Filed Pursuant to Rule 424(b)(3)

Registration No. 333-256448

PROSPECTUS

ONCOTELIC

THERAPEUTICS, INC.

33,863,445 SHARES OF COMMON STOCK

This

prospectus relates to the resale of shares of our Common stock, par value $0.01 per share (the “Common Stock”), of an aggregate

of 33,863,445 Common Stock Shares pursuant to our May 3, 2021 Equity Purchase Agreement which may be offered by Peak One Opportunity

Fund, LP (“Peak One”) and Peak One Investments (“Peak One Investments) (the “EPA”), as follows: (a) up

to 33,613,445 Common Stock Shares to be issued to Peak One pursuant to put notices under the May 3, 2021 Equity Purchase Agreement

with Peak One; (b) 125,000 Commitment Fee Shares issued to Peak One and Peak One Investments for an aggregate of 250,000 Commitment Fee

Shares (Peak One Investments is the General Partner of Peak One, both of which are Delaware corporations); and (c) pursuant to Rule 416

under the Securities Act, an indeterminate number of shares of common stock that are issuable upon stock splits, stock dividends, recapitalizations

or other similar transactions affecting the shares of the selling stockholder.

The

amount of shares of Common Stock which may be sold pursuant to this Prospectus would constitute 8.4% of the Company’s issued

and outstanding Common Stock as of May 20, 2021 (33,863,445 divided by current outstanding of 369,446,959 plus 33,863,445

for a total of 403,310,404, which includes the 250,000 Commitment Fee Shares, and assuming that we sell all 33,613,445

shares to the selling security holders (the “Selling Stockholders”).

Peak

One and Peak One Investments are the Selling Stockholders and are deemed to be each an “underwriter” within the meaning

of the Securities Act of 1933, as amended (the “Act”) and any broker-dealers or agents that are involved in selling

the shares may be deemed to be “underwriters” within the meaning of the Act in connection with such sales. In such

event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them

may be deemed to be underwriting commissions or equivalent expenses and expenses of legal counsel applicable to the sale of the

shares.

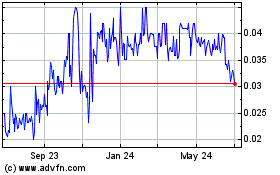

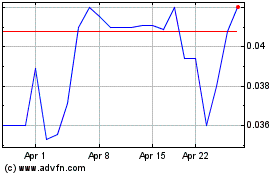

Our

Common Stock is subject to quotation the OTCQB Market under the symbol “OTLC”. On May 20, 2021, the last reported

sales price for our Common Stock was $0.2975 per share. We urge prospective purchasers of our Common Stock to obtain current information

about the market prices of our Common Stock. We will not receive proceeds from the sale of shares of our Common Stock in the open market

or negotiated prices by the Selling Stockholders. However, we will receive cash proceeds from Peak One pursuant to Purchase Notices they

issue to us. The Selling Stockholders may offer all or part of the shares for resale from time to time through public or private transactions,

at either prevailing market prices or at privately negotiated prices. We provide more information about how the Selling Stockholders

may sell its shares of common stock in the section titled “Plan of Distribution” on page 31. We will pay for all expenses

of this Offering, except that the Selling Stockholders will pay fifty percent (50%) of any broker discounts or commissions or

equivalent expenses and all expenses of legal counsel applicable to the sale of the shares.

The

prices at which the Selling Stockholders may sell the shares of Common Stock in this Offering will be determined by the prevailing

market prices for the shares of Common Stock or in negotiated transactions.

Our

independent registered public accounting firm has expressed substantial doubt as to our ability to continue as going concern.

An

investment in our common stock involves a high degree of risk. You should purchase our common stock only if you can afford a complete

loss of your purchase.

We

urge you to read carefully the “Risk Factors” section beginning on page 7 where we describe specific risks associated

with an investment in these securities before you make your investment decision.

Prior

to this Offering, there has been a limited market for our securities. While our common stock is quoted on OTC Markets, there has

been limited trading volume of our stock. There is no guarantee that an active trading market will develop in our securities.

This

Offering is highly speculative, and these securities involve a high degree of risk and should be considered only by persons who

can afford the loss of their entire investment. Neither the Securities and Exchange Commission nor any state securities commission

has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the

contrary is a criminal offense.

The

date of this Prospectus is June 2, 2021.

Table

of Contents

The

following table of contents has been designed to help you find information contained in this prospectus. We encourage you to read

the entire prospectus.

Please

read this Prospectus carefully and in its entirety. This Prospectus contains disclosure regarding our business, our financial

condition and results of operations and risk factors related to our business and our Common Stock, among other material disclosure

items. We have prepared this Prospectus so that you will have the information necessary to make an informed investment decision.

You

should rely only on information contained in this Prospectus. We have not authorized any other person to provide you with different

information. This Prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the

offer or sale is not permitted. The Selling Stockholder may not sell the securities listed in this Prospectus until the Registration

Statement filed with the Securities and Exchange Commission is effective. The information in this Prospectus is complete and accurate

as of the date on the front cover, but the information may have changed since that date.

The

Registration Statement containing this Prospectus, including the exhibits to the Registration Statement, provides additional information

about us and our Common Stock offered under this Prospectus. The Registration Statement, including the exhibits and the documents

incorporated herein by reference, can be read on the Securities and Exchange Commission website or at the Securities and Exchange

Commission offices mentioned under the heading “Where You Can Find More Information.”

PROSPECTUS

SUMMARY

You

should carefully read all information in the prospectus, including the financial statements and their explanatory notes under

the Financial Statements prior to making an investment decision.

This

summary highlights selected information appearing elsewhere in this prospectus. While this summary highlights what we consider

to be important information about us, you should carefully read this entire prospectus before investing in our Common Stock, especially

the risks and other information we discuss under the headings “Risk Factors”, our “Management’s Discussion

and Analysis of Financial Condition and Results of Operation” and our consolidated financial statements and related notes

beginning on page F-1. Our fiscal year end is December 31 and our audited financial statements for fiscal years ended December

31, 2020 and 2019 as well as our unaudited financial statements for the 3 month periods ending March 31, 2021 and

2020 are included in this prospectus. Some of the statements made in this prospectus discuss future events and developments,

including our future strategy and our ability to generate revenue. These forward-looking statements involve risks and uncertainties

which could cause actual results to differ materially from those contemplated in these forward-looking statements. See “Special

Note Regarding Forward-Looking Statements” at page 7 of this Prospectus.

Except

as otherwise required by the context, references in this prospectus to “we,” “our,” “us” refer

to Oncotelic Therapeutics, Inc. Peak One Opportunity Fund, LP is referred to herein as “Peak One” or “Investor”

and Peak One Investments is referred to herein a “Peak One Investments”.

