Plant-Based Meat Makers Compete on Price-Update

March 03 2020 - 10:40AM

Dow Jones News

By Jacob Bunge and Heather Haddon

Makers of plant-based meat alternatives are cutting prices, as

startups compete with food-industry giants for slices of the

rapidly growing market.

Impossible Foods Inc. said Tuesday that it had reduced wholesale

prices for its products by 15%. Big food companies -- including

Nestlé SA, Smithfield Foods Inc., Cargill Inc. and food distributor

Sysco Corp. -- have recently set plans to introduce their own

meat-free patties, sometimes at lower prices than those charged by

startups, like Impossible, that helped popularize plant-based

products.

Impossible and rival Beyond Meat Inc. are jockeying with

food-industry giants for a plant-based meat alternative market that

is growing faster than sales of traditional meat. Plant-based meat

sales in U.S. retail stores totaled a little over $1 billion for

the 52 weeks ended Jan. 25, according to Nielsen, up 14% from the

prior year. Sales of traditional meat grew 0.8% to $96 billion over

that period.

Using new engineering and production techniques, companies can

form plant fibers and proteins into burger patties that sizzle and

bleed like traditional ground beef. Restaurants are signing up to

add them to menus to lure sustainability-minded consumers.

"We're getting hit up by everybody," said Paul Griffin, head of

culinary research for BurgerFi International LLC, a Florida-based

chain that has sold Beyond's patty for about three years. He said

Sysco recently offered a competing plant-based burger to BurgerFi

that cost about 5 cents less per patty than the Beyond product, but

that he had no plans to switch.

Starbucks Corp. and Yum Brands Inc.'s KFC division have added

plant-based meat products to their menus this year. McDonald's

Corp. in January broadened a test in Canada of a sandwich made with

a Beyond patty. Burger King and White Castle put Impossible's

plant-based burger patties on sale across the U.S. over the past

two years.

Impossible and Beyond say they use less grain, water and energy

to make burgers from soy and pea protein than companies that feed,

slaughter and transport livestock. But the plant-based production

processes are more expensive than traditional burger making, partly

because meat mimics are made on a scale far smaller than the global

meat industry.

Impossible and Beyond say they are working to change that

dynamic by adding more manufacturing plants and making their

processing techniques more efficient. A lower price point will make

their products more appealing to customers, plant-based food

proponents say.

"A lot of people won't try it unless it's cost competitive,"

said Dennis Woodside, president of Redwood City, Calif.-based

Impossible.

Impossible said its 15% price cut would reduce what it charges

for direct sales of its plant-based meat to about $7.90-$8.50 a

pound. Impossible said it couldn't specify how the price cut would

affect restaurants and retailers that buy its products through

distributors.

Beyond Chief Executive Ethan Brown said competitors are trying

to undercut the El Segundo, Calif.,-based company on price. So far,

he said, Beyond has resisted broadly discounting its burgers, but

the company aspires to match the price of traditional meat with at

least one of its products by 2024. Beyond reported a $452,000

quarterly loss last week, though sales more than tripled.

Burger King, owned by Restaurant Brands International Inc.,

sells its Impossible Whopper for $5.99, around a dollar more than

the original beef version. This year the chain added the Impossible

sandwich to its two-for-$6 promotional menu to entice additional

customers.

"Some of the feedback we got back from guests is they felt it

was too expensive," Restaurant Brands's CEO Jose Cil said in an

interview last month.

Some Burger King franchisees said they haven't seen much of a

sales increase for the sandwich since it was added to the

promotional menu. Chris Finazzo, Burger King's president for the

Americas, said Impossible Whopper is drawing repeat customers to

the chain's restaurants.

Joe Pobereskin, a 60-year-old sales representative from the

Chicago suburbs, said he tried an Impossible Whopper last year,

going so far as to conduct a blind taste test to compare it with

the beef version. He was amazed at how similar they tasted, but he

hasn't bought an Impossible Whopper since.

"I don't feel it's worth paying more to eat Impossible Whoppers.

I'm not a vegetarian," Mr. Pobereskin said.

Write to Jacob Bunge at jacob.bunge@wsj.com and Heather Haddon

at heather.haddon@wsj.com

(END) Dow Jones Newswires

March 03, 2020 10:25 ET (15:25 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

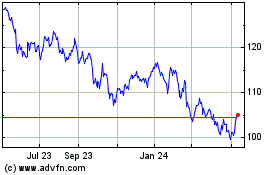

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024