LAFAYETTE,

LOUISIANA -- November

18, 2020

-- InvestorsHub NewsWire -- RedHawk Holdings

Corp. (OTC:

SNDD) ("RedHawk" or the

"Company"), a diversified holding

company primarily engaged in sales and

distribution of medical devices, announced today its financial results for

the three months and fiscal year ended June 30,

2020.

For the three month

period ended June 30, 2020, on revenues of

$916,203,

the Company

reported net income from operations

of

$38,534. Starting from reported net

income from operations of $38,534 for the three month

period,

and excluding $34,326 of research and

development charges for the now completed

SANDD

Pro™ reverse

engineering project, $40,153 of expenses

for a

now

completed marketing consulting agreement, and

$7,656 of costs necessary to update the RedHawk Medical Products

website,

RedHawk's adjusted net income from operations

was

$120,769

for the quarter

ended June 30, 2020. As previously announced,

revenues for the quarter ended June 30, 2020

increased more than 500% when compared to

revenues for

the

immediate

preceding quarter ended March 31,

2020.

For the

fiscal year

ended June

30, 2020,

on revenues

of $1,134,192, RedHawk reported a net loss from operations

of

$779,777.

Starting

from a reported net

loss

from operations of

$779,777 for the fiscal year, and excluding $118,327 of research and development

charges for the now completed

SANDD

Pro™ reverse

engineering project, $153,921 of marketing

expenses for a now completed consulting relationship, and $39,352 of costs

necessary

to update the

RedHawk Medical Products website, the Company's adjusted net loss from operations

was

$468,177 for the fiscal year ended June 30,

2020.

For the fiscal year

ended

June 30,

2019,

RedHawk

previously

reported a net loss

from operations of $661,943 on revenues of $129,006.

The increase in

year over year revenues was primarily attributable to

the Company's decision

in the fiscal year

ended June 30, 2019, to temporarily exit its

primary

marketing focus on pharmaceutical sales

in the United Kingdom and instead deploy its available working

capital to develop and expand its

more profitable

lines of medical devices in the United

States.

Additionally,

RedHawk announced today that it has executed a non-binding letter

of intent to acquire certain cannabis assets, including licenses to grow,

manufacture and sell in the State of Oklahoma, with an

anticipated initial focus on "craft"

cultivation and distribution of product. Closing of the acquisition

is contingent upon, among other

things, completion of satisfactory due

diligence, approval by RedHawk's board of

directors, the negotiation, acceptance and

execution of

a definitive purchase agreement, acceptance and approval by

the requisite shareholders, satisfactory

completion of legal, regulatory

and financial due

diligence, and the closing of the required amount of

acquisition financing. Accordingly, RedHawk

cannot

provide any assurance that a definitive agreement will be reached

on acceptable terms or at all, that due diligence will be

satisfactory, that the required acquisition financing will be

obtained by RedHawk on acceptable terms or at all, or that the

acquisition

will ultimately be completed in any particular time frame or at

all.

# # #

About RedHawk Holdings Corp.

RedHawk Holdings Corp. is a diversified holding company which,

through its subsidiaries, is engaged in the sales

and distribution of medical devices, sales

of branded generic pharmaceutical drugs,

commercial real estate investment and leasing,

sales of point of entry full-body security systems,

and specialized financial services. Through its

medical products business unit, the Company sells

the Sharps and Needle Destruction Device

(SANDD™), WoundClot Surgical - Advanced Bleeding

Control, and a line of Personal Protection equipment

including face masks and shields, digital non-contact thermometers

and portable UV Sterilization lights.

Through our United Kingdom based subsidiary, we

manufacture and market branded generic pharmaceuticals. RedHawk

Energy holds the exclusive U.S. manufacturing and distribution

rights for the Centri Controlled Entry System, a unique, closed

cabinet, nominal dose transmission full-body x-ray

scanner. For more information, please visit: http://www.redhawkholdingscorp.com

Non-GAAP Financial Measures

This press release contains non-GAAP financial measures,

including adjusted net income from operations and adjusted

net loss from operations. These are important financial

measures for us but are not financial measures as defined by

generally accepted accounting principles ("GAAP"). The presentation

of this financial information is not intended to be

considered in isolation of or as a substitute for, or superior to,

the financial information prepared and presented in accordance with

GAAP.

We use these non-GAAP financial measures for financial and

operational decision making and as a means to evaluate

period-to-period comparisons. We believe these measures provide

useful information about operating results, enhance the overall

understanding of past financial performance and future prospects

and allow for greater transparency with respect to key

metrics used by management in its financial and operational

decision making. By disclosing these non-GAAP financial measures,

we believe we offer investors a greater understanding of, and an

enhanced level of transparency into, the means by which

our management operates the company.

These non-GAAP financial measures are not measures presented in

accordance with GAAP, and our use of these terms may vary from that

of others in our industry. These non-GAAP financial measures should

not be considered as an alternative to net income from

operations, net loss from operations or any other measures derived

in accordance with GAAP as measures of operating performance or

liquidity.

Adjusted net income (loss) from operations - We define

Adjusted net income (loss) from operations as net income (loss)

from operations with adjustments to reflect the addition

or elimination of certain statement of earnings items including,

but not limited to:

• research and development charges;

• expenses for a now completed marketing consulting

agreement; and

• costs necessary to update the RedHawk Medical

Products website

Cautionary Statement Regarding Forward-Looking

Statements

This release may contain forward-looking statements.

Forward-looking statements are all statements other than statements

of historical fact. Statements contained in this release that are

not historical facts may be deemed to be forward-looking

statements. The words "anticipate," "may," "can," "plans,"

"believes," "estimates," "expects," "projects," "targets,"

"intends," "likely," "will," "should," "to be," "potential" and any

similar expressions are intended to identify those

assertions as forward-looking statements.

Investors are cautioned that forward-looking statements are

inherently uncertain. Actual performance and results,

including any potential completion of the acquisition of the

cannabis assets described herein, may differ materially

from that projected or suggested herein due to certain risks and

uncertainties including, but not limited to, the negotiation,

acceptance and execution of a final definitive purchase agreement,

acceptance and approval by the board of directors and the

shareholders of the seller, satisfactory completion of legal and

financial due diligence, RedHawk obtaining the required amount of

acquisition financing, and the obtainment of all necessary consents

and approvals of any third parties. In

evaluating forward-looking statements, you should consider the

various factors which may cause actual results to differ materially

from any forward-looking statements including those listed in the

"Risk Factors" section of our latest 10-K report. Further,

the Company may make changes to its business plans that could or

will affect its results. Investors are cautioned that the Company

will undertake no obligation to update any forward-looking

statements.

Company

Contact:

G. Darcy

Klug, Chairman,

CEO and CFO

(337)

269-5933

darcy.klug@redhawkholdingscorp.com

Philip C.

Spizale, CEO

(337)

269-5933

philip.spizale@redhawkholdingscorp.com

Investor

Relations:

Stephanie

Prince, Managing Director

PCG

Advisory

(646)

762-4518

sprince@pcgadvisory.com

Media

Contact:

Valerie Allen

Valerie Allen

Public Relations

(310)

382-7800

valerie@valerieallenpr.com

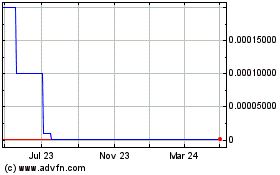

RedHawk (CE) (USOTC:SNDD)

Historical Stock Chart

From Mar 2024 to Apr 2024

RedHawk (CE) (USOTC:SNDD)

Historical Stock Chart

From Apr 2023 to Apr 2024