This

summary contains basic information about us and the offering. Because it is a summary, it does not contain all the information

that you should consider before investing. You should read the entire prospectus carefully, including the risk factors and our

financial statements and the related notes to those statements included in this prospectus.

We

have not authorized anyone to provide you with different information and you must not rely on any unauthorized information or

representation. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted.

This document may only be used where it is legal to sell these securities. You should assume that the information appearing in

this prospectus is accurate only as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus,

or any sale of our common stock. Our business, financial condition and results of operations may have changed since the date on

the front of this prospectus. We urge you to carefully read this prospectus before deciding whether to invest in any of the common

stock being offered.

Overview

We

are a clinical-stage biopharmaceutical developing drugs for the treatment of orphan oncology indications, developing antisense

and small molecule injectable drugs for the treatment of cancer with a focus on rare pediatric cancers, and addressing the current

global pandemic. As a result of the merger of Oncotelic and Oncotelic Inc. and the acquisition of PointR in April and November

2019, respectively, we believe we are well positioned as a biotech company with: 1) PointR AI/blockchain for superfast back office

support, 2) Edgepoint for developing technologies for supporting our COVID-19 programs, 3) Oncotelic Inc.’s antisense platform

with OT-101- the flagship drug candidate - targeting high value TGF-β2 target for various cancers and COVID-19, 4) Artemisinin

for COVID-19 and 5) the Company’s vascular disruptor proven safe in more than 500 patients capable of causing massive antigen

release which would stimulate immune response against the tumor.

The

Company is a developer of an antisense RNA therapeutic (“OT-101”) against TGF-β as immunotherapy for a

broad range of cancers. Cancers overexpress TGF-β, which suppresses host innate immune response to the cancers. Treatment

with OT-101 lifts the TGF-β cloaking effect and allows innate or therapeutic immunity to attack and eliminate the cancers.

We have completed phase 2 for pancreatic cancer and melanoma and phase 2 in glioblastoma with robust efficacy and safety. Last

year, the Food and Drug Administration (“FDA”) granted us Rare Pediatric Designation (“RPD”)

for pediatric Diffuse Intrinsic Pontine Glioma (“DIPG”). We are pushing forward into phase 3 either independently

or through a proposed joint venture with a Chinese entity with clinical trials in China for pancreatic cancer. Other indications

are to follow subsequently. In the United States of America (“United States”, “USA” or “US”)

we will be focusing pediatric DIPG with the clinical trials for which we are in discussions with various parties on how to proceed

with the program. This strategy of doing phase 3 trials in adults, including possibly in China, and doing rare pediatric pivotal

trials in the US will allow us to capitalize on the voucher program in the US and subsequently leverage on the Chinese data for

indication expansion into adult. By focusing on RPD we anticipate: 1) reducing the cost of clinical development by way of a smaller

and faster clinical trial, 2) acceleration of approval, 3) obtaining regulatory/ marketing exclusivity for 12 years for small

molecules and 17 years for biologics, and 4) obtaining a voucher worth upward of $100 million on approval. In the case of DIPG

for OT-101 we are anticipating the trial would last no more than 2 years with 30 patients costing approximately $5-7 million with

a substantial return on investment. This is the same strategy that we are adopting for our other pipeline drugs- CA4P and Oxi4503.

These are vascular disruptor agents with extensive phase 1 and phase 2 testing, and which we feel are ready to enter into meaningful

pivotal clinical trials. We are also developing OT-101, an antisense against TGF-β2 – for the treatment of various

viruses, including the Severe Acute Respiratory Syndrome (“SARS”) and the current coronavirus (“COVID-19”),

on its own and in conjunction with other compounds. In addition, the Company is developing Artemisinin, through its product ArtiShieldTM.

Artemisinin, purified from a plant Artemisia annua, is able to inhibit TGF-β activity and is able to neutralize COVID-19.

The Company’s test results during an in vitro study at Utah State University showed Artemisinin having an EC50 of 0.45 ug/ml,

and a Safety Index of 140. Artemisinin can target multiple viral threats including COVID-19 by suppressing both viral replication

and clinical symptoms that arise from viral infection. Viral replication cannot occur without TGF-β. Artemisinin also has

been reported to have antiviral activities against hepatitis B and C viruses, human herpes viruses, HIV-1, influenza virus A,

and bovine viral diarrhea virus in the low micromolar range. TGF-β surge and cytokine storm cannot occur without TGF-β.

In a clinical study undertaken in India, clinical consequences related to the TGF-β surge, including ARDS and cytokine storm,

were suppressed by targeting TGF-β with Artemisinin. The clinical study showing these results was a global study with India

to contribute at least 120 patients to the total aggregate of 3000 patients. The ARTI-19 trials were conducted in India by Windlas

Biotech Private Limited, the Company’s business partner in India, as part of the Company’s global effort at deploying

ArtiShieldTM across India, Africa, and Latin America.

The

Company has also developed a cough app to help patients use to assess their respiratory condition at the onset of taking the drug

and over the period of their treatment, which is key in COVID-19 patients. Patients would use the app to measure their coughs

and get a real-time assessment of the cough to show how the patient is progressing in terms of their treatment. The Company has

also developed a post marketing survey (“PMS”) tool for patients to use and provide data that would be useful

to determine the efficacy of the drug. The cough app and PMS both use AI technologies. All in all, the drug plus the app and the

PMS are a full 360 degree of treatment.

As

we move into clinical and commercial development of our various products enumerated below, we are planning on implementing AI

& vision powered Blockchain technology into our drug development process so that clinical development, clinical trials, and

drug manufacturing can be done real time with full data integrity using AI/Vision powered blockchain technology.

We

have seven primary drug and AI technology programs we are seeking to advance:

|

|

●

|

OT-101

- an antisense against TGF-β2 – for the treatment of solid tumors with focus

on brain cancer in adult and DIPG in children. RPD for pediatric DIPG granted by US FDA.

|

|

|

●

|

OT-101

- an antisense against TGF-β2 –for the treatment of various viruses, including

the SARS and the current COVID-19, on its own and in conjunction with other compounds.

|

|

|

●

|

Artemisinin

– a natural derivative from an Asian herb Artemisia Annua - Artemisinin has shown

to be highly potent at inhibiting the ability of the COVID-19 causing virus to multiply

while also having an excellent safety index.

|

|

|

●

|

CA4P-

a vascular disrupting agent (“VDA”)- in combination with Ipilimumab

for the treatment of solid tumors with focus on melanoma in adult and pediatric melanoma.

