Current Report Filing (8-k)

July 18 2019 - 4:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported)

July 12,

2019

PCT LTD

(Exact name of registrant as specified in its

charter)

|

Nevada

|

000-31549

|

90-0578516

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

4235 Commerce Street

Little River, South Carolina

|

29566

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including

area code:

(843) 390-7900

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

☐

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule

405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2

of this chapter).

|

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use

the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section

13(a) of the Exchange Act.

|

Item 1.01 Entry into a Material Definitive Agreement

On July 12, 2019, the Registrant

entered into a binding letter of intent (the “LOI”) with 2705908 Ontario Inc. (“Ontario”), a recently incorporated

Canadian company. Pursuant to the terms of the LOI, the parties agreed to negotiate and enter into a definitive agreement pursuant

to which, by way of a loan agreement and option agreement, Ontario will be entitled to acquire at least 51% control of the Registrant,

through the acquisition of common shares in the capital of the Registrant and direct issuance(s) of common shares from the Registrant

(the “Proposed Transaction”). Following completion of the Proposed Transaction, Ontario will use its commercially reasonable

efforts to complete a transaction to list on the TSX Venture Exchange or the Canadian Securities Exchange, which transaction will

likely be a reverse take-over with a publicly listed shell company and considered a “Qualifying Transaction.”

Pursuant to the terms of

the LOI, the parties agreed to enter into a definitive agreement that will provide for the following, among other things:

|

1.

|

Ontario will enter into a loan agreement with

the Registrant (the “Loan Agreement”) pursuant to which Ontario will make a secured loan of US$1,450,000 (the “Loan”)

to the Registrant on or before the Closing Date (July 30, 2019). A portion of the Loan amount shall be placed into the trust account

of legal counsel to Ontario and directed to fully repay approximately US$750,000 principal amount of convertible debt of the Registrant

(the “Convertible Debt”) that is currently outstanding, and the balance shall be used as working capital. The Loan

will be convertible, at the option of Ontario, into common shares of the Registrant at US$0.04 per share (36,250,000 common shares).

The Loan will automatically convert into common shares of the Registrant at US$0.04 per share upon completion of the Concurrent

Placement (as defined below).

US$250,000 of the Loan (the “Escrowed

Amount”) shall be placed into trust with legal counsel to Ontario and held in escrow. The Escrowed Amount shall be: (i) released

for the benefit of the Registrant and treated as part of the Loan to repay the Convertible Debt; or (ii) returned to Ontario if

the Loan is not advanced to the Registrant on or before the Closing Date.

Ontario will enter into an option agreement

with the Registrant (the “Option Agreement”) pursuant to which Ontario will be entitled to subscribe for up to US$3,500,000

worth of common shares of the Registrant at a price of US$0.08 per share. The Option Agreement shall have a term of 4 months from

the date of the Option Agreement and provide Ontario with a right of first refusal on future share issuances of the Registrant

(on financings and acquisition transactions) and a top up right such that Ontario can maintain its shareholding percentage at a

minimum of 51% of the common shares of the Registrant on a fully diluted basis through completion of the Proposed Transaction.

The Option Agreement shall specify that upon:

(i) conversion of the Loan; and (ii) exercise of the Option Agreement, Ontario will own approximately 51% of the common shares

of the Registrant on a fully diluted basis. If Ontario does not own 51% of the outstanding common shares of the Registrant, upon

exercise of the Option Agreement, then the Registrant shall issue to and Ontario shall subscribe for, common shares at the nominal

price of $0.00001 per share, in order to provide Ontario with enough shares to bring its ownership to 51%.

|

|

|

|

|

2.

|

Concurrent with the completion of the Qualifying Transaction, Ontario and the Registrant will work together to complete a private placement directly into Ontario for gross proceeds of up to C$5,000,000 (the “Concurrent Placement”).

|

|

|

|

|

3.

|

Subject to the completion of the Transaction, the Registrant and its subsidiary, Paradigm Convergence Technologies Corporation, each agree that its respective rights to operate its business in Canada shall be licensed on an exclusive and perpetual basis to Ontario, or as it may direct, and shall provide documentation in form and content satisfactory to Ontario in this respect.

|

|

|

|

|

4.

|

Ontario will engage Francis J. Read, the CEO and a Director of the Registrant, to serve as CEO and a Director for Ontario, as well as continue in his current capacity as CEO and a Director of the Registrant, with the view of ensuring continuity with operations.

|

|

|

|

|

5.

|

The funding of the Loan pursuant to the Definitive Agreements for the Proposed Transaction incorporating the terms hereof shall occur on or before July 30, 2019, or such other date as may be agreed upon by Ontario and the Registrant (the “Closing Date”).

|

The LOI provides that the

parties will carry out due diligence and will proceed reasonably and in good faith toward the negotiation and execution of definitive

documentation regarding the Proposed Transaction. The completion of the Proposed Transaction is subject to the receipt of all necessary

approvals, all required consents and other authorizations of any regulatory authorities, shareholders or third parties (including

executed payout letters from each holder of the Convertible Debt), and satisfactory due diligence review by Ontario, in its sole

discretion, of all of the relevant corporate documents, contracts, liabilities and material agreements relating to the Registrant.

If a definitive agreement

is not executed by the parties on or before July 30, 2019 (or such other date agreed to by the parties), the LOI will terminate.

The foregoing description

of the LOI does not purport to be complete and is qualified in its entirety by reference to the full text of the LOI, a copy of

which is filed as Exhibit 10.1 to this current report on Form 8-K, and is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities

On July 17, 2017, the Registrant issued TFK

Investments LLC 5,540,000 shares of its common stock at $0.00063 per share upon conversion of $3,490.20 in principal plus $500.00

in fees under the promissory note dated November 28, 2018. Following this conversion, the principal balance remaining under the

note was $28,274.82.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number

|

Description

|

|

|

|

|

10.1

|

Ontario Letter of Intent dated July 12, 2019

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

PCT LTD

By:

/s/ F. Jody Read

F. Jody Read, CEO

Date: July 18, 2019

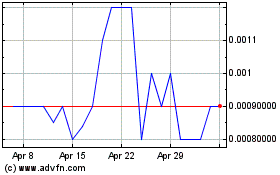

PCT (PK) (USOTC:PCTL)

Historical Stock Chart

From Mar 2024 to Apr 2024

PCT (PK) (USOTC:PCTL)

Historical Stock Chart

From Apr 2023 to Apr 2024