Current Report Filing (8-k)

June 01 2021 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the Securities and Exchange Act

of 1934

Date of Report (Date of earliest event reported): May 19,

2021

NATURALSHRIMP INCORPORATED

(Exact

name of Registrant as specified in its charter)

|

Nevada

|

|

000-54030

|

|

74-3262176

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

15150 Preston Road, Suite #300

Dallas, Texas 75248

(Address of principal executive offices, including zip

code)

(866) 351-5907

(Registrant’s telephone number, including area

code)

Check

the appropriate box below if the 8-K filing is intended to

simultaneously satisfy the filing obligations of the registrant

under any of the following provisions:

[

] Written communication pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

[

] Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

[

] Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

[

] Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)).

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging

growth company [ ]

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act.

[ ]

Item 1.01. Entry Into a Material Definitive

Agreement.

SPA

On May

19, 2021, NaturalShrimp Incorporated (the “Company”)

entered into a Securities Purchase Agreement (the

“SPA”) with F&T Water Solutions, LLC

(“F&T”). Prior to entering into the SPA, the

Company owned fifty-one percent (51%) and F&T owned forty-nine

percent (49%) of the issued and outstanding shares of common stock

of Natural Aquatic Systems, Inc., a Texas corporation

(“NAS”). Upon the closing of the SPA, the Company would

purchase the NAS shares owned by F&T (980,000 shares of

NAS’ common stock) for a purchase price of $1 million dollars

in cash and shares of the Company’s common stock with a value

of $2 million.

The

Company paid the cash purchase price on May 20, 2021 and the

parties agreed on May 25, 2021 that the Company would issue shares

with a value of $0.505 per share for a total issuance of 3,960,396

shares of the Company’s common stock to F&T in connection

with the SPA. The purchase of the NAS shares closed on May 25,

2021.

Patents Purchase Agreement

On May

19, 2021, the Company entered into a Patents Purchase Agreement

(the “Patents Agreement”) with F&T. The Company and

F&T had previously jointly developed and patented a water

treatment technology used or useful in growing aquatic species in

re-circulating and enclosed environments (the “Patent”)

with each party owning a fifty percent (50%) interest. Upon the

closing of the Patents Agreement, the Company would purchase

F&T’s interest in the Patent, F&T’s 100%

interest in a second patent associated with the first Patent issued

to F&T in March 2018, and all other intellectual property

rights owned by F&T for a purchase price of $2 million dollars

in cash and shares of the Company’s common stock with a value

of $5 million.

The

Company paid the cash purchase price on May 20, 2021 and the

parties agreed on May 25, 2021 that the Company would issue shares

with a value of $0.505 per share for a total issuance of 9,900,990

shares of the Company’s common stock to F&T in connection

with the Patents Agreement. The closing of the Patents Agreement

took place on May 25, 2021.

Leak-Out Agreements

In

connection with the issuance of a total of 13,861,386 shares of the

Company’s common stock pursuant to the SPA and the Patents

Agreement (the “Shares”), the Company and F&T, on

May 19, 2021, entered into two separate leak-out agreements (the

“Leak-Out Agreements”). Pursuant to the Leak-Out

Agreements, F&T agreed that it would not sell or transfer the

Shares for six (6) months following the closing of the SPA and

Patents Agreement and that, following these six months, each

shareholder of F&T who was issued a portion of the Shares could

sell up to one-sixth (1/6) of their portion of the Shares every

thirty (30) day period occurring thereafter for the next six (6)

months. Following the one year anniversary of the closings, there

will be no further restrictions regarding the sale or transfer of

the Shares.

The

foregoing provides only a brief description of the material terms

of the SPA, the Patents Agreement, and the Leak-Out Agreements and

does not purport to be a complete description of the rights and

obligations of the parties thereunder, and such descriptions are

qualified in their entirety by reference to the full text of the

SPA, the Patents Agreement, and the Leak-Out Agreements filed as

exhibits to this Current Report on Form 8-K, and is incorporated

herein by reference.

Item 2.01 Completion of Acquisition or Disposition of

Assets

The

applicable information included in Item 1.01 of this 8K with regard

to the May 25, 2021 closing of the SPA and the Patents Agreement is

incorporated herein by reference. As the Company did not acquire a

“business” as defined in Rule 11-01(d) of Regulation

S-X, the financial statements of F&T and pro forma financial

information are not required to be filed.

Item 3.02 Unregistered Sales of Equity Securities.

The

applicable information included in Item 1.01 of this 8-K is

incorporated by reference in this Item 3.02. The issuance of the

Share was not registered under the under the Securities Act of

1933, as amended (the “Securities Act”) but qualified

for exemption under Section 4(a)(2) of the Securities

Act.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits

|

Exhibit No.

|

|

Description

|

|

|

|

Securities

Purchase Agreement by and between NaturalShrimp Incorporated and

F&T Water Solutions, LLC, dated May 19, 2021

|

|

|

|

|

|

|

|

Patents

Purchase Agreement by and between NaturalShrimp Incorporated and

F&T Water Solutions, LLC, dated May 19, 2021.

|

|

|

|

|

|

|

|

Form of

Leak-Out Agreement by and between NaturalShrimp Incorporated and

F&T Water Solutions, LLC, dated May 19, 2021.

|

#

Certain schedules and exhibits have been omitted pursuant to Item

601(a)(5) of Regulation S-K. The Company will furnish

supplementally copies of omitted schedules and exhibits to the

Securities and Exchange Commission or its staff upon its

request.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf

by the undersigned, hereunto duly authorized.

|

|

NATURALSHRIMP INCORPORATED

|

|

|

|

|

|

|

|

Date:

June 1, 2021

|

By:

|

/s/

Gerald

Easterling

|

|

|

|

Name:

|

Gerald

Easterling

|

|

|

|

Title:

|

Chief

Executive Officer

|

|

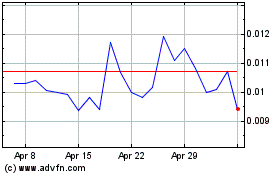

NaturalShrimp (QB) (USOTC:SHMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

NaturalShrimp (QB) (USOTC:SHMP)

Historical Stock Chart

From Apr 2023 to Apr 2024