By Saabira Chaudhuri

Comfort foods from big brands are seeing a resurgence,

executives say, as consumers seek familiarity and convenience amid

the coronavirus pandemic.

Many shoppers have favored fresh and specialty brands over Big

Food's processed products in recent years, while others have opted

for cheaper store brands. Now, the world's largest makers of

packaged foods say frozen pizza, pasta sauce, and mac and cheese

are rising in favor as consumers in lockdown eat at home.

Nestlé SA became the latest to detail the trend Friday when it

reported stronger organic sales growth for the first quarter driven

by Americans stockpiling its DiGiorno pizza, Stouffer's frozen

meals and Hot Pockets sandwiches. Baking brands like Toll House and

Carnation also performed well, it said.

Demand for those products -- as well as Purina pet food, Nescafé

coffee and Gerber baby products -- drove a 7.4% rise in organic

sales in the Americas in the first three months of the year and

helped outweigh weakness in China.

Overall, the world's biggest packaged foods maker said organic

sales growth -- a key measure that strips out currency changes,

acquisitions and divestments -- rose 4.3% in the first three months

of the year, beating analyst estimates of 3%.

Nestlé Chief Executive Mark Schneider said the company's food

and drink brands "provide comfort" to consumers, echoing recent

comments made by executives across the industry.

As consumers eat three meals a day at home, rather than at

office cafeterias, schools and restaurants, demand for easy-to-make

foods has risen, company and independent data show. Executives have

said they expect restaurants to operate at lower capacity for

months to come because of social distancing protocols, meaning the

shift to cooking at home could last even as lockdowns lift.

Overall, U.S. store sales of soup rose 37%, canned meat climbed

60% and frozen pizza jumped 51% for the week to April 11, according

to research firm Nielsen.

Earlier this month, Kraft Heinz Co.'s Chief Executive Miguel

Patricio said almost all of the company's brands were in high

demand, including Mac & Cheese, Classico pasta sauce and Oscar

Mayer bacon and hot dogs. That resurgence comes after the company

last year wrote down the value of some of its big brands and said

in February it would boost advertising spending to win back

consumers.

Unilever PLC on Thursday said some of its older brands, like

Hellmann's mayonnaise, have performed well in the first quarter

amid the pandemic.

"We've seen time and time again that big brands tend to do well

when people are feeling anxious and under threat," Chief Executive

Alan Jope said. He added that he expects the shift to larger brands

to last a couple of years.

Campbell Soup Co. last month said retailers were buying more of

its canned soup as well as products like SpaghettiOs and Swanson

canned chicken.

Big food makers have been squeezed at the higher end from niche,

local food brands as well as at the lower end by more affordable

store brands. Companies including Nestlé, Kraft and Unilever have

been snapping up the makers of organic tea, plant-based products

and high-end ketchup, and selling legacy businesses like cold meats

and spreads in an attempt to compete better. Frozen food has been a

particular focus for Nestlé, who has worked to cut salt, sugar and

other less healthful ingredients from its ready-made meals.

Barclays analyst Warren Ackerman this week said the pandemic is

also attracting new shoppers to brands, helping brands from Nestlé

and Unilever increase their penetration in the U.S. "Whether these

brands can retain new consumers over the long-term remains a

question, but mature categories acquiring new consumers is a rare

phenomenon," he said.

For Nestlé, the strong performance of its food brands in

developed markets in the first quarter offset weaker sales in

China, where organic sales fell for ice cream, peanut milk and

confectionery. Nestlé's business that sells ingredients to

restaurants also suffered as the country battled coronavirus.

Nestlé confirmed that it would explore a sale of its Yinlu

business, which sells peanut milk and rice porridge in China after

years of efforts to jump-start growth have floundered. The arm

generated sales of 700 million Swiss francs last year.

Like Unilever, some of Nestlé's businesses were hurt by

lockdowns that have forced consumers to stay indoors, including its

ice cream arm and confectionery business.

Overall, sales fell 6.2% to 20.81 billion Swiss francs ($21.29

billion) because of currency changes and mergers and acquisitions.

Despite uncertainty over the pandemic, Nestlé maintained its

full-year guidance, saying it expects organic sales growth to

improve.

Analysts welcomed the forecast -- in contrast to rivals that

have scrapped guidance amid the pandemic -- and said that while the

first quarter numbers benefited from stockpiling, which will tail

off, Nestlé's performance was strong.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

April 24, 2020 09:55 ET (13:55 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

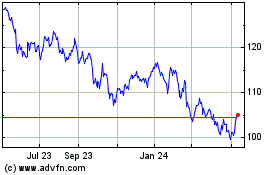

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024