On May 4th, 2020, FDA granted Rare Pediatric Disease Designation for CA4P/

Fosbretabulin for the treatment of stage IIB–IV melanoma due to genetic mutations

that disproportionately affect pediatric patients as a drug for a “rare pediatric

disease”.

|

|

|

●

|

Oxi4503-

a second generation VDA- for the treatment of liquid tumors with focus on childhood leukemia.

RPD application for pediatric AML submitted to US FDA and favorable initial response

obtained.

|

|

|

●

|

Backoffice

support using PointR fabric cluster computing grids for blockchain/AI for pharmaceutical

manufacturing and clinical monitoring and PointR AI Navigator for drug development.

|

|

|

●

|

Developing

AI based technologies to enhance and support the development and commercialization of

our Artemisinin based products.

|

Corporate

History

Oncotelic

Therapeutics, Inc. (also d/b/a Mateon Therapeutics, Inc.) (“Oncotelic”), was formed in the State of New York

in 1988 as OXiGENE, Inc., was reincorporated in the State of Delaware in 1992, and changed its name to Mateon Therapeutics, Inc.

in 2016, and Oncotelic Therapeutics, Inc. in November 2020. Oncotelic conducts business activities through Oncotelic and its wholly-owned

subsidiaries, Oncotelic, Inc., a Delaware corporation, PointR Data, Inc. (“PointR”), a Delaware corporation,

and EdgePoint AI, Inc. (“Edgepoint”), a Delaware Corporation for which there are non-controlling interests,

(Oncotelic, Oncotelic Inc., PointR and Edgepoint are collectively called the “Company”). The Company is evaluating

the further development of its product candidates OXi4503 as a treatment for acute myeloid leukemia and myelodysplastic syndromes

and CA4P in combination with a checkpoint inhibitor for the treatment of advanced metastatic melanoma. Our principal corporate

office is in the United States at 29397 Agoura Road, Suite 107, Agoura Hills, CA 91301 (telephone: 650-635-7000). Our Internet

address is www.mateon.com.

Amendments

to Certificate of Incorporation

In

November 2020 the Company filed an amendment to its Certificate of Incorporation with the Secretary of State for the State of

Delaware changing its name from “Mateon Therapeutics, Inc.” to “Oncotelic Therapeutics, Inc.” A notice

of corporate action had been filed with the Financial Industry Regulatory Authority (“FINRA”), requesting confirmation

to change its name and approval for a new ticker symbol. On March 29, 2021, the Company received approval from FINRA on its notice

of corporate action, and effective March 30, 2021, the Company’s ticker symbol has changed from “MATN” to “OTLC”.

In

January 2021, the Company filed an additional amendment to its Certificate of Incorporation, as amended (the “Charter

Amendment”), with the Secretary of State for the State of Delaware, which Charter Amendment went effective immediately

upon acceptance by the Secretary of State for the State of Delaware. As approved by the Company’s stockholders by written

consent on August 10, 2020, the Charter Amendment increased the number of authorized shares of Common Stock from 150,000,000 shares

to 750,000,000 shares.

Conversion

of Series A Preferred Stock to Common Stock

Subsequent

to obtaining the approval from FINRA on March 29, 2021 related to the various corporate actions, the Company converted 278,188

Series A Preferred Stock into 278,187,847 shares of common stock of the Company. After such conversion and as of May 20,

2021, the total number of shares of common stock outstanding is 369,696,959.

Summary

of Risk Factors

This

Offering, which provides for the registration of Shares by Peak One and Peak One Investments as the Selling Stockholders and the

subsequent public resale of such shares, involves substantial risk. Our ability to execute our business strategy is also subject

to certain risks. The risks described under the heading “Risk Factors” included elsewhere in this Prospectus may cause

us not to realize the full benefits of our business plan and strategy or may cause us to be unable to successfully execute all

or part of our strategy. Some of the most significant challenges and risks are:

|

|

●

|

We

may encounter difficulties in expanding our operations successfully, if and when we evolve

from a company that is primarily involved in clinical development to a company that is

also involved in commercialization.

|

|

|

●

|

We

will need substantial additional funding to continue our operations, which could result

in dilution to our stockholders.

|

|

|

●

|

If

physicians and patients do not accept our future products or if the market for indications

for which any product candidate is approved is smaller than expected, we may be unable

to generate significant revenue, if any.

|

|

|

●

|

The

Equity Purchase Agreement with Peak One may cause material dilution to our existing stockholders

|

|

|

●

|

Our

stock price may decline because Peak One will pay less than the then-prevailing market

price of our common stock.

|

|

|

●

|

An

investment in our shares is highly speculative.

|

|

|

●

|

We

may not have access to the full $10,000,000 amount of the Equity Purchase Agreement.

|

Before

you invest in our Common Stock, you should carefully consider all the information in this Prospectus, including matters set forth

under the heading “Risk Factors.”

Where

You Can Find Us

Our

principal executive office and mailing address and phone number are 29397 Agoura Road, Suite 107, Agoura Hills, CA 91301, (650)

635-7000.

Our

Filing Status as a “Smaller Reporting Company”

We

are a “smaller reporting company,” meaning that we are not an investment company, an asset-backed issuer, or a majority-owned

subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual

revenues of less than $50 million during the most recently completed fiscal year. As a “smaller reporting company,”

the disclosure we will be required to provide in our Securities and Exchange Commission (“SEC”) filings are less than

it would be if we were not considered a “smaller reporting company.” Specifically, “smaller reporting companies”

are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section

404(b) of the Sarbanes-Oxley Act of 2002 requiring that independent registered public accounting firms provide an attestation

report on the effectiveness of internal control over financial reporting; are not required to conduct say-on-pay and frequency

votes until annual meetings occurring on or after January 21, 2013; and have certain other decreased disclosure obligations in

their SEC filings, including, among other things, being permitted to provide two years of audited financial statements in annual

reports rather than three years. Decreased disclosures in our SEC filings due to our status as a “smaller reporting company”

may make it harder for investors to analyze our results of operations and financial prospects.

For

more details regarding this exemption, see “Management’s Discussion and Analysis of Financial Condition and Results

of Operations - Critical Accounting Policies and Significant Judgments and Estimates.”

