 89791

(Address

of Principal Executive Offices)

(619)

702 1404

(Issuer’s

telephone number)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item

1.01 Entry into a Material Definitive Agreement

On

December 16, 2019 Zander Therapeutics, Inc. (“Zander”), KCL Therapeutics, Inc. (“KCL”) and Regen Biopharma,

Inc. (“Regen”) entered into an agreement (“Agreement”) whereby:

1) Zander

shall return for cancellation 194,285,714 shares of the Series A Preferred stock of Regen (“Conversion Shares”) acquired

by Zander through conversion of $340,000 of principal indebtedness of a $350,000 convertible note payable issued by Regen to Zander.

Subsequent to this event the principal amount due to Zander by Regen pursuant to the Convertible Note shall be $350,000 which

shall be applied pursuant to the Agreement.

2) A

$35,000 one time charge due to Zander by Regen (“One Time Charge”) shall be applied pursuant to the Agreement.

3) $75,900

of principal indebtedness due to Regen by Zander and $4,328 of accrued but unpaid interest due by Regen to Zander shall be applied

pursuant to the Agreement.

No

actions were taken by any of the parties to enforce the terms of the Agreement.

On

April 15, 2021 the Agreement was amended as follows so that the material terms and conditions shall be:

|

|

a)

|

Zander

shall not return the Conversion shares for cancellation and the principal indebtedness

of the aforementioned convertible note shall not reflect such return

|

|

|

b)

|

As

of December 16, 2019 all principal and accrued interest payable by Regen to Zander on

that date resulting from Promissory Notes issued by Regen to Zander shall be credited

towards amounts due by Zander pursuant to that agreement, as amended, entered into by

and between Zander and Regen on June 23, 2015 (“License Agreement”) whereby

Regen granted to Zander an exclusive worldwide right and license for the development

and commercialization of certain intellectual property controlled by Regen for non-human

veterinary therapeutic use for a term of fifteen years and that License Assignment And

Consent agreement entered into by and between Regen, KCL and Zander on December 17, 2018

whereby Regen transferred and assigned to KCL all rights, duties, and obligations of

Regen under the License Agreement and KCL agreed to assume such duties and obligations

thereunder and be bound to the terms of the License Agreement with respect thereto.

|

The

foregoing description of the abovementioned Agreement is not complete and is qualified in its entirety by reference to the text

of the abovementioned agreement , which is attached to this Current Report on Form 8-K as Exhibit 10.1 and incorporated in this

Item 1.01 by reference. Regen, KCL and Zander are under common control. David Koos serves as sole Officer and Chairman of the

Board of Zander, Regen and KCL.

Item

9.01 Exhibits.

|

Exhibit

No.

|

|

Description

of Exhibit

|

|

10.1

|

|

AMENDMENT

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

REGEN

BIOPHARMA, INC.

|

|

|

|

|

Dated: April 15, 2021

|

By: /s/

David Koos

|

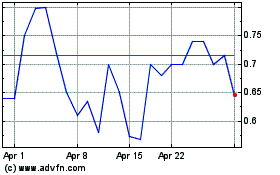

Regen Biopharma (PK) (USOTC:RGBP)

Historical Stock Chart

From Mar 2024 to Apr 2024

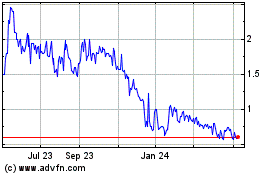

Regen Biopharma (PK) (USOTC:RGBP)

Historical Stock Chart

From Apr 2023 to Apr 2024