Current Report Filing (8-k)

May 15 2020 - 4:47PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date of Report (Date of earliest event reported): May 15,

2020

MJ Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

000-55900

|

|

20-8235905

|

|

(State

or other jurisdiction

|

|

(Commission

File Number)

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

|

|

Identification

No.)

|

1300 South Jones Blvd., Suite 104, Las Vegas, NV 89146

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: 702-879-4440

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐ Written communications pursuant to

Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

☐ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of

1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange

Act. ☐

Forward-looking Statements

This

Current Report on Form 8-K contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Such

forward-looking statements can generally be identified by our use

of forward-looking terminology such as "may," "will," "expect,"

"intend," "anticipate," "estimate," "believe," "continue," or other

similar words. Readers of this report should be aware that there

are various factors that could cause actual results to differ

materially from any forward-looking statements made in this report.

Factors that could cause or contribute to such differences include,

but are not limited to, changes in general economic, regulatory and

business conditions in Colorado, and or changes in U.S. Federal

law. Accordingly, readers are cautioned not to place undue reliance

on these forward-looking statements, which speak only as of the

date of this report.

Section 7 – Regulation FD

Item 7.01 Regulation FD Disclosure

On May

14, 2020, the Company’s Board Chairman and CEO, Paris

Balaouras, held a telephonic meeting with Mr. Roger Bloss, Director

and the Company’s President, Terrence M. Tierney to discuss

the ongoing impact of the COVID-19 pandemic on the Company’s

current and future operations. The company continues to experience

on-going setbacks due to the COVID-19 pandemic. While initially

declaring the legally regulated marijuana industry as essential,

Nevada Gov. Steve Sisolak quickly moved to shut down all in-person

retail sales and allowed for a delivery only model. Approximately

50% of Nevada dispensaries were able to operate under the delivery

guidelines, including very few of the Company’s current

customers. We were advised by some of our customers that they would

not be able to make any payments on outstanding invoices until

further notice, which has had a significant impact on the

Company’s cashflows. Due almost exclusively to the measures

implemented by Gov. Sisolak in late March of this year the Company

has been unable to sell any of its current inventory. Effective May

8, 2020, Nevada dispensaries were allowed to reopen their onsite

retail operations pursuant to strict social distancing and

occupancy guidelines. Market research indicates that many Las Vegas

dispensaries are holding higher than average inventories of

marijuana products due to the expected demand during the annual

NCAA March Madness and the

previously scheduled National Football League draft that was to be

held in late April in Las Vegas, due to COVID -19 these events were

both cancelled. The cancellation of these events and the

concomitant downturn in tourism and travel to Las Vegas has

significantly impacted demand for legally regulated marijuana

products in Las Vegas, resulting in a glut of inventory. The

Company is hopeful and expects demand to increase over the next

four to six weeks as Las Vegas casinos reopen and local demand

increases due to a return to onsite retail dispensary

operations.

The

Company has planted an auto-flower crop on approximately one acre

of land at its Amargosa, NV cultivation facility. While this crop

has not allowed us to re-hire any of our farm personnel we have

been able to maintain minimum staffing levels while adequately

servicing the farm. We expect to harvest this crop in mid-June of

2020. Due to this being the Company’s first springtime grow

on a one acre parcel we cannot accurately predict total yields at

this time; however, the plants are currently growing on schedule

and appear to be robust and healthy. We expect to plant our entire

three-acre grow (approximately 8,000 plants) in late June of 2020,

utilizing traditional photosensitive strains and clones from what

we believe are genetically superior mother plants. We anticipate a

mid to late October harvest with increased yields over our 2019

harvest primarily due to increased planting density and more

predictable outcomes due to the use of plant clones as opposed to

previous crops that were grown from seeds.

Section 8 – Other Events

Item 8.01 Other Events

On May

14, 2020, the Company’s Audit Committee held a telephonic

meeting to address the continuing effects of the COVID-19 pandemic

on the Company’s ability to meet its filing obligations on

Form 10-Q due on May 15, 2020. The Company is headquartered in Las

Vegas, NV and its President, Terrence M. Tierney, is based in New

York, NY and regularly travels between New York and Las Vegas, one

of Mr. Tierney’s duties is to serve as an advisor to the

Audit Committee. Mr. Tierney’s inability to freely travel

between the Company’s headquarters and his home due solely to

COVID-19 imposed travel restrictions and the Company’s

significant reduction in staff due to COVID-19 is making it very

difficult for Mr. Tierney to access necessary documents, to

effectively communicate with internal and external accounting

staff, and to comply with document and other requests from the

Company’s independent registered public accountants.

Additionally, operational issues and other restrictions, including

staffing and employee health issues related directly to the

COVID-19 pandemic has caused delays in delivering requested items

and documents to the Company’s independent registered public

accountants. Therefore, the Company’s management does not

believe that it has the ability to file its first quarter 2020

unaudited consolidated financial statements on Form 10-Q by May 15,

2020. It is anticipated that with the current easing of travel

restriction to Las Vegas that Mr. Tierney will be able to return to

the Las Vegas headquarters during the week of May 24,

2020.

The

Company, in reliance on the Order issued by the U.S. Securities and

Exchange Commission (“SEC”), pursuant to Section 36 of

the Exchange Act, that a registrant (as defined in Exchange Act

Rule 12b-2) subject to the reporting requirements of Exchange Act

Section 13(a) or 15(d), and any person required to make any filings

with respect to such a registrant, is exempt from any requirement

to file or furnish materials and any amendment thereto with the

Commission under Exchange Act Sections 13(a), 13(f), 13(g), 14(a),

14(c), 14(f), 15(d) and Regulations 13A, 13D-G (except for those

provisions mandating the filing of Schedule 13D or amendments to

Schedule 13D), 14A, 14C and 15D, and Exchange Act Rules 13f-1, and

14f-1, as applicable:

1.

The

Company is relying on SEC Order (Release No. 34-88465) dated March

25, 2020;

2.

Please

see information disclosed herein above; and

3.

While

Company management cannot commit to a date certain for the filing

of its first quarter 2020 unaudited consolidated financial

statements on Form 10-Q, the Company fully expects to complete and

submit the Form 10-Q within the timeframe established within the

Order and will continue to provide current information on Form

8-K.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

MJ

HOLDINGS, INC.

|

|

|

|

|

|

|

|

Date: May 15,

2020

|

By:

|

/s/ Terrence M.

Tierney

|

|

|

|

|

Terrence M.

Tierney

|

|

|

|

|

President

|

|

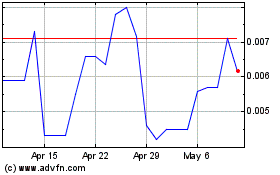

MJ (PK) (USOTC:MJNE)

Historical Stock Chart

From Mar 2024 to Apr 2024

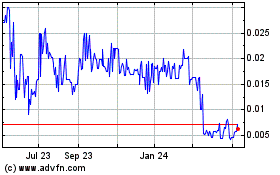

MJ (PK) (USOTC:MJNE)

Historical Stock Chart

From Apr 2023 to Apr 2024