SUMMARY

OF FINANCIAL INFORMATION

The

following summary consolidated statements of operations data for the fiscal year ended December 31, 2020 and December 31, 2019

have been derived from our audited consolidated financial statements and notes included elsewhere in this prospectus. The

summary consolidated statements of operations data for the three months ended March 31, 2021 and 2020 have been derived from our

unaudited interim consolidated financial statements and notes that are included elsewhere in this prospectus. The historical financial

data presented below is not necessarily indicative of our financial results in future periods, and the results for the full fiscal

year ended December 31, 2020 and three months ended March 31, 2021 is not necessarily indicative of our operating results to be

expected for the full fiscal year ending December 31, 2021 or any other period. You should read the summary consolidated financial

data in conjunction with those financial statements and the accompanying notes and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations.” Our consolidated financial statements are prepared and presented in accordance

with United States generally accepted accounting principles, or U.S. GAAP. Our consolidated financial statements have been prepared

on a basis consistent with our audited financial statements for the year ended December 31, 2020 and December

31, 2019 and unaudited financial statements for three months ended March 31, 2021 and 2020, and include all adjustments, consisting

of normal and recurring adjustments that we consider necessary for a fair presentation of the financial position and results of

operations as of and for such periods.

ONCOTELIC

THERAPEUTICS, INC. AND SUBSIDIARIES

(Formerly

Mateon Therapeutics, Inc.)

CONSOLIDATED

BALANCE SHEETS

|

|

|

March 31,

|

|

|

March 31,

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

2020

|

|

|

2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

830,719

|

|

|

$

|

183,437

|

|

|

$

|

474,019

|

|

|

$

|

81,964

|

|

|

Restricted cash

|

|

|

20,000

|

|

|

|

-

|

|

|

|

20,000

|

|

|

|

-

|

|

|

Accounts receivable

|

|

|

19,748

|

|

|

|

19,748

|

|

|

|

19,748

|

|

|

|

149,748

|

|

|

Prepaid & other current assets

|

|

|

84,707

|

|

|

|

70,967

|

|

|

|

101,869

|

|

|

|

41,288

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

955,174

|

|

|

|

274,152

|

|

|

|

615,636

|

|

|

|

273,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Development equipment, net of depreciation

|

|

|

7,610

|

|

|

|

38,135

|

|

|

|

10,148

|

|

|

|

47,554

|

|

|

Intangibles, net of accumulated amortization

|

|

|

860,365

|

|

|

|

911,731

|

|

|

|

873,206

|

|

|

|

924,572

|

|

|

In process R&D, net of accumulated amortization

|

|

|

1,101,760

|

|

|

|

1,308,340

|

|

|

|

1,101,760

|

|

|

|

1,377,200

|

|

|

Goodwill

|

|

|

21,062,455

|

|

|

|

21,062,455

|

|

|

|

21,062,455

|

|

|

|

21,062,455

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other long term assets

|

|

|

-

|

|

|

|

1,800

|

|

|

|

-

|

|

|

|

-

|

|

|

Total assets

|

|

$

|

23,987,362

|

|

|

$

|

23.596.613

|

|

|

$

|

23,663,205

|

|

|

$

|

23,684,781

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

$

|

3,594,260

|

|

|

$

|

2,202,571

|

|

|

$

|

2,735,805

|

|

|

$

|

2,054,983

|

|

|

Accounts payable to related party

|

|

|

365,323

|

|

|

|

763,026

|

|

|

|

391,631

|

|

|

|

601,682

|

|

|

Contingent Consideration

|

|

|

2,625,000

|

|

|

|

2,625,000

|

|

|

|

2,625,000

|

|

|

|

2,625,000

|

|

|

Derivative liability on Notes

|

|

|

1,168,784

|

|

|

|

1,778,272

|

|

|

|

777,024

|

|

|

|

540,517

|

|

|

Convertible debt for clinical trial

|

|

|

2,030,356

|

|

|

|

-

|

|

|

|

2,000,000

|

|

|

|

-

|

|

|

Convertible debt, net of costs

|

|

|

958,882

|

|

|

|

1,099,289

|

|

|

|

1,091,612

|

|

|

|

944,450

|

|

|

Convertible debt, related party, net of costs

|

|

|

425,181

|

|

|

|

16,019

|

|

|

|

297,989

|

|

|

|

16,474

|

|

|

Private placement convertible debt, net of costs

|

|

|

1,520,720

|

|

|

|

-

|

|

|

|

943,586

|

|

|

|

-

|

|

|

Private placement convertible debt, related party, net of costs

|

|

|

85,664

|

|

|

|

-

|

|

|

|

67,992

|

|

|

|

-

|

|

|

Payroll Protection Plan loan

|

|

|

252,349

|

|

|

|

-

|

|

|

|

251,733

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

13,026,519

|

|

|

|

|

|

|

|

11,182,372

|

|

|

|

6,783,106

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Convertible Preferred stock, $0.01 par value, 15,000,000 shares authorized; 0 and 278,188 shares issued and outstanding at March 31, 2021 and 2020, respectively: 278,188 and 278,188 shares issued and outstanding at December 31, 2020 and 2019, respectively

|

|

|

-

|

|

|

|

2,782

|

|

|

|

2,782

|

|

|

|

2,782

|

|

|

Common stock, $.01 par value; 750,000,000 shares

authorized as of March 31, 2021; and 150,000,000 shares authorized, as of March 31, 2020, December 31, 2020 and 2019

respectively; 369,446,959 and 88,032,112 shares issued and outstanding at March 31, 2021 and 2020, respectively; 90,601,912 and

84,069,967 shares issued and outstanding at December 31, 2020 and 2019, respectively

|

|

|

3,694,469

|

|

|

|

880,321

|

|

|

|

906,019

|

|

|

|

840,700

|

|

|

Additional paid-in capital

|

|

|

30,690,013

|

|

|

|

31,014,633

|

|

|

|

32,493,086

|

|

|

|

28,185,599

|

|

|

Accumulated deficit

|

|

|

(24,433,088

|

)

|

|

|

(16,785,300

|

)

|

|

|

(21,630,008

|

)

|

|

|

(12,127,406

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Oncotelic Therapeutics, Inc. stockholders’ equity

|

|

|

9,951,394

|

|

|

|

15,112,436

|

|

|

|

11,771,879

|

|

|

|

16,901,675

|

|

|

Non-controlling interests

|

|

|

1,009,449

|

|

|

|

-

|

|

|

|

708,954

|

|

|

|

-

|

|

|

Total stockholders’ equity

|

|

|

10,960,843

|

|

|

|

15,112,436

|

|

|

|

12,480,833

|

|

|

|

16,901,675

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity

|

|

$

|

23,987,362

|

|

|

$

|

23,596,613

|

|

|

$

|

23,663,205

|

|

|

$

|

23,684,781

|

|

ONCOTELIC

THERAPEUTICS, INC. AND SUBSIDIARIES

(Formerly

Mateon Therapeutics, Inc.)

