Current Report Filing (8-k)

March 26 2019 - 10:02AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 23, 2019

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

001-38255-NY

|

|

90-0114535

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

No.)

|

|

5348

Vegas Drive # 237 Las Vegas, NV

|

|

89108

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: 702-475-5430

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

SECTION

7 – REGULATION FD DISCLOSURE

Item

7.01 Regulation FD Disclosure

PHI

Group, Inc. Approves Stock Repurchase Program

The

information in this Item 7.01 of this Current Report is furnished pursuant to Item 7.01 and shall not be deemed “filed’

for any purpose, including for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that

Section. The information in this Current Report on Form 8-K shall not be deemed incorporated by reference into any filing under

the Securities Act or the Exchange Act regardless of any general incorporation language in such filing.

On

March 23, 2019, the Company’s Board of Directors passed a corporate resolution to authorize the repurchase of its own shares

of common stock from the open market from time to time in accordance with the terms mentioned below:

|

1.

|

Purpose

of Repurchase

: To enhance future shareholder returns.

|

|

2.

|

Details

of Repurchase

:

|

|

|

a.

|

Class

of shares to be repurchased: Common Stock of PHI Group, Inc.

|

|

|

b.

|

Total

number of repurchasable shares: 5.3 billion shares, or more as may be needed.

|

|

|

c.

|

Total

repurchase amount: To be determined by prevalent market prices at times of transaction.

|

|

|

d.

|

Method

of repurchase: Open market purchase.

|

|

|

e.

|

Repurchase

period: April 15, 2019 to March 13, 2020.

|

|

|

a.

|

PHI

Group, Inc. will fund the proposed share repurchase program with the proceeds from the disposal of a portion of certain non-core

assets and from future earnings of the Company.

|

|

|

b.

|

The

share repurchase program will be in full compliance with state and federal laws and certain covenants with the Company’s

note-holders.

|

SECTION

9 – FINANCIAL STATEMENTS AND EXHBITS

Item

9.01 Financial Statements and Exhibits

The

following is a complete list of exhibit(s) filed as part of this Report.

Exhibit

number(s) correspond to the number(s) in the exhibit table of Item 601 of Regulation S-K.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

Dated:

March 26, 2019

PHI

GROUP, INC.

(Registrant)

|

By:

|

/s/

Henry D. Fahman

|

|

|

|

Henry

D. Fahman

|

|

|

|

Chairman

and CEO

|

|

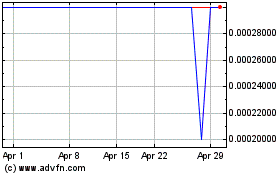

PHI (PK) (USOTC:PHIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

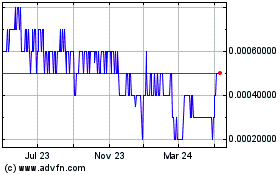

PHI (PK) (USOTC:PHIL)

Historical Stock Chart

From Apr 2023 to Apr 2024