Nestlé to Sell U.S. Ice Cream Business to Joint Venture --Update

December 11 2019 - 2:43PM

Dow Jones News

By Saabira Chaudhuri

Nestlé SA has agreed to sell its U.S. ice cream arm to a joint

venture it has with private-equity firm PAI Partners for $4

billion, a deal the Häagen-Dazs maker hopes will reinvigorate the

struggling business.

The sale, which also includes the Dreyer's and Drumstick brands,

follows a similar move in Europe and comes amid fierce competition

in the world's largest ice cream market.

Nestlé has been working to improve profit margins at the

division but has seen its U.S. market share decline in recent

years, dropping to 15% last year from 19.3% in 2010, according to

Euromonitor. The Swiss company, which focuses on premium ice cream,

has faced intense competition in that segment from market leader

Unilever PLC as well as upstart brands like Halo Top.

In selling its U.S. ice cream operations -- the country's second

largest with sales of $1.8 billion last year -- Nestle hopes to

replicate a move it says has been successful in Europe.

The packaged-food giant in 2016 merged its European ice-cream

business with PAI-owned R&R Group, which makes brands like

Cadbury Flake Cones and Rowntree's Fruit Pastille lollies, to

create Froneri.

That business has since expanded, logging sales of 2.9 billion

Swiss francs ($2.95 billion) last year, and Nestlé on Wednesday

said it was convinced the success of that model could be extended

to the U.S.

Ice cream, while high-growth compared with many other

packaged-foods categories, has increasingly looked like an oddity

at Nestlé. The company says it wants to focus on healthy,

nutritious food and has been cutting salt and sugar in many of its

products.

Nestlé has also recently been sharpening its focus, selling

businesses including U.S. confectionery, and putting greater

emphasis on a handful of businesses like bottled water, coffee and

pet food.

Nestlé and Unilever -- which owns Magnum, Ben & Jerry's and

Talenti -- have both been working on ways to make their ice cream

business less open to seasonal vagaries, through marketing,

delivery and convenience.

Americans eat more ice cream per capita than any other people in

the world, with most bought in supermarkets for consumption at

home, leaving the category open to intense discounting.

In contrast to Nestlé's declining market share, Unilever has

grown its U.S. share to 20.9% last year from 17.9% in 2010,

according to Euromonitor. In the face of tough competition, the

world's largest ice cream maker has launched its own high-protein,

low-sugar line under the Breyer's brand to counter Halo Top. It

also last year rolled out Culture Republick in the U.S., a

low-calorie ice cream brand containing probiotics in flavors like

turmeric chai and cinnamon, and milk and honey.

Nestlé said the sale of its U.S. ice cream business was expected

to close in the first quarter of next year and that it would

continue to manage its remaining ice cream operations in Canada,

Latin America and Asia as part of its current market structure.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

December 11, 2019 14:28 ET (19:28 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

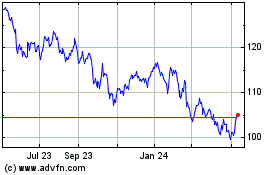

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024