Current Report Filing (8-k)

April 09 2020 - 6:03AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): April 8, 2020

PUREBASE

CORPORATION

(Exact

name of registrant as specified in charter)

|

Nevada

|

|

000-55517

|

|

27-2060863

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

8625

State Hwy, 124

Ione,

CA 95640

(Address

of principal executive offices)

(855)

743-6478

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

None

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

Effective

April 8, 2020, Calvin Lim resigned as a member of the Board of Directors (the “Board”) of Purebase Corporation (the

“Company”). His resignation was not the result of any dispute or disagreement with the Company or the Board on any

matter relating to the operations, policies or practices of the Company.

Effective

April 8, 2020, Mr. Jeffrey Joseph Guzy was appointed to serve on the Board, filling the vacancy created by Mr. Lim’s resignation.

Mr. Guzy shall serve on the Board and shall hold office until the next election of directors by shareholders and until his successor

is elected and qualified or until his earlier resignation or removal.

Mr.

Guzy was appointed as the chairman of the Audit Committee and the Compensation Committee.

Mr.

Guzy, age 68, was selected as a director for his general business management experience and experience serving on the board of

directors of public companies, along with his leadership skills and entrepreneurial spirit, will aid the Company to succeed going

forward.

The

Company entered into a Director Agreement with Mr. Guzy effective as of April 8, 2020 (the “Agreement”) for a term

of twelve months or until his removal or resignation. Pursuant to the Agreement, Mr. Guzy shall receive $1,000 per month, which

shall accrue as debt until the Company has its first cash flow positive month. At that time, the Company shall make arrangements

to pay the accrued monthly fee. If the term is completed or he has been removed or resigned, then the amount owed shall be converted

to shares of common stock at the lower of $0.15 per share or the 20-day VWAP from the last date Mr. Guzy was on the board.

Mr.

Guzy was also granted 250,000 stock options with an exercise price of $0.10 per share. The options are exercisable for five years.

The Agreement also contains customary confidentiality and non-compete provisions.

Other

than as described above, there are no arrangements or understandings between Mr. Guzy and any other person pursuant to which he

was appointed as a director of the Company. In addition, there are no family relationships between Mr. Guzy and any of the Company’s

other officers or directors. Further, there are no transactions since the beginning of our last fiscal year, or any currently

proposed transaction, in which the Company is a participant, the amount involved exceeds $120,000, and in which Mr. Guzy had,

or will have, a direct or indirect material interest, other than as described above.

The

foregoing description of the Agreement is qualified in its entirety by reference to the full text of such agreement, a copy of

which is attached hereto as Exhibit 10.14 and incorporated herein in its entirety by reference.

Item

7.01 Regulation FD Disclosure.

On

April 8, 2020, the Company issued a press release with respect to the appointment of Mr. Guzy to the Board. A copy of the press

release is filed as Exhibit 99.1 to this report and incorporated herein by reference.

The

information in this Item 7.01 of this Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed

“filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

nor shall it be deemed incorporated by reference in any of the Company’s filings under the Securities Act, or the Exchange

Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference to this Report

in such filing.

Cautionary

Note Regarding Forward-Looking Statements

This

Current Report on Form 8-K includes information that may constitute forward-looking statements. These forward-looking statements

are based on the Company’s current beliefs, assumptions and expectations regarding future events, which in turn are based

on information currently available to the Company. By their nature, forward-looking statements address matters that are subject

to risks and uncertainties. Forward looking statements include, without limitation, statements relating to projected industry

growth rates, the Company’s current growth rates and the Company’s present and future cash flow position. A variety

of factors could cause actual events and results, as well as the Company’s expectations, to differ materially from those

expressed in or contemplated by the forward-looking statements. Risk factors affecting the Company are discussed in detail in

the Company’s filings with the Securities and Exchange Commission. The Company undertakes no obligation to publicly update

or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent

required by applicable securities laws.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

|

Date:

April 8, 2020

|

PUREBASE

CORPORATION

|

|

|

|

|

|

|

By:

|

/s/

A. Scott Dockter

|

|

|

|

A.Scott

Dockter

Chief

Executive Officer

|

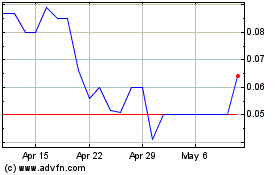

PureBase (PK) (USOTC:PUBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

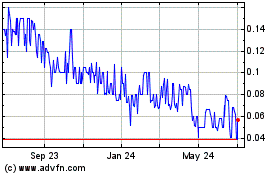

PureBase (PK) (USOTC:PUBC)

Historical Stock Chart

From Apr 2023 to Apr 2024