Current Report Filing (8-k)

October 22 2021 - 1:11PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): October 18, 2021

REDHAWK

HOLDINGS CORP.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

000-54323

|

20-3866475

|

|

(State

or other jurisdiction of incorporation)

|

(Commission

File Number)

|

(Employer

Identification No.)

|

|

100

Petroleum Drive, Suite 200, Lafayette, Louisiana 70508

|

|

(Address

of principal executive offices) (Zip Code)

|

Registrant’s

telephone number, including area code: (337) 269-5933

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

|

☐

|

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act: None.

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

In

connection with the acquisition of certain needle incineration technology formerly known as The Disintegrator (“SANDD™”),

on or about December 31, 2015, the Registrant entered into a consulting agreement (“Agreement”) with the owner of SANDD™.

In

exchange for advisory services to be provided to the Registrant by the consultant (“Consultant”), the Registrant agreed to

issue up to 60,000,000 shares of its common stock to the Consultant. Under the terms of the Agreement, the common stock is to be issued

in three (3) separate tranches of 20,000,000 million shares each after the Registrant reached three (3) separate mutually agreed upon

performance milestones.

During

the fiscal year ended June 30, 2020, the Registrant issued 20,000,000 shares of common stock to the Consultant under the terms of the

Agreement after the Registrant had reached the first mutually agreed upon milestone. The Registrant has not yet reached the second and

third mutually agreed upon milestones under the terms of the Agreement, as such, 40,000,000 shares remain unissued.

On

October 18, 2021, the Registrant entered into a Separation Agreement with the Consultant to cancel all of the remaining obligations under

the Agreement effective October 31, 2021, with the cash payment of $75,000 by the Registrant from available working capital, on or before

October 31, 2021, and an additional cash payment of $50,000 from available working capital, on or before November 30, 2021.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by

the undersigned, hereunto duly authorized.

|

|

REDHAWK HOLDINGS CORP.

|

|

|

|

|

Date: October 22, 2021

|

By:

|

/s/

G. Darcy Klug

|

|

|

|

G. Darcy Klug

|

|

|

|

Chief Financial Officer

|

RedHawk (CE) (USOTC:SNDD)

Historical Stock Chart

From Mar 2024 to Apr 2024

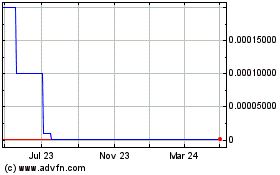

RedHawk (CE) (USOTC:SNDD)

Historical Stock Chart

From Apr 2023 to Apr 2024