CONSOLIDATED

STATEMENTS OF OPERATIONS

|

|

|

For the Three Months Ended

March 31,

|

|

|

For the Twelve Months Ended

December 31,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

2020

|

|

|

2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service Revenue

|

|

$

|

-

|

|

|

$

|

340,855

|

|

|

$

|

1,740,855

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

1,556,673

|

|

|

|

311,999

|

|

|

|

4,302,447

|

|

|

|

1,372,151

|

|

|

General and administrative

|

|

|

481,209

|

|

|

|

2,677,503

|

|

|

|

5,023,142

|

|

|

|

2,938,726

|

|

|

Total operating expenses

|

|

|

(2,037,882

|

)

|

|

|

(2,989,502

|

)

|

|

|

9,325,589

|

|

|

|

4,310,877

|

|

|

Loss from operations

|

|

|

(2,037,882

|

)

|

|

|

(2,648,647

|

)

|

|

|

(7,584,734

|

)

|

|

|

(4,310,877

|

)

|

|

Other expense:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

(520,906

|

)

|

|

|

(1,148,351

|

)

|

|

|

(1,998,321

|

)

|

|

|

(749,479

|

)

|

|

Change in fair value of derivative on debt

|

|

|

(536,345

|

)

|

|

|

(736,298

|

)

|

|

|

(45,051

|

)

|

|

|

191,643

|

|

|

Long term investment written off

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(1,769,300

|

)

|

|

Loss on debt conversion

|

|

|

(27,504

|

)

|

|

|

(124,598

|

)

|

|

|

(343,700

|

)

|

|

|

-

|

|

|

Total other expense

|

|

|

(1,084,755

|

)

|

|

|

(2,009,247

|

)

|

|

|

(2,387,072

|

)

|

|

|

(2,327,136

|

)

|

|

Net Loss

|

|

|

(3,122,637

|

)

|

|

|

(4,657,894

|

)

|

|

|

(9,971,806

|

)

|

|

|

(6,638,013

|

)

|

|

Net loss attributable to non-controlling interests

|

|

|

(319,557

|

)

|

|

|

-

|

|

|

|

469,204

|

|

|

|

-

|

|

|

Net loss attributable to Oncotelic Therapeutics, Inc

|

|

$

|

(2,803,080

|

)

|

|

$

|

(4,657,894

|

)

|

|

$

|

(9,502,602

|

)

|

|

$

|

(6,638,013

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic & diluted net loss per share attributable to common stock

|

|

$

|

(0.03

|

)

|

|

$

|

(0.03

|

)

|

|

$

|

(0.11

|

)

|

|

$

|

(0.11

|

)

|

|

Basic & diluted weighted average common stock outstanding

|

|

|

94,193,348

|

|

|

|

84,917,073

|

|

|

|

88,099,787

|

|

|

|

59,958,406

|

|

Special

Note Regarding Forward-Looking Statements

The

information contained in this Prospectus, including in the documents incorporated by reference into this Prospectus, includes

some statements that are not purely historical and that are “forward-looking statements.” Such forward-looking statements

include, but are not limited to, statements regarding our management’s expectations, hopes, beliefs, intentions and/or strategies

regarding the future, including our financial condition and results of operations. In addition, any statements that refer to projections,

forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking

statements. The words “anticipates,” “believes,” “continue,” “could,” “estimates,”

“expects,” “intends,” “may,” “might,” “plans,” “possible,”

“potential,” “predicts,” “projects,” “seeks,” “should,” “would”

and similar expressions, or the negatives of such terms, may identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking.

The

forward-looking statements contained in this Prospectus are based on current expectations and beliefs concerning future developments

and the potential effects on the parties and the transaction. There can be no assurance that future developments actually affecting

us will be those anticipated. These that may cause actual results or performance to be materially different from those expressed

or implied by these forward-looking statements, including the following forward-looking statements involve a number of risks,

uncertainties (some of which are beyond the parties’ control) or other assumptions.

RISK

FACTORS

The

shares of our Common Stock being offered for resale by the Selling Shareholders are highly speculative in nature, involve a high

degree of risk and should be purchased only by persons who can afford to lose their entire amount invested in the Common Stock.

Accordingly, prospective investors should carefully consider, along with other matters referred to herein, the following risk

factors in evaluating our business before purchasing any shares of Common Stocks. If any of the following risks actually occurs,

our business, financial condition or operating results could be materially adversely affected. In such case, you may lose all

or part of your investment. In addition to the risk factors described below, and some of which are part of our 2020 Annual Report

on Form 10-K filed with the SEC on April 15, 2021, you should carefully consider the risks and the other information in this Prospectus

before investing in our Common Stock.

Risks

Related to Our Business

If

we are unable to obtain additional funding, we may be forced to cease operations.

We

have experienced net losses every year since inception. In April 2019, the Company entered into an Agreement and Plan of Merger (the

“Merger Agreement”) with Oncotelic Inc., a clinical-stage biopharmaceutical company developing investigational drugs for

the treatment of orphan oncology indications and the Company’s wholly-owned subsidiary Oncotelic Acquisition Corporation (the “Merger

Sub”). Upon the terms of and subject to the satisfaction of the conditions described in the Merger Agreement, the Merger Sub would

be merged with and into Oncotelic Inc. (the “Merger”), with Oncotelic Inc. surviving the Merger as a wholly-owned subsidiary

of the Company. In April 2019, the Company completed the Merger and Oncotelic Inc. became a wholly-owned subsidiary of the Company. The

Merger was treated as a recapitalization and reverse acquisition for financial accounting purposes. Oncotelic is considered the acquirer

for accounting purposes, and the Company’s historical financial statements before the Merger have been replaced with the historical

financial statements of Oncotelic Inc. prior to the Merger in the financial statements and filings with the Securities and Exchange Commission.

The Company completed an acquisition of PointR Data, Inc. (“PointR”) in November 2019 and has a non-controlling interest

entity, EdgePoint AI, Inc. since February 2020. Even though Oncotelic Inc. is considered as the acquirer for accounting purposes,

the Company, as of March 31, 2021, had an accumulated deficit of approximately $24.4 million, including a net loss, before allocation

to non-controlling interests, of approximately $3.1 million in the first quarter of 2021. We have no source of product revenue

and do not expect to receive any product revenue in the near future except if we generate product revenues from Artemisinin in countries

around the globe other than India. We may generate revenues from services rendered in the future, but we cannot expect that to be a regular

and of recurring nature. If we remain in business, we expect to incur additional operating losses over the next several years, principally

as a result of our plans to continue clinical trials for our investigational drugs. As of March 31, 2021, we had approximately $831,000

in cash and current liabilities of approximately $13.0 million, of which $2.6 million of contingent liabilities that would

be issuable in shares of common stock of the Company to the PointR shareholders upon satisfaction of certain conditions. Based on our

planned operations, we expect our cash to only support our operations for a short period of time. Therefore, we will need to secure near-term

funding, or we would be forced to curtail or terminate operations. Because we do not currently have a guaranteed source of capital that

will sustain operations for at least the next twelve months, Management has determined that there is substantial doubt about our ability

to continue as a going concern.

