Current Report Filing (8-k)

November 29 2019 - 3:05PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 26, 2019

MESO

NUMISMATICS, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-56010

|

|

88-049

91

|

|

(State

or other jurisdiction

|

|

(Commission File

Number)

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

|

|

Identification

No.)

|

|

433

Plaza Real Suite 275

Boca

Raton, Florida

|

|

33432

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (800) 889-9509

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

|

|

|

|

|

ITEM

1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

On

November 26, 2019, the Company and the holders of the Series AA collectively owning 1,000,000 Series AA shares (“AA Stockholders”)

entered into a Repurchase Agreement (“Agreement”), whereby subject to the terms of the Agreement, at the Repurchase

Closing (as defined in the Agreement), the Company shall repurchase and acquire from each of the AA Stockholders, the Series AA

shares for an aggregate total purchase price equal to $160,000, half of which shall be paid to each of the AA Stockholders, in

tranches according to the schedule set forth in the Agreement

The

above description of the Agreement is filed as Exhibit 10.1 hereto and is incorporated in its entirety herein by this reference.

On

November 27, 2019, Meso Numismatics Inc. (the “Company” or “MESO”) entered into an Assignment and Assumption

Agreement (“Assignment “) with Global Stem Cells Group Inc. (“GSCG”) , a corporation duly formed under

the laws of the State of Florida, Benito Novas (“BN” or “Shareholder”) and Lans Holdings Inc. a Nevada

Corporation whose securities ceased to be registered as of September 18, 2019 (“LAHO”), whereby LAHO assigned all

of its rights to , obligations and interest in, the Original LOI (as defined in the Assignment) it previously entered into with

GSCG and BN.

The

above description of the Assignment is filed as Exhibit 10.2 hereto and is incorporated in its entirety herein by this reference.

On

November 27, 2019, the Company entered into a Binding Letter of Intent (“LOI”), with GSCG and BN (collectively the

“Parties”), setting forth the principal terms pursuant to which the Company will acquire 50,000,000 shares of common

stock of GSCG, representing all of GSCG’s issued and outstanding shares of common stock and 100% ownership in GSCG (“GSCG

Shares”), which GSCG Shares are all held by BN (the “Transaction”).

The

LOI sets forth the terms of the Transaction as follows:

|

|

1.

|

The

Parties agree to enter into a definitive agreement for the consummation and closing of

the Transaction within 150 days of the execution of the LOI.

|

|

|

2.

|

Such

definitive agreement will incorporate the Parties’ understandings with respect

to the terms of the closing of the Transaction, among other things, the following:

|

|

|

(i)

|

MESO

shall receive all of the GSCG Shares from BN

|

|

|

(ii)

|

In

exchange for the GSCG Shares, MESO shall issue the following to BN:

|

|

|

a.

|

1,000,000

shares of Series AA (as defined in the LOI); and

|

|

|

b.

|

8,974

shares of Series DD (as defined in the LOI).

|

|

|

(iii)

|

In

addition, MESO shall pay an amount equal to $225,000 USD to GSCG which may be paid in

multiple tranches with the total payment amount being paid in full at the latest upon

execution of the Definitive Agreement or at such other date as shall be specified by

the Parties;

|

The

above description of the LOI is filed as Exhibit 10.3 hereto and is incorporated in its entirety herein by this reference.

ITEM

3.02 UNREGISTERED SALES OF EQUITY SECURITIES

To

the extent required by Item 3.02 of Form 8-K, the information provided in response to Item 5.02 of this report is incorporated

by reference into this Item 3.02.

ITEM

3.03 MATERIAL MODIFICATION TO RIGHTS OF SECURITY HOLDERS.

Effective

November 26, 2019, the Company, after having obtained requisite shareholder approval, filed an amendment to its Certificate of

Designation with the Secretary of State of Nevada, increasing the authorized share capital and modifying certain rights and preferences

of its Series AA Super Voting Preferred Stock (“Series AA”).

The

above description of the amendment to the Company’s Certificate of Designation is filed as Exhibit 3.1 hereto and is incorporated

herein in its entirety by this reference.

Effective

November 26, 2019, the Company filed a Certificate of Designation for its Series CC Convertible Preferred Stock with the Secretary

of State of Nevada designating 1,000 shares of its authorized preferred stock, par value $0.001, as Series CC Convertible Preferred

Stock (“Series CC”). Such Series CC shall have the rights and preferences as set forth in the Certificate of Designation

of the Series CC.

