Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

September 17 2020 - 10:05AM

Edgar (US Regulatory)

Filed pursuant to Rule 424(b)(3)

Registration No. 333-218942

PROSPECTUS SUPPLEMENT NO. 1,

DATED SEPTEMBER 17, 2020

(To Prospectus dated June 23, 2017)

LUVU BRANDS, INC.

2,450,000 Shares of Common Stock

This prospectus supplement supplements

the prospectus of Luvu Brands, Inc. dated June 23, 2017 related to our 2015 Equity Incentive Plan (the “2015 Plan”)

and should be read in conjunction with the original prospectus related to this plan. This prospectus supplement provides updated

information on the Selling Security Holders named in original prospectus to reflect recent grants made to affiliates. This prospectus

supplement must be delivered with the prospectus dated June 23, 2017.

SELLING SECURITY HOLDERS

The information under this heading relates

to resales of shares covered by this prospectus by persons who are our "affiliates" as that term is defined under federal

securities laws. These persons are members of our board of directors, executive officers and/or employees of our company. Shares

of our common stock issued pursuant to this prospectus to our affiliates are "control" shares under federal securities

laws.

At September 17, 2020 there were 73,462,596

shares of our common stock issued and outstanding. The following table sets forth:

|

|

•

|

the name of each affiliated selling security holder,

|

|

|

•

|

the amount of common stock owned beneficially, directly or indirectly, by each affiliated selling security holder,

|

|

|

•

|

the maximum amount of shares to be offered by the affiliated selling security holders pursuant to this prospectus, and

|

|

|

•

|

the amount of common stock to be owned by each affiliated selling security holder following sale of the shares.

|

The address of each affiliated selling

security holder is in care of Luvu Brands, Inc., 2745 Bankers Industrial Drive, Atlanta, GA 30360. Beneficial ownership is determined

in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect

to securities and includes any securities which the person has the right to acquire within 60 days through the conversion or exercise

of any security or other right. The information as to the number of shares of our common stock owned by each affiliated selling

security holder is based upon our books and records and the information provided by our transfer agent.

We may amend or supplement this prospectus

from time to time to update the disclosure set forth in the table. Because the selling security holders identified in the table

may sell some or all of the shares owned by them which are included in this prospectus, and because there are currently no agreements,

arrangements or understandings with respect to the sale of any of the shares, no estimate can be given as to the number of shares

available for resale hereby that will be held by the affiliated selling security holders upon termination of the offering made

hereby. We have therefore assumed, for the purposes of the following table, that the affiliated selling security holders will sell

all of the shares owned by them, which are being offered hereby, but will not sell any other shares of our common stock that they

presently own.

Persons who receive stock grants under

the 2015 Plan and are deemed affiliates, may affect sales of shares of common stock covered hereby not in excess of 1% of our outstanding

common stock in any three-month period.

Grants may be made to affiliates in the

future which we are not able to identify at this time. Before any of our affiliates sell any of his shares received under the 2015

Plan, we will supplement this prospectus with the required information regarding the names of the persons selling, the total number

of shares owned by these persons and the number of shares proposed to be sold under this prospectus.

|

Name and address of selling security holder

|

|

Number of

shares owned prior to the offering

|

|

|

Shares to be

offered

|

|

|

Shares to be owned

after offering

|

|

|

% owned

after offering

|

|

|

Louis S. Friedman (1)

|

|

|

36,269,376

|

|

|

|

1,000,000

|

|

|

|

35,444,376

|

|

|

|

46.2

|

%

|

|

Ronald P. Scott (2)

|

|

|

808,016

|

|

|

|

625,000

|

|

|

|

295,516

|

|

|

|

1.1

|

%

|

|

Leslie Vogelman (3)

|

|

|

512,500

|

|

|

|

625,000

|

|

|

|

0

|

|

|

|

-

|

|

|

Manuel Munoz (4)