The

principal source of our working capital to date has been the proceeds from the sale of equity and debt, a substantial portion

of which has been provided by officers and certain insiders. If we are unable to access additional funds in the near term, whether

through the sale of additional equity, debt or another means, we may not be able to continue in business. We also may not be able

to continue the development of our investigational drugs. Any additional equity or debt financing, if available to us, may not

be available on favorable terms and would most likely be dilutive to stockholders. Any debt financing, if available, may involve

restrictive covenants and also be dilutive to current stockholders. If we obtain funds through collaborative or licensing arrangements,

we may be required to relinquish rights to some of our technologies or product candidates on terms that are not favorable to us.

Our ability to access capital when needed is not assured.

In

their audit report with regard to our financial statements as of December 31, 2020, we as well as our independent registered public

accountants have expressed an opinion that substantial doubt exists as to whether we can continue as a going concern. Because

we have limited cash resources, we believe that it will be necessary for us to either raise additional capital in the near term

or to enter into a license or other agreement with a larger pharmaceutical company. If we do not succeed in doing so, we may be

required to suspend or cease our business, which would likely materially harm the value of our common stock.

Due

in part to our limited financial resources, we may fail to select or capitalize on the most scientifically, clinically or commercially

promising or profitable indications or therapeutic areas for our product candidates, and we may be unable to pursue and complete

the clinical trials that we would like to pursue and complete.

We

have limited financial and technical resources to determine the indications on which we should focus the development efforts for

our product candidates. Due to our limited available financial resources, we have curtailed clinical development programs and

activities that might otherwise have led to more rapid progress of our product candidates through the regulatory and development

processes. We currently have insufficient financial resources to complete any additional drug development work.

If

we are able to raise funds and continue developing investigational drugs for cancer, we may make incorrect determinations with

regard to the indications and clinical trials on which to focus the available resources that we do have. Furthermore, we cannot

assure you that we will be able to retain adequate staffing levels to run our operations and/or to accomplish all of the objectives

that we otherwise would seek to accomplish. The decisions to allocate our research, management and financial resources toward

particular indications or therapeutic areas for our product candidates may not lead to the development of viable commercial products

and may divert resources from better opportunities. Similarly, our decisions to delay or terminate drug development programs may

also cause us to miss valuable opportunities. In addition, from time to time, we may in-license or otherwise acquire product candidates

to supplement our internal development activities. Those activities may use resources that otherwise would have been devoted to

our internal programs, and with research and development programs there is no way to assure that the outcome of any trials or

other activities will be positive, whether the program was internally generated or in-licensed.

We

may encounter difficulties in expanding our operations successfully if and when we evolve from a company that is primarily involved

in clinical development to a company that is also involved in commercialization.

As

we advance our product candidates through later stages of clinical trials, we will need to expand our development, regulatory,

manufacturing, marketing and sales capabilities or contract with third parties to provide these capabilities for us. As our operations

expand, we expect that we will need to manage additional relationships with such third parties, as well as additional collaborators,

distributors, marketers and suppliers.

Maintaining

third party relationships for these purposes will impose significant added responsibilities on members of our management and other

personnel. We must be able to manage our development efforts effectively, manage our participation in the clinical trials in which

our product candidates are involved effectively, and improve our managerial, development, operational and finance systems, all

of which may impose a strain on our administrative and operational infrastructure.

If,

following any approval of our product candidates, we enter into arrangements with third parties to perform sales, marketing or

distribution services, any product revenues that we receive, or the profitability of these product revenues to us, are likely

to be lower than if we were to market and sell any products that we develop ourselves. In addition, we may not be successful in

entering into arrangements with third parties to sell and market our products or in doing so on terms that are favorable to us.

We likely will have little control over such third parties, and any of them may fail to devote the necessary resources and attention

to sell and market our products effectively. If we do not establish sales and marketing capabilities successfully, either on our

own or in collaboration with third parties, we will not be successful in commercializing our products.

If

we were to submit an NDA for our drug candidates in the United States or a marketing application in the EU, we would need to undertake

commercial scale manufacturing activities at significant expense to us in order to proceed with the application for approval for

commercialization. We or our external vendors may encounter technical difficulties that preclude us from successfully manufacturing

the required registration and validation batches of active pharmaceutical ingredient, or API, and/or drug product and we may be

unable to recover any financial losses associated with the manufacturing activities. Further, our research or product development

efforts may not be successfully completed, any compounds currently under development by us may not be successfully developed into

drugs, any potential products may not receive regulatory approval on a timely basis, if at all, and competitors may develop and

bring to market products or technologies that render our potential products obsolete. If any of these problems occur, our business

would be materially and adversely affected.

We

have no manufacturing capacity and have relied on, and expect to continue to rely on, third-party manufacturers to produce our

product candidates.

We

do not own or operate manufacturing facilities for the production of clinical or commercial quantities of our product candidates

or any of the compounds that we are testing in our preclinical programs, and we lack the resources and the capabilities to do

so. As a result, we currently rely, and we expect to rely for the foreseeable future, on third-party manufacturers to supply our

product candidates. Reliance on third-party manufacturers entails risks to which we would not be subject if we manufactured our

product candidates or products ourselves, including:

|

|

●

|

reliance

on third-parties for manufacturing process development, regulatory compliance and quality

assurance;

|

|

|

●

|

limitations

on supply availability resulting from capacity and scheduling constraints of third-parties;

|

|

|

●

|

the

possible breach of manufacturing agreements by third-parties because of factors beyond

our control; and

|

|

|

●

|

the

possible termination or non-renewal of the manufacturing agreements by the third-party,

at a time that is costly or inconvenient to us.

|

If

we do not maintain our developed important manufacturing relationships, we may fail to find replacement manufacturers or develop

our own manufacturing capabilities, which could delay or impair our ability to obtain regulatory approval for our products and

substantially increase our costs or deplete profit margins, if any. If we do find replacement manufacturers, we may not be able

to enter into agreements with them on terms and conditions favorable to us, and there could be a substantial delay before new

facilities could be qualified and registered with the FDA, EMA and other foreign regulatory authorities.

The

FDA, EMA and other foreign regulatory authorities require manufacturers to register manufacturing facilities. The FDA and corresponding

foreign regulators also inspect these facilities to confirm compliance with current good manufacturing practices, or cGMPs. Contract

manufacturers may face manufacturing or quality control problems causing drug substance production and shipment delays or a situation

where the contractor may not be able to maintain compliance with the applicable cGMP requirements. Any failure to comply with

cGMP requirements or other FDA, EMA and comparable foreign regulatory requirements could adversely affect our clinical research

activities and our ability to develop our product candidates and market our products after approval.