The

above description of the Company’s Certificate of Designation is filed as Exhibit 3.2 hereto and is incorporated herein

in its entirety by this reference.

Effective

November 26, 2019, the Company filed a Certificate of Designation for its Series DD Convertible Preferred Stock with the Secretary

of State of Nevada designating 10,000 shares of its authorized preferred stock, par value $0.001, as Series DD Convertible Preferred

Stock (“Series DD”). Such Series DD shall have the rights and preferences as set forth in the Certificate of Designation

of the Series DD.

The

above description of the Company’s Certificate of Designation is filed as Exhibit 3.3 hereto and is incorporated herein

in its entirety by this reference.

To

the extent required by Item 3.03 of Form 8-K, the information provided in response to Item 1.01 of this report is incorporated

by reference into this Item 3.03.

ITEM

5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS

OF CERTAIN OFFICERS.

On

November 27, 2019, and in connection with the execution of the Assignment and the LOI, the Company’s Board of Directors

appointed Mr. David Christensen former director and CEO of LAHO, to serve as director and president of the Company and, as an

inducement, issued to Mr. Christensen 50,000 shares of its Series AA in connection with said appointments (”Inducement”).

Mr.

Christensen has over 25 years’ experience in strategy deployment including unique expertise in global supply chains, Point

Of Sale, logistics, freight, distributions, inventories, service repairs, CRM, customer service and call center work. Additionally,

his International team includes industry experts in engineering, IT hardware, ERP applications, security management, as well as

marketing and PR. As a Black Belt, he uses the best tools from Lean/Six Sigma Principles of Strategy Deployment. He is a known

expert for not only developing Strategic Business Objectives, but also for his methodology of Execution Excellence. His goal is

to help companies surpass the competition by creating a Sustainable Competitive Advantage.

From

2005 to the present, Mr. Christensen owned and operated ETC Consulting Services based out of Scottsdale, Arizona. He has a BA

in Organizational Communications from Brigham Young University in Provo, Utah.

Aside

from that provided above, Mr. Christensen does not hold and has not held over the past five years any other directorships in any

company with a class of securities registered pursuant to Section 12 of the Exchange Act or subject to the requirements of Section

15(d) of the Exchange Act or any company registered as an investment company under the Investment Company Act of 1940.

There

are no family relationships between our officers and/or directors. Other than the Inducement, Mr. Christensen has not had any

material direct or indirect interest in any of our transactions or proposed transactions over the last two years.

ITEM

5.03 AMENDMENTS TO ARTICLES OF INCORPORATION OR BYLAWS; CHANGE IN FISCAL YEAR.

Effective

November 26, 2019, the Company through its Board of Directors amended and restated its Bylaws (“Amended and Restated Bylaws”).

The

above description of the Company’s Amended and Restated Bylaws is filed as Exhibit 3.4 hereto and is incorporated herein

in its entirety by this reference.

To

the extent required by Item 5.03 of Form 8-K, the information provided in response to Item 1.01 of this report is incorporated

by reference into this Item 5.03.

To

the extent required by Item 5.03 of Form 8-K, the information provided in response to Item 3.03 of this report is incorporated

by reference into this Item 5.03.

ITEM

7.01. REGULATION FD DISCLOSURE.

On

November 29, 2019, the Company issued a press release with respect to the transactions above. The press release is attached to

this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The

information in this Item 7.01 of this Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed

“filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

nor shall it be deemed incorporated by reference in any filing of ours under the Securities Act of 1933, as amended, or the Exchange

Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference to this Form 8-K

in such filing.

ITEM

9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(c)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

Meso

Numismatics Inc.

|

|

|

|

|

|

Date:

November 27, 2019

|

By:

|

/s/

Melvin Pereira

|

|

|

|

Chief

Executive Officer

|

5

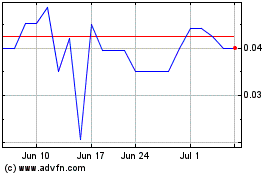

Meso Numismatics (PK) (USOTC:MSSV)

Historical Stock Chart

From Mar 2024 to Apr 2024

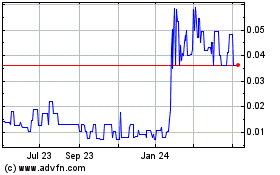

Meso Numismatics (PK) (USOTC:MSSV)

Historical Stock Chart

From Apr 2023 to Apr 2024