Nestlé to Refresh Bottled-Water Business as Sales Turn Flat

October 17 2019 - 4:16AM

Dow Jones News

By Saabira Chaudhuri

Nestlé SA said it would overhaul its struggling bottled-water

arm, hoping to reinvigorate growth in a business grappling with

rising competition, high costs and growing concerns about

single-use plastic.

The world's biggest packaged-food maker said its water arm,

which sells brands like Poland Spring, San Pellegrino, Pure Life

and Perrier, would go from being a stand-alone, globally managed

business with headquarters in France, to one managed locally in

Nestlé's various regions. It also said the head of Nestlé Waters,

Maurizio Patarnello, would leave the company by the end of the

year.

The change mimics a restructuring Chief Executive Mark Schneider

pushed through for Nestlé's infant nutrition arm, where the company

says results have since improved.

Nestlé Waters currently employs 28,000 people. A spokesman

declined to comment on whether there would be job losses. About 60%

of Nestlé's bottled-water sales come from local or regional brands

-- like Poland Spring in the U.S. Waters makes up about 8% of

overall sales and under 5% of Nestlé's profits, according to

Jefferies.

The restructuring came as Swiss-based Nestlé on Thursday said

sales in the nine months ended Sept. 30 were 68.37 billion Swiss

francs ($68.71 billion), compared with 66.42 billion francs in the

same period last year. Organic growth -- which strips out the

effects of currency movements, mergers and acquisitions -- was 3.7%

for the first three quarters, mostly driven by higher volumes,

meeting analyst estimates. It also backed its 2019 estimates and

said it would return 20 billion francs to investors over the next

few years, primarily through share buybacks. The company didn't

release profit figures.

In the water business, revenue was flat over the nine months,

while volumes dropped 2.2%.

Water is a "problem category" for Nestlé, said Jefferies analyst

Martin Deboo earlier this month, saying the business is losing

share to rivals in the U.S., its biggest market. Nestlé last year

began selling sparkling, flavored water under Poland Spring,

Arrowhead and other brands in the U.S. but the company has

struggled to stand out in an increasingly crowded category. Apart

from LaCroix -- the market leader -- Coca-Cola Co. and PepsiCo Inc.

have rolled out sparkling-water competitors, while startups and

private-label seltzer brands abound.

On Thursday, Nestlé said organic growth in its North America

water business had been flat and declined in Europe, where it sold

less water than hoped over the past summer. Bottled water makers --

particularly in Europe -- are facing consumer and regulatory

pressure over their use of single-use plastic, amid a backlash

about waste.

Since taking over in 2017, Mr. Schneider has tried to focus

Nestlé's energies on a handful of core businesses he views as

high-growth. Water is one of these, along with nutrition pet food

and coffee. The company has faced scrutiny from activist investor

Daniel Loeb to improve its financial performance and sell its stake

in L'Oréal SA.

Mr. Schneider has made a string of changes including selling

slower-growth, nonfood assets like its skin-health unit and has

made big acquisitions like splashing out $7 billion to buy the

rights to sell Starbucks Corp.'s coffee and tea in grocery and

retail stores. The company on Thursday said it was creating a new

strategy and business development role, which would be filled by

its head of acquisitions, Sanjay Bahadur. The role is intended to

help Nestlé identify new growth opportunities.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

October 17, 2019 04:01 ET (08:01 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

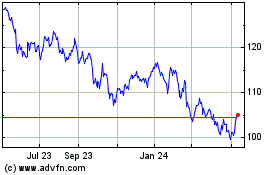

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024