Our

current and anticipated future dependence upon others for the manufacture of our product candidates may adversely affect our ability

to develop our product candidates, our ability to commercialize any products that receive regulatory approval and our potential

future profit margins on these products.

Our

product candidates have not completed clinical trials, and may never demonstrate sufficient safety and efficacy in order to do

so.

Our

product candidates are in the clinical stage of development. In order to achieve profitable operations, we alone or in collaboration

with others, must successfully develop, manufacture, introduce and market our products. The time frame necessary to achieve market

success for any individual product is long and uncertain. The products currently under development by us may require significant

additional research and development and additional preclinical and clinical testing prior to application for commercial use. A

number of companies in the biotechnology and pharmaceutical industries have suffered significant setbacks in clinical trials,

even after showing promising results in early or later-stage studies or clinical trials. Although we have obtained some favorable

results to date in preclinical studies and clinical trials of certain of our potential products, such results may not be indicative

of results that will ultimately be obtained in or throughout such clinical trials, and clinical trials may not show any of our

products to be safe or capable of producing a desired result. Additionally, we may encounter problems in our clinical trials that

may cause us to delay, suspend or terminate those clinical trials.

Adverse

events observed to date and associated with CA4P and OXi4503 have generally been found to be manageable for drugs treating the

indications for which we are developing our product candidates. However, we will be required to continue to test and evaluate

the safety of our product candidates in additional clinical trials, and to demonstrate their safety to the satisfaction of appropriate

regulatory agencies, as a condition to receipt of any regulatory approvals. In clinical trials to date, transient hypertension

believed to be associated with CA4P and OXi4503 has been effectively managed through pre-treatment with anti-hypertensive medication.

We cannot assure you, however, that we will be able to make the necessary demonstrations of safety to allow us to receive regulatory

approval for our product candidates in any indication.

We

only have a limited number of employees to manage and operate our business.

As

of May 20, 2021, we had fifteen full-time employees. We rely on consultants and professionals to augment our staffing needs. Our

limited financial resources require us to manage and operate our business in a highly efficient manner. We cannot assure you that we

will be able to retain adequate staffing levels to run our operations and/or to accomplish all of the objectives that we otherwise would

seek to accomplish.

We

depend on our executive officers and principal consultants and the loss of their services could materially harm our business.

We

believe that our success depends, and will likely continue to depend, upon our ability to retain the services of our current executive

officers, particularly our Chief Executive Officer, Chief Technology Officer, Chief Business Officer and Chief Financial Officer,

our principal consultants and others. Two of our executive officers have been working at 50% salaries since early April 2019 (and

prior to the reverse merger since October 2017) and one of our Executive Officer worked at 60% of salary till October 2020, which

increases the risk that we may not be able to retain their services. The loss of the services of any of these individuals could

have a material adverse effect on our business. In addition to these key service providers, we have established relationships

with universities, hospitals and research institutions, which have historically provided, and continue to provide, us with access

to research laboratories, clinical trials, facilities and patients. Additionally, we believe that we may, at any time and from

time to time, materially depend on the services of consultants and other unaffiliated third parties. We cannot assure you that

consultants and other unaffiliated third parties will provide the level of service to us that we require in order to achieve our

business objectives.

Our

industry is highly competitive, and our product candidates may become obsolete.

We

are engaged in a rapidly evolving field. Competition from other pharmaceutical companies, biotechnology companies and research

and academic institutions is intense and likely to increase. Many of those companies and institutions have substantially greater

financial, technical and human resources than we do. Many of those companies and institutions also have substantially greater

experience in developing products, conducting clinical trials, obtaining regulatory approval and in manufacturing and marketing

pharmaceutical products. Our competitors may succeed in obtaining regulatory approval for their products more rapidly than we

do. Competitors have developed or are in the process of developing technologies that are, or in the future may be, the basis for

competitive products. Some of these competitive products may have an entirely different approach or means of accomplishing the

desired therapeutic effect than products being developed by us. Our competitors may succeed in developing products that are more

effective and/or cost competitive than those we are developing, or that would render our product candidates less competitive or

even obsolete. In addition, one or more of our competitors may achieve product commercialization or patent protection earlier

than we do, which could materially adversely affect us.

If

clinical trials or regulatory approval processes for our product candidates are prolonged, delayed or suspended, we may be unable

to out-license or commercialize our product candidates on a timely basis, which would require us to incur additional costs and

delay or prevent our receipt of any proceeds from potential license agreements or product sales.

We

cannot predict whether we will encounter problems with any of our completed, ongoing or planned clinical trials that will cause

us or any regulatory authority to delay or suspend those clinical trials or delay or invalidate the analysis of data derived from

them. A number of events, including any of the following, could delay the completion of our other ongoing and planned clinical

trials and negatively impact our ability to obtain regulatory approval for, and to market and sell, a particular product candidate:

|

|

●

|

conditions

imposed on us by the FDA, EMA or another foreign regulatory authority regarding the scope or design of our clinical trials;

|

|

|

|

|

|

|

●

|

delays

in obtaining, or our inability to obtain, required approvals from institutional review boards or other reviewing entities

at clinical sites selected for participation in our clinical trials;

|

|

|

|

|

|

|

●

|

insufficient

supply of our product candidates or other materials necessary to conduct and complete our clinical trials;

|

|

|

|

|

|

|

●

|

slow

enrollment and retention rate of subjects in clinical trials;

|

|

|

|

|

|

|

●

|

any

compliance audits and pre-approval inspections by the FDA, EMA or other regulatory authorities;

|

|

|

|

|

|

|

●

|

negative

or inconclusive results from clinical trials, or results that are inconsistent with earlier results;

|

|

|

|

|

|

|

●

|

serious

and unexpected drug-related side effects; and

|

|

|

|

|

|

|

●

|

failure

of our third-party contractors to comply with regulatory requirements or otherwise meet their contractual obligations to us.

|

Commercialization

or licensure of our product candidates may be delayed or prevented by the imposition of additional conditions on our clinical

trials by the FDA, EMA or another foreign regulatory authority or the requirement of additional supportive clinical trials by

the FDA, EMA or another foreign regulatory authority. In addition, clinical trials require sufficient patient enrollment, which

is a function of many factors, including the size of the patient population, the nature of the trial protocol, the proximity of

patients to clinical sites, the availability of effective treatments for the relevant disease, the conduct of other clinical trials

that compete for the same patients as our clinical trials, and the eligibility criteria for our clinical trials. Our failure to

enroll patients in our clinical trials could delay the completion of the clinical trial beyond our expectations, or it could prevent

us from being able to complete the clinical trial. In addition, the FDA and EMA could require us to conduct clinical trials with

a larger number of subjects than we have projected for any of our product candidates. We may not be able to enroll a sufficient

number of patients in a timely or cost-effective manner. Furthermore, enrolled patients may drop out of our clinical trials, which

could impair the validity or statistical significance of the clinical trials.