|

|

|

100,000

|

|

|

|

200,000

|

|

|

|

0

|

|

|

|

-

|

|

|

Total

|

|

|

|

|

|

|

2,450,000

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

The number of shares of our common stock beneficially owned by Mr. Friedman includes:

|

|

|

|

|

•

|

4,300,000 shares of common stock issuable upon conversion of 4,300,000 shares of Series A Convertible Preferred stock which are convertible at the discretion of the holder; and

|

|

|

|

|

•

|

825,000 shares of our common stock issuable upon the exercise of vested options granted under the 2015 Plan with exercise prices ranging from $0.0125 to $0.03 per share and expiring between December 29, 2020 and December 11, 2022.

|

|

|

|

|

The number of shares of common stock beneficially owned by Mr. Friedman excludes 175,000 shares issuable upon the exercise of unvested options granted under the 2015 Plan with exercise prices ranging from $0.028 to $0.03 per share and expiring between February 13, 2022 and December 11, 2022. The number of shares offered by Mr. Friedman includes 1,000,000 shares of our common stock issuable upon the exercise of the vested and unvested options granted under the 2015 Plan.

|

|

|

|

|

|

|

|

(2)

|

|

The number of shares of our common stock beneficially owned by Mr. Scott includes 512,500 shares of our common stock issuable upon the exercise of vested options granted under the 2015 Plan with an exercise prices ranging from $0.0125 to $0.03 per share and expiring between December 29, 2020 and December 11, 2022. The number of shares of common stock beneficially owned by Mr. Scott excludes 112,500 shares issuable upon the exercise of unvested options granted under the 2015 Plan with exercise prices ranging from $0.028 to $0.03 per share and expiring between February 13, 2022 and December 11, 2022. The number of shares offered by Mr. Scott includes 625,000 shares of our common stock issuable upon the exercise of the vested and unvested options granted under the 2015 Plan.

|

|

|

|

|

|

|

|

(3)

|

|

The number of shares of our common stock beneficially owned by Mr. Vogelman includes 512,500 shares of our common stock issuable upon the exercise of vested options granted under the 2015 Plan with an exercise prices ranging from $0.0125 to $0.03 per share and expiring between December 29, 2020 and December 11, 2022. The number of shares of common stock beneficially owned by Mr. Vogelman excludes 112,500 shares issuable upon the exercise of unvested options granted under the 2015 Plan with exercise prices ranging from $0.028 to $0.03 per share and expiring between February 13, 2022 and December 11, 2022. The number of shares offered by Mr. Vogelman includes 625,000 shares of our common stock issuable upon the exercise of the vested and unvested options granted under the 2015 Plan.

|

|

|

|

|

|

|

|

(4)

|

|

The number of shares of our common stock beneficially owned by Mr. Munoz includes 100,000 shares of our common stock issuable upon the exercise of vested options granted under the 2015 Plan with an exercise price of $0.046 per share and expiring July 2, 2023. The number of shares of common stock beneficially owned by Mr. Munoz excludes 100,000 shares issuable upon the exercise of unvested options granted under the 2015 Plan with an exercise price of $0.046 per share and expiring July 2, 2023. The number of shares offered by Mr. Munoz includes 200,000 shares of our common stock issuable upon the exercise of the vested and unvested options granted under the 2015 Plan.

|

The date of this Prospectus Supplement September

17, 2020

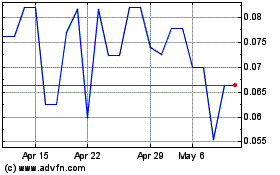

Luvu Brands (QB) (USOTC:LUVU)

Historical Stock Chart

From Mar 2024 to Apr 2024

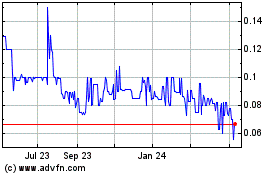

Luvu Brands (QB) (USOTC:LUVU)

Historical Stock Chart

From Apr 2023 to Apr 2024