Current Report Filing (8-k)

March 18 2021 - 5:14PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

March 14, 2021

Medicine Man Technologies, Inc.

(Exact Name of Registrant

as Specified in Its Charter)

|

Nevada

|

001-36868

|

46-5289499

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

4880 Havana Street, Suite 201

Denver, Colorado

|

|

80239

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

(303) 371-0387

|

|

(Registrant’s Telephone Number, Including Area Code)

|

|

|

|

|

|

Not Applicable

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name

of Each Exchange On

Which Registered

|

|

Not applicable

|

|

Not applicable

|

|

Not applicable

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 14, 2021, the board of directors of Medicine Man Technologies,

Inc. (the “Company”) increased the size of the board of directors from five to seven directors, designated the two

new directorships as Class A, and appointed Jeffrey A. Cozad and Salim Wahdan as Class A directors. The term of Class A directors

expires at the Company’s 2021 annual meeting of stockholders. Mr. Cozad will serve as a member of the board of directors’

Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. Mr. Wahdan will serve as a member of

the board of directors’ Audit Committee.

Mr. Cozad was designated for appointment to the Company’s

board of directors by CRW Capital Cann Holdings, LLC (“CRW”) pursuant to the terms of the letter agreement between

the Company and CRW, dated February 26, 2021 (the “CRW Agreement”), which provides that, for as long as CRW meets the

Ownership Threshold (as defined in the CRW Agreement), the Corporation shall take all actions to ensure that one individual designated

by CRW shall be appointed to the Company’s board of directors. Among other terms of the CRW Agreement, the Company will pay

CRW a monitoring fee equal to $150,000, payable to CRW Capital, LLC in monthly installments of $10,000. The Company previously

reported the terms of the CRW Agreement in the Company’s Current Report on Form 8-K filed March 4, 2021 and attached a copy

of the CRW Agreement as Exhibit 10.2 thereto, and such disclosure and exhibit are incorporated by reference herein. As previously

reported, on February 26, 2021, the Company entered into a Securities Purchase Agreement (the “CRW Purchase Agreement”)

with CRW pursuant to which the Company issued and sold 25,350 shares of the Company’s Series A preferred stock (the “Preferred

Stock”) to CRW at a price of $1,000 per share for aggregate gross proceeds of $25,350,000. Mr. Cozad is a manager of CRW

Capital, LLC, which is the sole manager of CRW and owns a carried interest in CRW, and he shares voting and disposition power of

the shares of Preferred Stock held by CRW. Mr. Cozad owns 50% of CRW Capital, LLC. Mr. Cozad and his family members indirectly

own membership interests in CRW. The Company previously reported the terms of the CRW Purchase Agreement in the Company’s

Current Report on Form 8-K filed March 4, 2021 and attached a copy of the CRW Agreement as Exhibit 10.1 thereto, and such disclosure

and exhibit are incorporated by reference herein.

Mr. Wahdan was designated for appointment to the Company’s

board of directors jointly by Brian Ruden and Naser Joudeh pursuant to the terms of the Omnibus Amendment No. 2 to Asset Purchase

Agreements among the Company and the sellers party thereto, dated December 17, 2020 (the “Star Buds Agreement”), which

provides that, for as long as the Sellers (as defined in the Star Buds Agreement) and the Members (as defined in the Star Buds

Agreement) meet a specified ownership threshold, the Company shall recommend to its board of directors that Brian Ruden and Naser

Joudeh jointly be permitted to designate up to three directors for appointment to the board of directors if the board of directors

consists of seven or more members. The Company previously reported the terms of the Star Buds Agreement in the Company’s

Current Report on Form 8-K filed December 23, 2020 and attached a copy of the Star Buds Agreement as Exhibit 2.1 thereto, and such

disclosure and exhibit are incorporated by reference herein. Mr. Wahdan is a manager of one of the Company’s dispensaries

and earns an annual salary in such role.

The Company’s current policy is to award each director

an annual grant of shares of the Company’s common stock worth $50,000 and the Company expects to make such awards to Messrs.

Cozad and Wahdan in the future.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

MEDICINE MAN TECHNOLOGIES, INC.

|

|

|

|

|

|

By:

|

/s/ Daniel R. Pabon

|

|

Date: March 18, 2021

|

|

Daniel R. Pabon

General Counsel

|

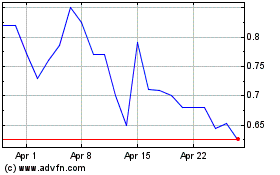

Medicine Man Technologies (QX) (USOTC:SHWZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Medicine Man Technologies (QX) (USOTC:SHWZ)

Historical Stock Chart

From Apr 2023 to Apr 2024