We

do not know whether our clinical trials will begin as planned, will need to be restructured, or will be completed on schedule,

if at all. Delays in our clinical trials will result in increased development costs for our product candidates, and our financial

resources may be insufficient to fund any incremental costs. In addition, if our clinical trials are delayed, our competitors

may be able to bring products to market before we do and the commercial viability of our product candidates could be limited.

If

physicians and patients do not accept our future products or if the market for indications for which any product candidate is

approved is smaller than expected, we may be unable to generate significant revenue, if any.

Even

if any of our product candidates obtain regulatory approval, they may not gain market acceptance among physicians, patients, and

third-party payers. Physicians may decide not to prescribe our drugs for a variety of reasons including:

|

|

●

|

timing

of market introduction of competitive products;

|

|

|

|

|

|

|

●

|

demonstration

of clinical safety and efficacy compared to other products;

|

|

|

|

|

|

|

●

|

cost-effectiveness;

|

|

|

|

|

|

|

●

|

limited

or no coverage by third-party payers;

|

|

|

|

|

|

|

●

|

convenience

and ease of administration;

|

|

|

|

|

|

|

●

|

prevalence

and severity of adverse side effects;

|

|

|

|

|

|

|

●

|

restrictions

in the label of the drug;

|

|

|

●

|

other

potential advantages of alternative treatment methods; and

|

|

|

|

|

|

|

●

|

ineffective

marketing and distribution support of our products.

|

If

any of our product candidates is approved, but fails to achieve market acceptance, we may not be able to generate significant

revenue and our business would suffer.

The

uncertainty associated with pharmaceutical reimbursement and related matters may adversely affect our business.

Market

acceptance and sales of any one or more of our product candidates that we develop will depend on reimbursement policies and may

be affected by future healthcare reform measures in the United States and in foreign jurisdictions. Government authorities and

third-party payers, such as private health insurers and health maintenance organizations, decide which drugs they will cover and

establish payment levels. We cannot be certain that reimbursement will be available for any product candidates that we develop.

Also, we cannot be certain that reimbursement policies will not reduce the demand for, or the price paid for, our products. If

reimbursement is not available or is available on a limited basis, we may not be able to successfully commercialize any product

candidates that we develop.

In

the United States, the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, also called the Medicare Modernization

Act, or MMA, changed the way Medicare covers and pays for pharmaceutical products. The legislation established Medicare Part D,

which expanded Medicare coverage for outpatient prescription drug purchases by the elderly but provided authority for limiting

the number of drugs that will be covered in any therapeutic class. The MMA also introduced a new reimbursement methodology based

on average sales prices for physician-administered drugs.

The

United States and several foreign jurisdictions are considering, or have already enacted, a number of legislative and regulatory

proposals to change the healthcare system in ways that could affect our ability to sell our products profitably. Among policy

makers and payers in the United States and elsewhere, there is significant interest in promoting changes in healthcare systems

with the stated goals of containing healthcare costs, improving quality and/or expanding access to healthcare. In the United States,

the pharmaceutical industry has been a particular focus of these efforts and has been significantly affected by major legislative

initiatives. We expect to experience pricing pressures in connection with the sale of any products that we develop due to the

trend toward managed healthcare, the increasing influence of health maintenance organizations and additional legislative proposals.

In

March 2010, the Affordable Care Act, as amended by the Health Care and Education Affordability Reconciliation Act, or collectively,

ACA, became law in the U.S. The goal of ACA is to reduce the cost of health care and substantially change the way health care

is financed by both government and private insurers. While we cannot predict what impact on federal reimbursement policies this

legislation will have in general or on our business specifically, the ACA may result in downward pressure on pharmaceutical reimbursement,

which could negatively affect market acceptance of, and the price we may charge for, any products we develop that receive regulatory

approval.

More

recently, the current U.S. presidential administration has made statements suggesting plans to seek repeal of all or portions

of the ACA. There is uncertainty regarding the impact that the President’s administration may have on matters currently

governed by the ACA, if any, and any regulatory or legislative changes will likely take time to unfold. These changes could have

an impact on coverage and reimbursement for healthcare items and services covered by plans that were authorized by the ACA. However,

we cannot predict the ultimate content, timing or effect of any healthcare reform legislation or the impact of potential legislation

on us. Any reduction in reimbursement from Medicare or other government programs may result in a similar reduction in payments

from private payors. The implementation of cost containment measures or other healthcare reforms may prevent us from being able

to generate revenue, attain profitability, or commercialize our products.

Our

business and operations could suffer in the event of system failures.

Despite

the implementation of security measures, our internal computer systems and those of our third-party CROs and other contractors

and consultants are vulnerable to damage from computer viruses, unauthorized access, natural disasters, terrorism, war and telecommunication

and electrical failures. Furthermore, we have little or no control over the security measures and computer systems of our third-party

CROs and other contractors and consultants. While we have not experienced any material system failure, accident, or security breach

to date, if such an event were to occur and cause interruptions in our operations, it could result in a material disruption of

our programs. For example, the loss of clinical trial data for our product candidates could result in delays in our marketing

approval efforts and significantly increase our costs to recover or reproduce the data. To the extent that any disruption or security

breach results in a loss of or damage to our data or applications or other data or applications relating to our technology or

product candidates, or inappropriate disclosure of confidential or proprietary information, we could incur liabilities and the

further development of our product candidates could be delayed.

Risks

Related to Our Securities

Dilution

of our shares will likely be adversely affected by sales of our common stock pursuant to our agreement with the Selling Stockholders.

Sales

of an aggregate of 33,863,445 shares of our Common Stock being registered herein on behalf of Peak One and Peak One Investments

and the subsequent resale of those shares will have a material dilutive effect upon our shares and will likely have a depressive effect

on the market price of our Common Stock.

The

price of our common stock is volatile, and is likely to continue to fluctuate due to reasons beyond our control; a limited public

trading market may cause volatility in the price of our common stock.

The

market price of our common stock has been, and likely will continue to be, highly volatile. Factors, including our financial results

or our competitors’ financial results, clinical trial and research development announcements and government regulatory action

affecting our potential products in both the United States and foreign countries, have had, and may continue to have, a significant

effect on our results of operations and on the market price of our common stock. We cannot assure you that an investment in our